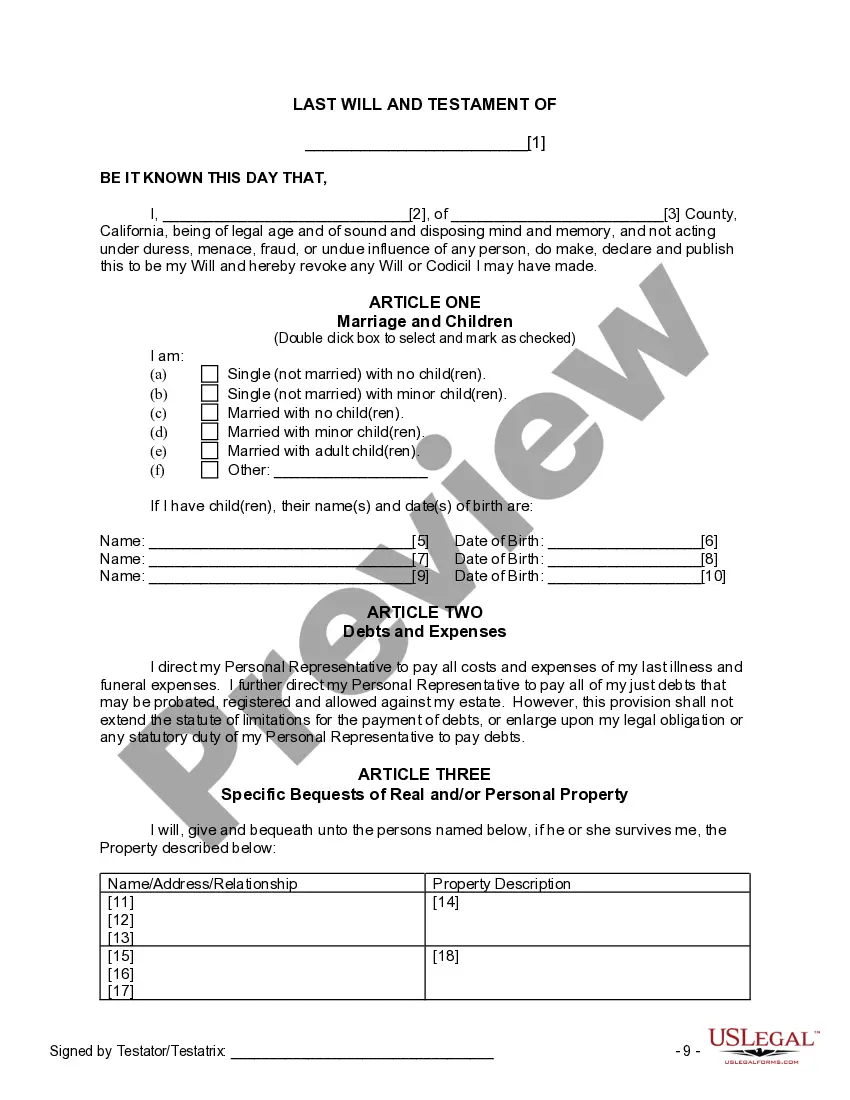

This form, a Last Will and Testament for other Persons, is for use if you cannot locate another document to fit your current needs. A will is a document that provides who is to receive your property at death, who will administer your estate, the appointment of trustees and guardians, if applicable, and other provisions. This is a will for anyone residing in the state of California. This will is specifically designed to be completed on your computer.

