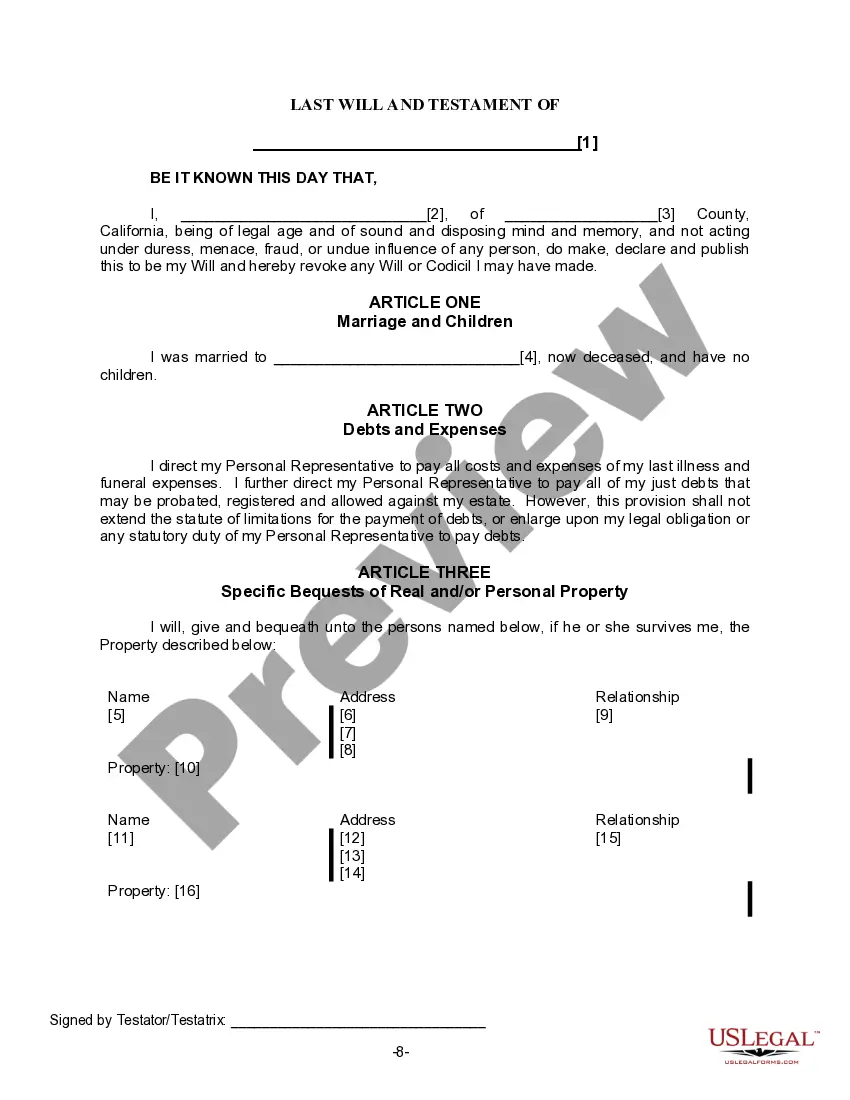

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

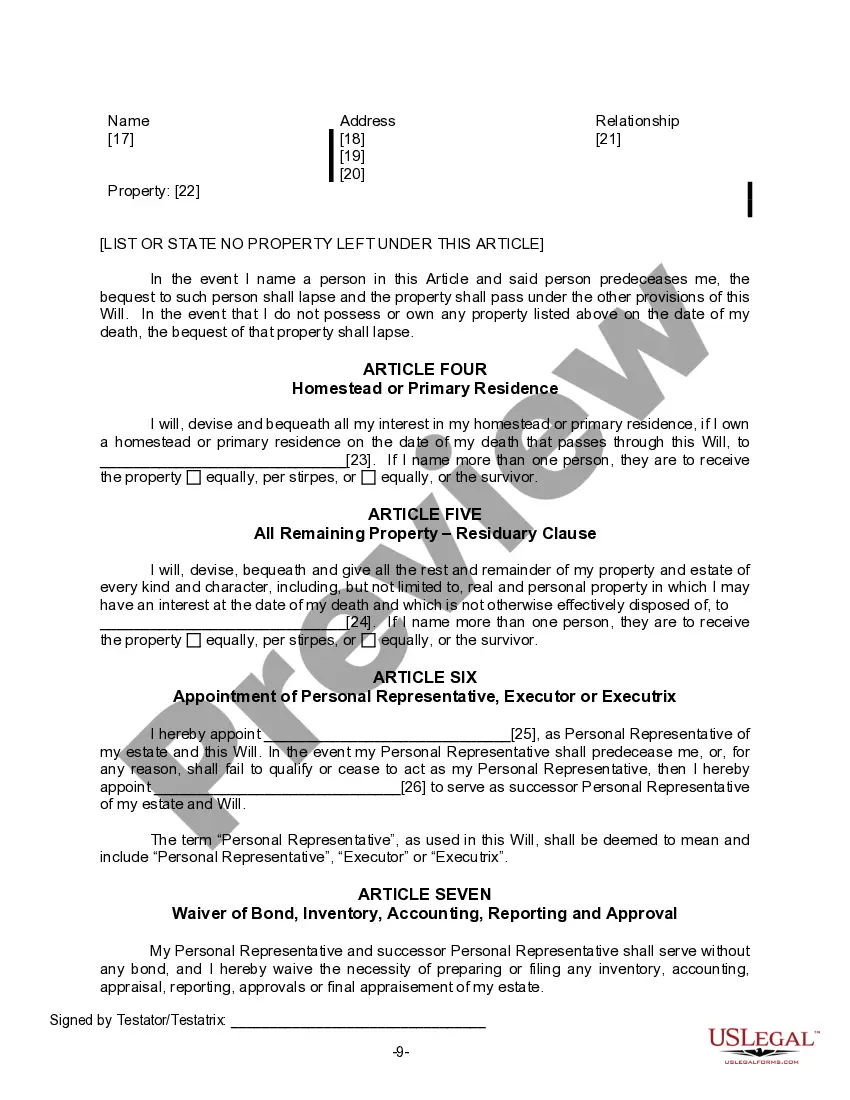

Santa Maria California Legal Last Will Form for a Widow or Widower with no Children serves as a vital document for individuals who wish to outline their final wishes and distribute their assets after their passing. This legally binding form ensures that the estate of a widow or widower with no children is managed and distributed according to their desires and state laws. The Santa Maria California Legal Last Will Form for a Widow or Widower with no Children includes the following key elements: 1. Introduction: The will begins with an introduction that clearly identifies the individual creating the will as a widow or widower with no children. 2. Appointment of Executor: The form provides a section to appoint an executor, the person responsible for overseeing the distribution of assets and managing any outstanding debts or taxes. 3. Asset Distribution: This section of the will allows the individual to specify how their assets, including real estate, investments, bank accounts, and personal belongings, should be distributed. It can include specific bequests to friends, family, or charitable organizations. 4. Debts and Expenses: They will form includes provisions for the payment of any outstanding debts, funeral expenses, and administrative costs from the estate. 5. Alternate Beneficiaries: In the event that any named beneficiaries predecease the individual, the will should designate alternate beneficiaries to ensure proper asset distribution. 6. Guardianship: If the individual has any dependents or individuals they wish to appoint as guardians, this section allows them to do so. However, since this is specifically for individuals without children, this section may not apply. 7. Residuary Clause: The form includes a residuary clause that ensures any assets not specifically mentioned in the will are still accounted for and distributed according to the individual's wishes. It's important to note that there may be variations or additional provisions to consider when creating a Santa Maria California Legal Last Will Form for a Widow or Widower with no Children. These additional forms or clauses could include a Living Will (healthcare directive) or Power of Attorney to designate someone to make medical or financial decisions on the individual's behalf. By utilizing a Santa Maria California Legal Last Will Form for a Widow or Widower with no Children appropriately, individuals can have peace of mind that their assets will be distributed as intended and in accordance with state law. It is crucial to consult an attorney or legal professional to ensure the correct and valid completion