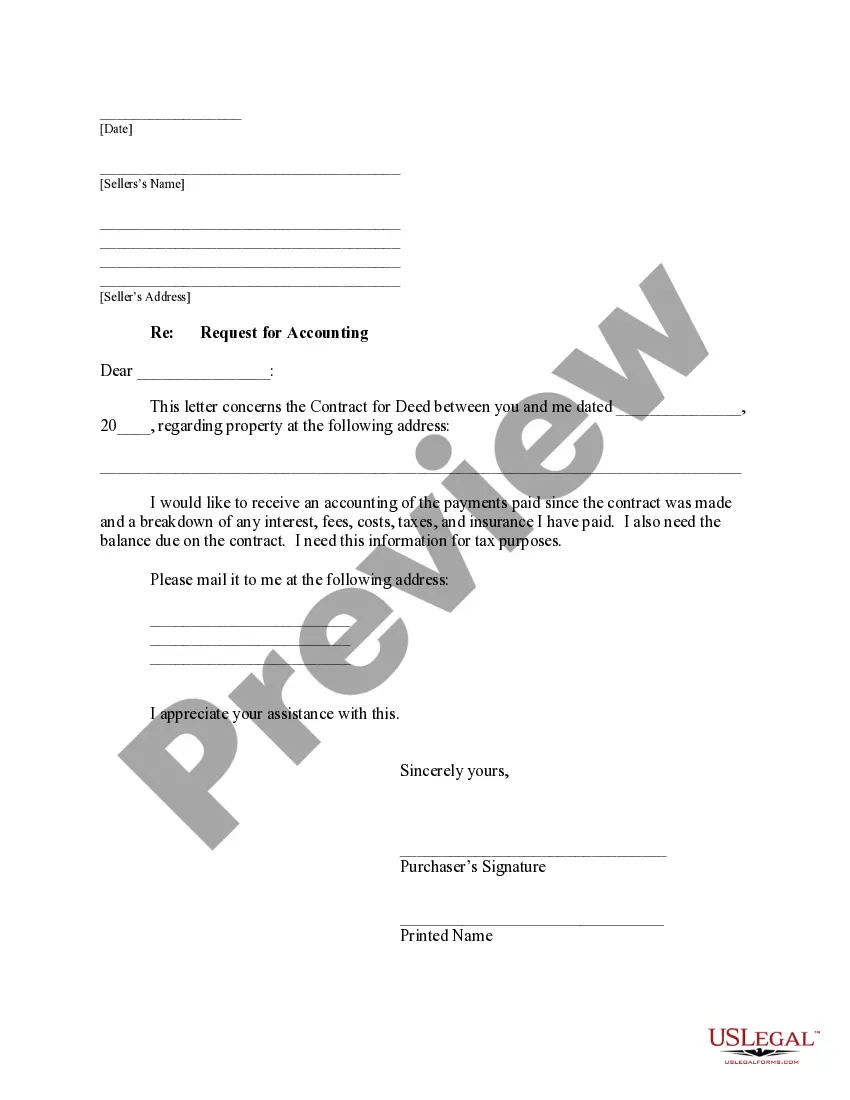

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

Thornton Colorado Buyer's Request for Accounting from Seller under Contract for Deed In Thornton, Colorado, when engaging in a real estate transaction under a Contract for Deed arrangement, the buyer may require the seller to provide an accounting of certain financial details. This request for accounting is an essential step to ensure transparency and protect the interests of both parties involved in the agreement. Here, we will delve into the different types of Thornton Colorado Buyer's Request for Accounting from Seller under Contract for Deed and highlight the relevant keywords associated with this topic. 1. Financial Records: One crucial aspect of the buyer's request for accounting is the disclosure of financial records by the seller. These records may include details about the property's purchase price, any down payment made by the buyer, and the balance owed on the contract. Other relevant financial information might encompass interest rates, applicable fees (if any), and the payment schedule in case of installment payments. 2. Property-related Expenses: The buyer may also seek an accounting of property-related expenses incurred by the seller under the Contract for Deed agreement. These expenses may consist of property taxes, insurance premiums, maintenance and repair costs, utility bills, and any assessments applicable to the property. Obtaining this information helps the buyer assess their financial obligations after assuming ownership. 3. Escrow Account Statements: If an escrow account is established as part of the Contract for Deed agreement, the buyer may request the seller to provide statements indicating the amount of money held in the account, any disbursements made, and a breakdown of how those funds were allocated. This accounting helps the buyer ensure that the escrow funds are being managed appropriately. 4. Reconciliation of Payments: To ensure accuracy and clear any potential discrepancies, the buyer may request a reconciliation of payments made by both parties. This process involves comparing the buyer's payment records with the seller's records to verify that all payments have been accounted for correctly. A comprehensive reconciliation eliminates any confusion or issues related to missed or misapplied payments. Keywords: — ThorntonColoredad— - Buyer's Request - Accounting — Selle— - Contract for Deed - Financial Records — PurchasPriceic— - Down Payment - Balance Owed — Interest Rate— - Fees - Payment Schedule — Property-related Expense— - Property Taxes — Insurance Premiums - Maintenance and Repair Costs — Utility Bill— - Assessments - Escrow Account Statements — Disbursement— - Allocation of Funds - Reconciliation — Payment Records Note: It's crucial for buyers and sellers to consult legal professionals or real estate agents familiar with local laws and regulations, as the specific requirements for a Buyer's Request for Accounting from Seller under Contract