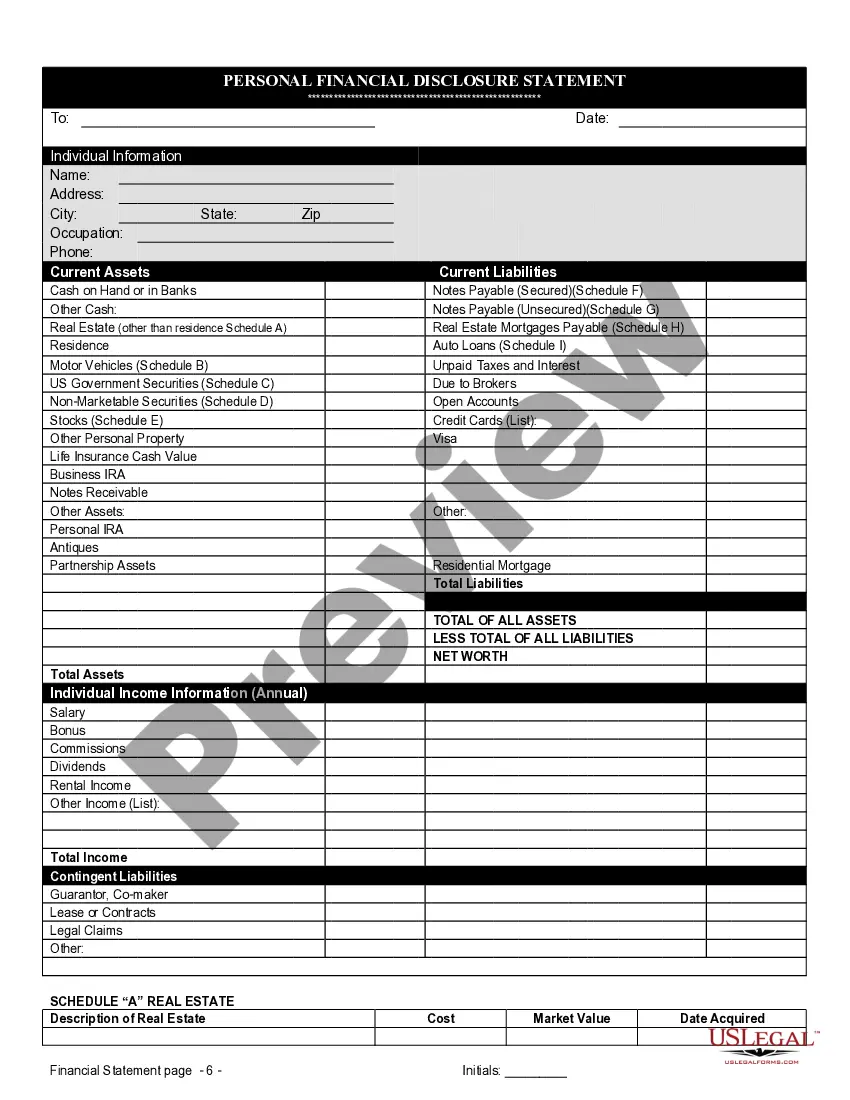

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

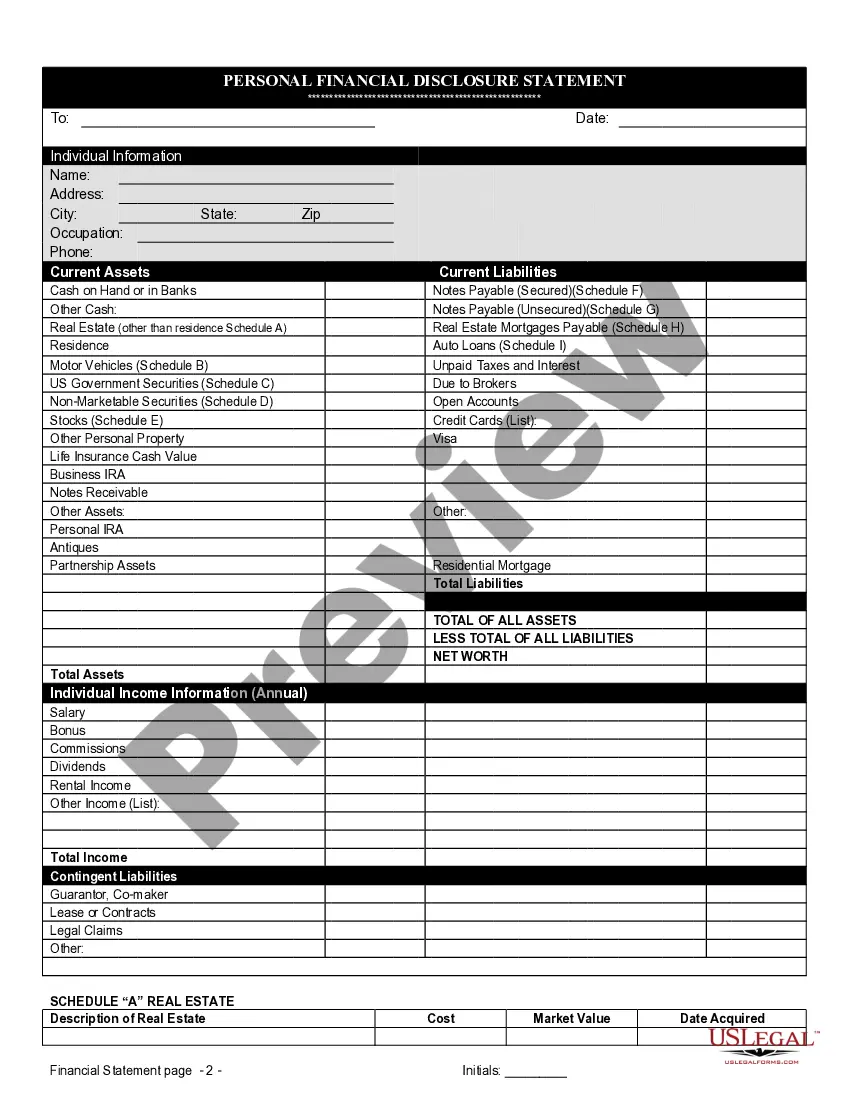

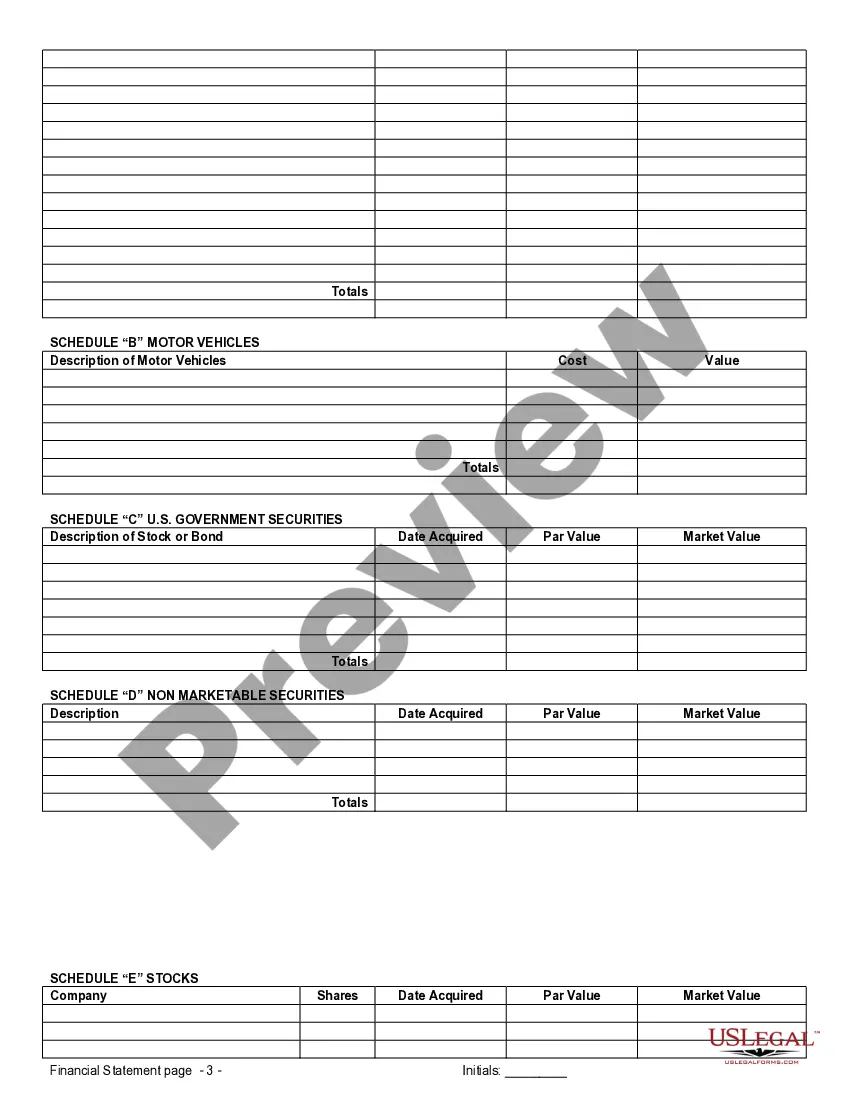

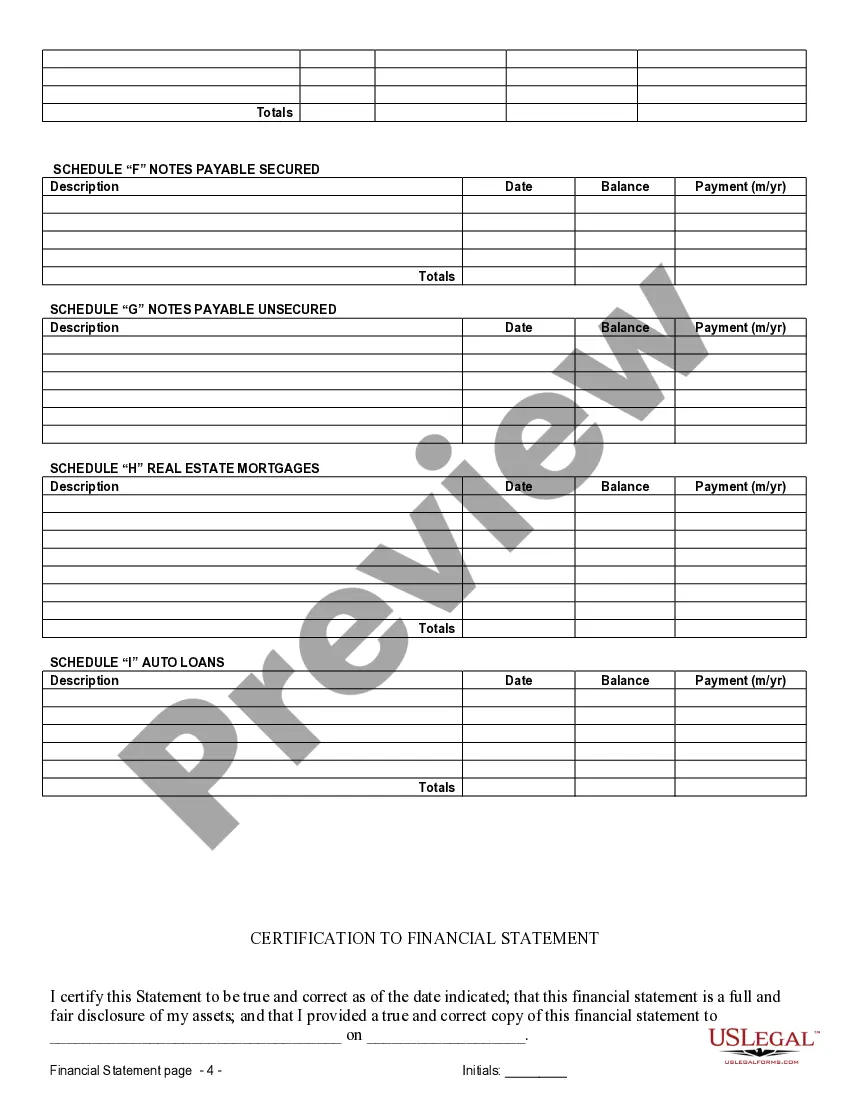

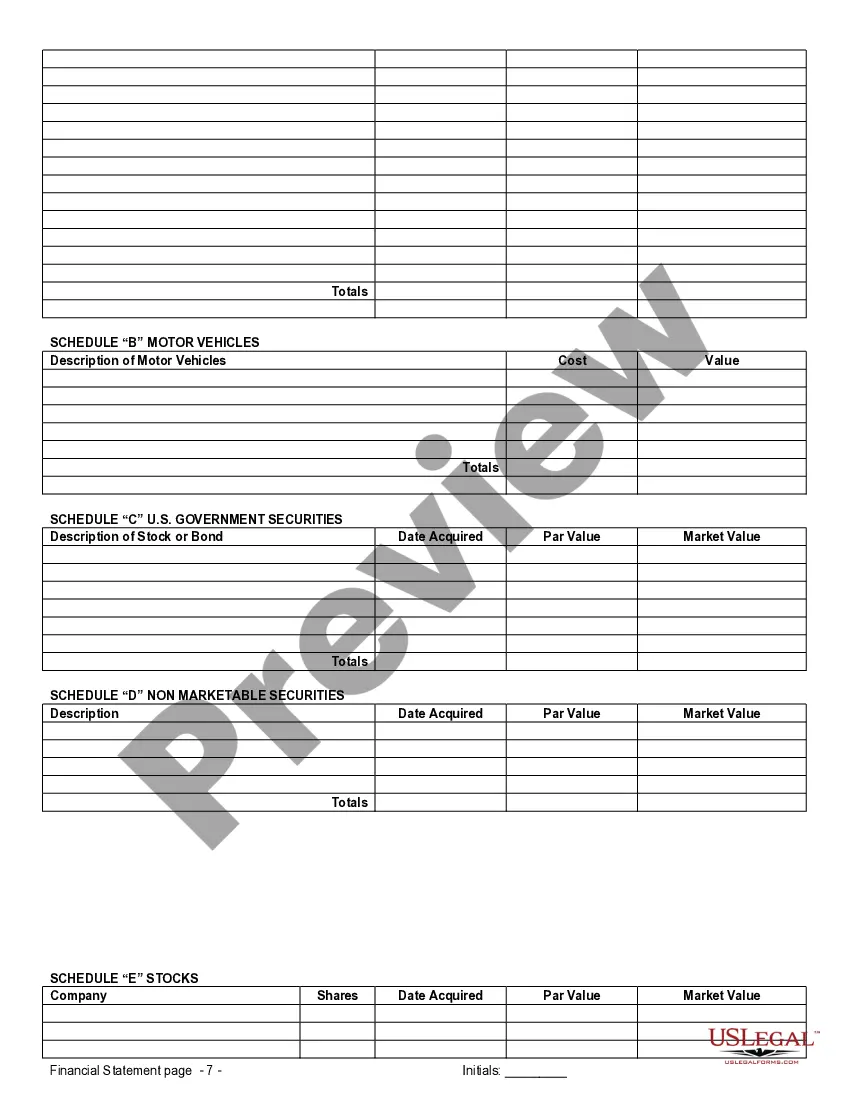

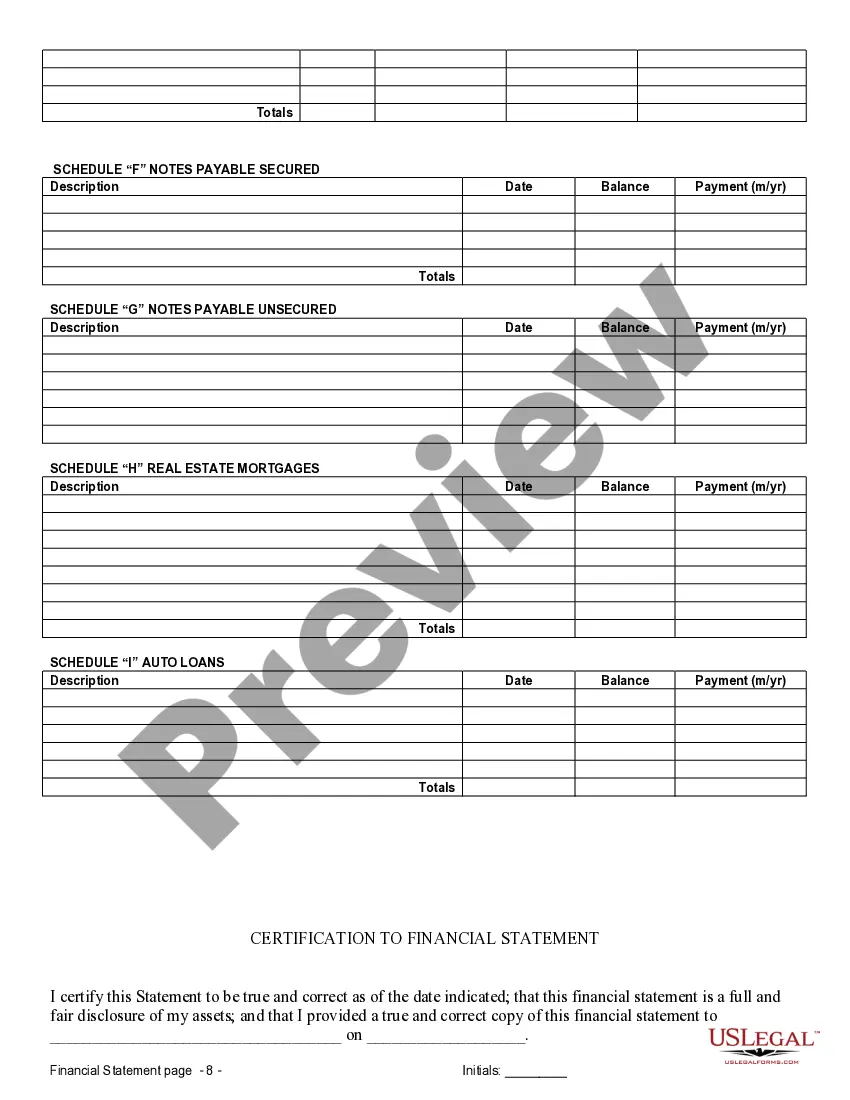

Thornton Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement serve as crucial documents that facilitate the planning and protection of individuals' financial interests when entering into a marriage. These statements are comprehensive overviews of an individual's financial standing and are essential for a transparent understanding and agreement regarding the distribution of assets, debts, and income in case of a divorce or separation. Understanding the importance of Thornton Colorado Financial Statements in Connection with Prenuptial Premarital Agreement is crucial for couples seeking to safeguard their financial rights. The financial statements provide an accurate and organized snapshot of each partner's financial resources, including assets, liabilities, incomes, and expenses. By diligently preparing these statements, couples can establish a solid foundation of trust and transparency before embarking on their marital journey, ensuring the fair