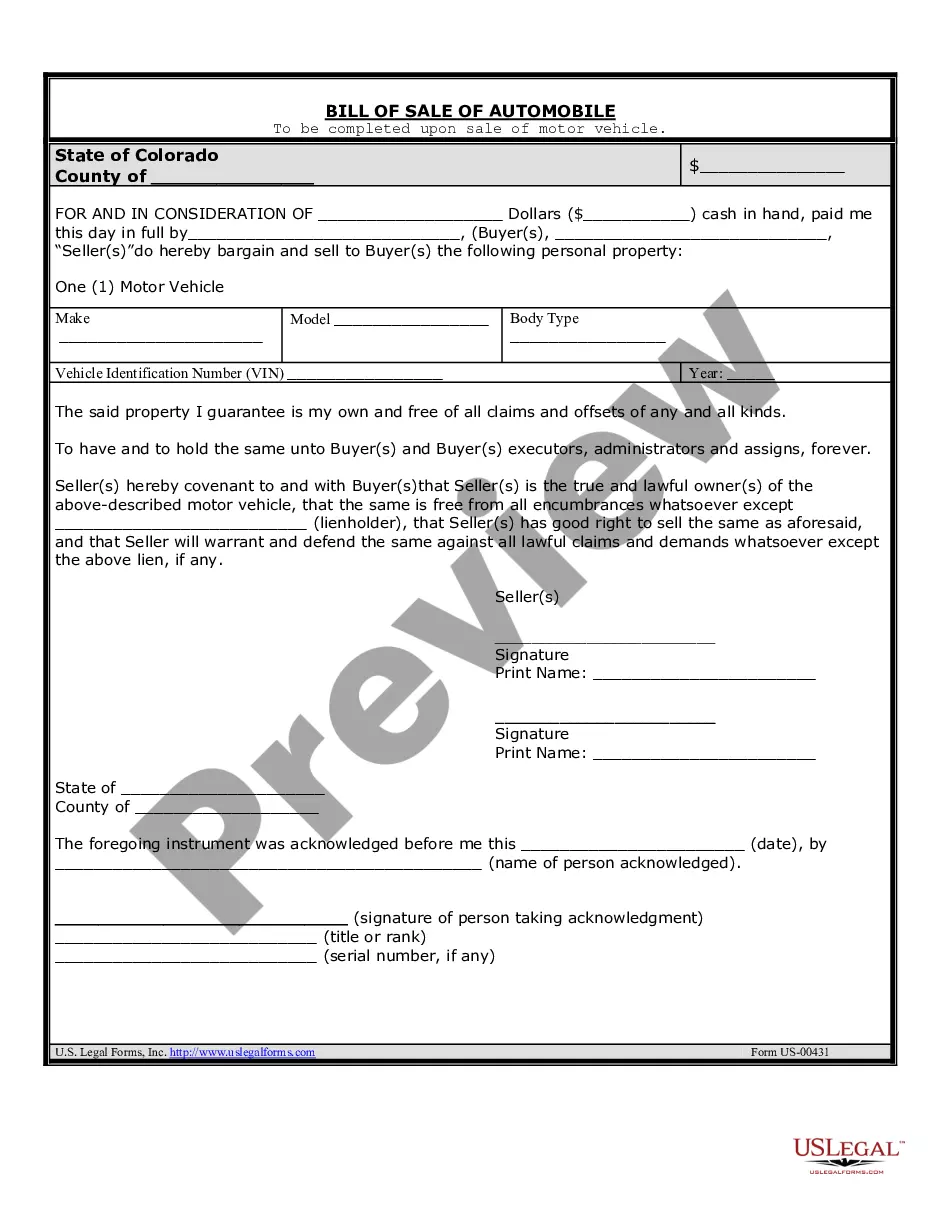

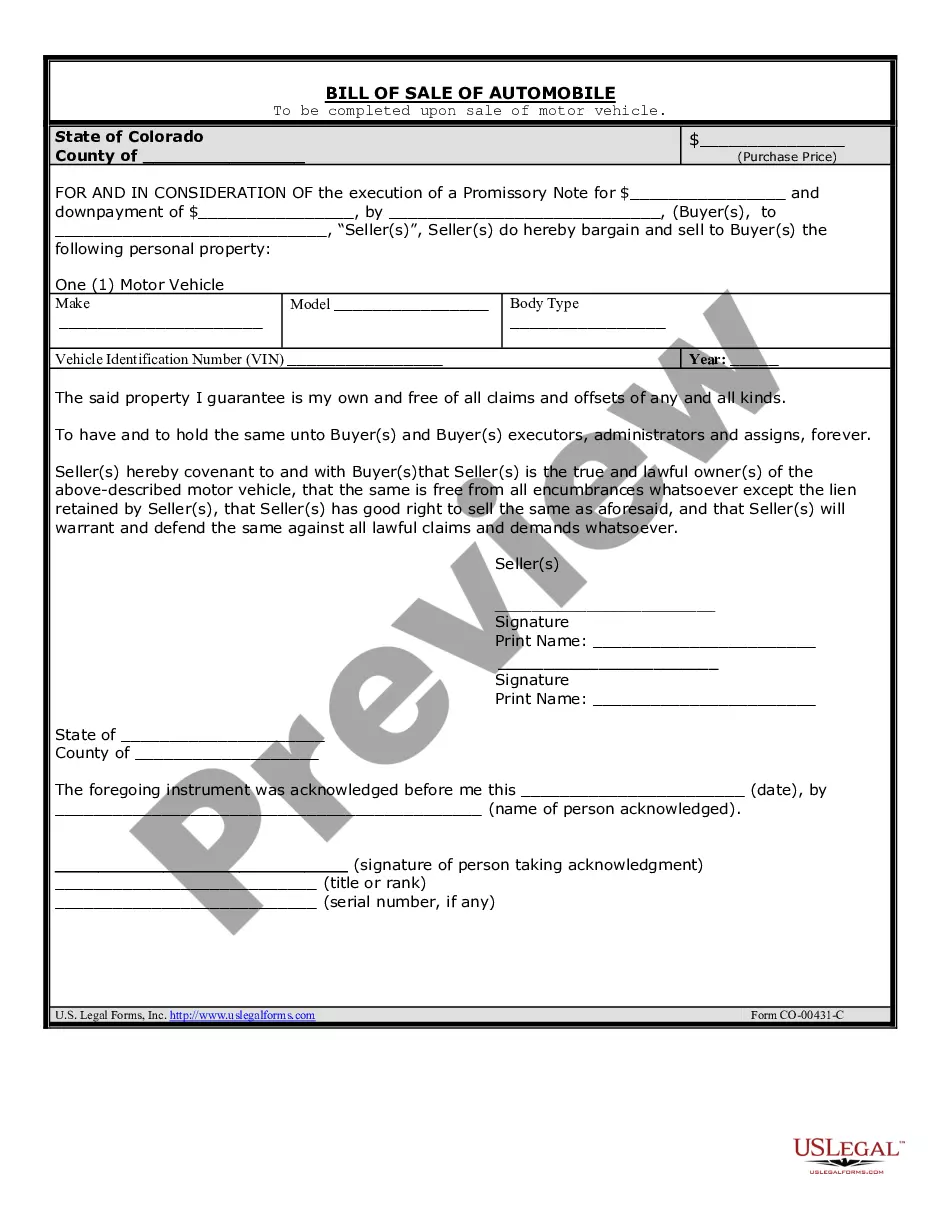

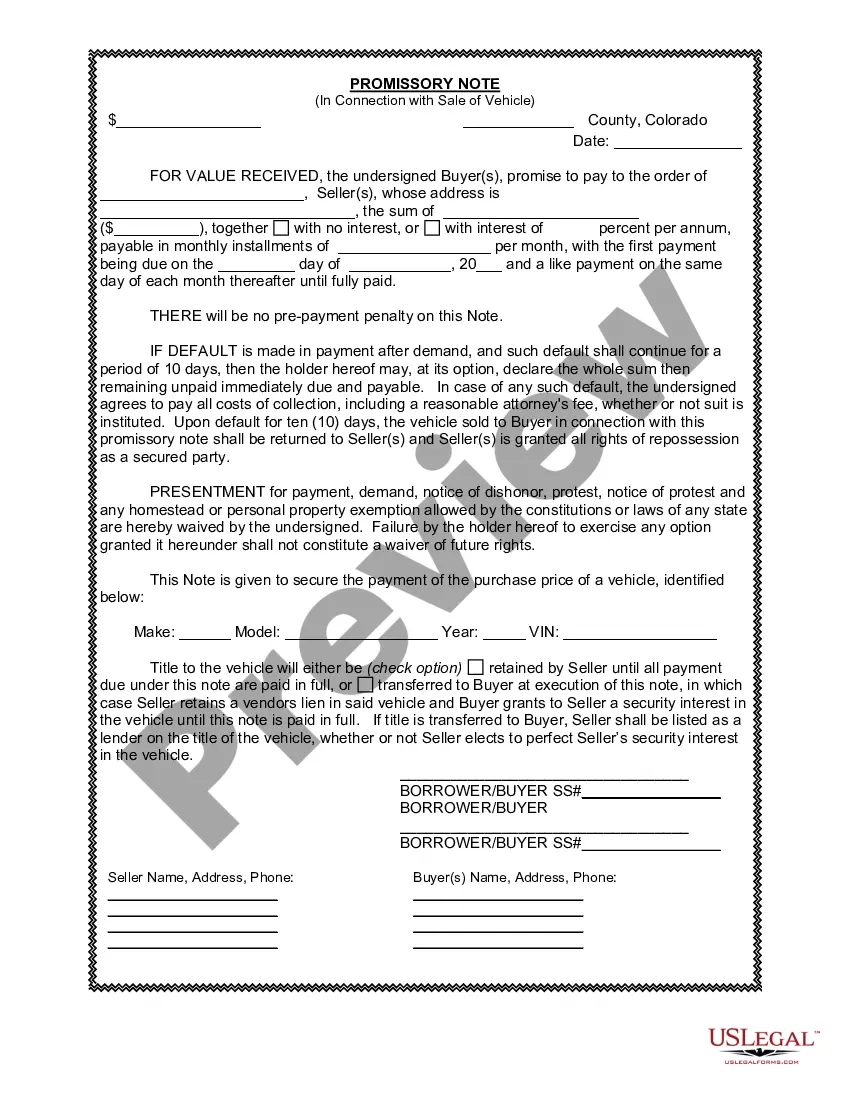

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

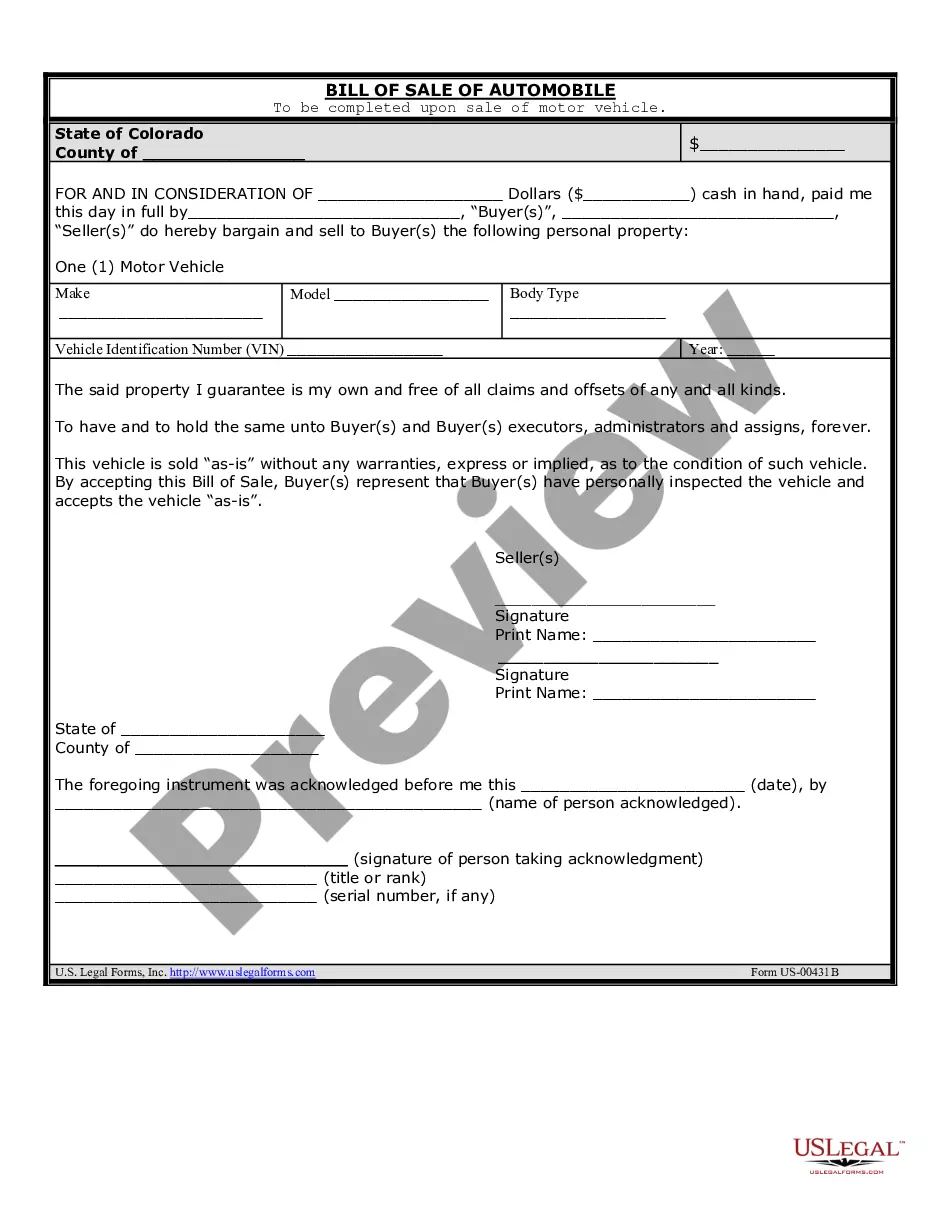

A Thornton Colorado Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between a buyer and a seller in the sale of a vehicle. It serves as an assurance that the buyer will repay the seller for the vehicle purchased, in installments and within a specified time frame. In case the buyer defaults on the payments, the seller can take legal action to recover the vehicle or seek compensation. The Thornton Colorado Promissory Note in Connection with Sale of Vehicle or Automobile typically contains essential details such as the names, addresses, and contact information of both the buyer and the seller. It also outlines the specific terms of the sale, including the purchase price, down payment (if any), interest rate, payment schedule, and the consequences of default. There are a few different types of Thornton Colorado Promissory Notes that can be used in connection with the sale of vehicles or automobiles: 1. Installment Promissory