This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

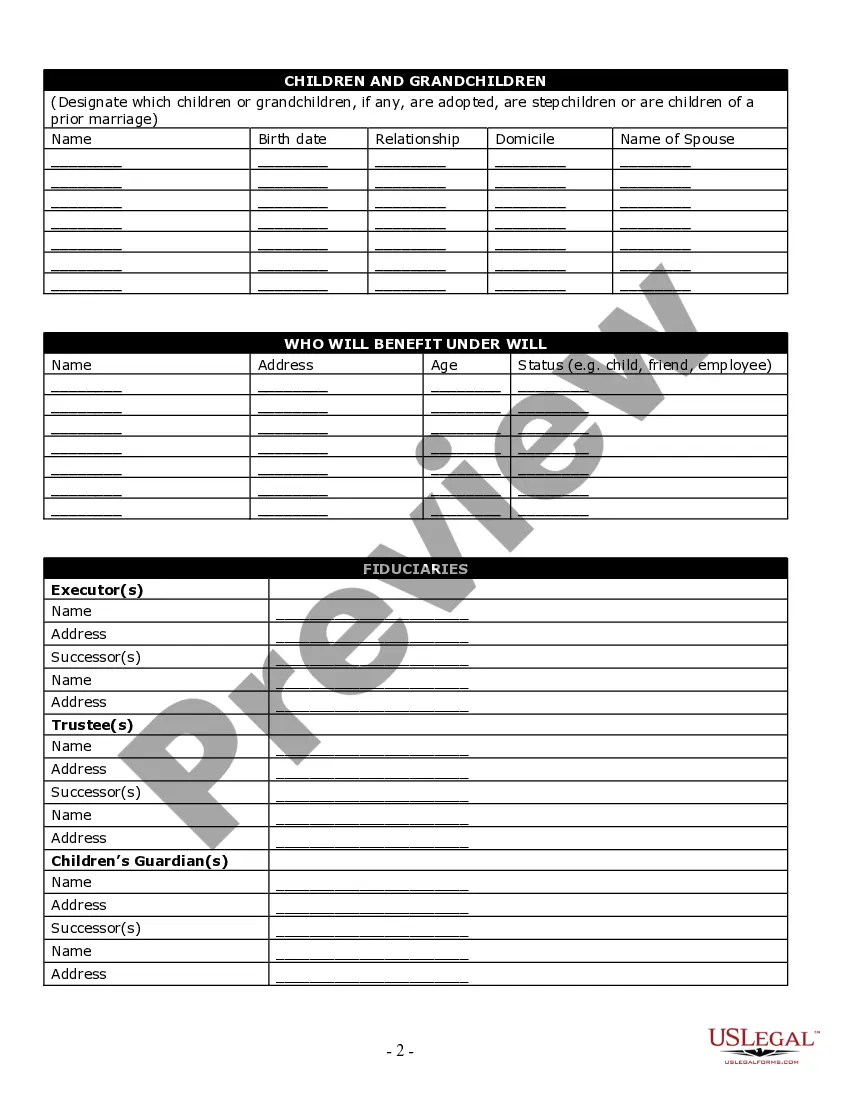

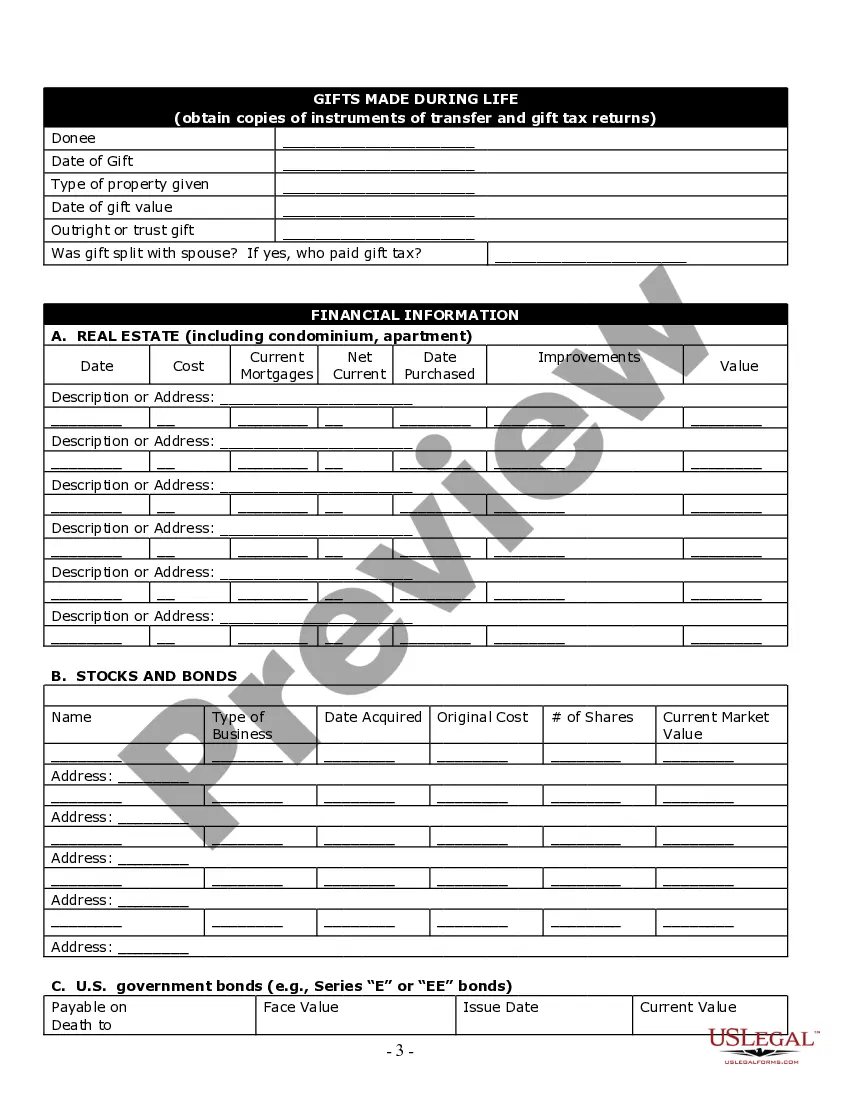

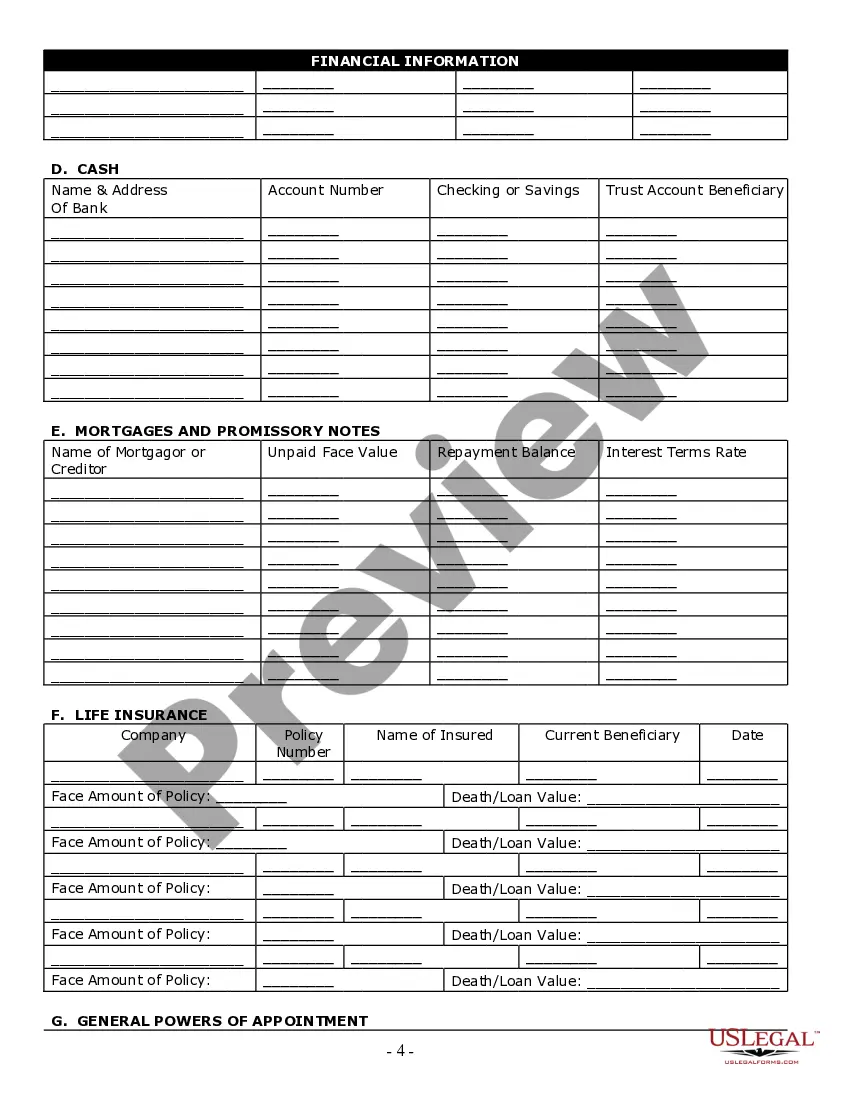

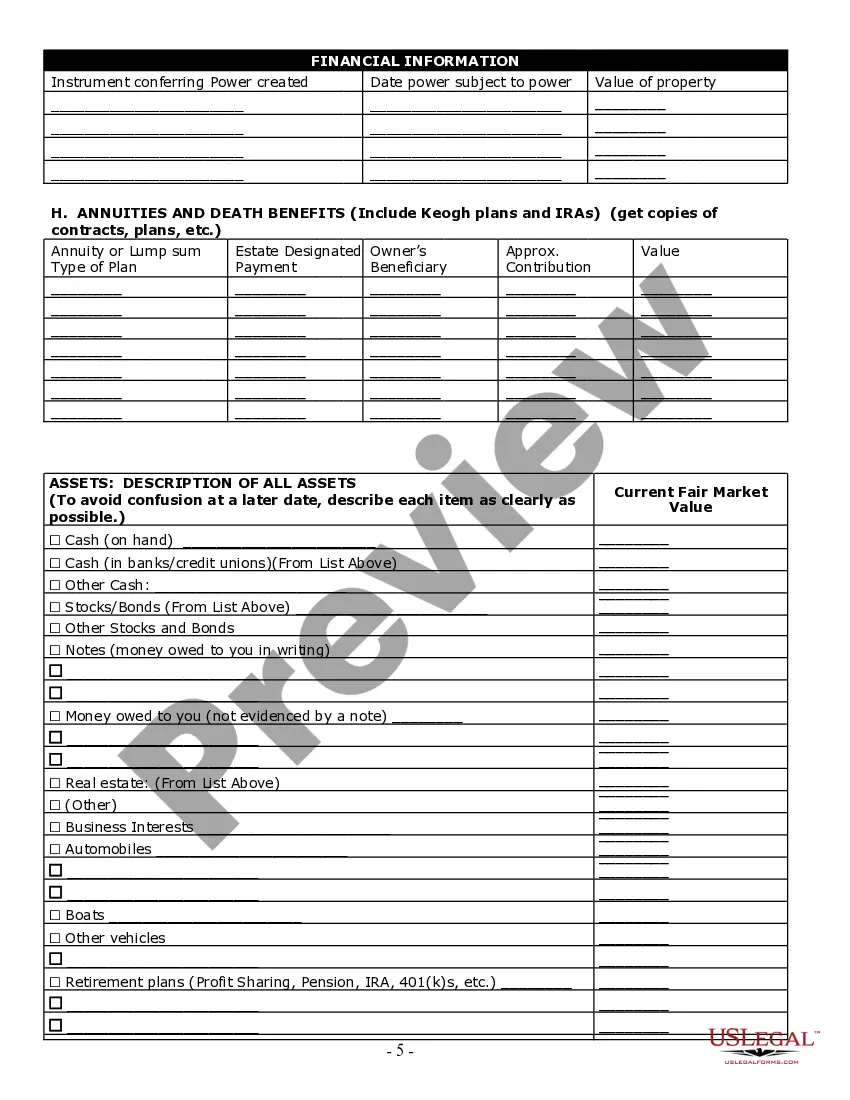

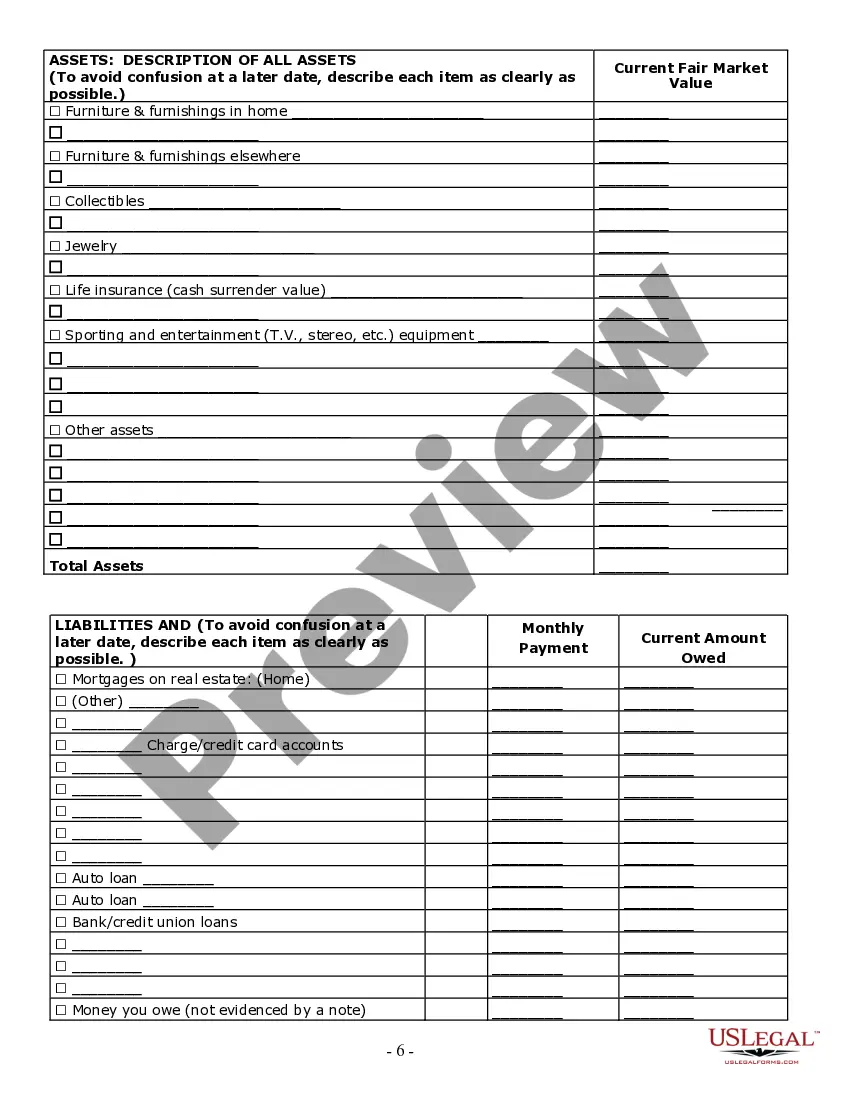

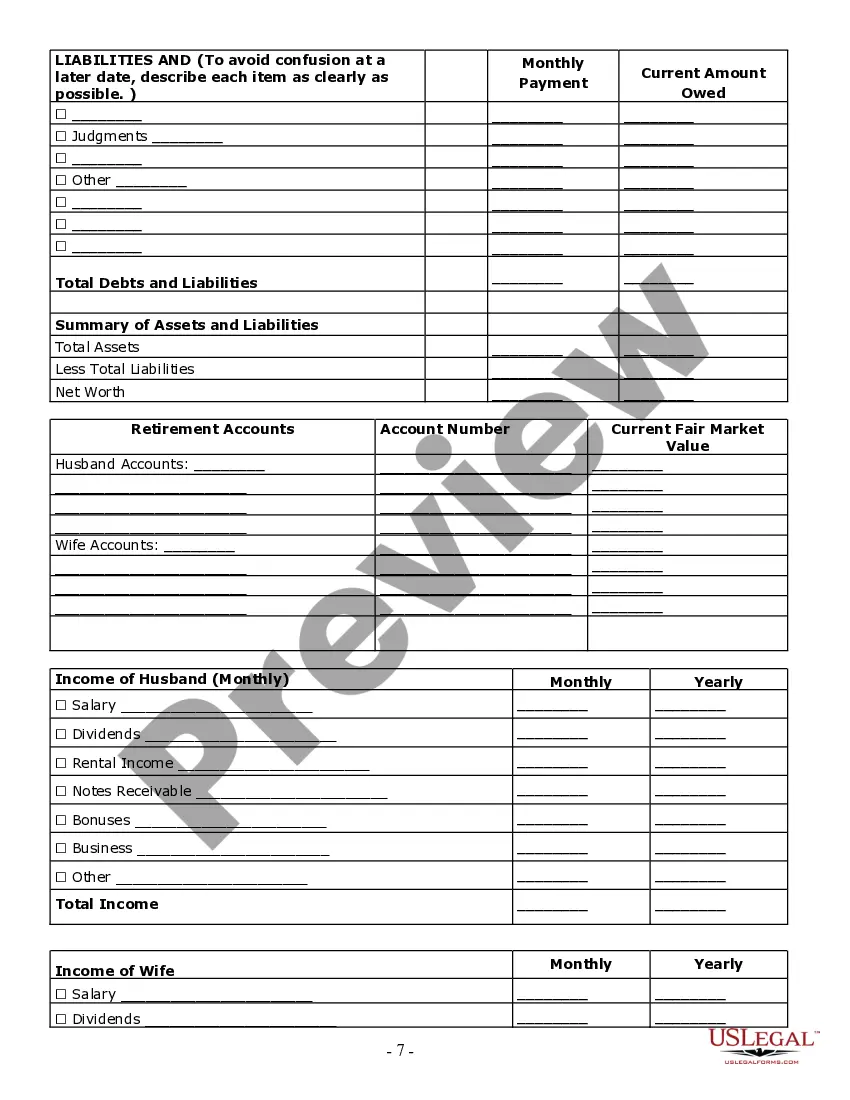

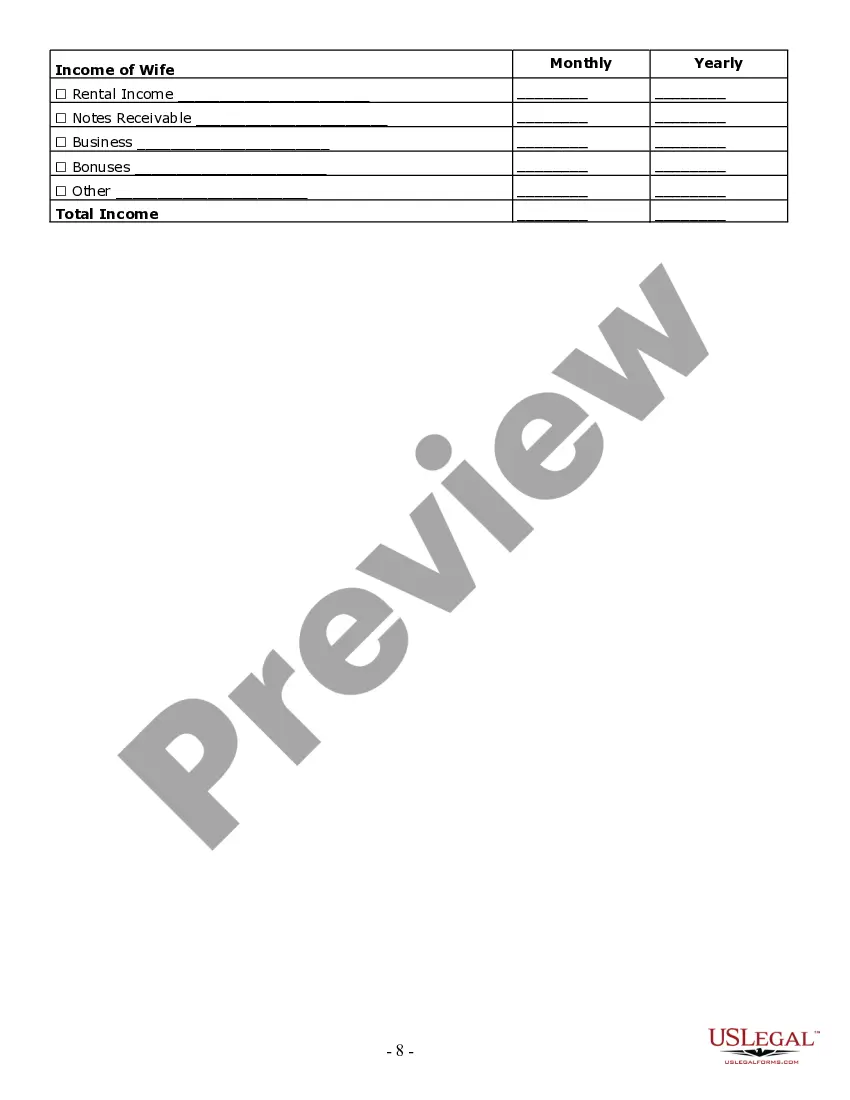

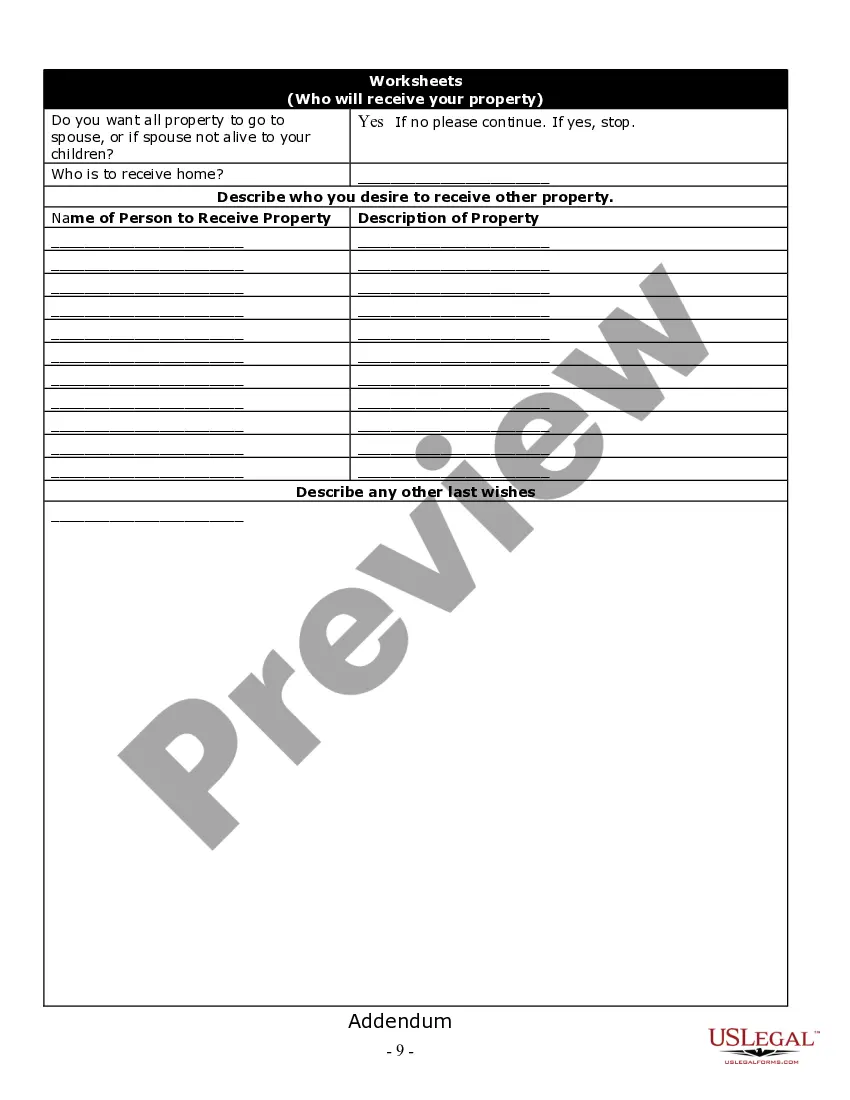

Murrieta California Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals in organizing and gathering important information to develop a tailored and effective estate plan. These questionnaires and worksheets aim to ensure that your wishes are properly documented and legally binding. The Murrieta California Estate Planning Questionnaire and Worksheets cover a wide range of topics related to estate planning, including but not limited to: 1. Personal Information: Capture essential details such as your full name, contact information, date of birth, and Social Security number for identification purposes. 