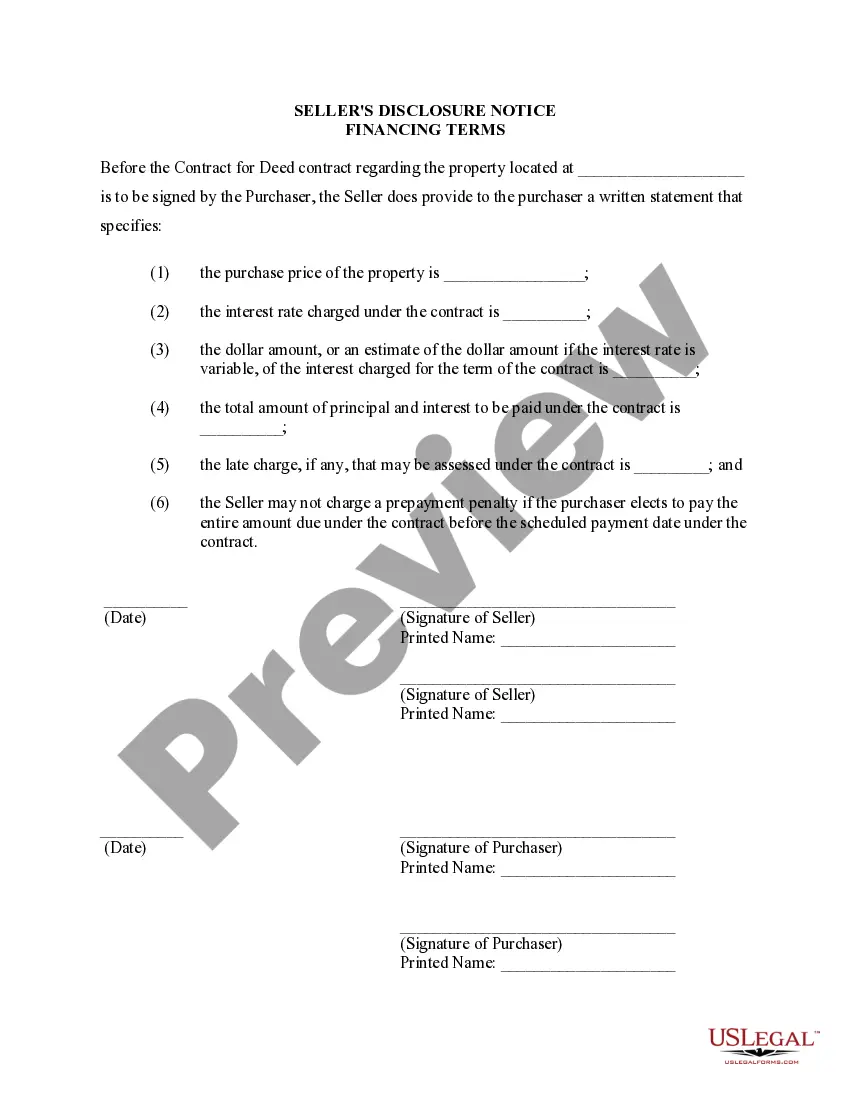

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Arvada Colorado Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the financing terms related to the sale of residential property in Arvada, Colorado. This disclosure is typically presented by the seller to the buyer before the parties enter into a contractual agreement. The disclosed financing terms play a significant role for both the seller and the buyer, as they provide clarity and transparency regarding the financial arrangements associated with the property transfer. These terms may vary based on individual circumstances and the specific contract or agreement for deed being utilized. In Arvada, Colorado, there are several types of Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Down Payment: This term refers to the initial amount of money the buyer is expected to submit to the seller as a down payment on the property. It is an essential component of the overall financing terms and may vary depending on the agreed-upon percentage or dollar amount. 2. Purchase Price: The purchase price is the total cost the buyer agrees to pay for the property. It is typically disclosed in the Seller's Disclosure of Financing Terms and serves as the basis for determining other financial aspects such as monthly installment payments and interest. 3. Interest Rate: The interest rate outlines the percentage that will be added to the outstanding balance of the property over time. It is disclosed in the financing terms and is crucial for both parties to understand the amount to be paid as interest over the term of the contract. 4. Installment Payments: The installment payments refer to the periodic payments the buyer agrees to make to the seller. These payments are typically made on a monthly basis and are determined by the purchase price, interest rate, and the agreed-upon length of the contract or agreement for deed. 5. Length of Contract: This term indicates the duration over which the buyer is obligated to make the installment payments and complete the purchase of the property. The length of the contract can vary, but it is usually disclosed in the Seller's Disclosure of Financing Terms to ensure both parties are aware of the timeline. 6. Maintenance and Repairs: In some cases, the financing terms may outline the responsibility for maintenance and repairs during the contract period. This disclosure helps clarify the expectations of each party regarding the property's upkeep and potential repairs. 7. Default and Remedies: The Seller's Disclosure of Financing Terms may also include information about the consequences of defaulting on the contract or agreement for deed. This may involve penalties, late fees, or potential actions the seller can take to protect their interests and ensure compliance. It is important to note that the above list is not exhaustive, and there might be additional terms specific to individual contracts or agreements for deed. Each transaction is unique, and the Seller's Disclosure of Financing Terms should accurately reflect the particular financial arrangement established between the buyer and the seller. To ensure legal compliance and protection of both parties involved, it is advisable to have the Seller's Disclosure of Financing Terms reviewed by a qualified real estate attorney before finalizing any contract