Note: This type of promissory note outlines the repayment terms in periodic installments, allowing the buyer to pay off the purchase price over time. It includes specific details regarding the number of installments, their frequency, and the amount due for each payment. 2. Balloon Promissory Note: With this type of promissory note, the buyer agrees to make regular installment payments for a specific period, but also has an additional lump sum payment due at the end of the term. The balloon payment is typically higher than the installment payments and is used to fully satisfy the remaining balance. 3. Secured Promissory Note: This note includes provisions for securing the loan with collateral, such as the vehicle itself. In case the buyer defaults, the seller can repossess the vehicle to recover the debt owed. 4. Unsecured Promissory Note: This type of promissory note does not involve any collateral, and instead relies on the borrower's creditworthiness and reputation to ensure repayment. It is important to consult with a legal professional to ensure that the Thornton Colorado Promissory Note in Connection with Sale of Vehicle or Automobile complies with state laws and includes all necessary terms and conditions relevant to the specific transaction.

A Thornton Colorado Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between a buyer and a seller in the sale of a vehicle. It serves as an assurance that the buyer will repay the seller for the vehicle purchased, in installments and within a specified time frame. In case the buyer defaults on the payments, the seller can take legal action to recover the vehicle or seek compensation. The Thornton Colorado Promissory Note in Connection with Sale of Vehicle or Automobile typically contains essential details such as the names, addresses, and contact information of both the buyer and the seller. It also outlines the specific terms of the sale, including the purchase price, down payment (if any), interest rate, payment schedule, and the consequences of default. There are a few different types of Thornton Colorado Promissory Notes that can be used in connection with the sale of vehicles or automobiles: 1. Installment Promissory Note: This type of promissory note outlines the repayment terms in periodic installments, allowing the buyer to pay off the purchase price over time. It includes specific details regarding the number of installments, their frequency, and the amount due for each payment. 2. Balloon Promissory Note: With this type of promissory note, the buyer agrees to make regular installment payments for a specific period, but also has an additional lump sum payment due at the end of the term. The balloon payment is typically higher than the installment payments and is used to fully satisfy the remaining balance. 3. Secured Promissory Note: This note includes provisions for securing the loan with collateral, such as the vehicle itself. In case the buyer defaults, the seller can repossess the vehicle to recover the debt owed. 4. Unsecured Promissory Note: This type of promissory note does not involve any collateral, and instead relies on the borrower's creditworthiness and reputation to ensure repayment. It is important to consult with a legal professional to ensure that the Thornton Colorado Promissory Note in Connection with Sale of Vehicle or Automobile complies with state laws and includes all necessary terms and conditions relevant to the specific transaction.