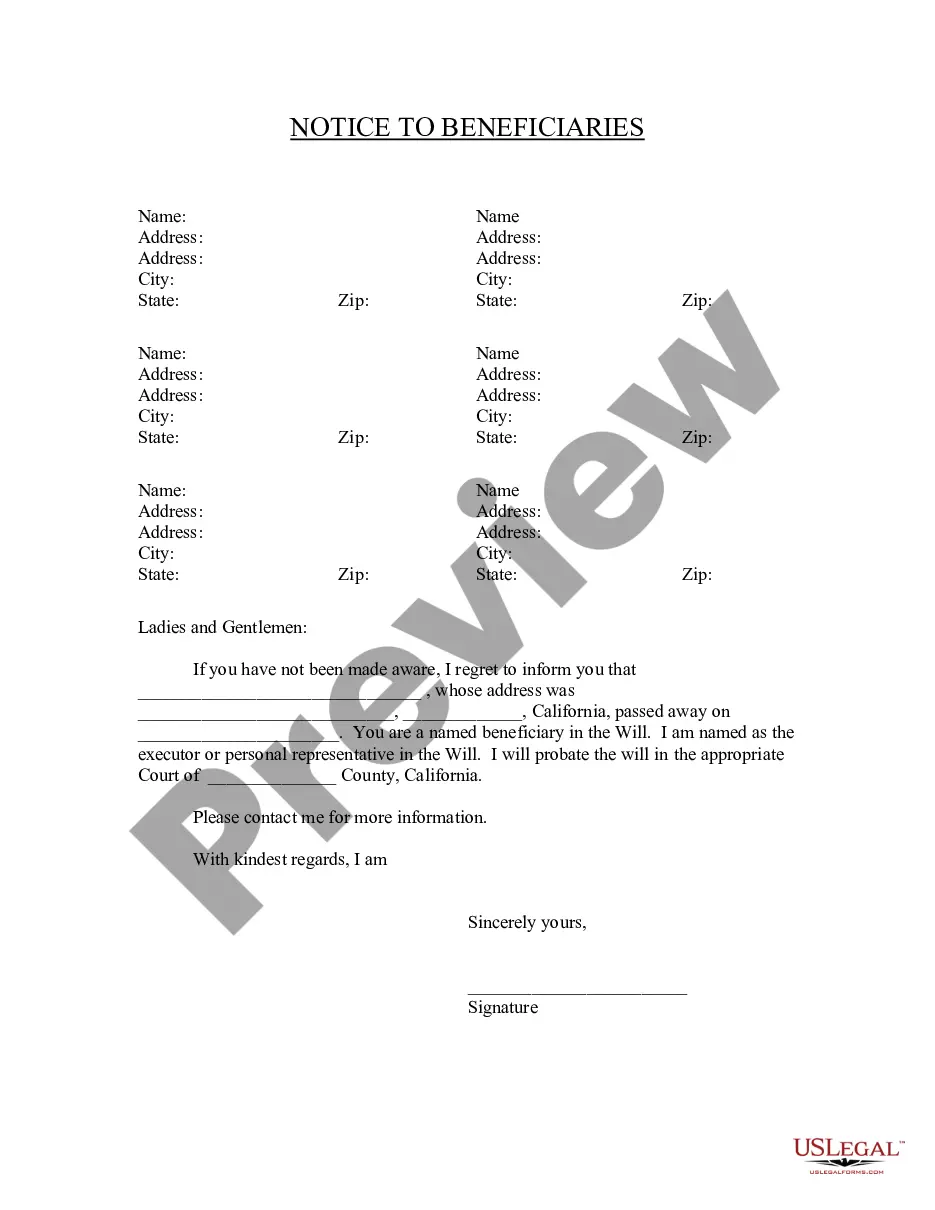

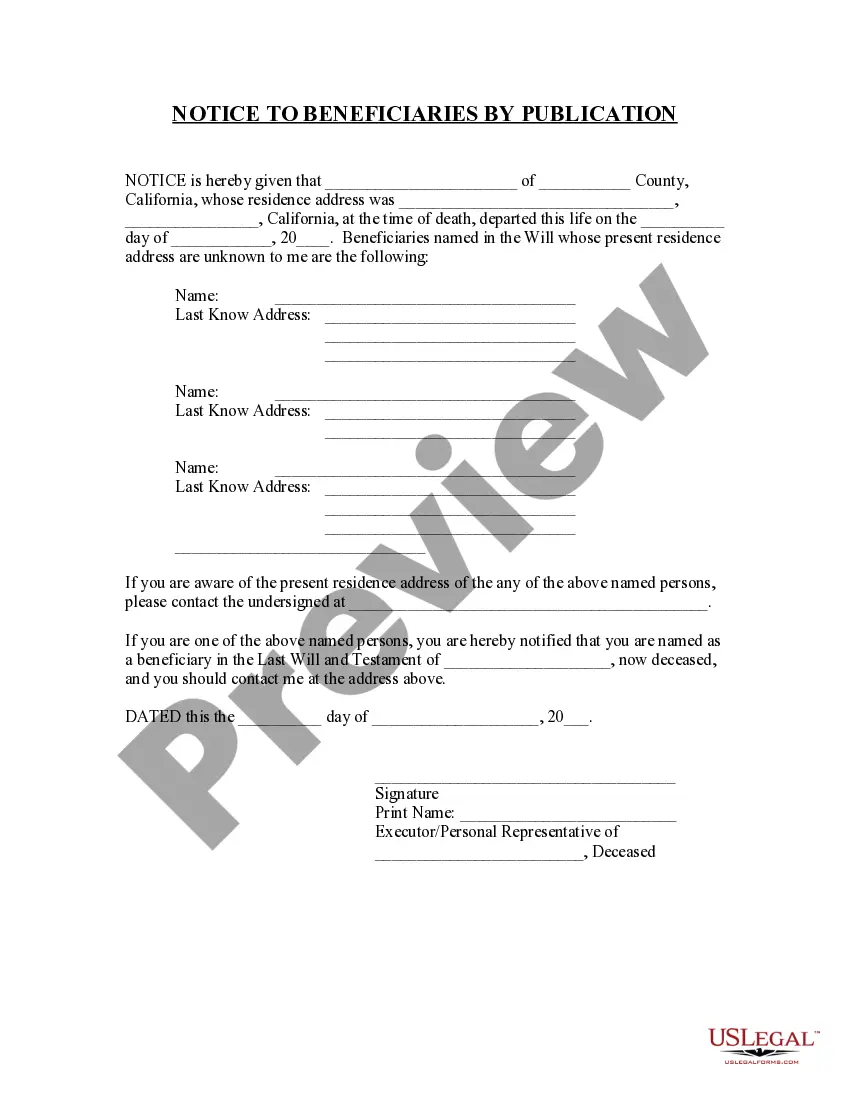

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

Bakersfield California Notice to Beneficiaries of being Named in Will

Description

How to fill out California Notice To Beneficiaries Of Being Named In Will?

In the event that you have utilized our service previously, Log In to your account and download the Bakersfield California Notice to Beneficiaries of being Named in Will to your device by clicking the Download button. Ensure that your subscription is active. If it isn't, renew it in accordance with your payment plan.

If this marks your initial experience with our service, adhere to these straightforward steps to acquire your document.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to retrieve it again. Utilize the US Legal Forms service to effortlessly find and save any template for your individual or professional needs!

- Ensure you have located the correct document. Review the description and utilize the Preview feature, if accessible, to determine if it aligns with your requirements. If it does not suit your needs, employ the Search tab above to discover the fitting one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Acquire your Bakersfield California Notice to Beneficiaries of being Named in Will. Choose the file format for your document and save it to your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Executors have a duty to communicate with beneficiaries. If they are not doing so, you are entitled to take action.

Helen: If someone has left a will and you are a beneficiary of an estate, you would usually be contacted by the executor, or the solicitor the executor has instructed, to notify you that you are a beneficiary.

A beneficiary is entitled to be told if they are named in a person's will. They are also entitled to be told what, if any, property/possessions have been left to them, and the full amount of inheritance they will receive.

