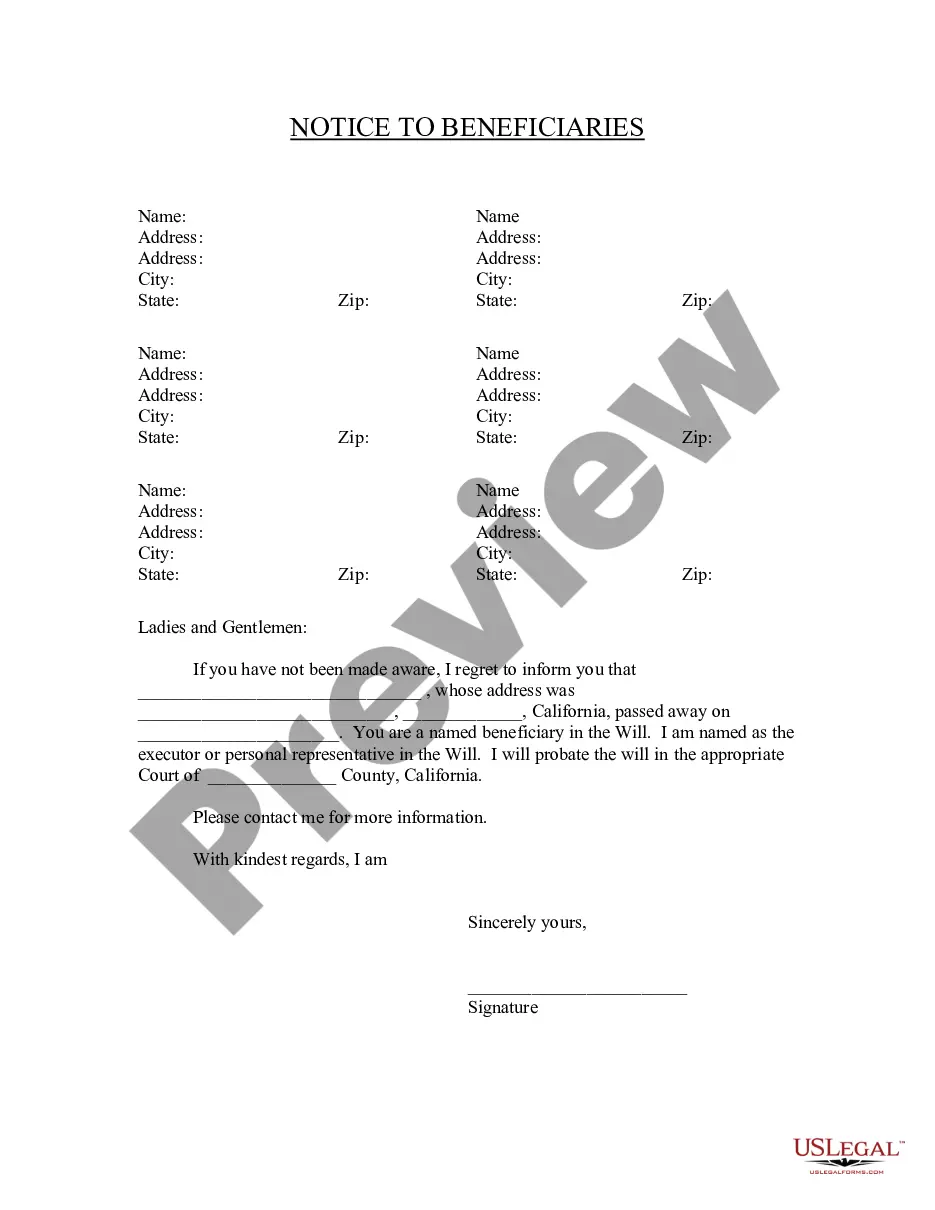

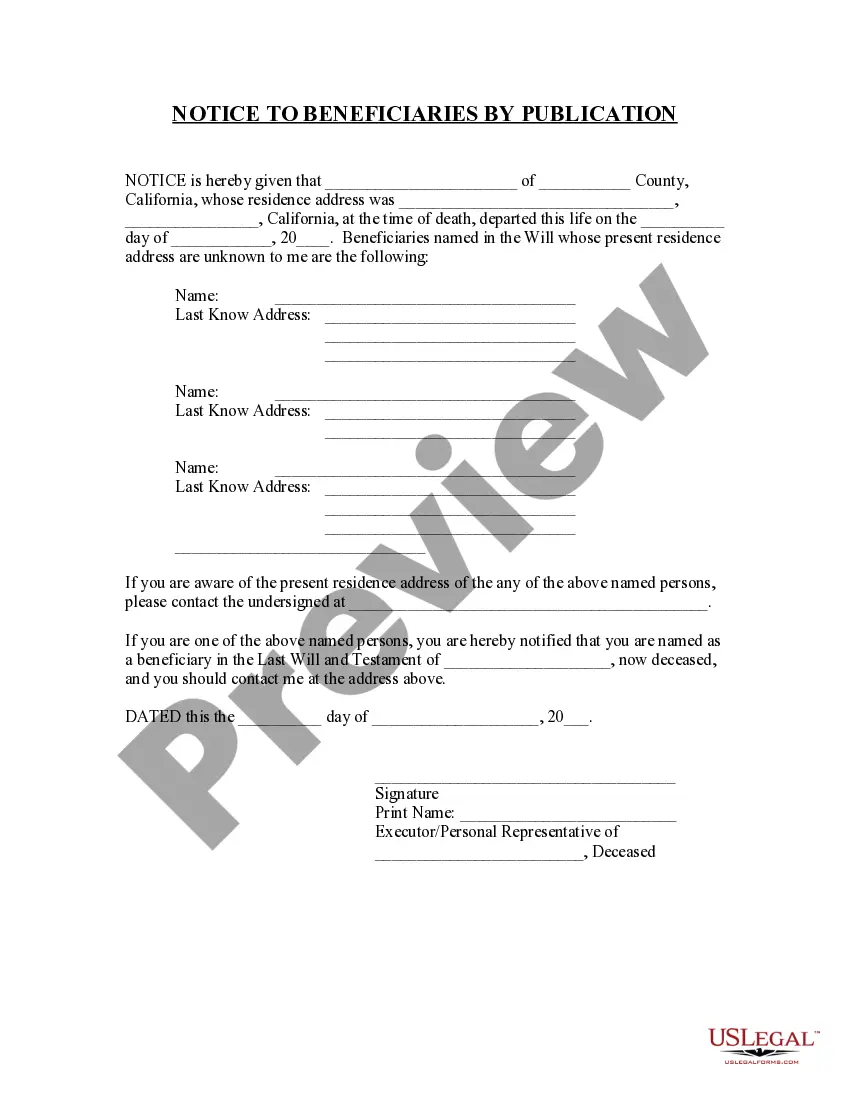

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

Irvine California Notice to Beneficiaries: A Comprehensive Guide for Those Named in a Will When it comes to estate planning, being named as a beneficiary in a will holds significant importance. If you find yourself in such a situation in Irvine, California, understanding the intricacies of the Notice to Beneficiaries is crucial. This detailed description aims to provide you with comprehensive information about the different types of Irvine California Notice to Beneficiaries and the key elements they encompass. 1. Notice to Beneficiaries: The basic Notice to Beneficiaries serves as a formal communication to individuals identified as beneficiaries in a will. In Irvine, California, this notice is typically sent out by the executor or personal representative of the estate. The main purpose of this notice is to inform the beneficiaries of their inclusion in the will, their rights, and any obligations they are required to fulfill. 2. Notice Regarding Changing Beneficiaries: In some cases, beneficiaries named in a will may change due to various reasons such as the passing of a primary beneficiary or if the testator decides to update their will. This type of Notice to Beneficiaries notifies involved parties about the changes and ensures transparency in the distribution of the estate. 3. Notice of Probate Proceedings: When a will enters the probate process, a Notice of Probate Proceedings is typically sent to beneficiaries. This notice details all relevant information regarding the probate process, including important dates, court appearances, and instructions on how beneficiaries can make their claims. 4. Notice of Trust Administration: If a will includes a trust, beneficiaries are required to receive a Notice of Trust Administration. This notice provides beneficiaries with essential details about the trust, its terms and conditions, the identity of the trustee(s), and how the trustee will carry out the distribution of assets. Understanding this notice is vital for beneficiaries to safeguard their inheritance rights. 5. Notice to Creditors: In situations where beneficiaries may not be the only ones involved in the estate, a Notice to Creditors is issued. This notice informs potential creditors about the death of the testator and the necessity to submit any valid claims against the estate within a specified timeframe. It is crucial for all beneficiaries named in a will in Irvine, California, to closely review and understand the Notice to Beneficiaries they receive. This notice acts as a fundamental means of communication between the executor and the beneficiaries, outlining the rights, responsibilities, and procedures associated with their inheritance. In conclusion, the different types of Irvine California Notices to Beneficiaries include the basic Notice to Beneficiaries, Notice Regarding Changing Beneficiaries, Notice of Probate Proceedings, Notice of Trust Administration, and Notice to Creditors. Being well-informed about these notices ensures beneficiaries can actively participate in the estate distribution process and protect their interests as intended by the testator.