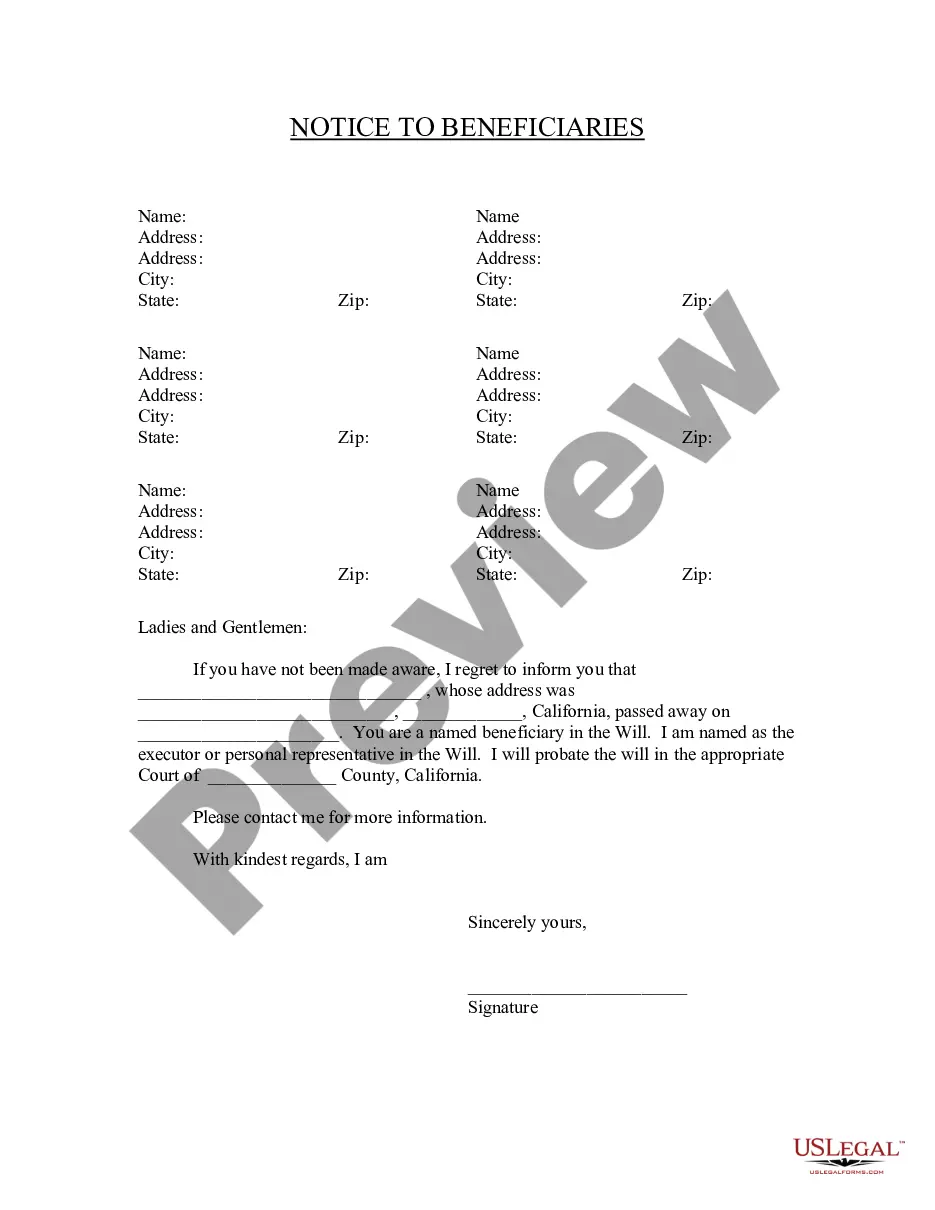

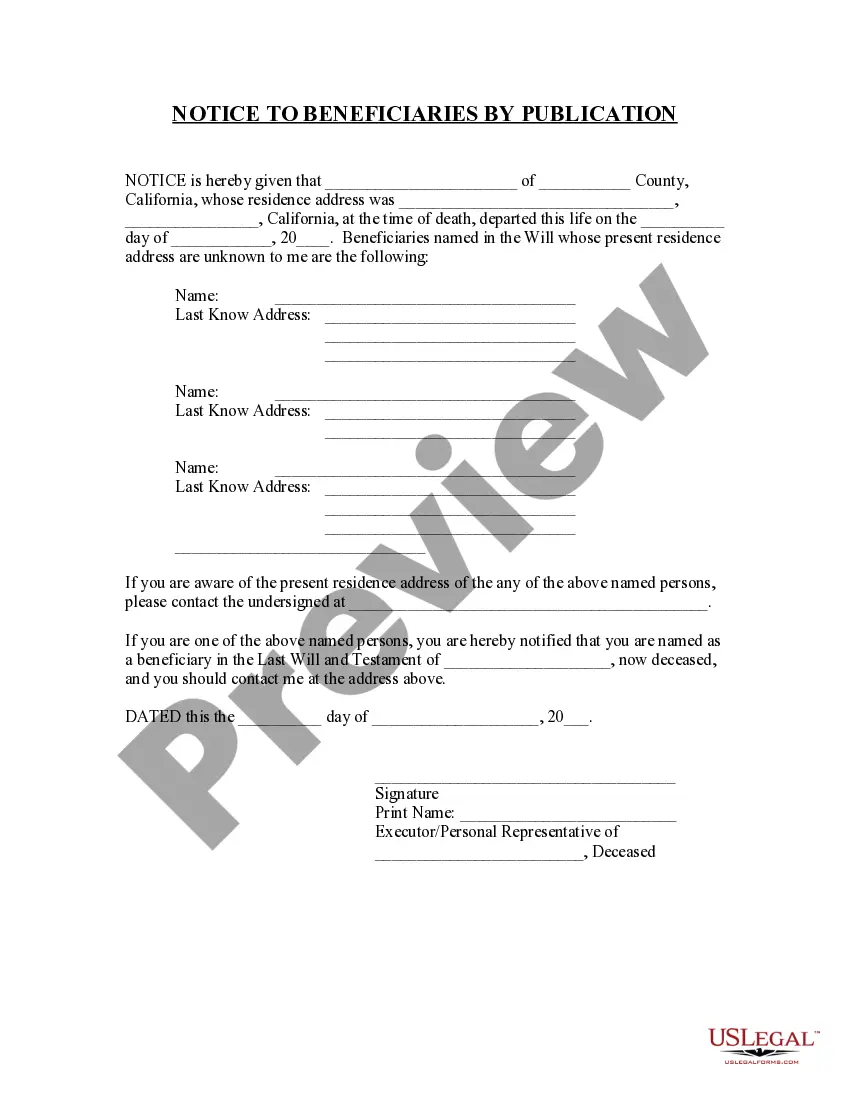

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

Title: Understanding the Thousand Oaks California Notice to Beneficiaries of Being Named in a Will Introduction: A Thousand Oaks California Notice to Beneficiaries of being named in a will is a crucial legal document that ensures transparency, communication, and compliance with the state law regarding estate planning. In this article, we will provide a comprehensive overview of what this notice entails and why it is important for all parties involved. 1. Definition of a Thousand Oaks California Notice to Beneficiaries of being Named in a Will: This notice is a written communication delivered to individuals named as beneficiaries in a will buy the executor or personal representative of the deceased person's estate. It serves the purpose of informing beneficiaries about their inclusion in the will, the nature and extent of their inheritance, and their rights and responsibilities. 2. Key Elements of the Notice: — Identification of the deceased: The notice should clearly state the full name and relevant details of the person who has passed away, ensuring that there is no confusion regarding the deceased individual's identity. — Executor or personal representative information: The notice should include the executor or personal representative's name, contact details, and their legal authority to carry out the estate administration. — Beneficiary designation: The notice should list all individuals named as beneficiaries in the will, specifying their relationship to the deceased and the portion of the estate they are entitled to receive. — Distribution timeline: The notice should provide an estimated timeline outlining when beneficiaries can expect to receive their inheritance. 3. Variations of Thousand Oaks California Notice to Beneficiaries: While the core purpose of the notice remains the same, there may be variations based on individual circumstances. Some of these include: — Notice to contingent beneficiaries: If a primary beneficiary predeceases the testator (the person who created the will), a separate notice may be issued to the contingent beneficiary outlining their potential entitlement. — Notice to minor beneficiaries: When minors are named as beneficiaries, additional steps may be taken to appoint a guardian or set up a trust to manage their inheritance until they reach legal age. — Revised notice: In the event of a significant change or amendment to the will, a revised notice should be promptly delivered to ensure beneficiaries are aware of any adjustments made to their inheritance. Conclusion: A Thousand Oaks California Notice to Beneficiaries of being Named in a Will is a vital legal obligation that promotes transparency and protects the interests of both the deceased person's estate and the beneficiaries. By providing detailed information about their inheritance, this notice allows beneficiaries to understand their rights and participate actively in the probate process. It is essential for all parties involved to comply with the notice requirements to ensure a smooth and fair distribution of assets according to the deceased individual's wishes.