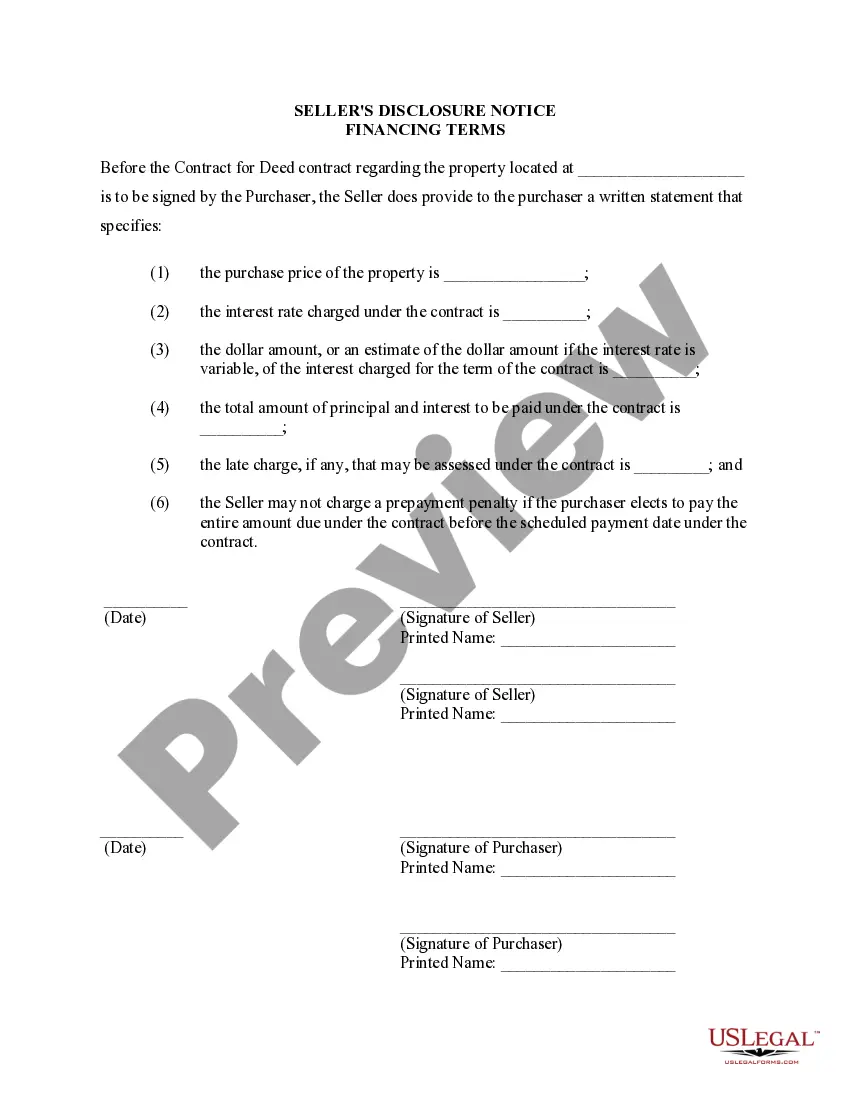

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Lakewood Colorado Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that provides transparency and essential information regarding the financing terms between the seller and the buyer in a residential property transaction. This disclosure aims to protect both parties by outlining the terms and conditions of the agreement, ensuring that they have a clear understanding of the financial obligations involved. Below, we will discuss the various types of Lakewood Colorado Seller's Disclosure of Financing Terms for Residential Property. 1. Standard Financing Terms: This type of Seller's Disclosure outlines the typical financing terms associated with a residential property transaction. It includes essential information such as the purchase price, down payment amount, interest rate, loan duration, and any specific payment schedule. 2. Interest Rate Disclosures: This type of Seller's Disclosure focuses specifically on the interest rate associated with the financing terms. It details whether the interest rate is fixed or adjustable, and if it is adjustable, includes information on the index used for adjustment, the margin, and any periodic or lifetime caps that may apply. 3. Payment Schedule and Late Fees: This type of Seller's Disclosure highlights the specific payment schedule agreed upon by the seller and buyer. It outlines the frequency of payments (monthly, bi-monthly, etc.), the due date, and the accepted payment methods. Additionally, it may include information regarding any late fees or penalties that may be imposed for delinquent payments. 4. Prepayment Privileges: This type of Seller's Disclosure focuses on the terms related to prepayment of the loan. It denotes whether there are any prepayment penalties or fees involved and outlines any conditions or restrictions on prepaying the loan amount, such as a specified period during which prepayment is not allowed. 5. Default and Remedies: This type of Seller's Disclosure provides crucial information on the consequences and remedies in the event of default by the buyer. It outlines the seller's rights and options in case of non-payment or breach of any other terms specified in the financing agreement, including but not limited to foreclosure procedures. 6. Escrow Accounts: This type of Seller's Disclosure deals with escrow accounts, if applicable. It outlines whether an escrow account will be established and used for payment of property taxes and insurance premiums. It also includes details regarding the allocation of funds and any requirements for a minimum balance in the escrow account. 7. Additional Terms and Conditions: This type of Seller's Disclosure addresses any additional terms and conditions that may be specific to the financing agreement. It could include provisions related to the transferability of the agreement, penalties for early termination, or any other custom terms agreed upon by the buyer and seller. It is crucial for both the buyer and seller to thoroughly review and understand the specific Lakewood Colorado Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. Seeking legal advice or guidance from a qualified professional during this process is highly recommended ensuring compliance and clarity in the