2. Family and Beneficiaries: Provide a clear overview of your immediate family members, including spouses, children, and other dependents. Moreover, identify your intended beneficiaries for assets, ensuring an accurate distribution. 3. Asset Inventory: Create a comprehensive inventory of your assets, including real estate properties, investments, bank accounts, retirement funds, life insurance policies, and personal belongings. This helps to assess the total value of your estate and streamline the process of distributing your assets. 4. Debts and Liabilities: Identify any outstanding debts, loans, or obligations you may have, whether it be mortgages, credit card debts, or other financial liabilities. This information aids in managing your estate's financial aspects and settling outstanding dues. 5. Health Care Directives: In the event of incapacitation, specify your preferences regarding medical treatment, life support, and organ donation. This helps ensure that your wishes are honored and provides guidance for your appointed health care agent. 6. Power of Attorney: Designate a trusted individual to make financial and legal decisions on your behalf if you become incapacitated. Specify the scope of authority granted and provide necessary contact details. 7. Guardianship: If you have minor children, indicate your preferred guardianship arrangements, ensuring their well-being and care if you are no longer able to fulfill the role. Some variations of these questionnaires and worksheets may include additional sections relevant to specific estate planning requirements, such as: — Trust Planning: For individuals inclined towards establishing a trust, specific sections may prompt you to provide details about your chosen trustee, beneficiaries, and specific instructions for asset management and distribution. — Business Succession Planning: Suitable for business