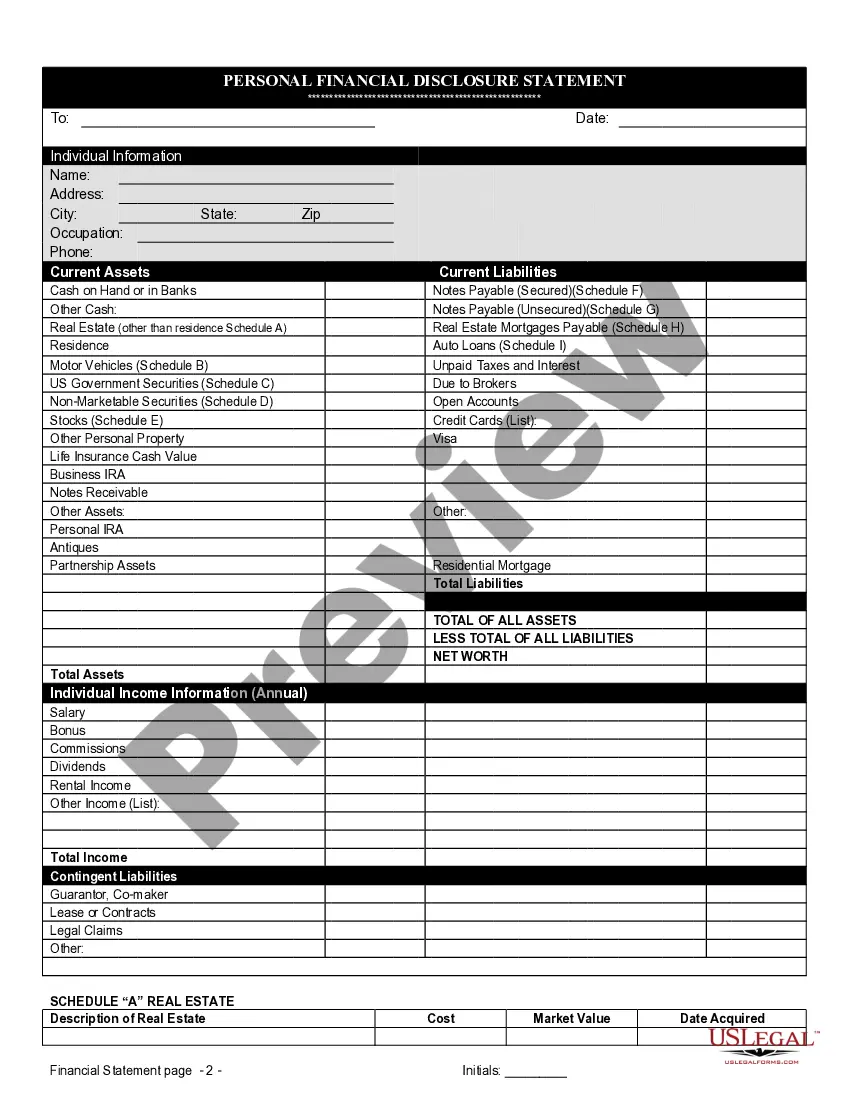

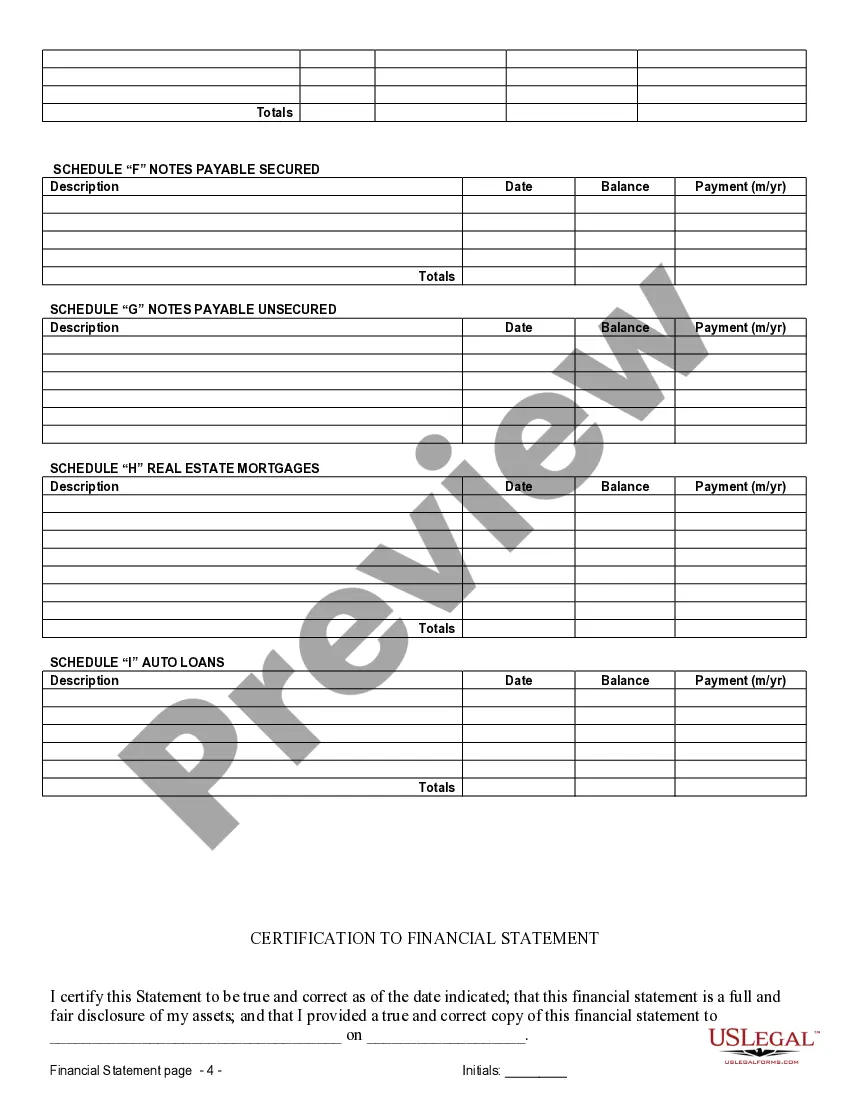

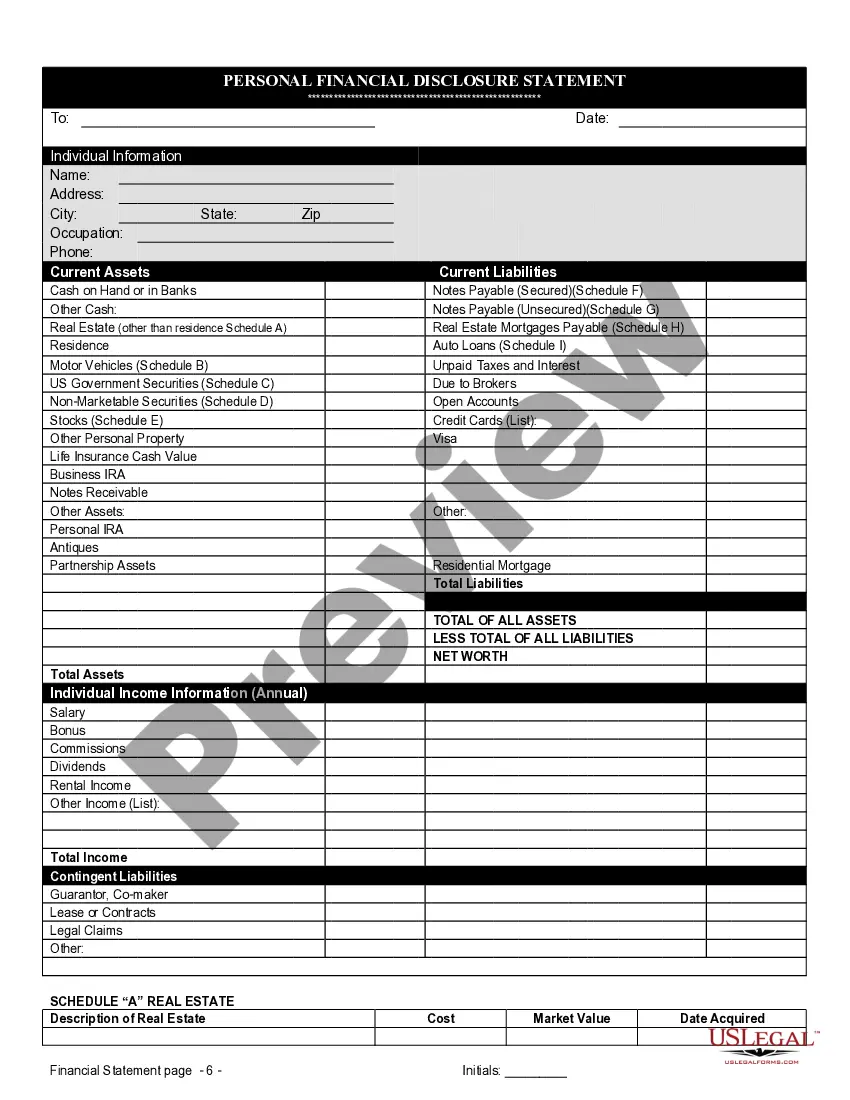

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

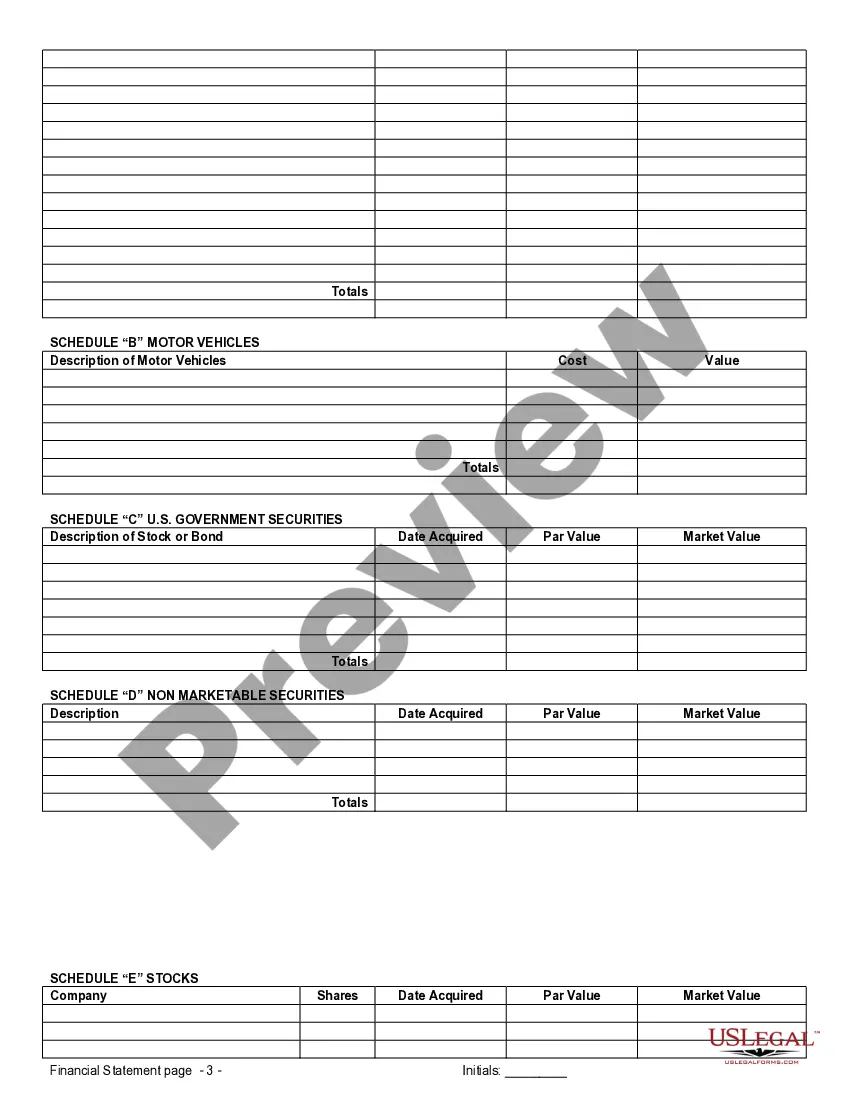

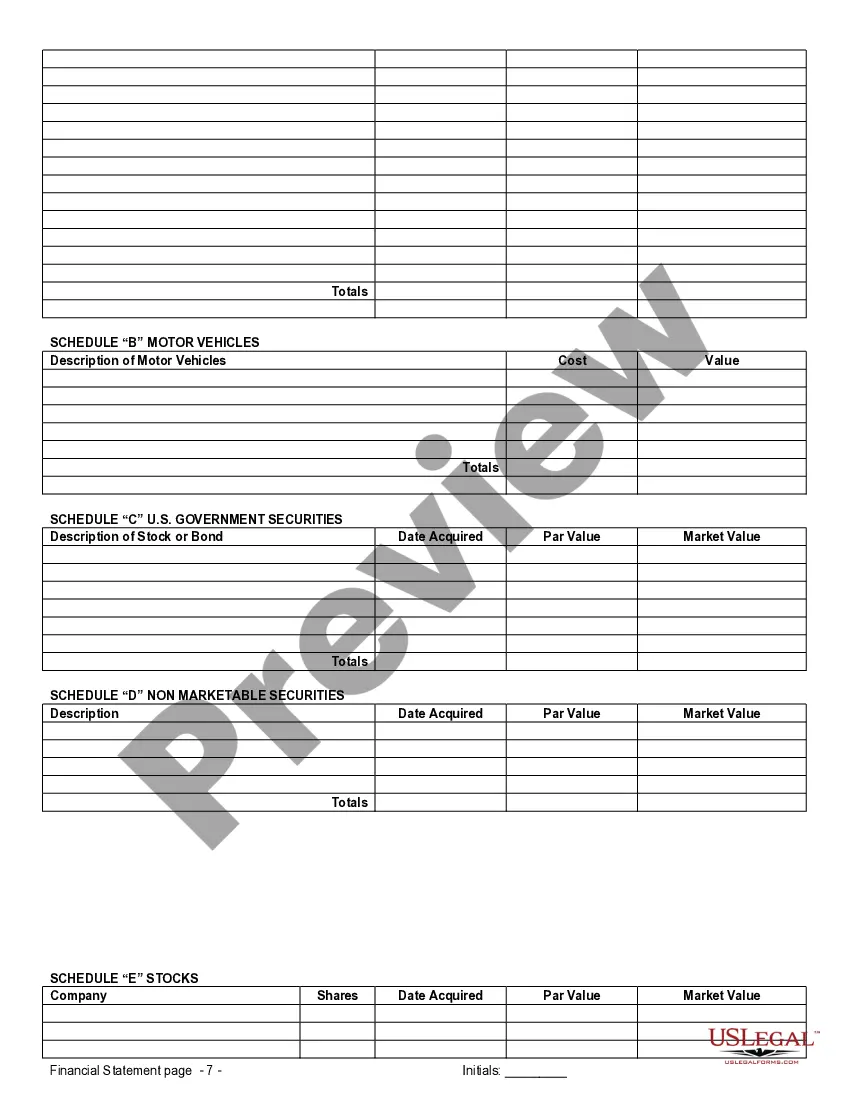

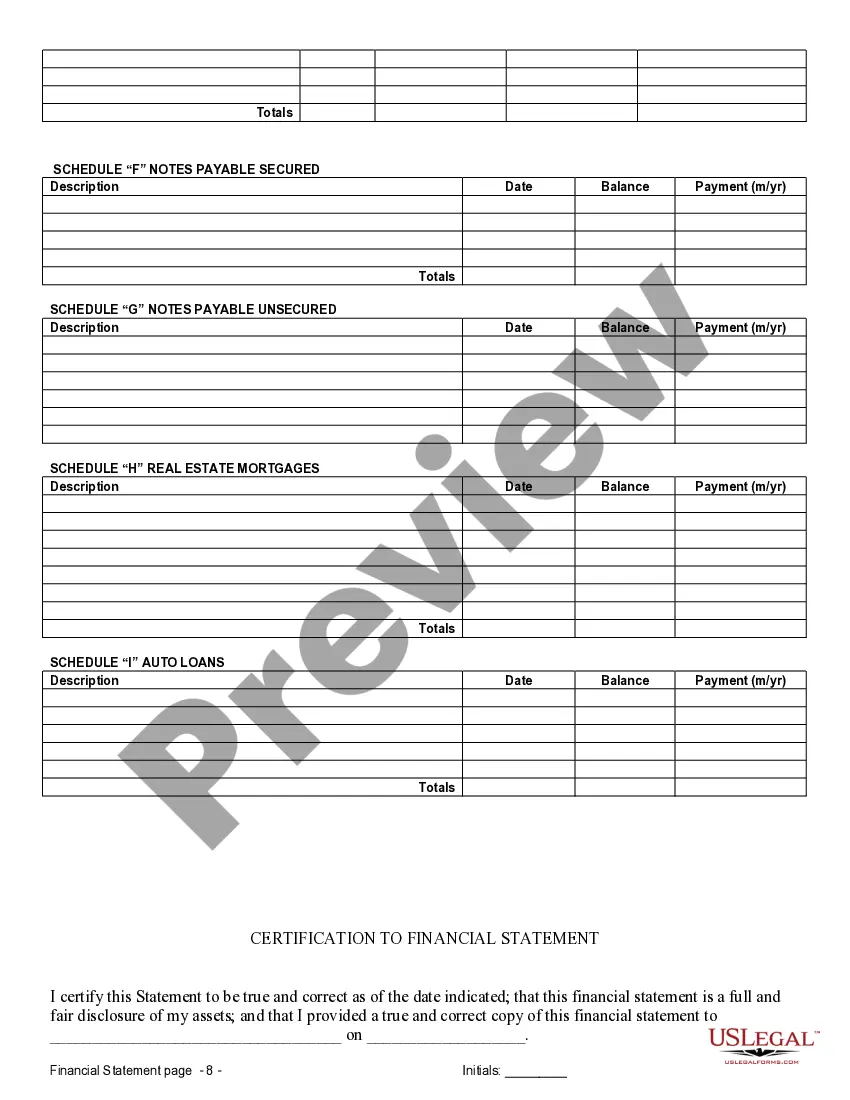

Centennial Colorado Financial Statements in Connection with Prenuptial Premarital Agreements serve as crucial documentation when individuals are entering into a marriage contract in the Centennial area. These statements are a comprehensive representation of a couple's financial status, assets, and liabilities at the time of entering into a prenuptial agreement, enabling them to set clear expectations and determine financial responsibilities in case of divorce or separation. Financial Statements in Connection with Prenuptial Premarital Agreement Centennial Colorado 1. Income Statement: This financial statement showcases the income and expenses of both parties involved in the prenuptial agreement. It provides a detailed breakdown of earnings, including salary, investments, bonuses, and other sources of income. 