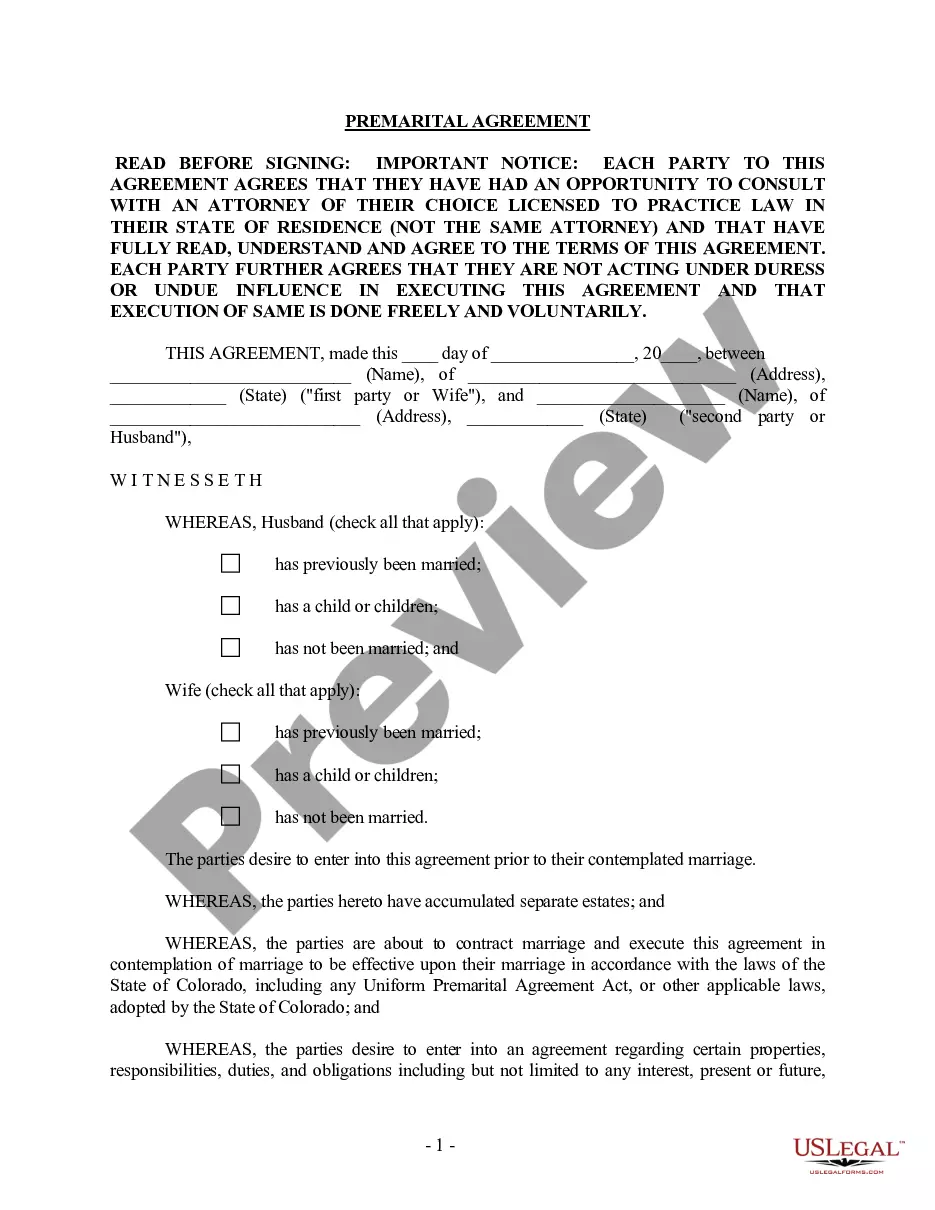