owners, these questionnaires may incorporate sections related to your business interests, ownership documentation, succession plans, and instructions for the smooth transition of the business to chosen heirs or partners. — Tax Planning: To optimize your estate's tax efficiency, some questionnaires might delve into more detailed financial information, such as current tax liabilities, potential tax reduction strategies, and charitable giving plans. It is crucial to consult with an experienced estate planning attorney in Murrieta, California, to ensure accurate completion and the formulation of a comprehensive estate plan that aligns with your specific requirements and goals.Murrieta California Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals in organizing and gathering important information to develop a tailored and effective estate plan. These questionnaires and worksheets aim to ensure that your wishes are properly documented and legally binding. The Murrieta California Estate Planning Questionnaire and Worksheets cover a wide range of topics related to estate planning, including but not limited to: 1. Personal Information: Capture essential details such as your full name, contact information, date of birth, and Social Security number for identification purposes. 2. Family and Beneficiaries: Provide a clear overview of your immediate family members, including spouses, children, and other dependents. Moreover, identify your intended beneficiaries for assets, ensuring an accurate distribution. 3. Asset Inventory: Create a comprehensive inventory of your assets, including real estate properties, investments, bank accounts, retirement funds, life insurance policies, and personal belongings. This helps to assess the total value of your estate and streamline the process of distributing your assets. 