or agreement for deed in Arvada, Colorado.The Arvada Colorado Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the financing terms related to the sale of residential property in Arvada, Colorado. This disclosure is typically presented by the seller to the buyer before the parties enter into a contractual agreement. The disclosed financing terms play a significant role for both the seller and the buyer, as they provide clarity and transparency regarding the financial arrangements associated with the property transfer. These terms may vary based on individual circumstances and the specific contract or agreement for deed being utilized. In Arvada, Colorado, there are several types of Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed: 1. Down Payment: This term refers to the initial amount of money the buyer is expected to submit to the seller as a down payment on the property. It is an essential component of the overall financing terms and may vary depending on the agreed-upon percentage or dollar amount. 2. Purchase Price: The purchase price is the total cost the buyer agrees to pay for the property. It is typically disclosed in the Seller's Disclosure of Financing Terms and serves as the basis for determining other financial aspects such as monthly installment payments and interest. 3. Interest Rate: The interest rate outlines the percentage that will be added to the outstanding balance of the property over time. It is disclosed in the financing terms and is crucial for both parties to understand the amount to be paid as interest over the term of the contract. 4. Installment Payments: The installment payments refer to the periodic payments the buyer agrees to make to the seller. These payments are typically made on a monthly basis and are determined by the purchase price, interest rate, and the agreed-upon length of the contract or agreement for deed. 5. Length of Contract: This term indicates the duration over which the buyer is obligated to make the installment payments and complete the purchase of the property. The length of the contract can vary, but it is usually disclosed in the Seller's Disclosure of Financing Terms to ensure both parties are aware of the timeline. 6. Maintenance and Repairs: In some cases, the financing terms may outline the responsibility for maintenance and repairs during the contract period. This disclosure helps clarify the expectations of each party regarding the property's upkeep and potential repairs. 7. Default and Remedies: The Seller's Disclosure of Financing Terms may also include information about the consequences of defaulting on the contract or agreement for deed. This may involve penalties, late fees, or potential actions the seller can take to protect their interests and ensure compliance. It is important to note that the above list is not exhaustive, and there might be additional terms specific to individual contracts or agreements for deed. Each transaction is unique, and the Seller's Disclosure of Financing Terms should accurately reflect the particular financial arrangement established between the buyer and the seller. To ensure legal compliance and protection of both parties involved, it is advisable to have the Seller's Disclosure of Financing Terms reviewed by a qualified real estate attorney before finalizing any contract or agreement for deed in Arvada, Colorado.