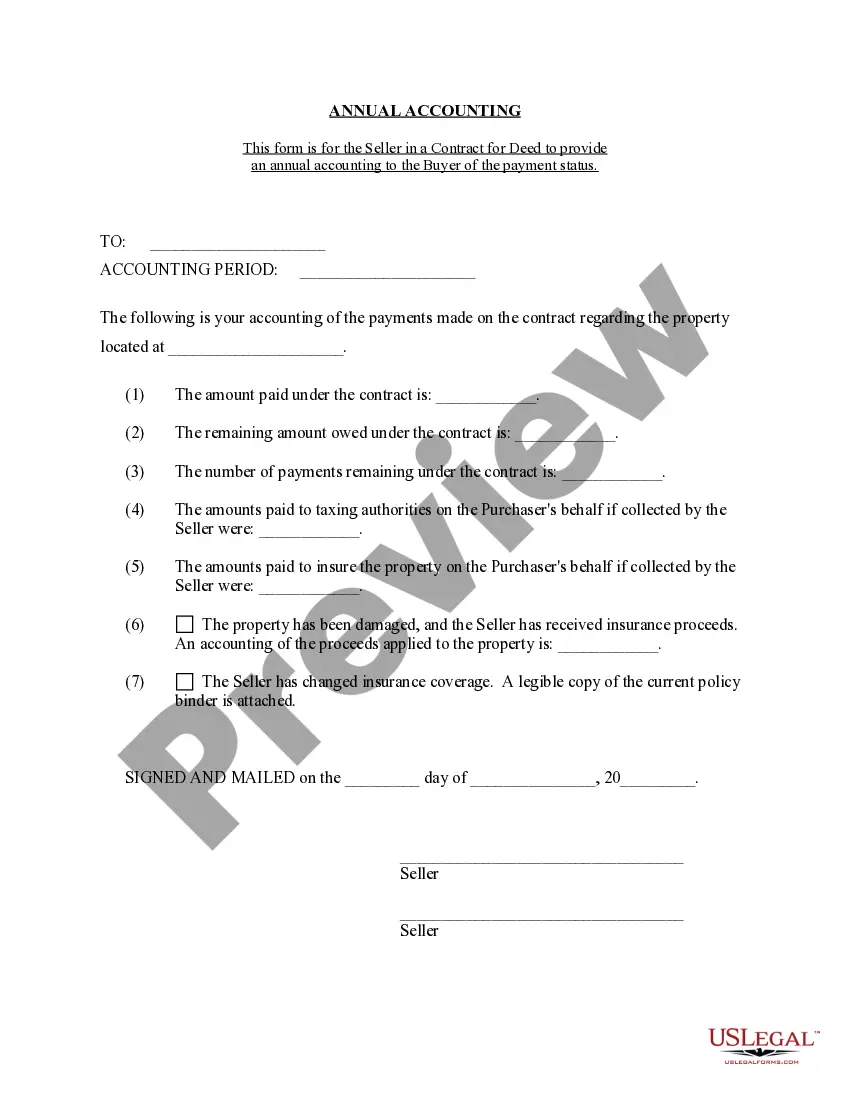

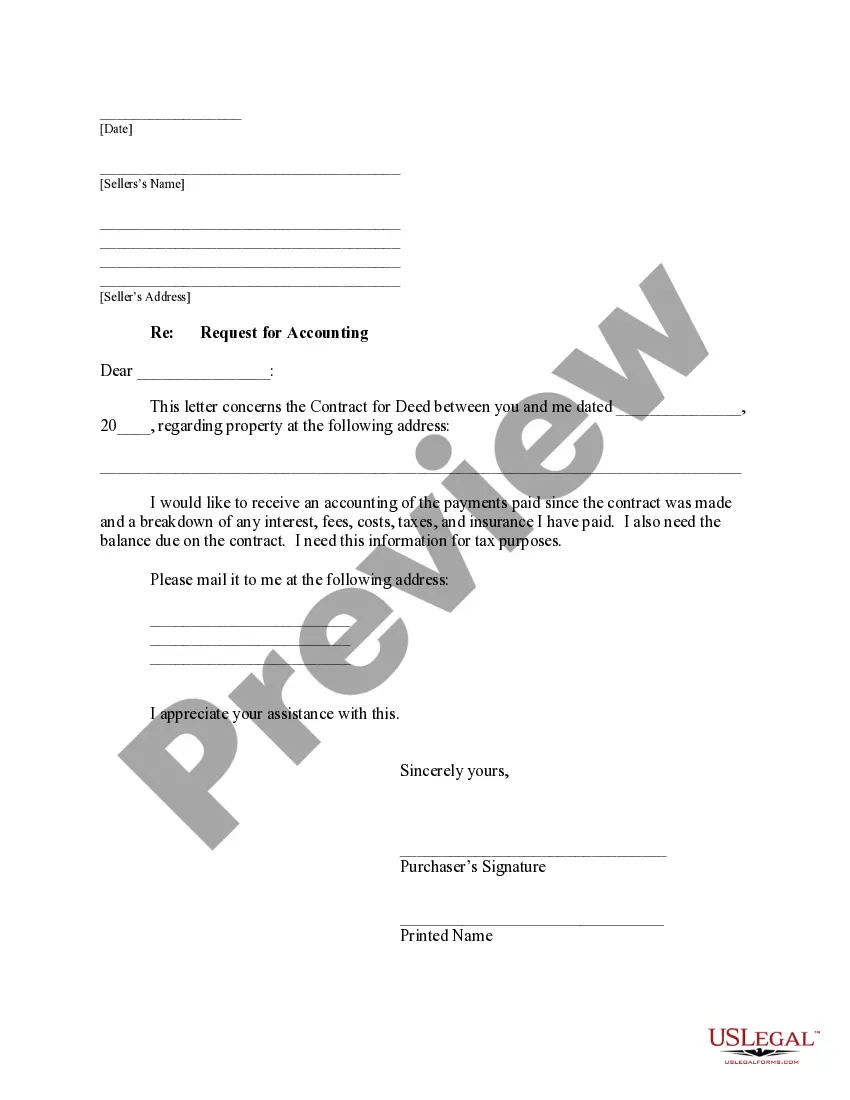

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

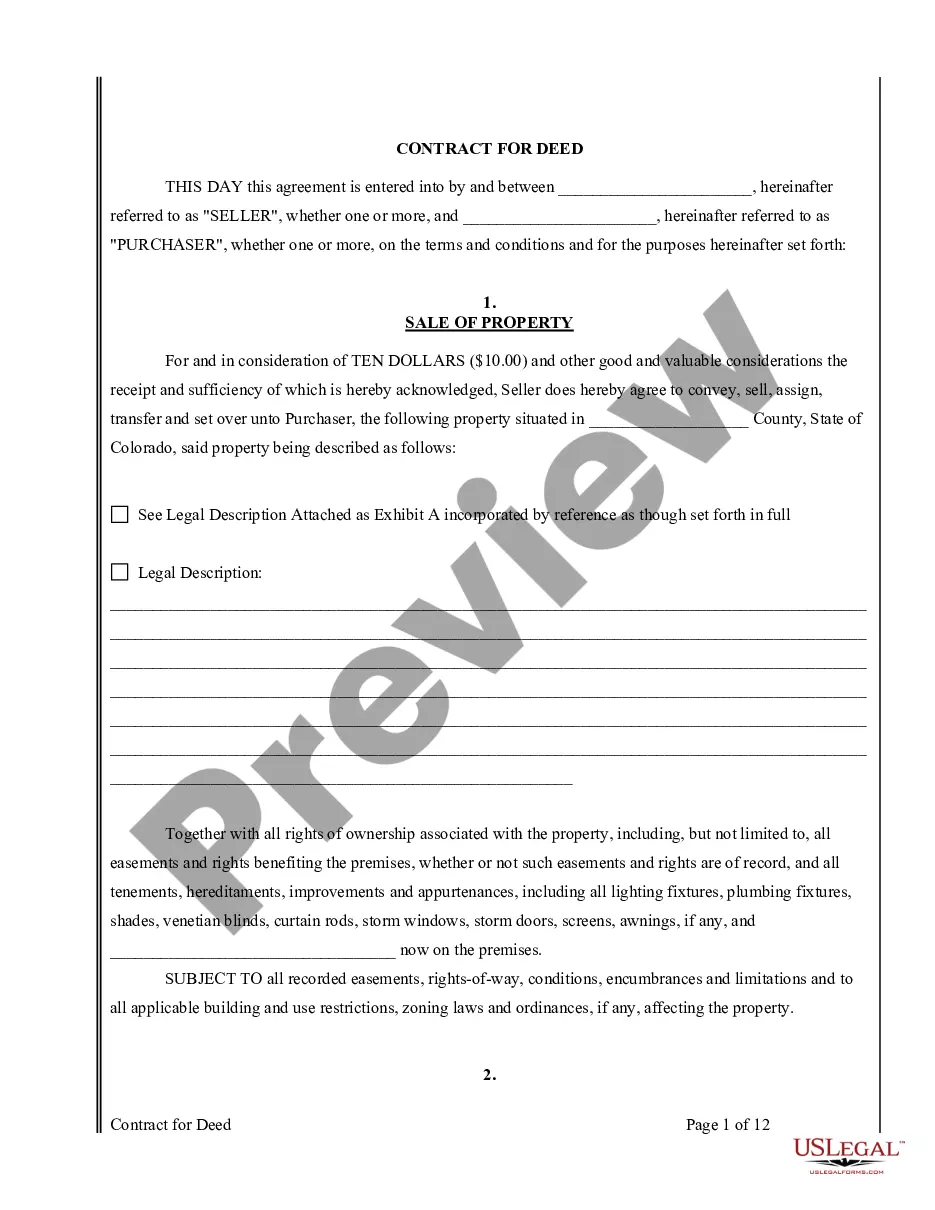

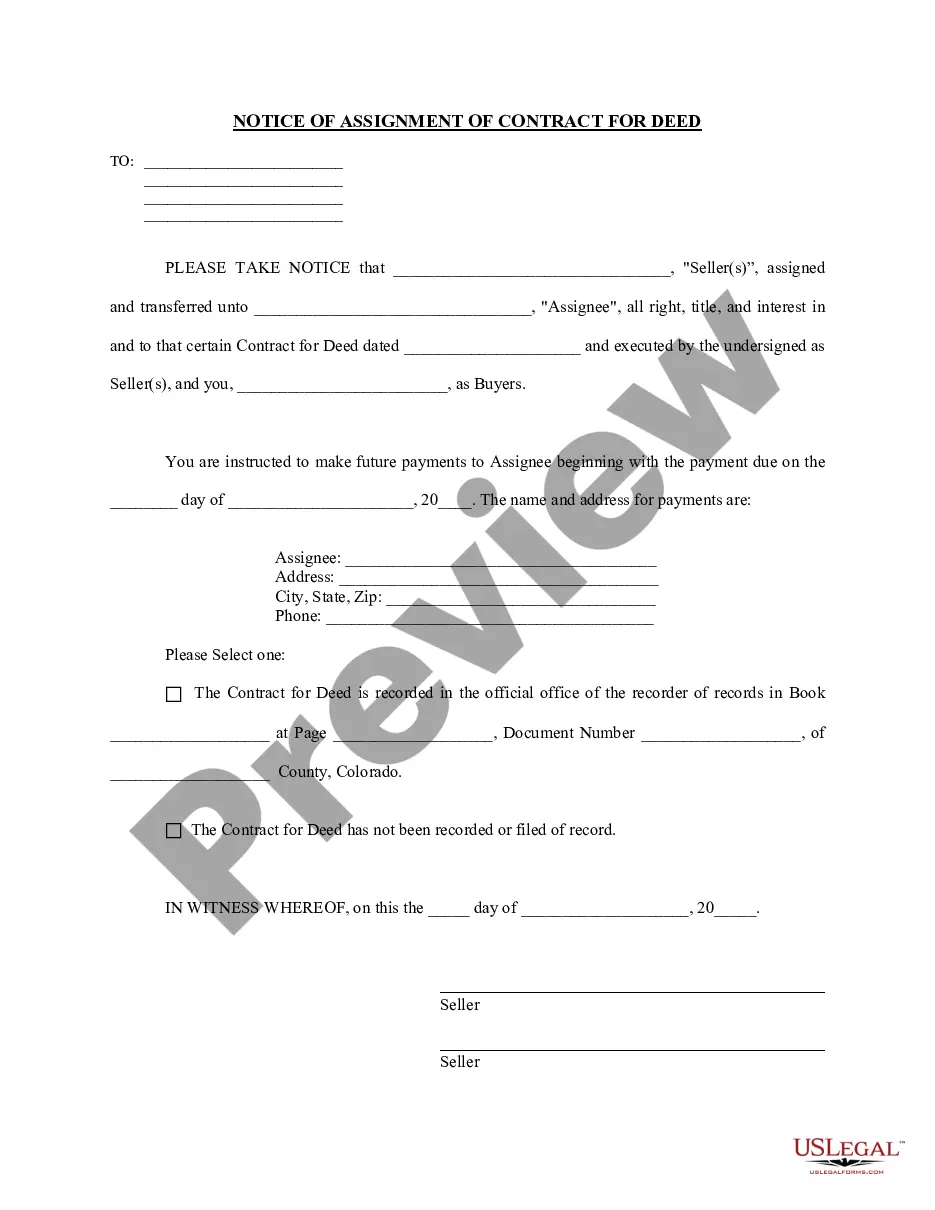

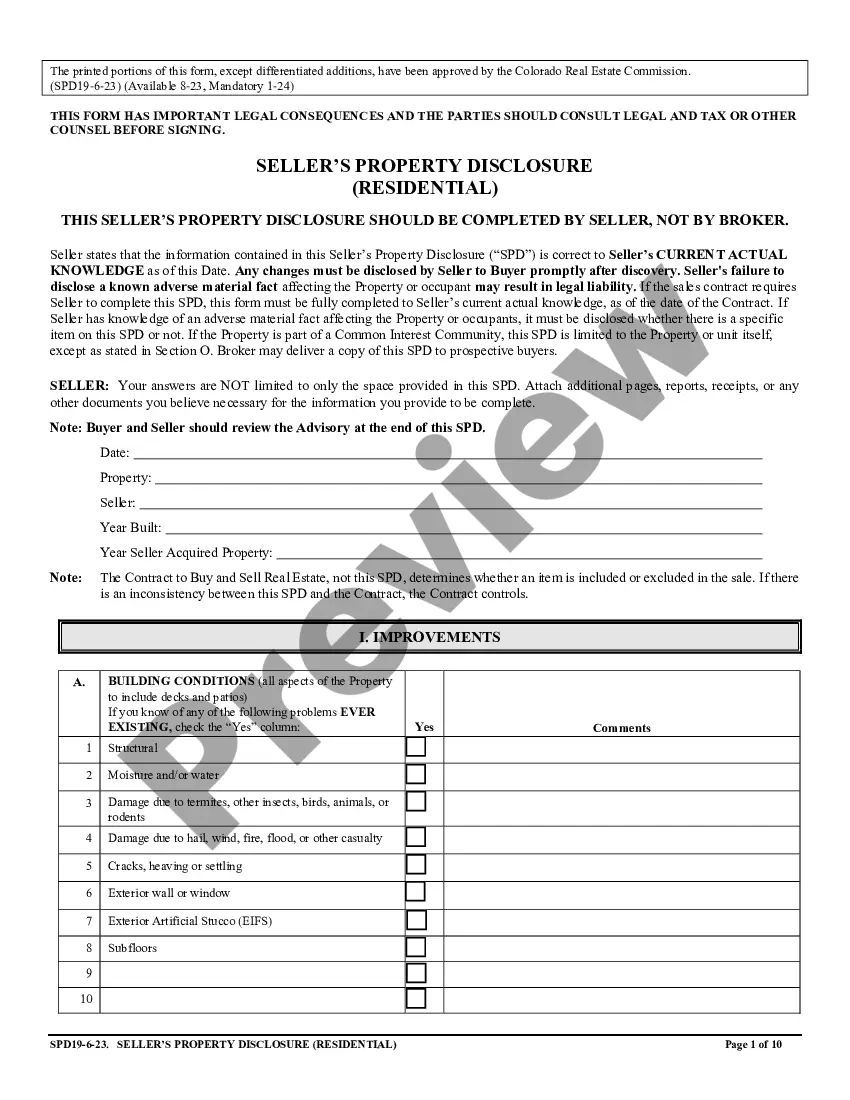

Description: Aurora Colorado Buyer's Request for Accounting from Seller under Contract for Deed In Aurora, Colorado, when entering into a contract for deed, buyers have the right to request accounting information from the seller. This buyer's request for accounting is an essential step in ensuring transparency and accuracy in the financial aspects of the agreement. By requesting accounting details, buyers can evaluate the seller's compliance with the terms outlined in the contract and gain a better understanding of the financial position of the property. Sellers are legally obligated to provide this information upon the buyer's request. There are various types of Aurora Colorado Buyer's Request for Accounting from Seller under Contract for Deed, including: 1. Financial Statements: Buyers may request comprehensive financial statements, such as income statements or balance sheets, to evaluate the seller's financial stability and solvency. These statements provide insight into the seller's income, expenses, assets, and liabilities. 