for Deed may vary in different jurisdictions.Thornton Colorado Buyer's Request for Accounting from Seller under Contract for Deed In Thornton, Colorado, when engaging in a real estate transaction under a Contract for Deed arrangement, the buyer may require the seller to provide an accounting of certain financial details. This request for accounting is an essential step to ensure transparency and protect the interests of both parties involved in the agreement. Here, we will delve into the different types of Thornton Colorado Buyer's Request for Accounting from Seller under Contract for Deed and highlight the relevant keywords associated with this topic. 1. Financial Records: One crucial aspect of the buyer's request for accounting is the disclosure of financial records by the seller. These records may include details about the property's purchase price, any down payment made by the buyer, and the balance owed on the contract. Other relevant financial information might encompass interest rates, applicable fees (if any), and the payment schedule in case of installment payments. 2. Property-related Expenses: The buyer may also seek an accounting of property-related expenses incurred by the seller under the Contract for Deed agreement. These expenses may consist of property taxes, insurance premiums, maintenance and repair costs, utility bills, and any assessments applicable to the property. Obtaining this information helps the buyer assess their financial obligations after assuming ownership. 3. Escrow Account Statements: If an escrow account is established as part of the Contract for Deed agreement, the buyer may request the seller to provide statements indicating the amount of money held in the account, any disbursements made, and a breakdown of how those funds were allocated. This accounting helps the buyer ensure that the escrow funds are being managed appropriately. 4. Reconciliation of Payments: To ensure accuracy and clear any potential discrepancies, the buyer may request a reconciliation of payments made by both parties. This process involves comparing the buyer's payment records with the seller's records to verify that all payments have been accounted for correctly. A comprehensive reconciliation eliminates any confusion or issues related to missed or misapplied payments. Keywords: — ThorntonColoredad— - Buyer's Request - Accounting — Selle— - Contract for Deed - Financial Records — PurchasPriceic— - Down Payment - Balance Owed — Interest Rate— - Fees - Payment Schedule — Property-related Expense— - Property Taxes — Insurance Premiums - Maintenance and Repair Costs — Utility Bill— - Assessments - Escrow Account Statements — Disbursement— - Allocation of Funds - Reconciliation — Payment Records Note: It's crucial for buyers and sellers to consult legal professionals or real estate agents familiar with local laws and regulations, as the specific requirements for a Buyer's Request for Accounting from Seller under Contract for Deed may vary in different jurisdictions.