of the form and to consider other relevant estate planning documents.Santa Maria California Legal Last Will Form for a Widow or Widower with no Children serves as a vital document for individuals who wish to outline their final wishes and distribute their assets after their passing. This legally binding form ensures that the estate of a widow or widower with no children is managed and distributed according to their desires and state laws. The Santa Maria California Legal Last Will Form for a Widow or Widower with no Children includes the following key elements: 1. Introduction: The will begins with an introduction that clearly identifies the individual creating the will as a widow or widower with no children. 2. Appointment of Executor: The form provides a section to appoint an executor, the person responsible for overseeing the distribution of assets and managing any outstanding debts or taxes. 3. Asset Distribution: This section of the will allows the individual to specify how their assets, including real estate, investments, bank accounts, and personal belongings, should be distributed. It can include specific bequests to friends, family, or charitable organizations. 4. Debts and Expenses: They will form includes provisions for the payment of any outstanding debts, funeral expenses, and administrative costs from the estate. 5. Alternate Beneficiaries: In the event that any named beneficiaries predecease the individual, the will should designate alternate beneficiaries to ensure proper asset distribution. 6. Guardianship: If the individual has any dependents or individuals they wish to appoint as guardians, this section allows them to do so. However, since this is specifically for individuals without children, this section may not apply. 7. Residuary Clause: The form includes a residuary clause that ensures any assets not specifically mentioned in the will are still accounted for and distributed according to the individual's wishes. It's important to note that there may be variations or additional provisions to consider when creating a Santa Maria California Legal Last Will Form for a Widow or Widower with no Children. These additional forms or clauses could include a Living Will (healthcare directive) or Power of Attorney to designate someone to make medical or financial decisions on the individual's behalf. By utilizing a Santa Maria California Legal Last Will Form for a Widow or Widower with no Children appropriately, individuals can have peace of mind that their assets will be distributed as intended and in accordance with state law. It is crucial to consult an attorney or legal professional to ensure the correct and valid completion of the form and to consider other relevant estate planning documents.