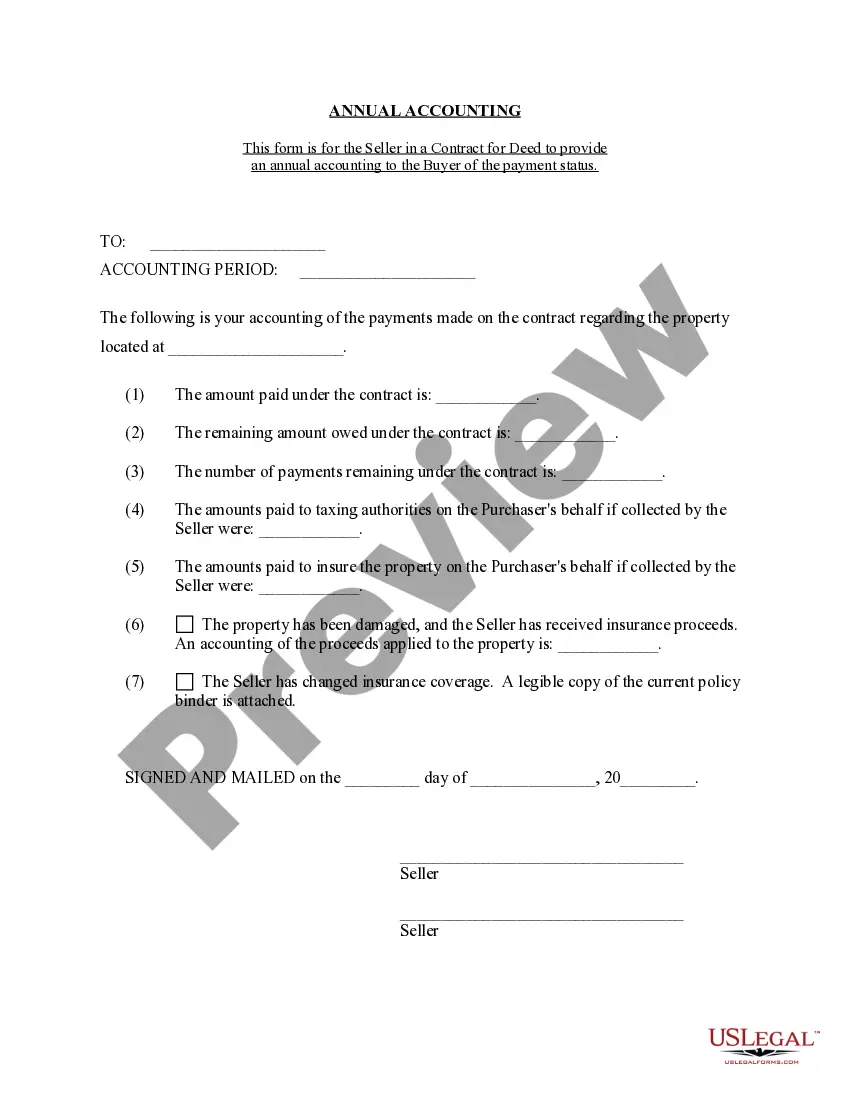

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Centennial Colorado Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of a seller's financial transactions and activities related to the sale of a property through a contract for deed agreement in Centennial, Colorado. This statement serves as a record of all monetary exchanges between the seller and the buyer throughout the year. Keywords: Centennial Colorado, contract for deed, annual accounting statement, seller, financial transactions, property sale, buyer, monetary exchanges, record There are two main types of Centennial Colorado Contract for Deed Seller's Annual Accounting Statements: 1. Basic Annual Accounting Statement: This type of statement includes a breakdown of all payments made by the buyer to the seller over the course of the year. It highlights the principal amount, interest, and any other fees or charges associated with the contract for deed. Additionally, it may provide details about the current balance owed by the buyer and the remaining term of the contract. Keywords: Centennial Colorado, contract for deed, annual accounting statement, payments, buyer, seller, principal amount, interest, fees, charges, contract balance, remaining term 2. Comprehensive Annual Accounting Statement: This statement goes beyond the basic information and provides a more detailed analysis of the financial transactions. It includes a summary of all payments received by the seller, along with a breakdown of principal reductions, interest earnings, late fees, and any additional charges specified in the contract for deed agreement. It may also include a provision for reporting property taxes, insurance payments, and any other relevant financial obligations of the buyer. Keywords: Centennial Colorado, contract for deed, annual accounting statement, payments received, principal reductions, interest earnings, late fees, additional charges, property taxes, insurance payments, financial obligations, buyer, seller, detailed analysis Overall, the Centennial Colorado Contract for Deed Seller's Annual Accounting Statement plays a critical role in ensuring transparency and accountability in the financial aspect of a contract for deed agreement. It is essential for both the seller and the buyer to review and understand this statement to maintain a clear record of all financial transactions and obligations throughout the year.