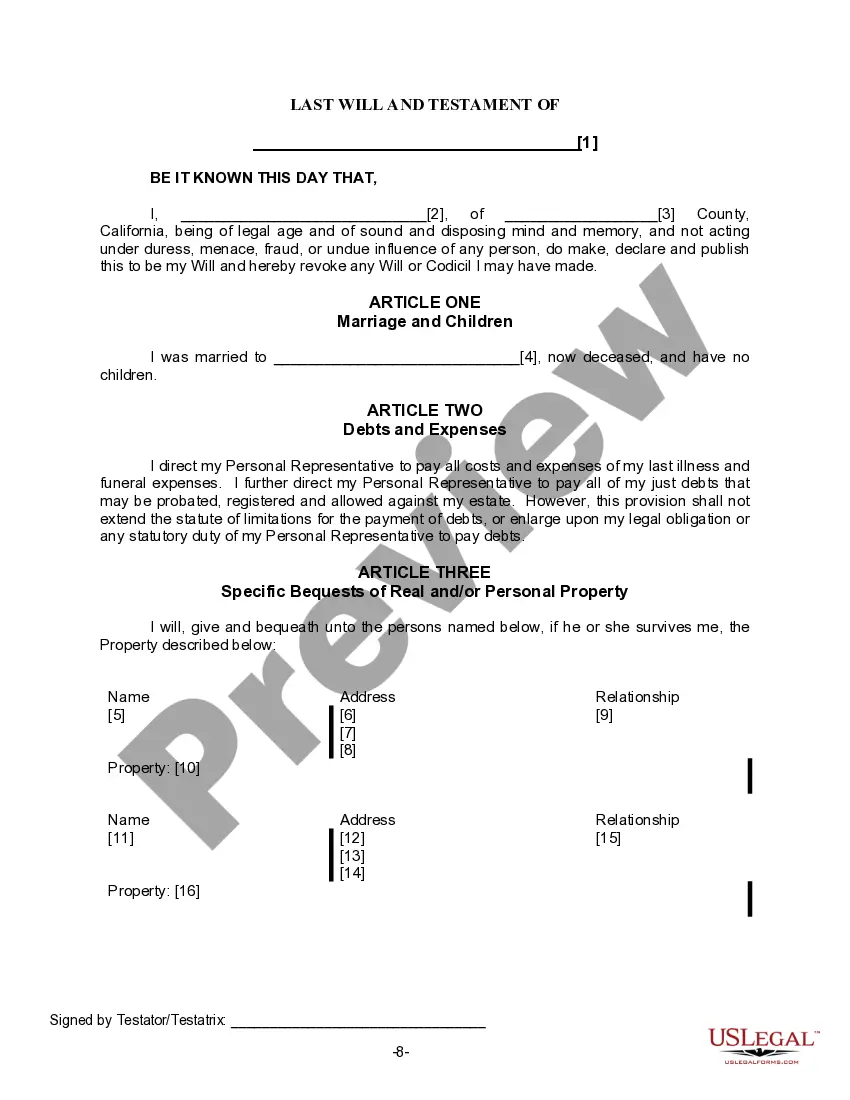

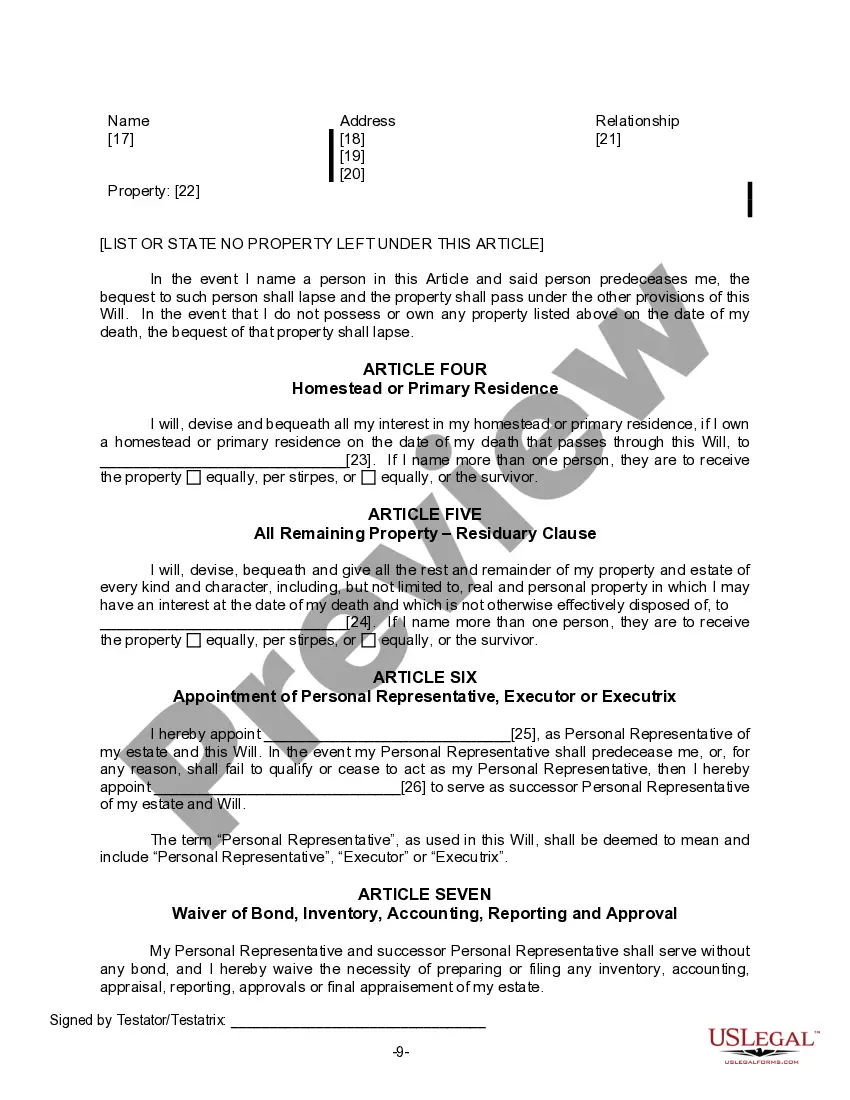

The Legal Last Will Form and Instructions you have found is for a widow or widower with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

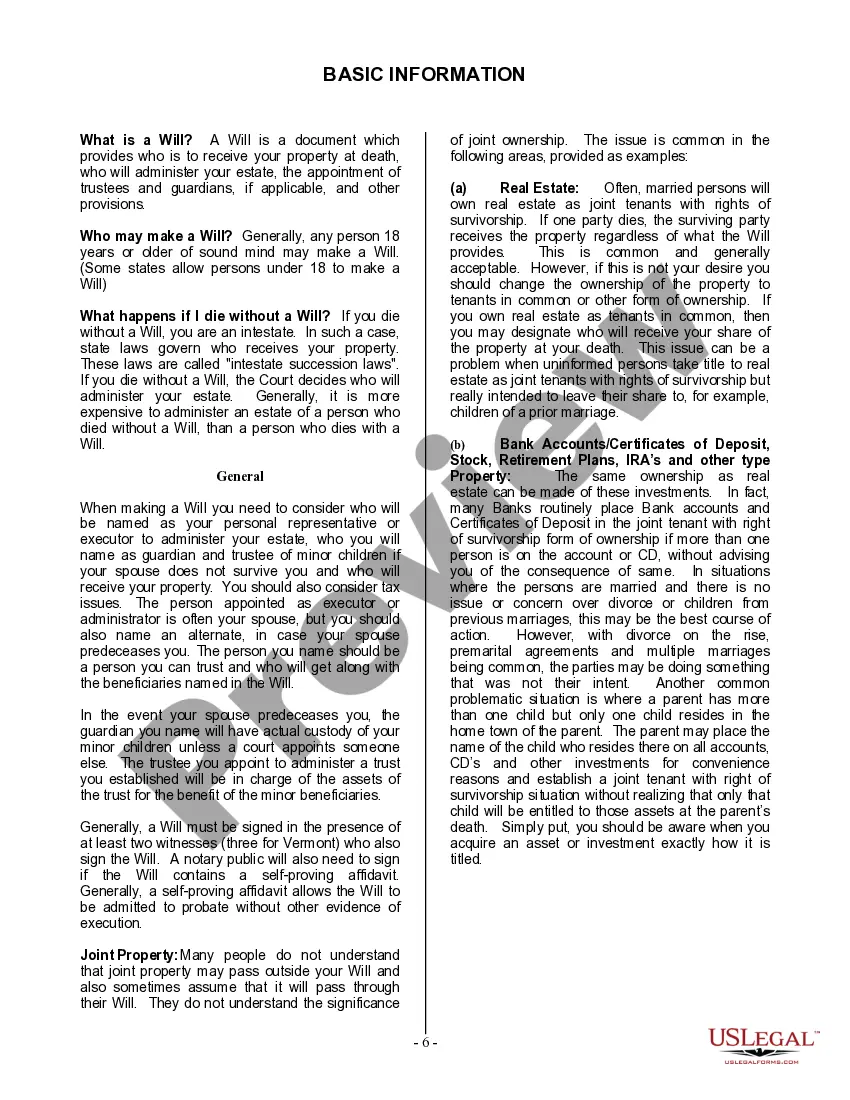

Title: Thousand Oaks California Legal Last Will Form for a Widow or Widower with no Children: A Comprehensive Guide Introduction: In Thousand Oaks, California, it is essential for individuals to have a clearly defined legal last will to ensure their assets are distributed according to their wishes. This guide aims to provide a detailed description of the Thousand Oaks California Legal Last Will Form tailored specifically for widows or widowers without children. Keywords: Thousand Oaks California Legal Last Will Form, widow, widower, no children Types of Thousand Oaks California Legal Last Will Form for a Widow or Widower with no Children: 1. Basic Last Will and Testament: The Basic Last Will and Testament is a straightforward document that outlines how a widow or widower's assets will be distributed upon their passing. This form primarily covers the essential components of a will, including identifying the executor, designating beneficiaries, and specifying the distribution of assets among them. 2. Pour-Over Will: A Pour-Over Will is recommended for individuals with complex estate plans. It allows you to transfer any assets not covered by your existing trusts into the trust after your passing. By doing so, you can ensure comprehensive estate planning, incorporating any property or assets that were not included in the initial trust. 3. Living Will: Though not specifically tailored to widows or widowers without children, a Living Will is worth considering for those seeking to outline their medical wishes in the event they become incapacitated. It grants authority to a designated agent to make medical decisions on your behalf, ensuring your preferences are respected. 