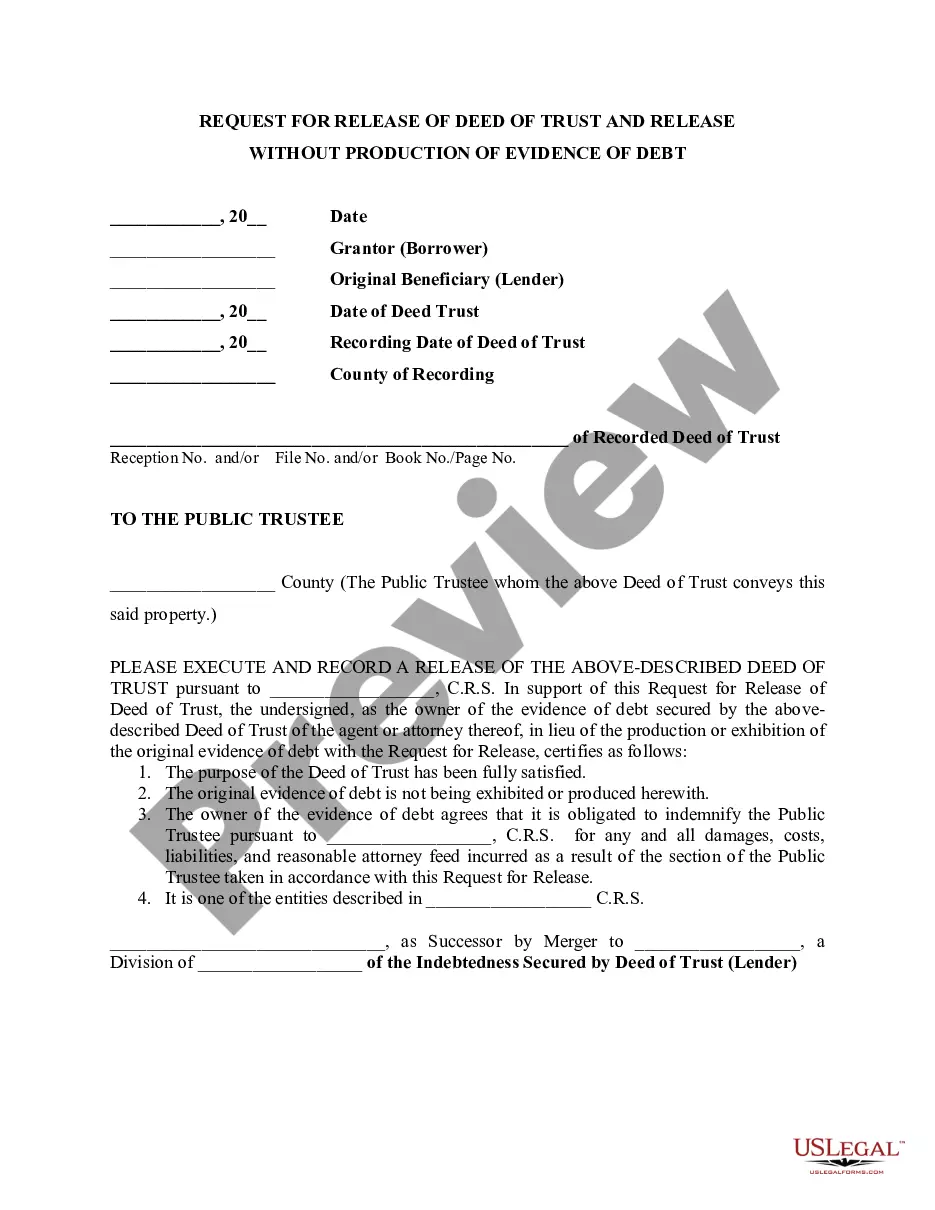

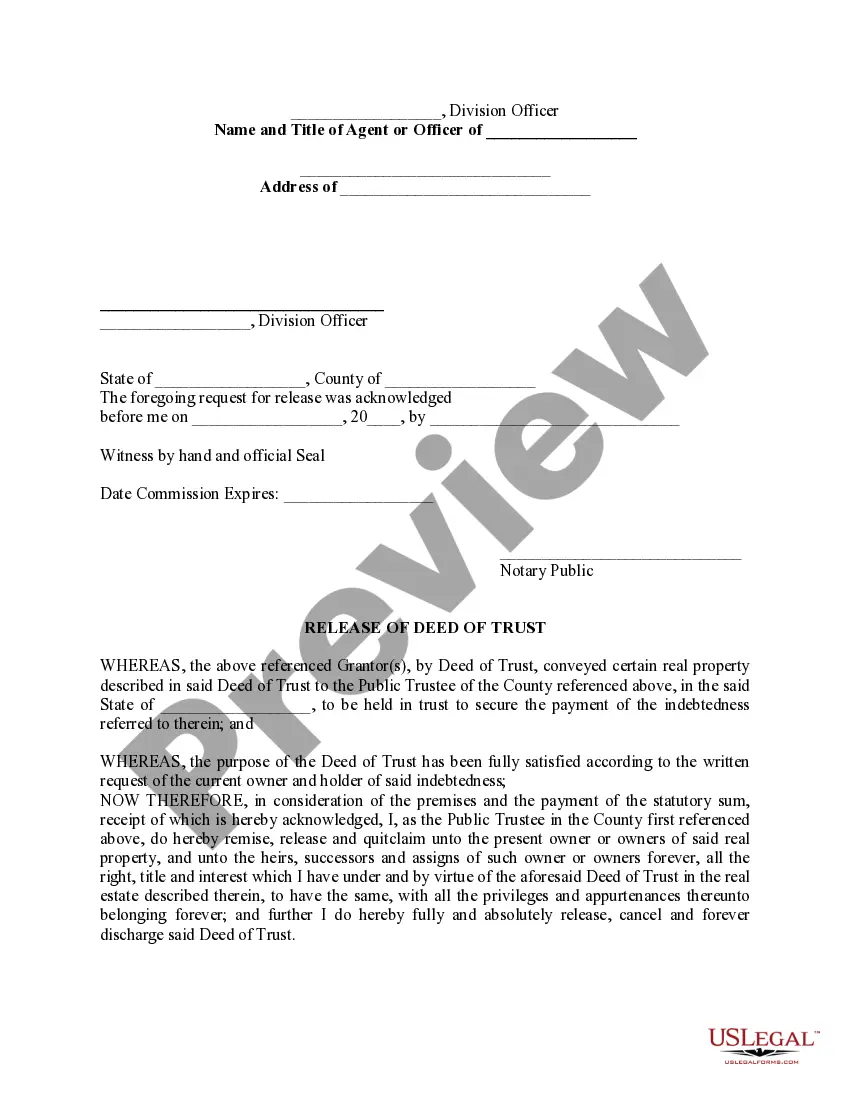

A Thornton Colorado Request for Release of Deed of Trust and Release Without Production of Evidence of Debt is a legal document used when a borrower has fully paid off their mortgage or loan secured by a deed of trust, and they are requesting the release of the lien on their property. This document is essential for homeowners in Thornton, Colorado, as it allows them to clear the title on their property and obtain proof of full ownership. The process of requesting a release of deed of trust and release without production of evidence of debt in Thornton, Colorado typically involves the following steps: 1. Gather the necessary information: To begin the process, the borrower needs to collect all relevant information, including the property address, the borrower's name, the lender's name, the original loan amount, and the loan or mortgage account number. 2. Complete the request form: There are different types of Thornton Colorado Request for Release of Deed of Trust and Release Without Production of Evidence of Debt forms available, depending on the specific circumstances of the borrower. Common variations may include separate forms for commercial and residential properties or forms specific to different lenders. It is crucial to choose the correct form and ensure that all required fields are accurately completed. 3. Attach supporting documents: Along with the request form, it may be necessary to provide additional supporting documentation for the release of the deed of trust. These documents usually include proof of payment, such as a bank statement showing the final payment, or a satisfaction of mortgage letter from the lender. 4. Contact the lender: Once the request form and supporting documents are prepared, the borrower will need to contact the lender to confirm the specific procedures for submitting the request. This may include mailing the documents to a specific address or delivering them in person to a specified department or office. 