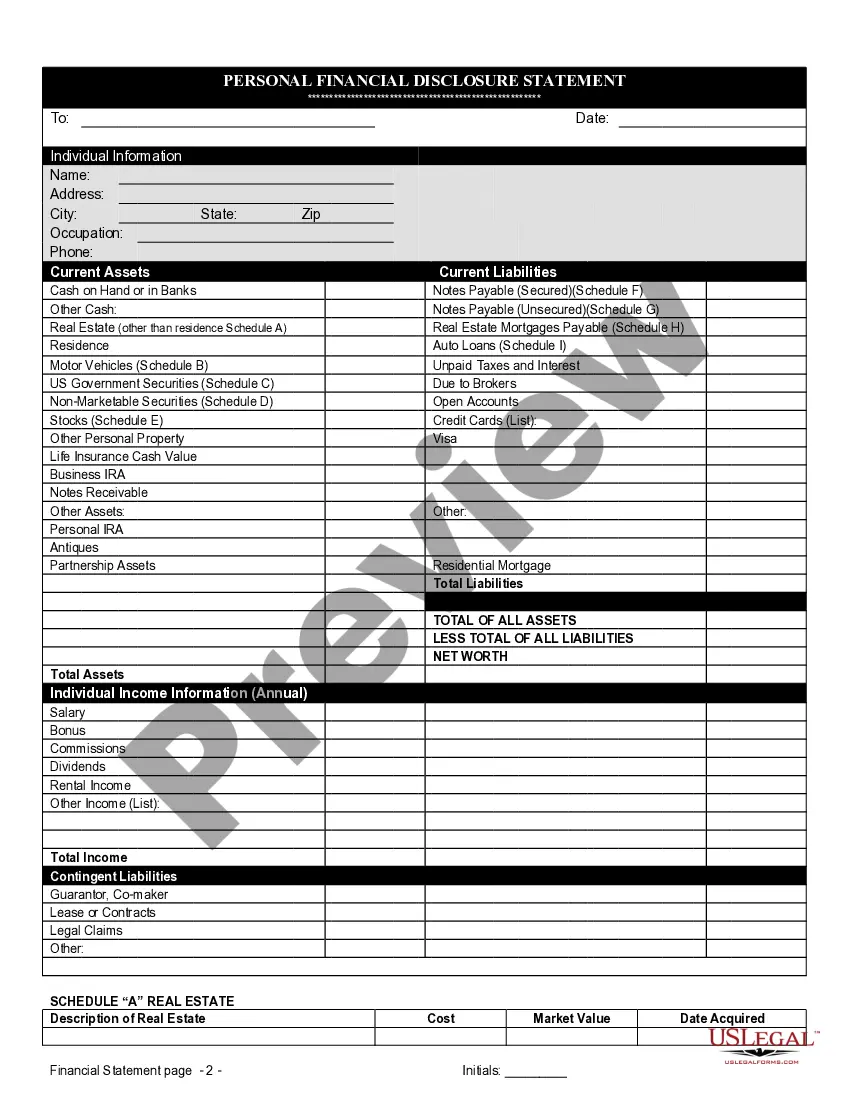

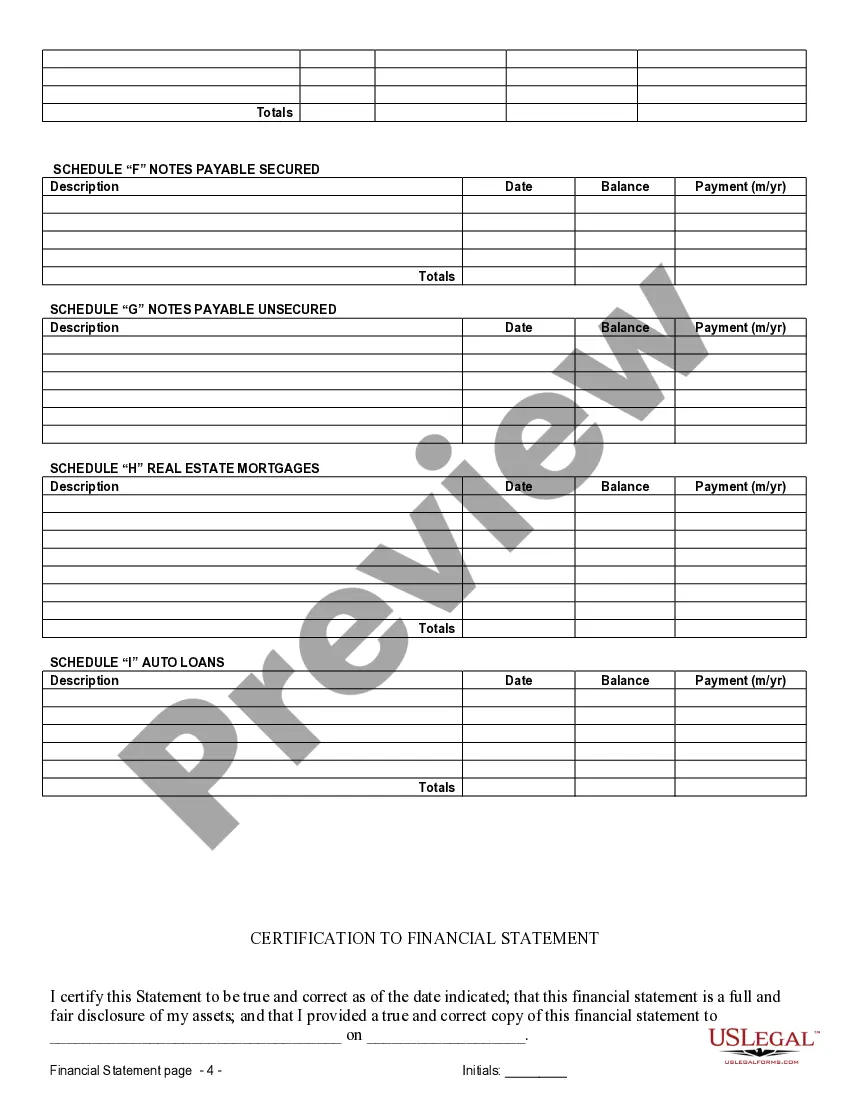

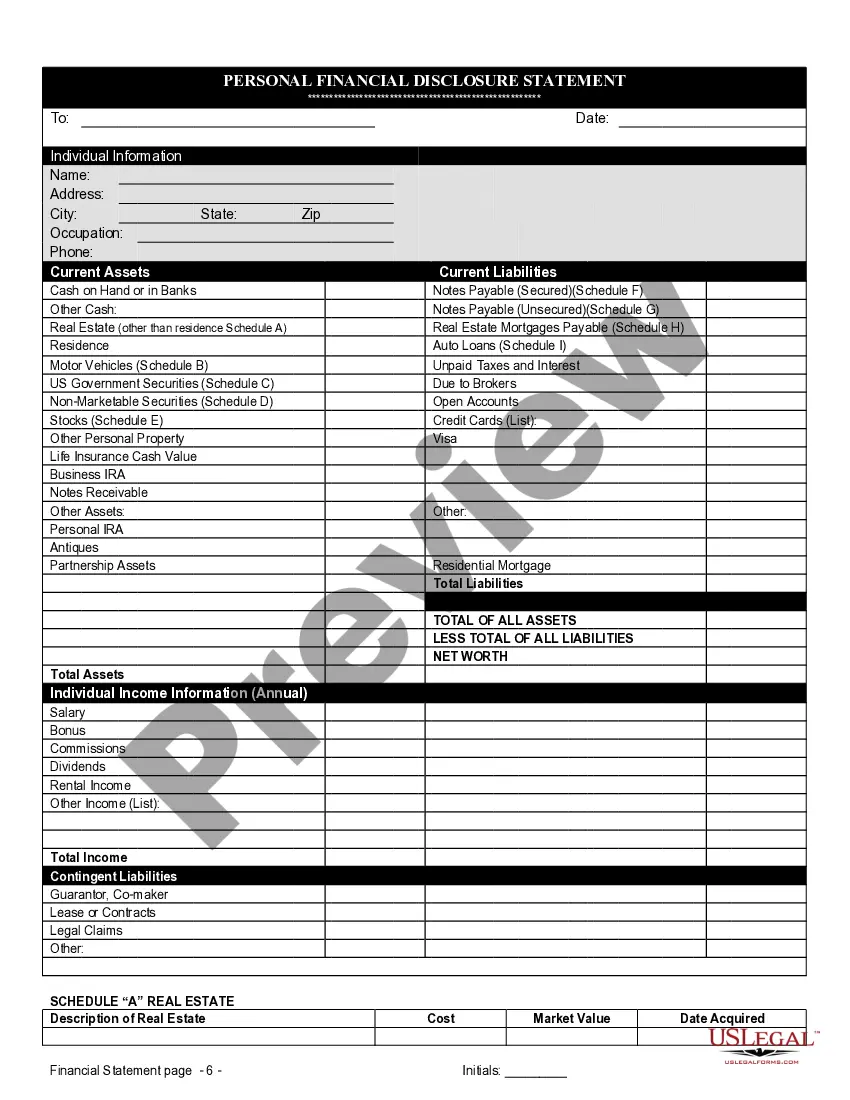

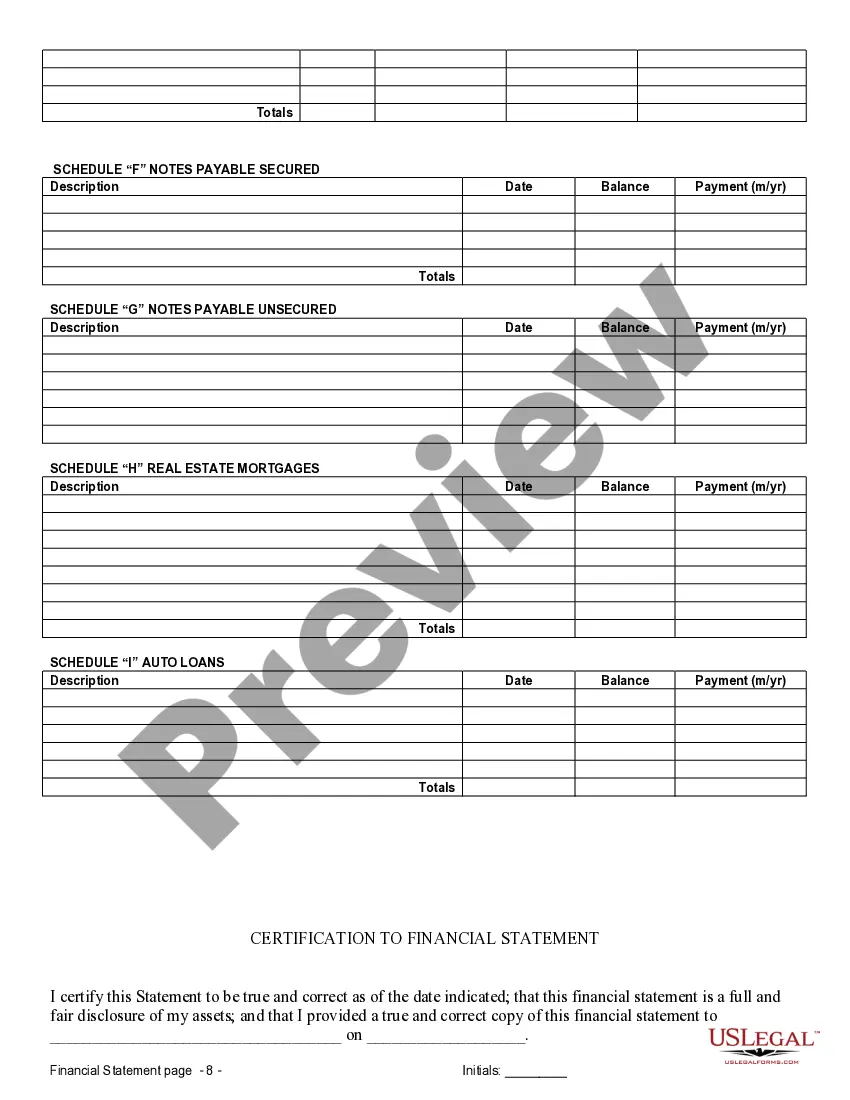

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

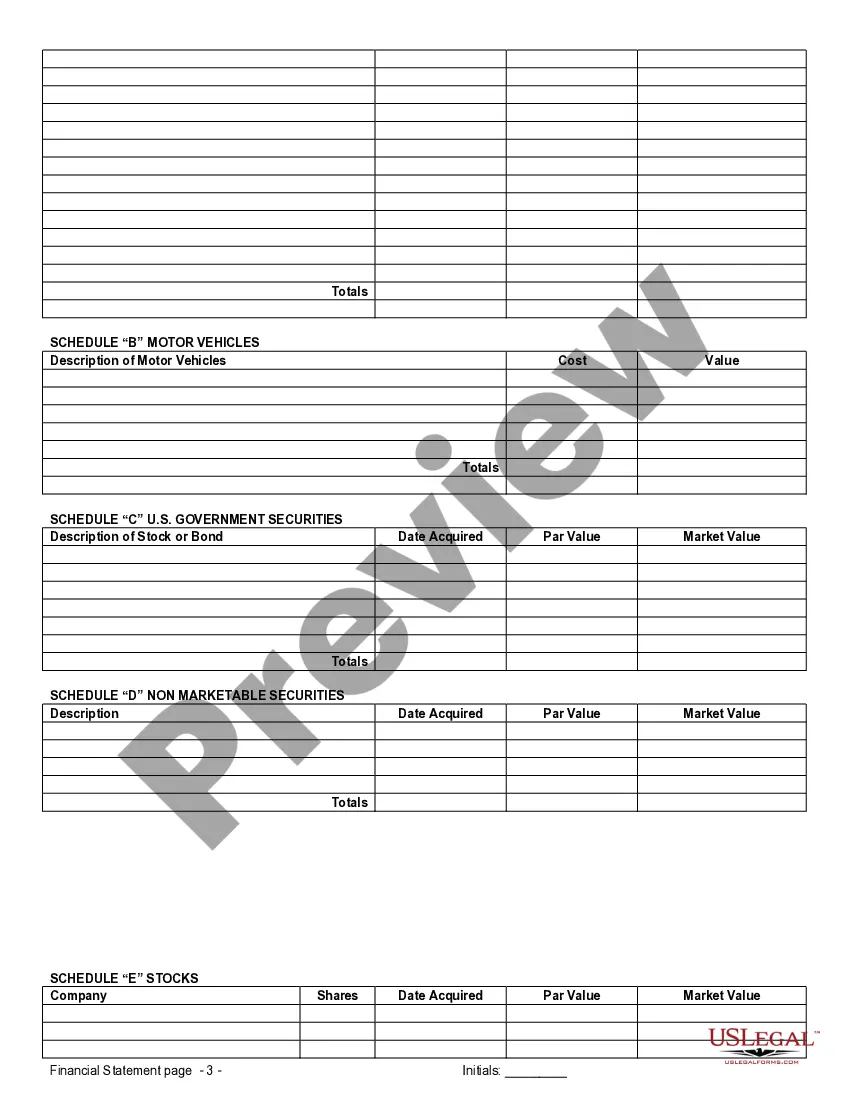

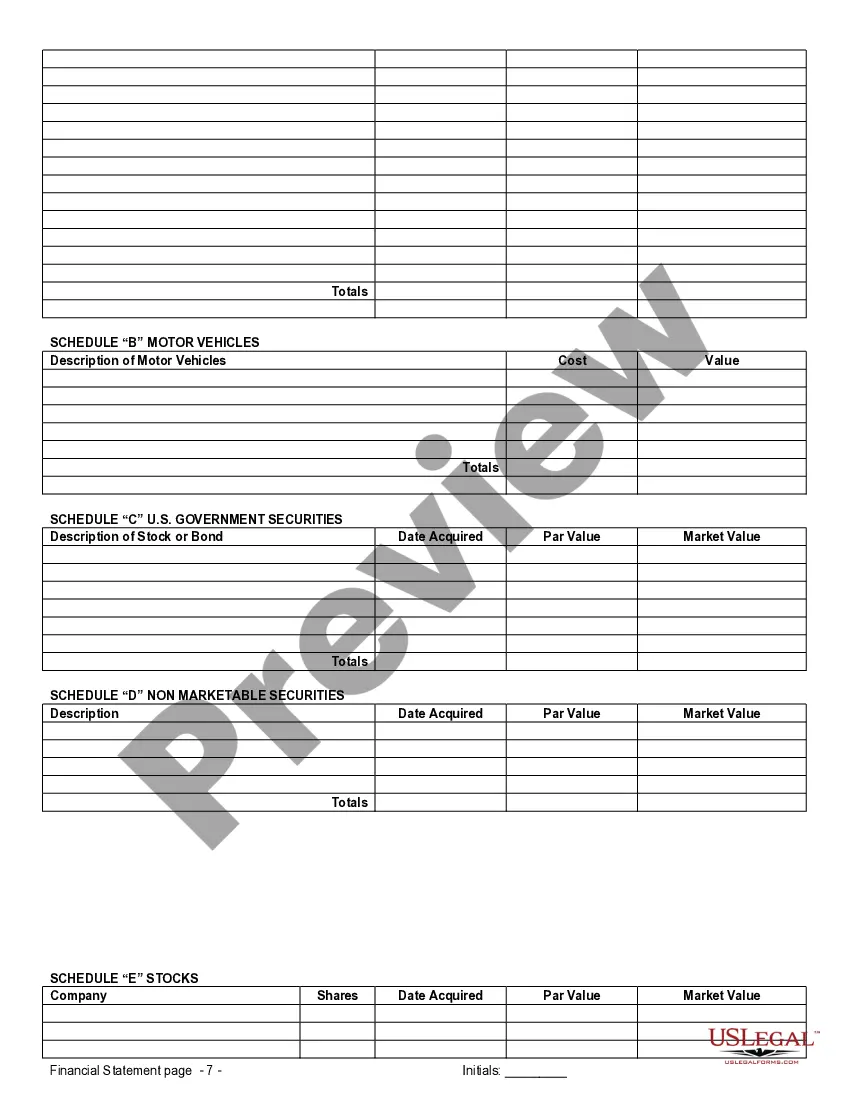

Fort Collins Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement: Fort Collins, Colorado residents who are considering entering into a prenuptial or premarital agreement should be familiar with the concept of financial statements. Financial statements play a crucial role in outlining the financial assets and liabilities of each partner before entering into marriage, providing transparency and clarity. In the context of prenuptial or