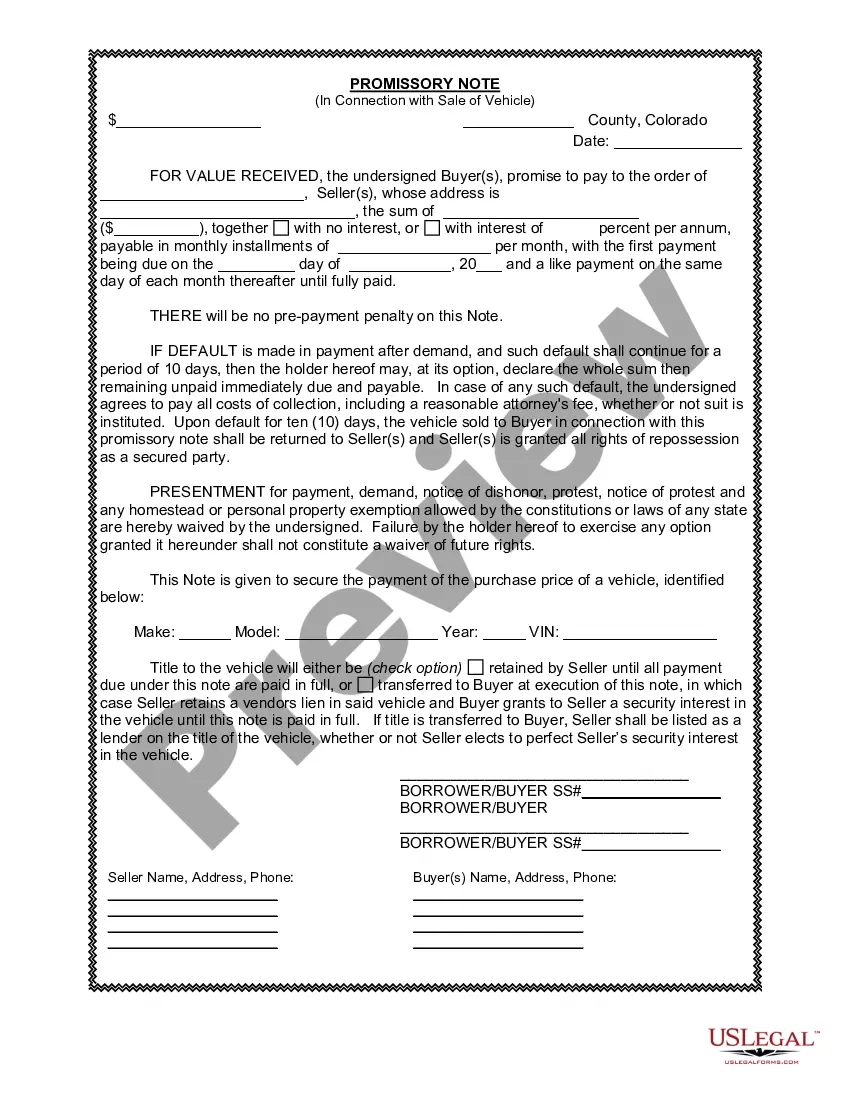

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Fort Collins Colorado Promissory Note is a legal document that outlines the terms and conditions of a financial agreement between the seller and the buyer in a vehicle or automobile sale. It serves as evidence of the loan, specifying the amount borrowed, repayment terms, interest rate, and any other pertinent details. By signing this document, both parties commit to fulfilling their obligations and ensuring a smooth transaction. The Fort Collins Colorado Promissory Note in Connection with Sale of Vehicle or Automobile provides a framework that protects the interests of both the seller and the buyer. It is crucial to have a detailed agreement to avoid any misunderstandings or disputes in the future. Different types of Fort Collins Colorado Promissory Note in Connection with Sale of Vehicle or Automobile can include: 1. Secured Promissory Note: This type of promissory note includes collateral, usually the vehicle being sold. If the buyer fails to make the agreed-upon payments, the seller has the legal right to repossess the vehicle as a means of repayment. 2. Unsecured Promissory Note: In this case, the promissory note does not include any collateral. The buyer agrees to repay the loan amount according to the agreed-upon terms without any assets being held as security. This type of promissory note is more common when there is an existing level of trust or a close relationship between the parties involved. 3. Installment Promissory Note: This type of promissory note breaks down the repayment of the loan into regular, predetermined installments. Each installment includes a portion of the principal amount plus the interest charged. This structure allows for a steady repayment schedule and can be agreed upon based on the buyer's ability to pay. 4. Balloon Promissory Note: A balloon promissory note includes a large final payment, known as a balloon payment, which is due at the end of the loan term. This method allows for smaller monthly payments throughout the term with the understanding that a significant payment will be made at the end. This type of note often suits buyers who expect to receive a lump sum of money in the future. It is crucial to consult with a legal professional or obtain a template from a reputable source to create a Fort Collins Colorado Promissory Note in Connection with Sale of Vehicle or Automobile. Ensuring that the note complies with local laws and includes all necessary information is vital to protect both parties involved in the transaction.A Fort Collins Colorado Promissory Note is a legal document that outlines the terms and conditions of a financial agreement between the seller and the buyer in a vehicle or automobile sale. It serves as evidence of the loan, specifying the amount borrowed, repayment terms, interest rate, and any other pertinent details. By signing this document, both parties commit to fulfilling their obligations and ensuring a smooth transaction. The Fort Collins Colorado Promissory Note in Connection with Sale of Vehicle or Automobile provides a framework that protects the interests of both the seller and the buyer. It is crucial to have a detailed agreement to avoid any misunderstandings or disputes in the future. Different types of Fort Collins Colorado Promissory Note in Connection with Sale of Vehicle or Automobile can include: 1. Secured Promissory Note: This type of promissory note includes collateral, usually the vehicle being sold. If the buyer fails to make the agreed-upon payments, the seller has the legal right to repossess the vehicle as a means of repayment. 2. Unsecured Promissory Note: In this case, the promissory note does not include any collateral. The buyer agrees to repay the loan amount according to the agreed-upon terms without any assets being held as security. This type of promissory note is more common when there is an existing level of trust or a close relationship between the parties involved. 3. Installment Promissory Note: This type of promissory note breaks down the repayment of the loan into regular, predetermined installments. Each installment includes a portion of the principal amount plus the interest charged. This structure allows for a steady repayment schedule and can be agreed upon based on the buyer's ability to pay. 4. Balloon Promissory Note: A balloon promissory note includes a large final payment, known as a balloon payment, which is due at the end of the loan term. This method allows for smaller monthly payments throughout the term with the understanding that a significant payment will be made at the end. This type of note often suits buyers who expect to receive a lump sum of money in the future. It is crucial to consult with a legal professional or obtain a template from a reputable source to create a Fort Collins Colorado Promissory Note in Connection with Sale of Vehicle or Automobile. Ensuring that the note complies with local laws and includes all necessary information is vital to protect both parties involved in the transaction.