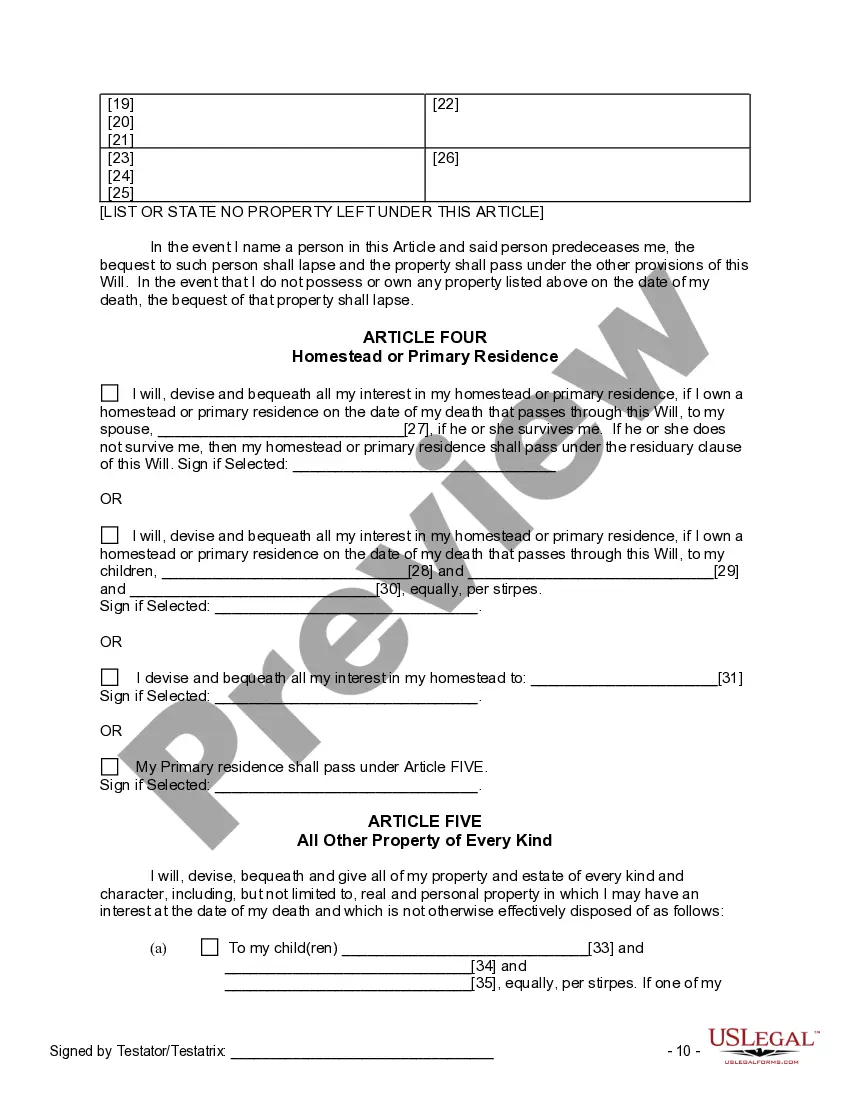

Sunnyvale California Last Will and Testament for Other Persons: A Comprehensive Guide to Estate Planning Introduction: The Sunnyvale California Last Will and Testament for other Persons is a legally binding document that allows individuals to ensure their assets and personal wishes are carried out after their death. It serves as a vital part of the estate planning process, providing clarity, protection, and distribution instructions for personal belongings, financial assets, and even guardianship arrangements for minor children. This detailed description will explore the key aspects of the Sunnyvale California Last Will and Testament, including its types and associated benefits. 1. Types of Sunnyvale California Last Will and Testament for other Persons: a. Simple Last Will and Testament: This type of will is suitable for individuals with a straightforward estate and minimal assets. It outlines how one's assets should be distributed and appoints an executor to oversee the process. b. Living Will: Also known as an Advance Directive, a living will allows individuals to specify their medical treatment preferences in case they become incapacitated and unable to communicate their wishes. 2. Purpose and Importance: a. Asset Distribution: The primary objective of a Sunnyvale California Last Will and Testament is to ensure the smooth transfer and distribution of assets, such as properties, investments, bank accounts, and personal belongings, according to the decedent's wishes. b. Appointment of Executor: The document names an executor who will manage the estate's administration, including settling debts, paying taxes, and distributing the assets to beneficiaries. c. Guardianship Arrangements: If the testator has minor children, the will can appoint a guardian to provide care, support, and guidance should the parents pass away. 3. Key Elements: a. Testator's Personal Information: The will includes details of the testator, including their full name, address, and contact information. b. Executor Selection: The document designates a trustworthy and responsible person to act as the executor and carry out the stipulations outlined in the will. c. Asset Distribution: The will specifies how assets should be distributed among beneficiaries or organizations, including charities or nonprofit organizations. d. Alternate Beneficiaries: In case a primary beneficiary is unable or unwilling to accept the bequest, alternate beneficiaries are named to ensure a smooth transfer of assets. e. Contingency Plans: The will may include instructions for various scenarios, such as the simultaneous death of both spouses, to provide contingencies for unexpected situations. 4. Benefits and Considerations: a. Peace of Mind: Creating a Sunnyvale California Last Will and Testament ensures that one's final wishes are documented, reducing potential conflicts and confusion among beneficiaries. b. Family Protection: The will facilitates the financial well-being of dependents by outlining child custody preferences and appointing guardian(s) for minors. c. Tax Planning: Through a well-crafted will, individuals can implement strategies to minimize estate taxes and potentially save beneficiaries from unnecessary tax burdens. d. Flexibility: Sunnyvale California Last Will and Testament can be revised and updated at any time to reflect changes in circumstances, such as births, deaths, or changes in assets. Conclusion: The Sunnyvale California Last Will and Testament for other Persons plays a crucial role in preserving an individual's legacy and ensuring the orderly administration of their estate. With its various types available and comprehensive elements covered, this legal document provides individuals with peace of mind, family protection, and the opportunity to dictate their asset distribution exactly as intended. Seeking professional legal advice is always recommended ensuring compliance with local laws and to tailor the will to specific