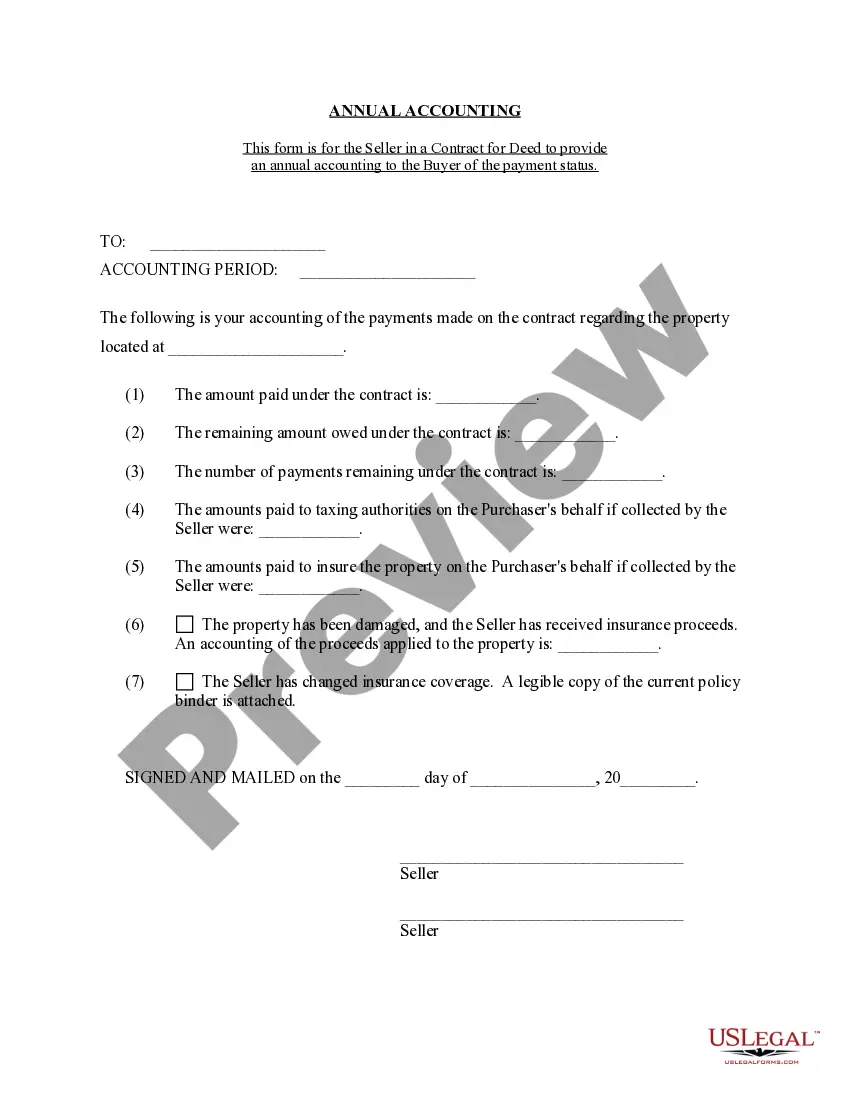

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Westminster Colorado Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial details of the agreement between the seller and the buyer in a contract for deed transaction. This statement provides a comprehensive breakdown of the financial transactions related to the contract for deed throughout the year. It is essential for both parties to have a clear understanding of the finances involved in the agreement. The Westminster Colorado Contract for Deed Seller's Annual Accounting Statement typically includes various key elements and keywords such as: 1. Parties Involved: The statement should clearly mention the names and contact information of both the seller and the buyer involved in the contract for deed agreement. 2. Payment Overview: This section outlines the total amount received from the buyer throughout the year and breaks it down into monthly or quarterly payments, including the principal, interest, and any additional charges. 3. Outstanding Balance: It is important to include the remaining balance or the outstanding amount that the buyer still owes to the seller. This shows the buyer's progress in paying off the contract for deed. 4. Escrow Account: If there is an escrow account involved, the statement should mention the balance held in the account, details of any expenses paid from the escrow account, and any adjustments made throughout the year. 5. Taxes and Insurance: The seller's statement should include information about property taxes and insurance payments made on behalf of the buyer, if applicable. 6. Maintenance Expenses: If there are any maintenance or repair costs incurred by the seller during the year, they should be itemized in this section. This includes any repairs made to the property or expenses related to its upkeep. 7. Legal Fees: In case any legal assistance was sought during the year regarding the contract for deed, such as drafting or reviewing documents, the associated costs should be documented in this section. 8. Other Expenses: Any additional expenses directly related to the contract for deed, such as recording fees or property inspection costs, should be included separately. The Westminster Colorado Contract for Deed Seller's Annual Accounting Statement is a vital tool for both sellers and buyers to keep track of the financial aspects of their agreement. It ensures transparency and helps maintain a healthy financial relationship between the parties involved. While there might not be different types of the Westminster Colorado Contract for Deed Seller's Annual Accounting Statement per se, its content and format may vary depending on the specific terms and conditions outlined in the contract for deed agreement and the preferences of the parties involved.The Westminster Colorado Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial details of the agreement between the seller and the buyer in a contract for deed transaction. This statement provides a comprehensive breakdown of the financial transactions related to the contract for deed throughout the year. It is essential for both parties to have a clear understanding of the finances involved in the agreement. The Westminster Colorado Contract for Deed Seller's Annual Accounting Statement typically includes various key elements and keywords such as: 1. Parties Involved: The statement should clearly mention the names and contact information of both the seller and the buyer involved in the contract for deed agreement. 2. Payment Overview: This section outlines the total amount received from the buyer throughout the year and breaks it down into monthly or quarterly payments, including the principal, interest, and any additional charges. 3. Outstanding Balance: It is important to include the remaining balance or the outstanding amount that the buyer still owes to the seller. This shows the buyer's progress in paying off the contract for deed. 4. Escrow Account: If there is an escrow account involved, the statement should mention the balance held in the account, details of any expenses paid from the escrow account, and any adjustments made throughout the year. 5. Taxes and Insurance: The seller's statement should include information about property taxes and insurance payments made on behalf of the buyer, if applicable. 6. Maintenance Expenses: If there are any maintenance or repair costs incurred by the seller during the year, they should be itemized in this section. This includes any repairs made to the property or expenses related to its upkeep. 7. Legal Fees: In case any legal assistance was sought during the year regarding the contract for deed, such as drafting or reviewing documents, the associated costs should be documented in this section. 8. Other Expenses: Any additional expenses directly related to the contract for deed, such as recording fees or property inspection costs, should be included separately. The Westminster Colorado Contract for Deed Seller's Annual Accounting Statement is a vital tool for both sellers and buyers to keep track of the financial aspects of their agreement. It ensures transparency and helps maintain a healthy financial relationship between the parties involved. While there might not be different types of the Westminster Colorado Contract for Deed Seller's Annual Accounting Statement per se, its content and format may vary depending on the specific terms and conditions outlined in the contract for deed agreement and the preferences of the parties involved.