4. Durable Power of Attorney for Finances: A Durable Power of Attorney for Finances enables a widow or widower to designate a trusted individual to manage their financial affairs in case of incapacitation. This legal document ensures that their financial matters will be handled appropriately and in alignment with their wishes. 5. Revocable Living Trust: While a Revocable Living Trust primarily focuses on the management of assets, it allows a widow or widower to maintain control of their property while providing for a seamless transfer of ownership upon their passing. This form can be a beneficial addition to ensure effective estate planning. Conclusion: Thousand Oaks, California, offers several types of legal last will form suitable for widows or widowers without children. From the Basic Last Will and Testament to a Revocable Living Trust, individuals can choose the form that aligns with their specific needs and estate planning requirements. It is advisable to consult with a qualified attorney to determine the most appropriate legal document to secure assets and protect the future.Title: Thousand Oaks California Legal Last Will Form for a Widow or Widower with no Children: A Comprehensive Guide Introduction: In Thousand Oaks, California, it is essential for individuals to have a clearly defined legal last will to ensure their assets are distributed according to their wishes. This guide aims to provide a detailed description of the Thousand Oaks California Legal Last Will Form tailored specifically for widows or widowers without children. Keywords: Thousand Oaks California Legal Last Will Form, widow, widower, no children Types of Thousand Oaks California Legal Last Will Form for a Widow or Widower with no Children: 1. Basic Last Will and Testament: The Basic Last Will and Testament is a straightforward document that outlines how a widow or widower's assets will be distributed upon their passing. This form