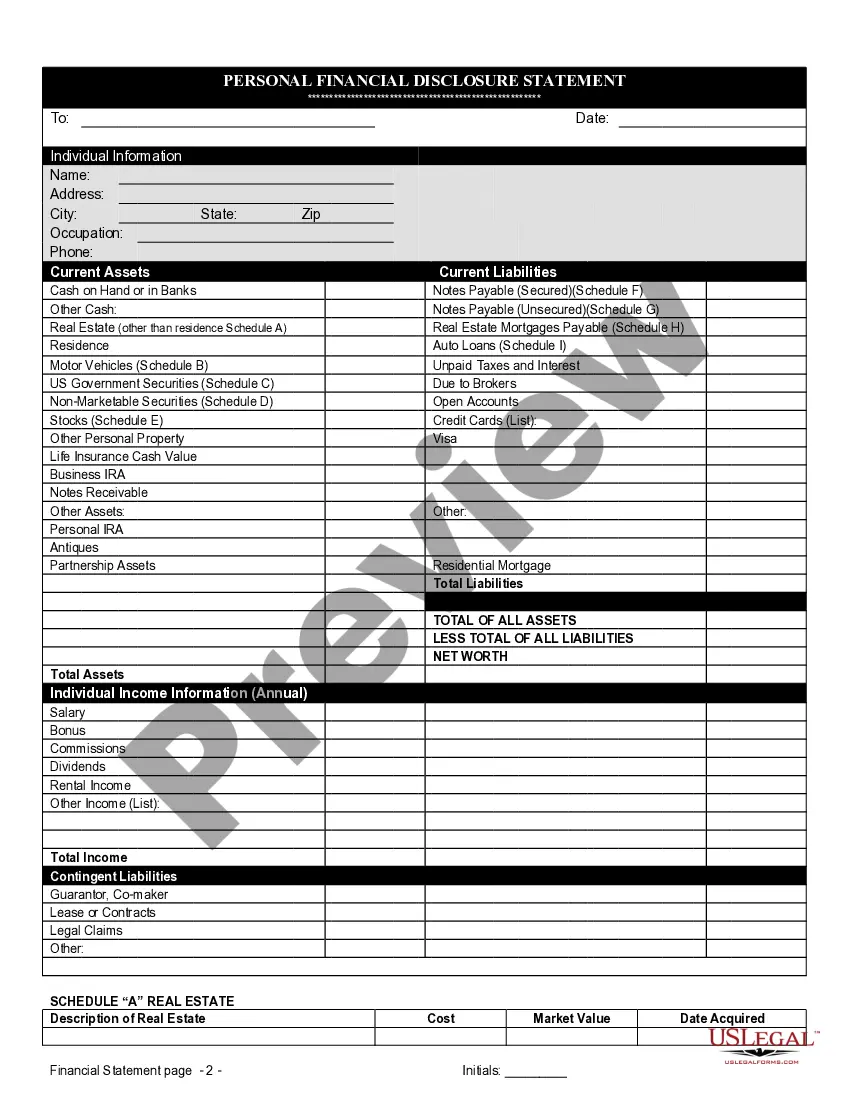

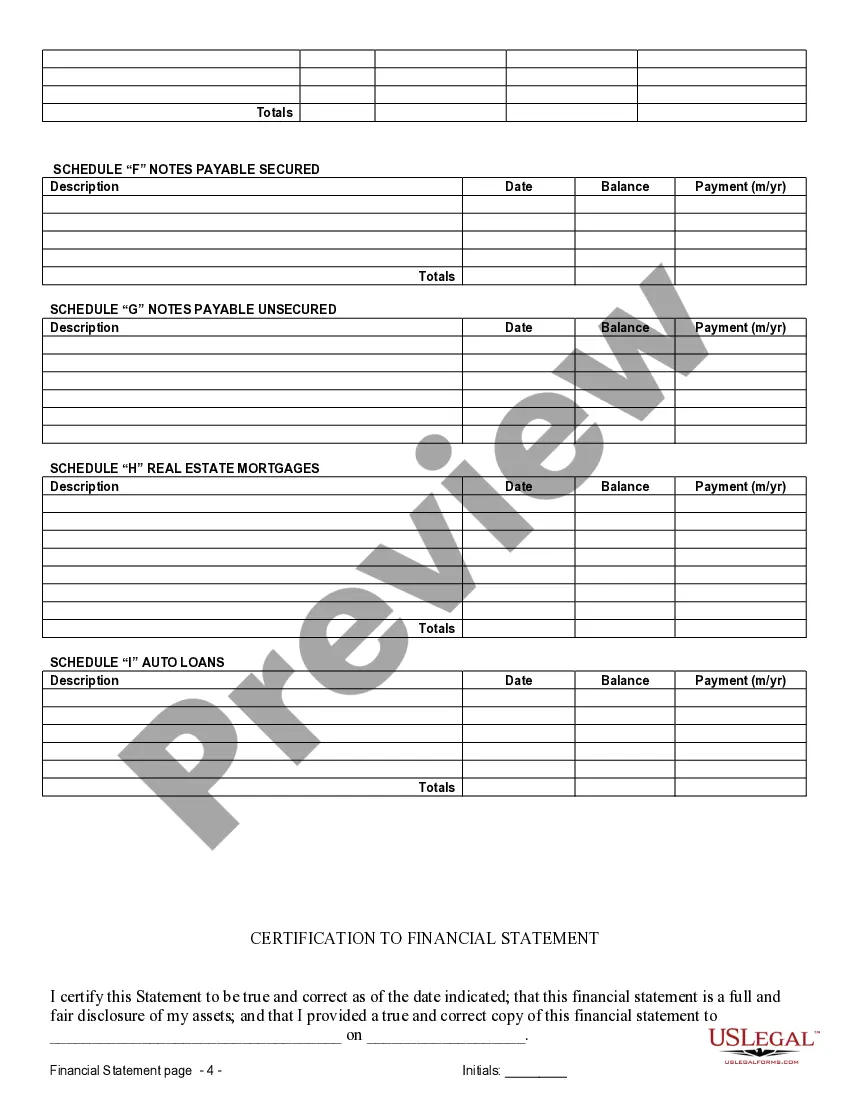

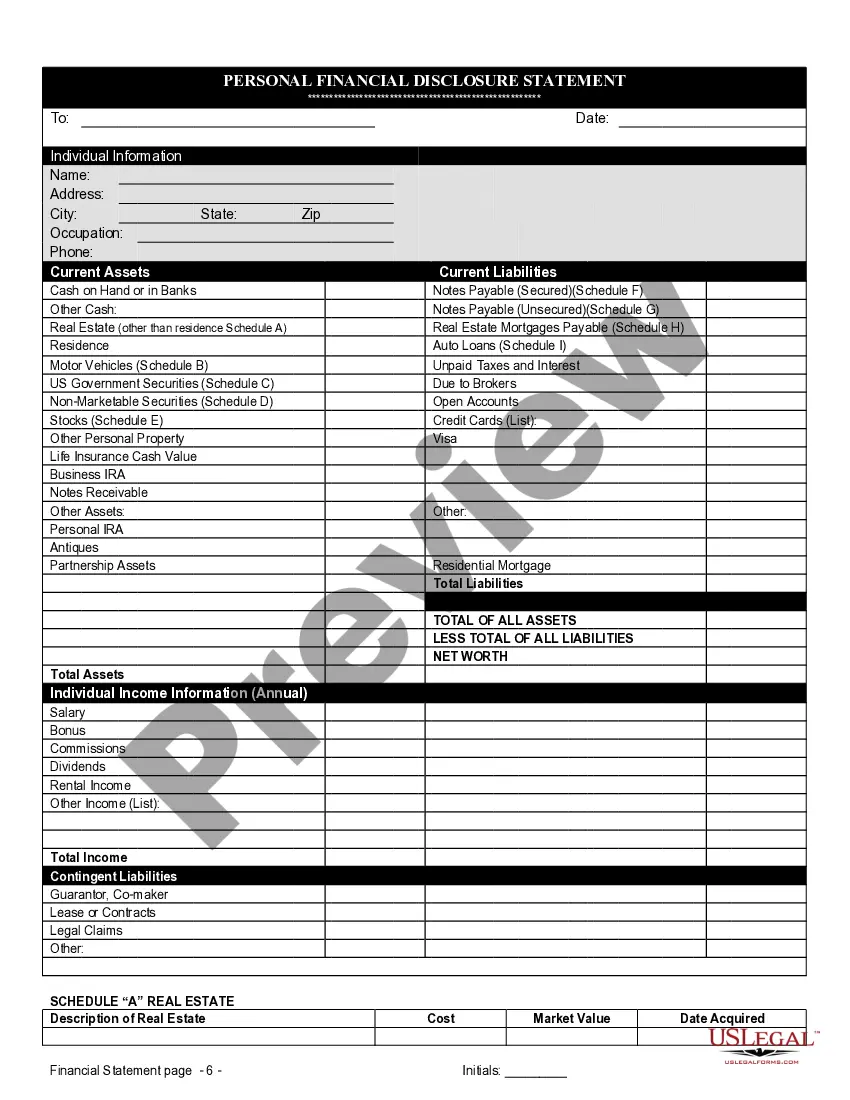

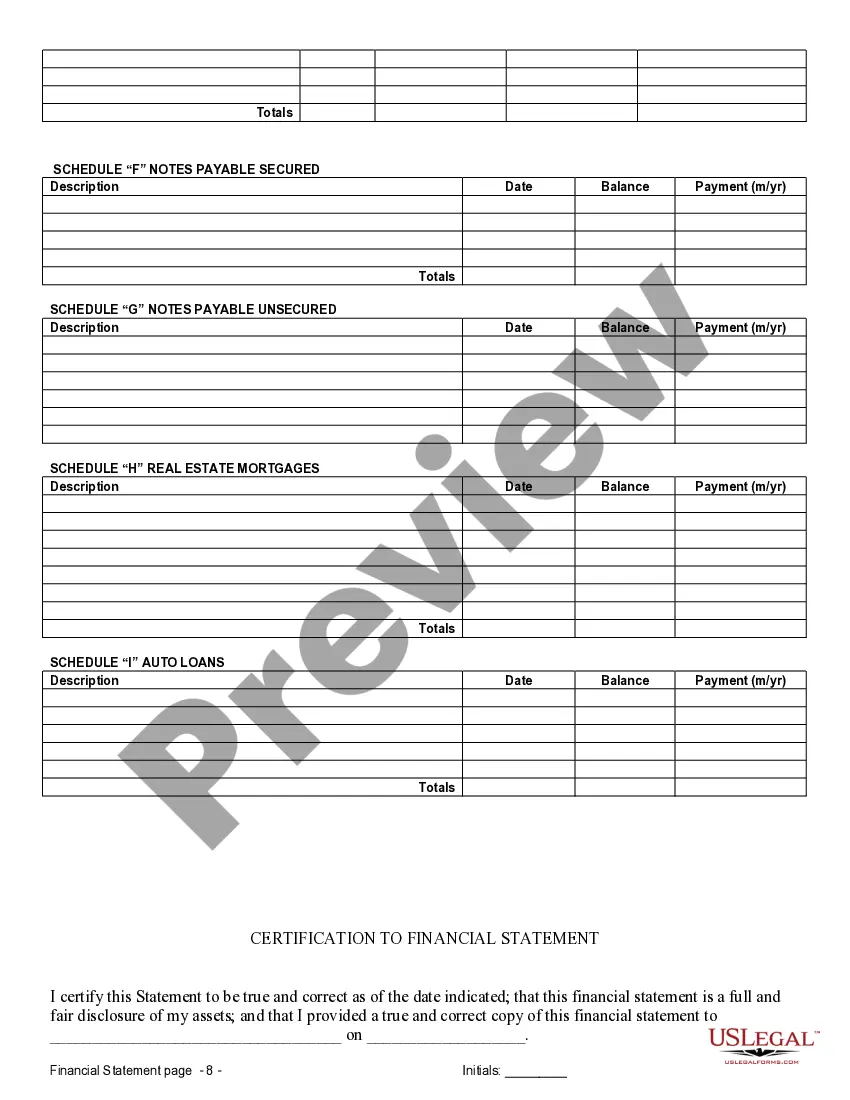

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

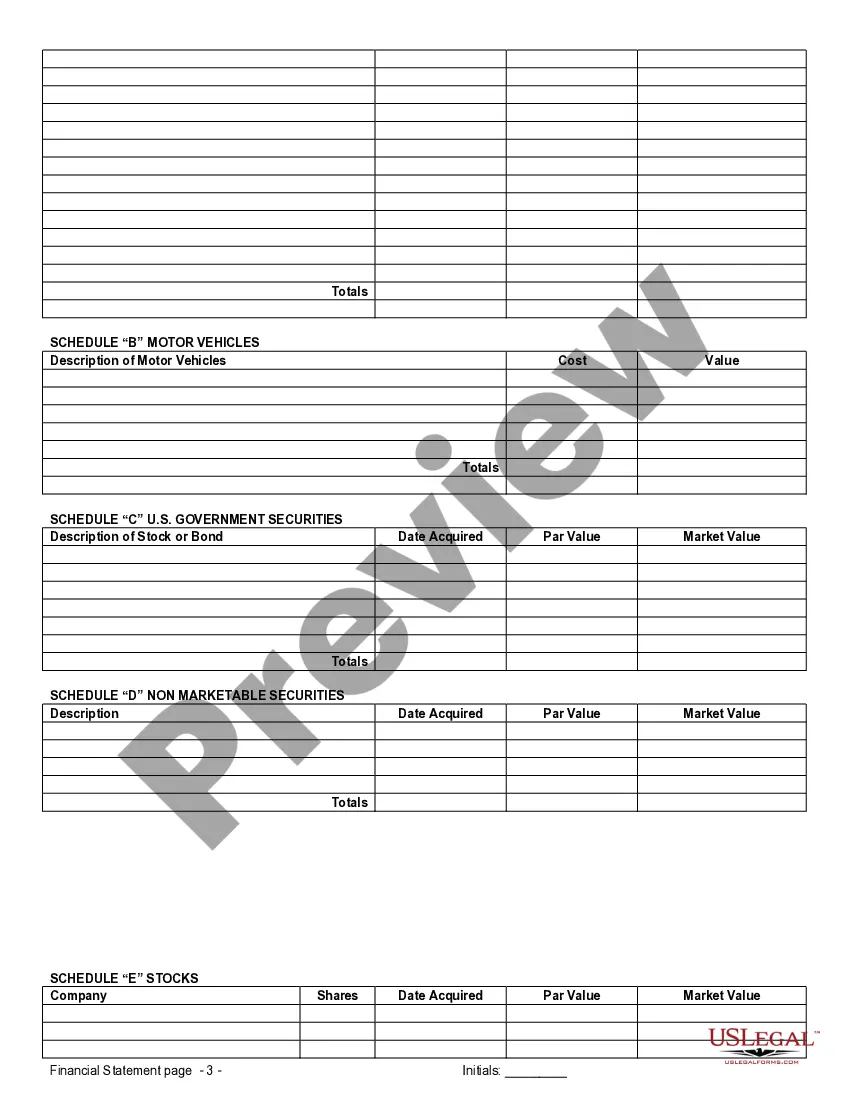

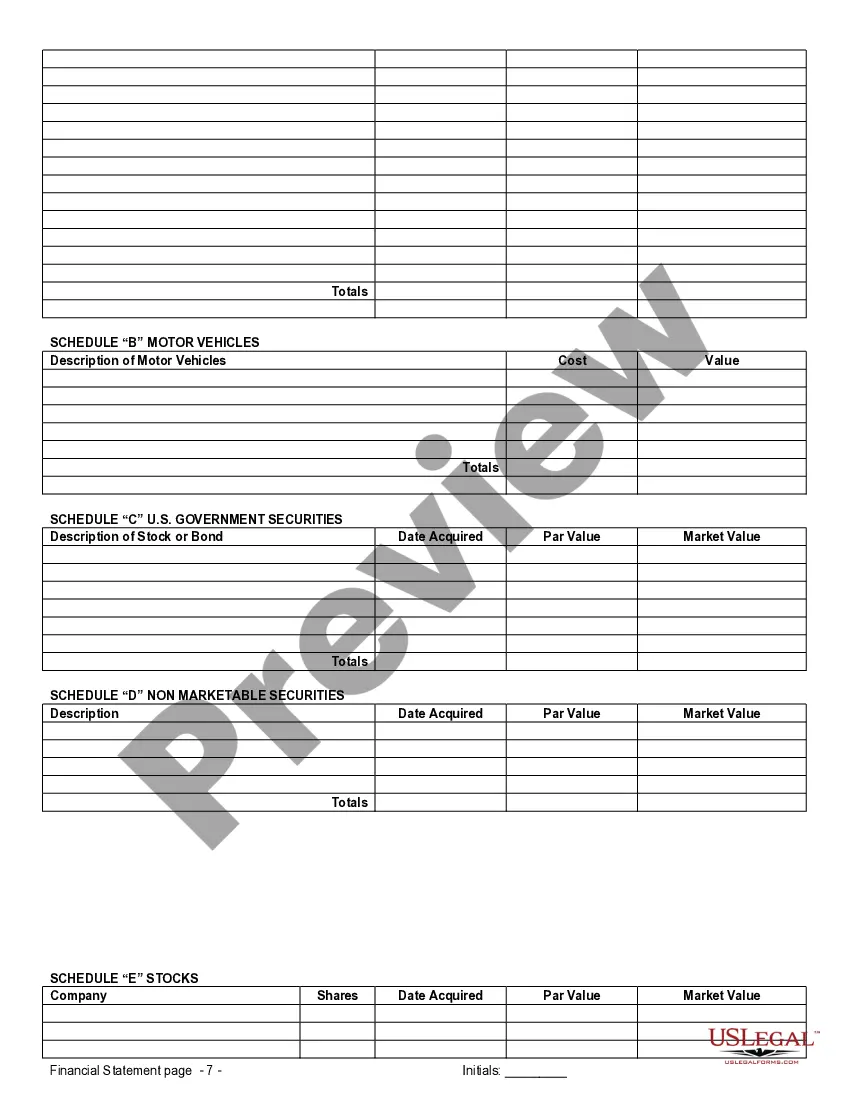

Westminster Colorado Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Westminster, Colorado, it is essential to understand the significance and requirements of financial statements. Financial statements serve as crucial evidence of each spouse's financial standing and help ensure transparency and fairness within the agreement. Key Terms: Westminster Colorado, Financial Statements, Prenuptial Agreement, Premarital Agreement Types of Financial Statements in Connection with Prenuptial Premarital Agreement: 1. Income Statement: The income statement is a document that provides a summary of an individual's income and expenses over a specified period. It includes details such as salary, investments, business profits, and basic living expenses. Having accurate income statements is crucial for determining each spouse's earning capacity and assessing the potential financial impact of the agreement. 