2. Balance Sheet: The balance sheet outlines the couple's assets, liabilities, and net worth. It comprises a list of properties, real estate, vehicles, bank accounts, investments, loans, debts, and other financial holdings of both parties entering into the prenuptial agreement. 3. Cash Flow Statement: This statement tracks the inflow and outflow of money in the concerned individuals' lives. It clarifies the regular income, expenses, purchases, savings, and any financial obligations, allowing future spouses to comprehend each other's spending and saving habits. 4. Tax Returns: Centennial Colorado Financial Statements in Connection with Prenuptial Premarital Agreements also require the submission of recent tax returns. This step offers an accurate picture of each partner's income, deductions, credits, and overall tax liabilities. 5. Financial Disclosures: These detailed statements disclose comprehensive financial information such as bank statements, investment portfolios, retirement plans, credit card statements, and outstanding debts. The purpose is to provide complete transparency regarding any individual's financial situation. Including these various types of financial statements in the prenuptial agreement offers a level of financial security and transparency to both parties involved. By providing a complete financial snapshot, these statements pave the way for open communication, trust, and a solid understanding of each other's financial obligations. It also ensures that both individuals can make informed decisions and negotiate fair terms in the event of a divorce or separation.Centennial Colorado Financial Statements in Connection with Prenuptial Premarital Agreements serve as crucial documentation when individuals are entering into a marriage contract in the Centennial area. These statements are a comprehensive representation of a couple's financial status, assets, and liabilities at the time of entering into a prenuptial