2. Tax Returns: Buyers may ask for copies of the seller's tax returns to review their reported income, deductions, and potential liabilities. This information can help buyers assess the accuracy of the seller's financial disclosures and verify their compliance with tax laws. 3. Records of Payments: Buyers may request records of payments made by the seller towards property-related expenses, such as mortgage payments, insurance, taxes, or maintenance costs. Reviewing these records can help buyers ensure that the seller is fulfilling their financial obligations as agreed upon in the contract. 4. Proof of Insurance: Buyers may inquire about the seller's insurance coverage on the property. This includes homeowner's insurance, flood insurance, or any other relevant insurance policies. Understanding the extent of coverage can provide buyers with a sense of security and protect them from unexpected financial burdens. 5. Outstanding Liabilities: Buyers may ask for a detailed list of any outstanding liabilities related to the property, such as mortgages, liens, or judgments. By reviewing these records, buyers can assess the financial burden associated with the property and determine if any potential issues may affect their interest in the contract. 6. Utility Bills: Buyers may request copies of recent utility bills, including electricity, gas, water, or sewer bills. Examining these bills can help buyers estimate ongoing costs and confirm that the seller has maintained up-to-date payments. In conclusion, Aurora Colorado Buyer's Request for Accounting from Seller under Contract for Deed encompasses various types of information that buyers can request to ensure financial transparency and compliance from the seller. By obtaining these accounting details, buyers can make informed decisions and protect their interests throughout the contract period.Description: Aurora Colorado Buyer's Request for Accounting from Seller under Contract for Deed In Aurora, Colorado, when entering into a contract for deed, buyers have the right to request accounting information from the seller. This buyer's request for accounting is an essential step in ensuring transparency and accuracy in the financial aspects of the agreement. By requesting accounting details, buyers can evaluate the seller's compliance with the terms outlined in the