2. Bank Statements: Bank statements showcase an individual's financial transactions, displaying their income, expenses, and asset movement. These statements help identify existing assets, liabilities, and any debts, ensuring comprehensive disclosure within the prenuptial agreement. It is crucial to provide recent, complete, and accurate bank statements to ensure fairness and transparency. 3. Tax Returns: Tax returns are vital financial documents that reveal an individual's income, deductions, credits, and tax liabilities. In a prenuptial agreement, tax returns help establish a clear understanding of each spouse's tax obligations, potential refunds, and financial responsibilities. Accurate copies of recent tax returns should be included to ensure fair wealth distribution and effective tax planning. 4. Investment Portfolio Statements: Investment portfolio statements outline an individual's holdings, risks, and returns on various investments such as stocks, bonds, mutual funds, or real estate properties. These statements showcase the value and growth potential of one's assets, providing valuable insights during asset division discussions in a prenuptial agreement. Including comprehensive investment portfolio statements is crucial for a fair distribution of wealth. 5. Real Estate Valuations: Determining the value of real estate properties owned by either spouse is a vital aspect of a prenuptial agreement. Property valuations help assess the financial impact of asset distribution, potential mortgages, and property taxes, ensuring fairness and accuracy. Obtaining professional appraisals or market valuations for real estate properties is vital for creating a valid and comprehensive prenuptial agreement. In conclusion, when drafting a prenuptial or premarital agreement in Westminster, Colorado, it is crucial to include various financial statements to ensure fair, transparent, and informed decision-making. The commonly used financial statements include income statements, bank statements, tax returns, investment portfolio statements, and real estate valuations. These documents