This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out California Last Will And Testament With All Property To Trust Called A Pour Over Will?

If you’ve previously used our service, Log In to your profile and store the Victorville California Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your first encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile within the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Confirm you’ve located the correct document. Review the description and utilize the Preview option, if provided, to verify if it aligns with your needs. If it doesn’t meet your requirements, use the Search tab above to find the right one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Victorville California Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will. Select the file format for your document and save it to your device.

- Complete your template. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

While putting your house in a trust can provide benefits like avoiding probate, there are some disadvantages to consider. You may have to incur costs for creating the trust, and transferring ownership may have tax implications. Additionally, it can complicate access to your property if the trust's terms are not clearly defined. Understanding these aspects is vital when establishing a Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will.

To put your property in a trust in California, you need to create the trust document and execute a transfer deed for the property. This deed should clearly state that the property is being transferred to your trust. Utilizing resources like USLegalForms can simplify the process and ensure that your Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will is properly structured.

In many cases, a trust can override a last will and testament. If a property is transferred to a trust prior to your passing, it will not be included in your will. This is particularly relevant if you have a Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will, as assets in the trust typically bypass probate and distribute directly to the beneficiaries.

Transferring property into a trust in California involves executing a transfer deed that officially moves ownership from you to the trust. You will need to identify the property and ensure that the deed is properly recorded with the county. This process helps to include your property in your estate plan, particularly when considering a Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will.

Yes, you can set up a trust without an attorney in California. However, it is important to ensure that the trust complies with state laws to be valid. Using online platforms like USLegalForms can guide you in creating an appropriate trust document. For a comprehensive estate plan, including a Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will, consulting with an attorney might still be beneficial.

One of the biggest mistakes people make with wills is failing to update them after significant life changes, such as marriage, divorce, or the birth of a child. Additionally, many overlook the importance of detailing their wishes clearly. When crafting your Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will, it's important to regularly review and update it to reflect your current circumstances and intentions.

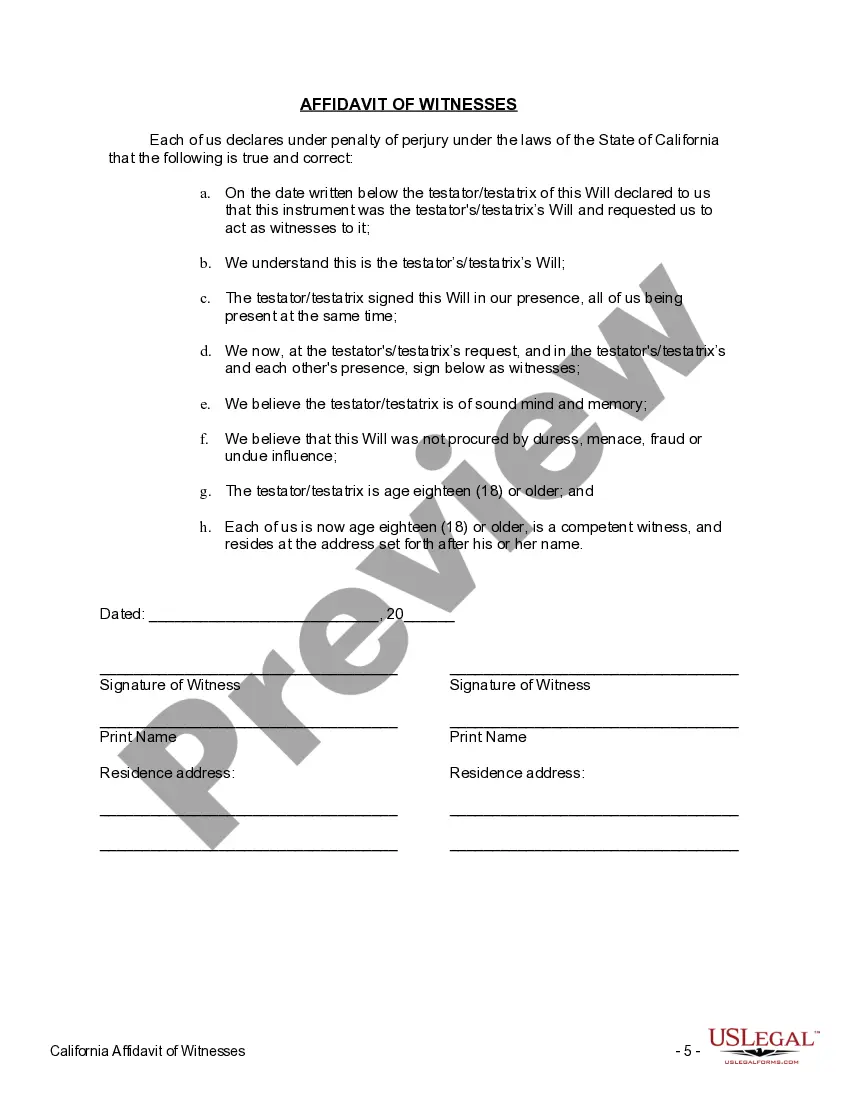

To ensure that your will is valid in California, it must be in writing, clearly state your desires for property distribution, and be signed by you. You also need at least two witnesses who are not beneficiaries to sign the document. When preparing your Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will, meeting these requirements is essential for your will to stand up in court.

over will acts as a safety net for your trust, facilitating the transfer of any remaining assets into the trust after your passing. When you create a Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will, it directs that any assets not previously included in your trust will be transferred into it, simplifying the estate distribution process. This ensures that all your wishes are honored and managed efficiently.

In California, several factors can void a will, including lack of proper execution or the presence of undue influence. If a testator was not of sound mind at the time of signing, the will may also be disqualified. Understanding these factors is crucial when drafting your Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will, as it helps ensure its validity.

A last will and testament is considered legal in California when it meets specific requirements outlined by law. The document must be in writing, signed by the testator, and witnessed by at least two qualified individuals. Additionally, if you are creating a Victorville California Last Will and Testament with All Property to Trust called a Pour Over Will, ensure that it clearly expresses your intentions regarding property distribution.