contract and gain a better understanding of the financial position of the property. Sellers are legally obligated to provide this information upon the buyer's request. There are various types of Aurora Colorado Buyer's Request for Accounting from Seller under Contract for Deed, including: 1. Financial Statements: Buyers may request comprehensive financial statements, such as income statements or balance sheets, to evaluate the seller's financial stability and solvency. These statements provide insight into the seller's income, expenses, assets, and liabilities. 2. Tax Returns: Buyers may ask for copies of the seller's tax returns to review their reported income, deductions, and potential liabilities. This information can help buyers assess the accuracy of the seller's financial disclosures and verify their compliance with tax laws. 3. Records of Payments: Buyers may request records of payments made by the seller towards property-related expenses, such as mortgage payments, insurance, taxes, or maintenance costs. Reviewing these records can help buyers ensure that the seller is fulfilling their financial obligations as agreed upon in the contract. 4. Proof of Insurance: Buyers may inquire about the seller's insurance coverage on the property. This includes homeowner's insurance, flood insurance, or any other relevant insurance policies. Understanding the extent of coverage can provide buyers with a sense of security and protect them from unexpected financial burdens. 5. Outstanding Liabilities: Buyers may ask for a detailed list of any outstanding liabilities related to the property, such as mortgages, liens, or judgments. By reviewing these records, buyers can assess the financial burden associated with the property and determine if any potential issues may affect their interest in the contract. 6. Utility Bills: Buyers may request copies of recent utility bills, including electricity, gas, water, or sewer bills. Examining these bills can help buyers estimate ongoing costs and confirm that the seller has maintained up-to-date payments. In conclusion, Aurora Colorado Buyer's Request for Accounting from Seller under Contract for Deed encompasses various types of information that buyers can request to ensure financial transparency and compliance from the seller. By obtaining these accounting details, buyers can make informed decisions and protect their interests throughout the contract period.