provide the necessary information to evaluate each spouse's financial position accurately and facilitate equitable asset division within the agreement.Westminster Colorado Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Westminster, Colorado, it is essential to understand the significance and requirements of financial statements. Financial statements serve as crucial evidence of each spouse's financial standing and help ensure transparency and fairness within the agreement. Key Terms: Westminster Colorado, Financial Statements, Prenuptial Agreement, Premarital Agreement Types of Financial Statements in Connection with Prenuptial Premarital Agreement: 1. Income Statement: The income statement is a document that provides a summary of an individual's income and expenses over a specified period. It includes details such as salary, investments, business profits, and basic living expenses. Having accurate income statements is crucial for determining each spouse's earning capacity and assessing the potential financial impact of the agreement. 2. Bank Statements: Bank statements showcase an individual's financial transactions, displaying their income, expenses, and asset movement. These statements help identify existing assets, liabilities, and any debts, ensuring comprehensive disclosure within the prenuptial agreement. It is crucial to provide recent, complete, and accurate bank statements to ensure fairness and transparency. 3. Tax Returns: Tax returns are vital financial documents that reveal an individual's income, deductions, credits, and tax liabilities. In a prenuptial agreement, tax returns help establish a clear understanding of each spouse's tax obligations, potential refunds, and financial responsibilities. Accurate copies of recent tax returns should be included to ensure fair wealth distribution and effective tax planning. 4. Investment Portfolio Statements: Investment portfolio statements outline an individual's holdings, risks, and returns on various investments such as stocks, bonds, mutual funds, or real estate properties. These statements showcase the value and growth potential of one's assets, providing valuable insights during asset division discussions in a prenuptial agreement. Including comprehensive investment portfolio statements is crucial for a fair distribution of wealth. 5. Real Estate Valuations: Determining the value of real estate properties owned by either spouse is a vital aspect of a prenuptial agreement. Property valuations help assess the financial impact of asset distribution, potential mortgages, and property taxes, ensuring fairness and accuracy. Obtaining professional appraisals or market valuations for real estate properties is vital for creating a valid and comprehensive prenuptial agreement. In conclusion, when drafting a prenuptial or premarital agreement in Westminster, Colorado, it is crucial to include various financial statements to ensure fair, transparent, and informed decision-making. The commonly used financial statements include income statements, bank statements, tax returns, investment portfolio statements, and real estate valuations. These documents provide the necessary information to evaluate each spouse's financial position accurately and facilitate equitable asset division within the agreement.