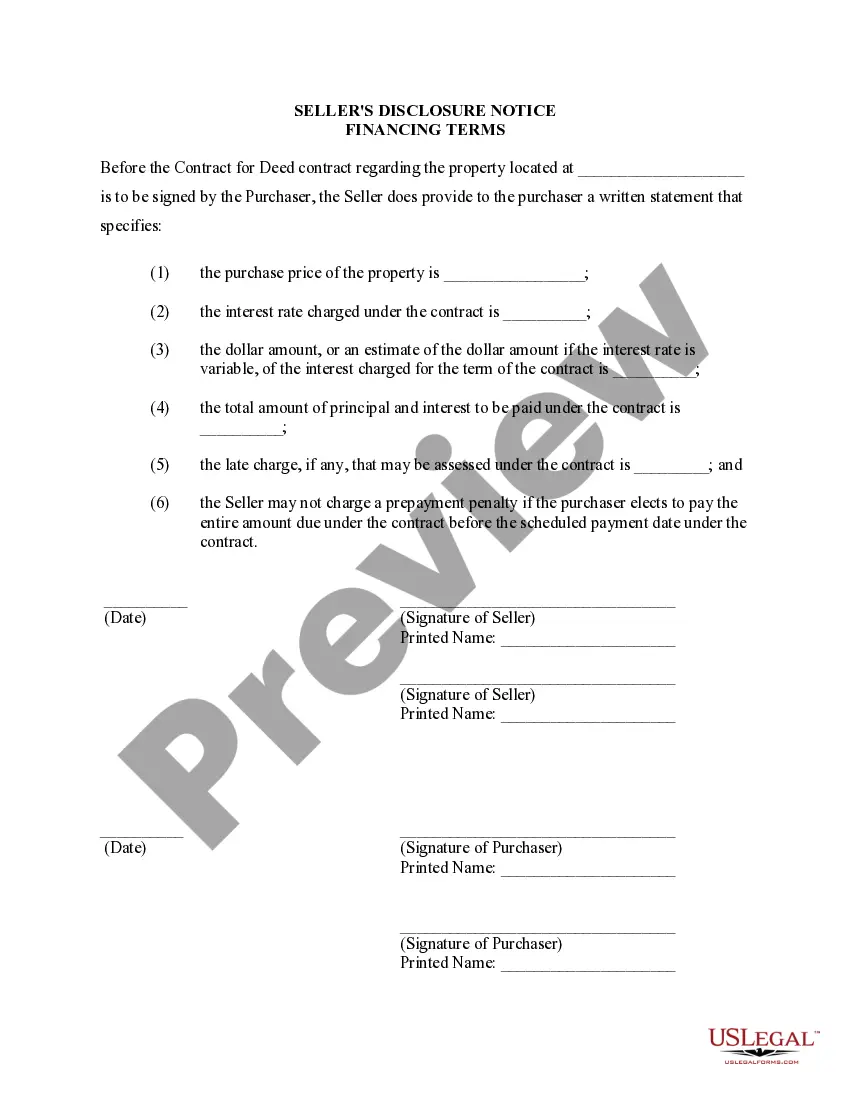

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Colorado Springs Colorado Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the financial terms and conditions between the seller and the buyer in a real estate transaction. This disclosure serves as a protection for both parties involved, providing transparency and clarity regarding the financing arrangements. It is important to understand the different types of Seller's Disclosure of Financing Terms available in Colorado Springs, as they can vary based on specific circumstances. 1. Standard Financing Terms: In a typical Seller's Disclosure of Financing Terms, the document will outline the basic financial information such as the purchase price, down payment amount, interest rate, and repayment terms. It will also specify whether the financing is based on a fixed rate, adjustable rate, or any special terms agreed upon by both parties. 2. Balloon Payment Financing Terms: Another type of financing arrangement that may be disclosed in Colorado Springs is a balloon payment. This type of financing structure involves making regular payments over a specific period, but with a large lump sum payment due at the end of the term. This disclosure will outline the amount of the balloon payment, the date it is due, and any other relevant details. 3. Owner Financing Terms: In some cases, the seller may offer to finance the purchase directly without involving a traditional lending institution. This type of financing is known as owner financing or seller financing. The Seller's Disclosure of Financing Terms for this arrangement will outline the terms, including the interest rate, repayment schedule, and any other financing conditions agreed upon. 4. Assumption of Existing Mortgage Terms: In certain scenarios, the buyer may assume the seller's existing mortgage rather than obtaining a new loan. In this case, the Seller's Disclosure of Financing Terms will provide details about the mortgage in question, including the current outstanding balance, interest rate, monthly payments, and any other relevant information. Overall, the Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed provides necessary information to both the seller and the buyer to ensure transparency and understanding of the financial obligations involved in the real estate transaction. It is crucial for both parties to review and agree upon these terms before finalizing the contract, promoting a smooth and informed buying or selling process.The Colorado Springs Colorado Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the financial terms and conditions between the seller and the buyer in a real estate transaction. This disclosure serves as a protection for both parties involved, providing transparency and clarity regarding the financing arrangements. It is important to understand the different types of Seller's Disclosure of Financing Terms available in Colorado Springs, as they can vary based on specific circumstances. 1. Standard Financing Terms: In a typical Seller's Disclosure of Financing Terms, the document will outline the basic financial information such as the purchase price, down payment amount, interest rate, and repayment terms. It will also specify whether the financing is based on a fixed rate, adjustable rate, or any special terms agreed upon by both parties. 2. Balloon Payment Financing Terms: Another type of financing arrangement that may be disclosed in Colorado Springs is a balloon payment. This type of financing structure involves making regular payments over a specific period, but with a large lump sum payment due at the end of the term. This disclosure will outline the amount of the balloon payment, the date it is due, and any other relevant details. 3. Owner Financing Terms: In some cases, the seller may offer to finance the purchase directly without involving a traditional lending institution. This type of financing is known as owner financing or seller financing. The Seller's Disclosure of Financing Terms for this arrangement will outline the terms, including the interest rate, repayment schedule, and any other financing conditions agreed upon. 4. Assumption of Existing Mortgage Terms: In certain scenarios, the buyer may assume the seller's existing mortgage rather than obtaining a new loan. In this case, the Seller's Disclosure of Financing Terms will provide details about the mortgage in question, including the current outstanding balance, interest rate, monthly payments, and any other relevant information. Overall, the Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed provides necessary information to both the seller and the buyer to ensure transparency and understanding of the financial obligations involved in the real estate transaction. It is crucial for both parties to review and agree upon these terms before finalizing the contract, promoting a smooth and informed buying or selling process.