division of assets and debts if their relationship doesn't work out as planned. There are several types of Thornton Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement that are necessary to consider, depending on the circumstances: 1. Summary of Assets and Liabilities: This statement outlines all the individual assets and liabilities held by each partner. It includes detailed information about properties, investments, bank accounts, vehicles, and outstanding debts such as mortgages, student loans, and credit card balances. 2. Income and Expense Statements: These statements reveal the income earned by each individual, including salaries, bonuses, dividends, rental incomes, or any other sources of revenue. Additionally, they list the monthly expenses incurred by each partner, covering categories like housing, transportation, utilities, healthcare, and discretionary spending. 3. Business Ownership and Financial Interests: If either partner owns a business or holds significant financial interests in any venture, a detailed statement outlining the nature, value, and ownership percentage of these assets should be included. This section is crucial for ensuring fair distribution or protection of business assets in the event of separation. 4. Retirement and Insurance Accounts: Any retirement plans, pension funds, 401(k) accounts, IRAs, or life insurance policies should be disclosed. These statements will ensure that the value of such accounts is accounted for in the event of a dissolution of marriage. 5. Real Estate Holdings: If either partner owns or has an interest in any real estate properties, detailed documentation regarding these assets should be provided. This includes property valuations, mortgage information, and any legal agreements associated with the properties. 6. Personal Debts and Obligations: A comprehensive outline of any personal debts or obligations, such as outstanding loans, credit card debts, or legal liabilities should be included in the financial statements. This disclosure ensures that both parties have a clear understanding of their partner's financial responsibilities. By gathering and disclosing all relevant financial information within the Thornton Colorado Financial Statements in Connection with Prenuptial Premarital Agreement, couples can protect their individual financial interests while establishing a foundation of trust, transparency, and fair distribution in the event that their marriage ends. It is essential to consult a qualified attorney to ensure that all necessary legal requirements are met and that the financial statements comply with the applicable local laws and regulations in Thornton, Colorado.