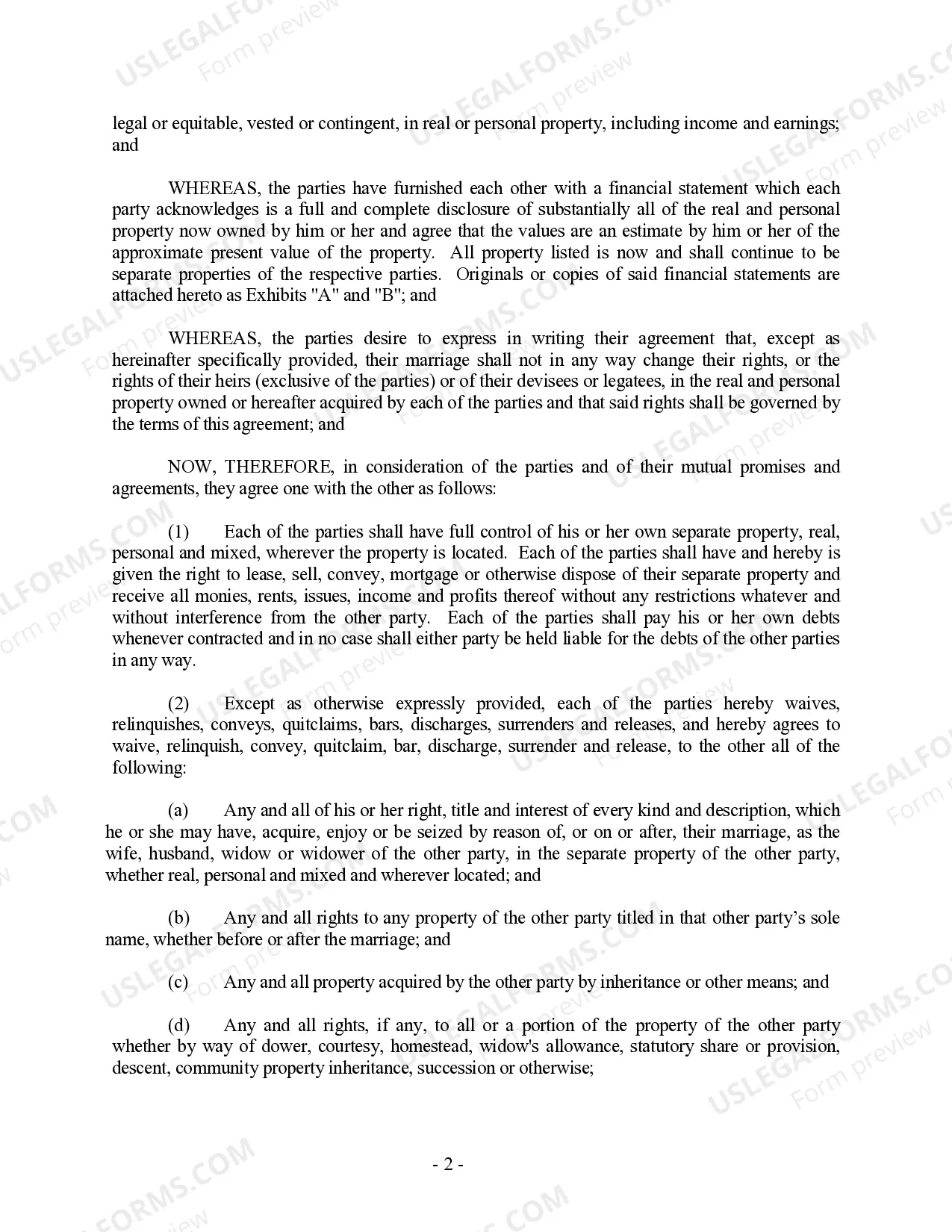

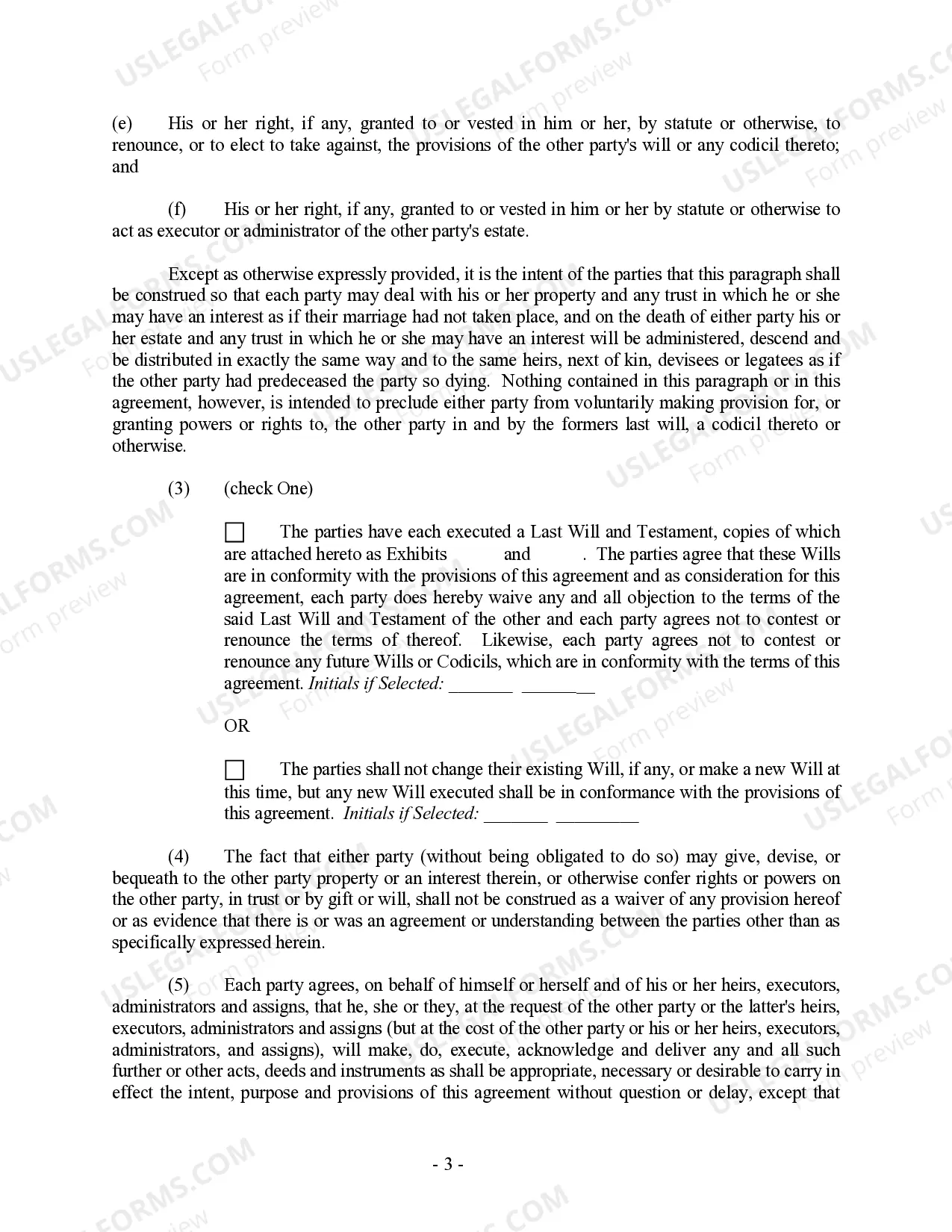

