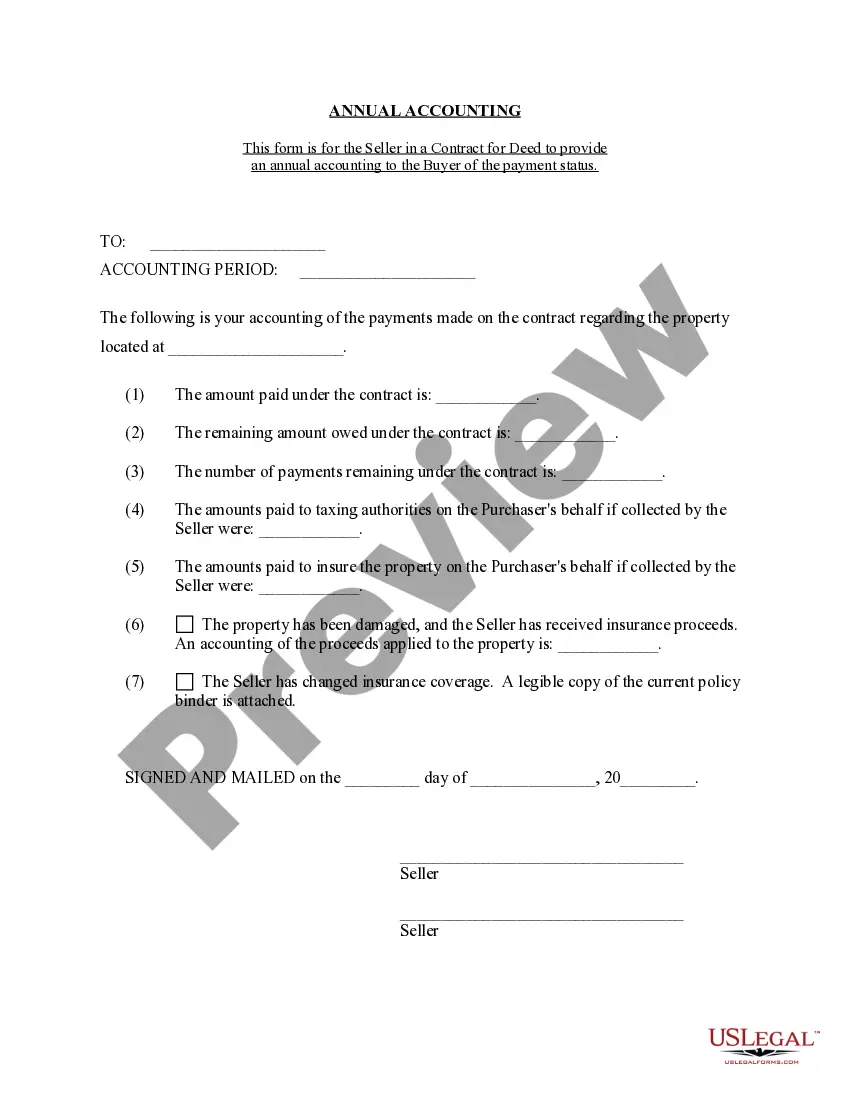

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Arvada Colorado Contract for Deed Seller's Annual Accounting Statement