Thornton Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement serve as crucial documents that facilitate the planning and protection of individuals' financial interests when entering into a marriage. These statements are comprehensive overviews of an individual's financial standing and are essential for a transparent understanding and agreement regarding the distribution of assets, debts, and income in case of a divorce or separation. Understanding the importance of Thornton Colorado Financial Statements in Connection with Prenuptial Premarital Agreement is crucial for couples seeking to safeguard their financial rights. The financial statements provide an accurate and organized snapshot of each partner's financial resources, including assets, liabilities, incomes, and expenses. By diligently preparing these statements, couples can establish a solid foundation of trust and transparency before embarking on their marital journey, ensuring the fair division of assets and debts if their relationship doesn't work out as planned. There are several types of Thornton Colorado Financial Statements only in Connection with Prenuptial Premarital Agreement that are necessary to consider, depending on the circumstances: 1. Summary of Assets and Liabilities: This statement outlines all the individual assets and liabilities held by each partner. It includes detailed information about properties, investments, bank accounts, vehicles, and outstanding debts such as mortgages, student loans, and credit card balances. 2. Income and Expense Statements: These statements reveal the income earned by each individual, including salaries, bonuses, dividends, rental incomes, or any other sources of revenue. Additionally, they list the monthly expenses incurred by each partner, covering categories like housing, transportation, utilities, healthcare, and discretionary spending. 3. Business Ownership and Financial Interests: If either partner owns a business or holds significant financial interests in any venture, a detailed statement outlining the nature, value, and ownership percentage of these assets should be included. This section is crucial for ensuring fair distribution or protection of business assets in the event of separation. 4. Retirement and Insurance Accounts: Any retirement plans, pension funds, 401(k) accounts, IRAs, or life insurance policies should be disclosed. These statements will ensure that the value of such accounts is accounted for in the event of a dissolution of marriage. 5. Real Estate Holdings: If either partner owns or has an interest in any real estate properties, detailed documentation regarding these assets should be provided. This includes property valuations, mortgage information, and any legal agreements associated with the properties. 6. Personal Debts and Obligations: A comprehensive outline of any personal debts or obligations, such as outstanding loans, credit card debts, or legal liabilities should be included in the financial statements. This disclosure ensures that both parties have a clear understanding of their partner's financial responsibilities. By gathering and disclosing all relevant financial information within the Thornton Colorado Financial Statements in Connection with Prenuptial Premarital Agreement, couples can protect their individual financial interests while establishing a foundation of trust, transparency, and fair distribution in the event that their marriage ends. It is essential to consult a qualified attorney to ensure that all necessary legal requirements are met and that the financial statements comply with the applicable local laws and regulations in Thornton, Colorado.