The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

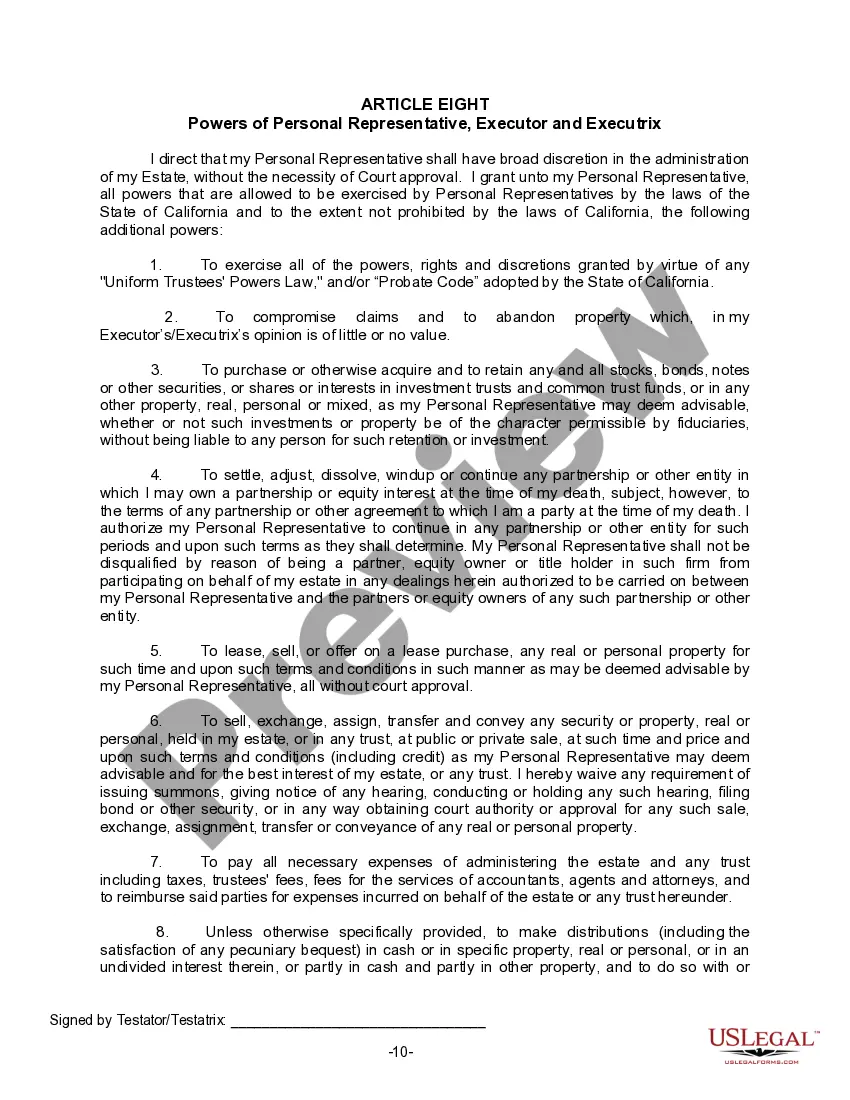

Keywords: Rialto California Legal Last Will Form, Widow or Widower, no Children, types Description: A Rialto California Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and have no children to dictate their final wishes regarding the distribution of their assets and the appointment of an executor. This form ensures that your assets are distributed according to your desires after your passing and provides clarity and peace of mind to both the individual and their loved ones. There are various types of Rialto California Legal Last Will Forms for a Widow or Widower with no Children, each designed to meet different needs and circumstances. These forms include: 1. Basic Last Will Form: This is a simple and straightforward document that enables a widow or widower with no children to outline their wishes regarding the distribution of their assets. It allows individuals to identify specific beneficiaries and assign the executor responsible for managing the estate and carrying out the provisions of the will. 2. Testamentary Trust Will Form: This type of form creates a trust, often referred to as a testamentary trust, where the widow or widower's assets are held for the benefit of named beneficiaries. The trust stipulates the distribution and management of the assets according to the instructions outlined in the will. 3. Living Will and Last Will Form: For individuals who wish to outline their healthcare preferences and end-of-life decisions alongside their distribution of assets, a Living Will and Last Will Form is available. This comprehensive document provides guidance to healthcare professionals, family members, and the appointed executor about medical treatment preferences and specific instructions on asset distribution after death. 4. Joint Last Will Form: In cases where a widow or widower wishes to create a will that applies jointly to them and their deceased spouse's assets, a Joint Last Will Form is appropriate. This form allows the individual to combine their assets and ensures that both their wishes and the wishes of their deceased spouse are fulfilled after their passing. To create a legally valid Rialto California Legal Last Will Form for a Widow or Widower with no Children, it is recommended to consult with an attorney specializing in estate planning. They can guide you through the process, ensuring that your form complies with the relevant laws and accurately reflects your intentions.Keywords: Rialto California Legal Last Will Form, Widow or Widower, no Children, types Description: A Rialto California Legal Last Will Form for a Widow or Widower with no Children is a legally binding document that allows individuals who have lost their spouse and have no children to dictate their final wishes regarding the distribution of their assets and the appointment of an executor. This form ensures that your assets are distributed according to your desires after your passing and provides clarity and peace of mind to both the individual and their loved ones. There are various types of Rialto California Legal Last Will Forms for a Widow or Widower with no Children, each designed to meet different needs and circumstances. These forms include: 1. Basic Last Will Form: This is a simple and straightforward document that enables a widow or widower with no children to outline their wishes regarding the distribution of their assets. It allows individuals to identify specific beneficiaries and assign the executor responsible for managing the estate and carrying out the provisions of the will. 2. Testamentary Trust Will Form: This type of form creates a trust, often referred to as a testamentary trust, where the widow or widower's assets are held for the benefit of named beneficiaries. The trust stipulates the distribution and management of the assets according to the instructions outlined in the will. 3. Living Will and Last Will Form: For individuals who wish to outline their healthcare preferences and end-of-life decisions alongside their distribution of assets, a Living Will and Last Will Form is available. This comprehensive document provides guidance to healthcare professionals, family members, and the appointed executor about medical treatment preferences and specific instructions on asset distribution after death. 4. Joint Last Will Form: In cases where a widow or widower wishes to create a will that applies jointly to them and their deceased spouse's assets, a Joint Last Will Form is appropriate. This form allows the individual to combine their assets and ensures that both their wishes and the wishes of their deceased spouse are fulfilled after their passing. To create a legally valid Rialto California Legal Last Will Form for a Widow or Widower with no Children, it is recommended to consult with an attorney specializing in estate planning. They can guide you through the process, ensuring that your form complies with the relevant laws and accurately reflects your intentions.