terms and conditions outlined in the document.The Lakewood Colorado Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that provides transparency and essential information regarding the financing terms between the seller and the buyer in a residential property transaction. This disclosure aims to protect both parties by outlining the terms and conditions of the agreement, ensuring that they have a clear understanding of the financial obligations involved. Below, we will discuss the various types of Lakewood Colorado Seller's Disclosure of Financing Terms for Residential Property. 1. Standard Financing Terms: This type of Seller's Disclosure outlines the typical financing terms associated with a residential property transaction. It includes essential information such as the purchase price, down payment amount, interest rate, loan duration, and any specific payment schedule. 2. Interest Rate Disclosures: This type of Seller's Disclosure focuses specifically on the interest rate associated with the financing terms. It details whether the interest rate is fixed or adjustable, and if it is adjustable, includes information on the index used for adjustment, the margin, and any periodic or lifetime caps that may apply. 3. Payment Schedule and Late Fees: This type of Seller's Disclosure highlights the specific payment schedule agreed upon by the seller and buyer. It outlines the frequency of payments (monthly, bi-monthly, etc.), the due date, and the accepted payment methods. Additionally, it may include information regarding any late fees or penalties that may be imposed for delinquent payments. 4. Prepayment Privileges: This type of Seller's Disclosure focuses on the terms related to prepayment of the loan. It denotes whether there are any prepayment penalties or fees involved and outlines any conditions or restrictions on prepaying the loan amount, such as a specified period during which prepayment is not allowed. 5. Default and Remedies: This type of Seller's Disclosure provides crucial information on the consequences and remedies in the event of default by the buyer. It outlines the seller's rights and options in case of non-payment or breach of any other terms specified in the financing agreement, including but not limited to foreclosure procedures. 6. Escrow Accounts: This type of Seller's Disclosure deals with escrow accounts, if applicable. It outlines whether an escrow account will be established and used for payment of property taxes and insurance premiums. It also includes details regarding the allocation of funds and any requirements for a minimum balance in the escrow account. 7. Additional Terms and Conditions: This type of Seller's Disclosure addresses any additional terms and conditions that may be specific to the financing agreement. It could include provisions related to the transferability of the agreement, penalties for early termination, or any other custom terms agreed upon by the buyer and seller. It is crucial for both the buyer and seller to thoroughly review and understand the specific Lakewood Colorado Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. Seeking legal advice or guidance from a qualified professional during this process is highly recommended ensuring compliance and clarity in the terms and conditions outlined in the document.