primarily covers the essential components of a will, including identifying the executor, designating beneficiaries, and specifying the distribution of assets among them. 2. Pour-Over Will: A Pour-Over Will is recommended for individuals with complex estate plans. It allows you to transfer any assets not covered by your existing trusts into the trust after your passing. By doing so, you can ensure comprehensive estate planning, incorporating any property or assets that were not included in the initial trust. 3. Living Will: Though not specifically tailored to widows or widowers without children, a Living Will is worth considering for those seeking to outline their medical wishes in the event they become incapacitated. It grants authority to a designated agent to make medical decisions on your behalf, ensuring your preferences are respected. 4. Durable Power of Attorney for Finances: A Durable Power of Attorney for Finances enables a widow or widower to designate a trusted individual to manage their financial affairs in case of incapacitation. This legal document ensures that their financial matters will be handled appropriately and in alignment with their wishes. 5. Revocable Living Trust: While a Revocable Living Trust primarily focuses on the management of assets, it allows a widow or widower to maintain control of their property while providing for a seamless transfer of ownership upon their passing. This form can be a beneficial addition to ensure effective estate planning. Conclusion: Thousand Oaks, California, offers several types of legal last will form suitable for widows or widowers without children. From the Basic Last Will and Testament to a Revocable Living Trust, individuals can choose the form that aligns with their specific needs and estate planning requirements. It is advisable to consult with a qualified attorney to determine the most appropriate legal document to secure assets and protect the future.