premarital agreements, financial statements in Fort Collins, Colorado capture an individual's financial position as a snapshot in time. These statements are often prepared and presented by both parties to disclose their respective financial situations accurately. There are several types of financial statements related to prenuptial or premarital agreements that individuals in Fort Collins might encounter: 1. Personal Financial Statements: Personal financial statements are prepared by individuals to present a comprehensive overview of their financial position. These statements typically include information regarding income, assets, liabilities, and expenses. When utilized for prenuptial or premarital agreements, these statements function as a baseline to establish each partner's financial standing before marriage. 2. Balance Sheets: Balance sheets form an integral part of financial statements related to prenuptial agreements. They provide a snapshot of an individual's financial health, highlighting assets, liabilities, and equity. Balance sheets may include investments, real estate, retirement accounts, bank accounts, outstanding debts, and other relevant financial information. 3. Income Statements: Income statements, also known as profit and loss statements, detail an individual's income and expenses over a specified period. They outline revenue sources, such as salary, investment income, or rental income, as well as expenses like mortgage payments, utility bills, and other monthly obligations. Including income statements in financial statements for prenuptial agreements helps to understand each partner's cash flow and financial habits. 4. Retirement Account Statements: Retirement account statements are essential components of financial statements specifically concerning prenuptial or premarital agreements. These statements cover retirement savings, such as 401(k), IRA, or pension accounts. By disclosing the value of these accounts, individuals can protect their retirement savings and outline how they should be divided in the event of divorce or separation. 5. Tax Returns: Tax returns reveal an individual's income, deductions, and tax liability for a given year. They provide valuable information about an individual's financial standing and support accurate financial disclosure in prenuptial agreements. In Fort Collins, Colorado, it is crucial to consult with legal and financial professionals to ensure the accuracy and completeness of financial statements in connection with prenuptial or premarital agreements. These professionals can guide individuals through the process, help them understand their rights and responsibilities, and ensure that the financial statements adhere to the applicable laws and regulations. Creating comprehensive financial statements in connection with prenuptial or premarital agreements allows couples in Fort Collins, Colorado, to navigate their financial matters transparently and make informed decisions that safeguard their interests.