Description

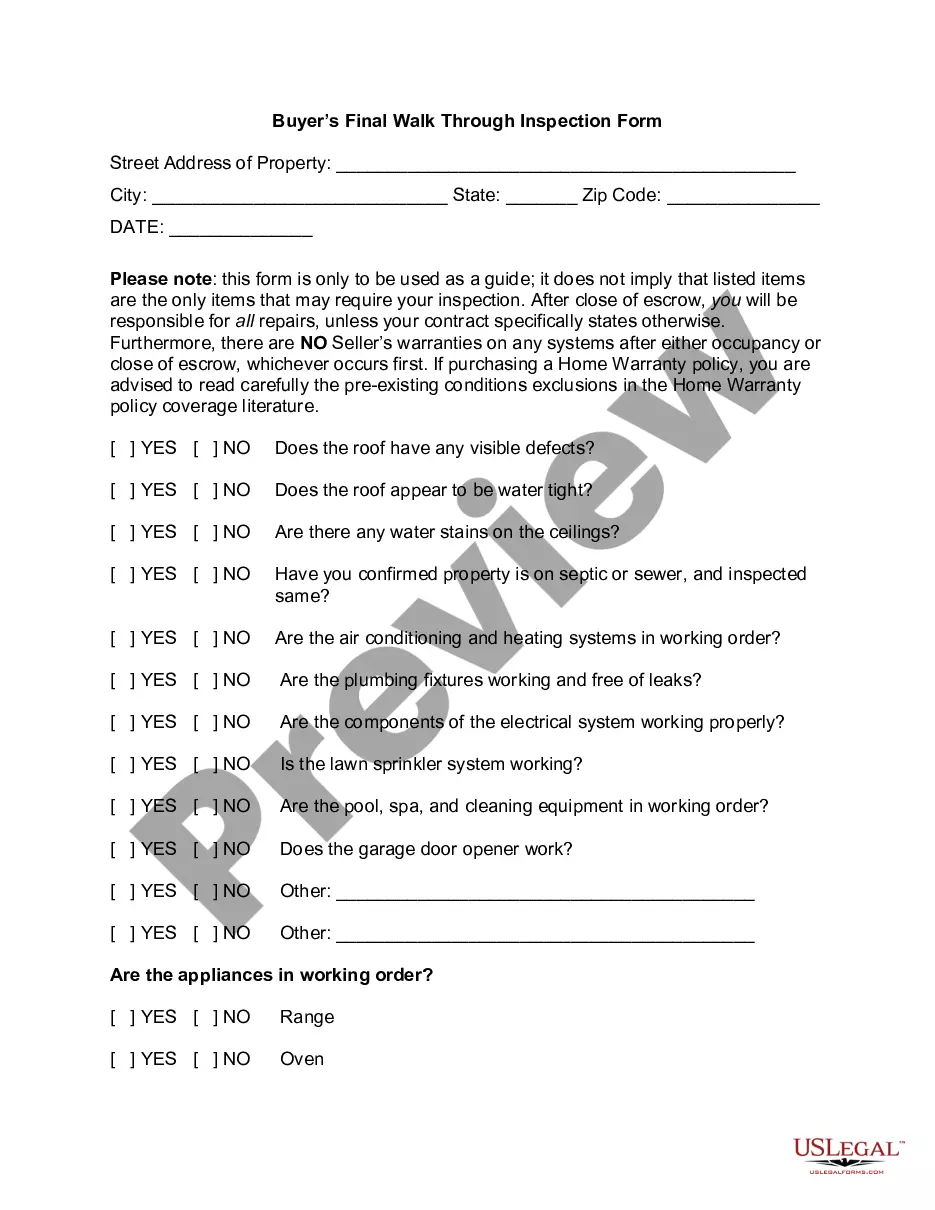

How to fill out Colorado Contract For Deed Seller's Annual Accounting Statement?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms archive.

It is an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the files are correctly categorized by usage area and jurisdictional regions, making the search for the Arvada Colorado Contract for Deed Seller's Annual Accounting Statement as straightforward as pie.

Maintaining paperwork organized and compliant with legal standards is of utmost significance. Leverage the US Legal Forms library to always have essential document templates for any requirements readily available!

- Ensure to preview the mode and form details.

- Verify you have selected the appropriate template that aligns with your needs and thoroughly adheres to your local jurisdiction standards.

- Look for an alternative template if necessary.

- If you discover any discrepancies, use the search option above to find the correct one. If it meets your criteria, proceed to the next step.

- Select the document by clicking on the buy now button and choose your preferred subscription plan.

Form popularity

FAQ

An SPD should be delivered to participants within 90 days after they become covered, whether they request it or not. Plan administrators of a new plan must distribute an SPD within 120 days after the plan is established.

Facts & Defects Disclosures In Colorado, sellers have a duty to disclose information the buyer would find of significant importance about the property. This information is a material fact. Sellers are also supposed to reveal issues that could negatively affect the property's value. This is an adverse material fact.

Colorado Seller's Property Disclosure Form?Disclosure Requirements. When you sell a home in Colorado, you need to make disclosures under the terms of the Seller's Property Disclosure statement.

Colorado courts have concluded that sellers are in a superior position to know the condition of a house and therefore have a duty to disclose defects in the house, which is typically accomplished through a seller's property disclosure form.

According to Rule F, the rule that specifically give guidelines regarding Commission-approved forms: A broker who is not a principal party to the contract may not insert personal provisions, personal disclaimers or exculpatory language in favor of the broker in the ?Additional Provisions? section of a Commission-

Any ongoing problems with neighbours, including boundary disputes. Any neighbours known to have been served an Anti Social Behaviour Order (ASBO) Whether there have been any known burglaries in the neighbourhood recently. Whether any murders or suicides have occurred in the property recently.

It requires the listing licensee to disclose the square footage of the floor space of the living area of the residence to the buyer and seller when a licensee disseminates such information, including submission to a multiple listing service.