5. Submit the request: Following the lender's instructions, the borrower should send the completed request form and attached documents by the designated method, ensuring that all required elements are included. It is advisable to keep copies of all documents submitted for personal records. 6. Wait for the response: After submitting the request, the borrower will need to wait for the lender to process the request and provide a response. The response typically includes a Release of Deed of Trust document, stating that the lien has been released, as well as any other relevant paperwork needed to update the property title. By following these steps, borrowers in Thornton, Colorado can effectively request the release of their deed of trust and release without production of evidence of debt. It is important to note that the specific requirements and processes may vary depending on the lender and the individual circumstances of the loan or mortgage. Therefore, it is advisable to consult with legal professionals or real estate experts for guidance on navigating this process accurately.

Deed Of Trust Colorado

Description

How to fill out Thornton Colorado Request For Release Of Deed Of Trust And Release Without Production Of Evidence Of Debt?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for attorney services that, as a rule, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to a lawyer. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Thornton Colorado Request for Release of Deed of Trust and Release Without Production of Evidence of Debt or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Thornton Colorado Request for Release of Deed of Trust and Release Without Production of Evidence of Debt adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Thornton Colorado Request for Release of Deed of Trust and Release Without Production of Evidence of Debt is proper for your case, you can select the subscription plan and make a payment.

- Then you can download the document in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!