personal circumstances.Sunnyvale California Last Will and Testament for Other Persons: A Comprehensive Guide to Estate Planning Introduction: The Sunnyvale California Last Will and Testament for other Persons is a legally binding document that allows individuals to ensure their assets and personal wishes are carried out after their death. It serves as a vital part of the estate planning process, providing clarity, protection, and distribution instructions for personal belongings, financial assets, and even guardianship arrangements for minor children. This detailed description will explore the key aspects of the Sunnyvale California Last Will and Testament, including its types and associated benefits. 1. Types of Sunnyvale California Last Will and Testament for other Persons: a. Simple Last Will and Testament: This type of will is suitable for individuals with a straightforward estate and minimal assets. It outlines how one's assets should be distributed and appoints an executor to oversee the process. b. Living Will: Also known as an Advance Directive, a living will allows individuals to specify their medical treatment preferences in case they become incapacitated and unable to communicate their wishes. 2. Purpose and Importance: a. Asset Distribution: The primary objective of a Sunnyvale California Last Will and Testament is to ensure the smooth transfer and distribution of assets, such as properties, investments, bank accounts, and personal belongings, according to the decedent's wishes. b. Appointment of Executor: The document names an executor who will manage the estate's administration, including settling debts, paying taxes, and distributing the assets to beneficiaries. c. Guardianship Arrangements: If the testator has minor children, the will can appoint a guardian to provide care, support, and guidance should the parents pass away. 3. Key Elements: a. Testator's Personal Information: The will includes details of the testator, including their full name, address, and contact information. b. Executor Selection: The document designates a trustworthy and responsible person to act as the executor and carry out the stipulations outlined in the will. c. Asset Distribution: The will specifies how assets should be distributed among beneficiaries or organizations, including charities or nonprofit organizations. d. Alternate Beneficiaries: In case a primary beneficiary is unable or unwilling to accept the bequest, alternate beneficiaries are named to ensure a smooth transfer of assets. e. Contingency Plans: The will may include instructions for various scenarios, such as the simultaneous death of both spouses, to provide contingencies for unexpected situations. 4. Benefits and Considerations: a. Peace of Mind: Creating a Sunnyvale California Last Will and Testament ensures that one's final wishes are documented, reducing potential conflicts and confusion among beneficiaries. b. Family Protection: The will facilitates the financial well-being of dependents by outlining child custody preferences and appointing guardian(s) for minors. c. Tax Planning: Through a well-crafted will, individuals can implement strategies to minimize estate taxes and potentially save beneficiaries from unnecessary tax burdens. d. Flexibility: Sunnyvale California Last Will and Testament can be revised and updated at any time to reflect changes in circumstances, such as births, deaths, or changes in assets. Conclusion: The Sunnyvale California Last Will and Testament for other Persons plays a crucial role in preserving an individual's legacy and ensuring the orderly administration of their estate. With its various types available and comprehensive elements covered, this legal document provides individuals with peace of mind, family protection, and the opportunity to dictate their asset distribution exactly as intended. Seeking professional legal advice is always recommended ensuring compliance with local laws and to tailor the will to specific personal circumstances.