Beneficiaries have a right to be notified that they are entitled to an inheritance from the estate. It is up to the executor to decide when is an appropriate time to inform the beneficiaries. Often executors will inform beneficiaries at the beginning of the administration of the estate.

A notice regarding the trust and the beginning of the trust administration period must be sent to all of the people named as beneficiaries of the trust. These notices must be sent out within 60 days of the date of the death that caused the change in the trust or initiated the trust administration period.

Who Notifies Me That I Am a Beneficiary of a Will? Typically, executors should notify beneficiaries of the estate within three months after the will has been filed in probate court. Items listed will become a part of the public record once admitted to probate.

You do not have an obligation to divulge the details of your will, but there are many good reasons to consider doing so. For example, letting your beneficiaries know what they can expect to inherit may reduce the risk of a contested will .

While it is often beneficial to communicate with beneficiaries regarding the estate administration, executors are not required to comply with every single request for information. Beneficiaries are often surprised to discover that in reality they have a right to very little information regarding an estate.

You should check all of your estate planning documents every three to four years?and the same goes for beneficiary designations. Most importantly, when you get divorced or make significant life changes, you want to check and revise all these documents.

There are three main ways to find out if someone left you money after their death. Reach out to their personal representative (executor) or attorney. This is the fastest way to find out.Contact the Court Clerk's Office.Learn your state's Intestacy Laws.