agreement, enabling them to set clear expectations and determine financial responsibilities in case of divorce or separation. Financial Statements in Connection with Prenuptial Premarital Agreement Centennial Colorado 1. Income Statement: This financial statement showcases the income and expenses of both parties involved in the prenuptial agreement. It provides a detailed breakdown of earnings, including salary, investments, bonuses, and other sources of income. 2. Balance Sheet: The balance sheet outlines the couple's assets, liabilities, and net worth. It comprises a list of properties, real estate, vehicles, bank accounts, investments, loans, debts, and other financial holdings of both parties entering into the prenuptial agreement. 3. Cash Flow Statement: This statement tracks the inflow and outflow of money in the concerned individuals' lives. It clarifies the regular income, expenses, purchases, savings, and any financial obligations, allowing future spouses to comprehend each other's spending and saving habits. 4. Tax Returns: Centennial Colorado Financial Statements in Connection with Prenuptial Premarital Agreements also require the submission of recent tax returns. This step offers an accurate picture of each partner's income, deductions, credits, and overall tax liabilities. 5. Financial Disclosures: These detailed statements disclose comprehensive financial information such as bank statements, investment portfolios, retirement plans, credit card statements, and outstanding debts. The purpose is to provide complete transparency regarding any individual's financial situation. Including these various types of financial statements in the prenuptial agreement offers a level of financial security and transparency to both parties involved. By providing a complete financial snapshot, these statements pave the way for open communication, trust, and a solid understanding of each other's financial obligations. It also ensures that both individuals can make informed decisions and negotiate fair terms in the event of a divorce or separation.