4. Debts and Liabilities: Identify any outstanding debts, loans, or obligations you may have, whether it be mortgages, credit card debts, or other financial liabilities. This information aids in managing your estate's financial aspects and settling outstanding dues. 5. Health Care Directives: In the event of incapacitation, specify your preferences regarding medical treatment, life support, and organ donation. This helps ensure that your wishes are honored and provides guidance for your appointed health care agent. 6. Power of Attorney: Designate a trusted individual to make financial and legal decisions on your behalf if you become incapacitated. Specify the scope of authority granted and provide necessary contact details. 7. Guardianship: If you have minor children, indicate your preferred guardianship arrangements, ensuring their well-being and care if you are no longer able to fulfill the role. Some variations of these questionnaires and worksheets may include additional sections relevant to specific estate planning requirements, such as: — Trust Planning: For individuals inclined towards establishing a trust, specific sections may prompt you to provide details about your chosen trustee, beneficiaries, and specific instructions for asset management and distribution. — Business Succession Planning: Suitable for business owners, these questionnaires may incorporate sections related to your business interests, ownership documentation, succession plans, and instructions for the smooth transition of the business to chosen heirs or partners. — Tax Planning: To optimize your estate's tax efficiency, some questionnaires might delve into more detailed financial information, such as current tax liabilities, potential tax reduction strategies, and charitable giving plans. It is crucial to consult with an experienced estate planning attorney in Murrieta, California, to ensure accurate completion and the formulation of a comprehensive estate plan that aligns with your specific requirements and goals.