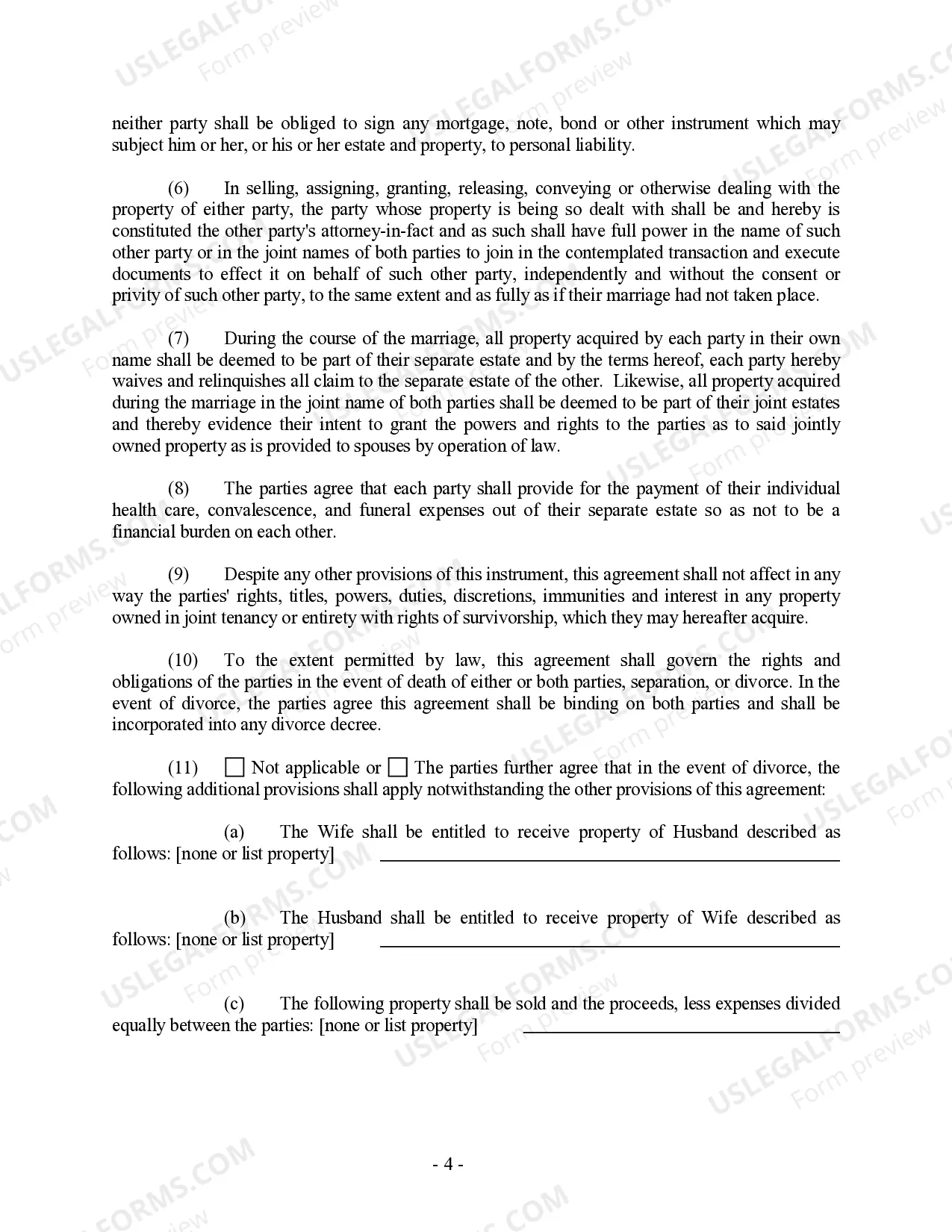

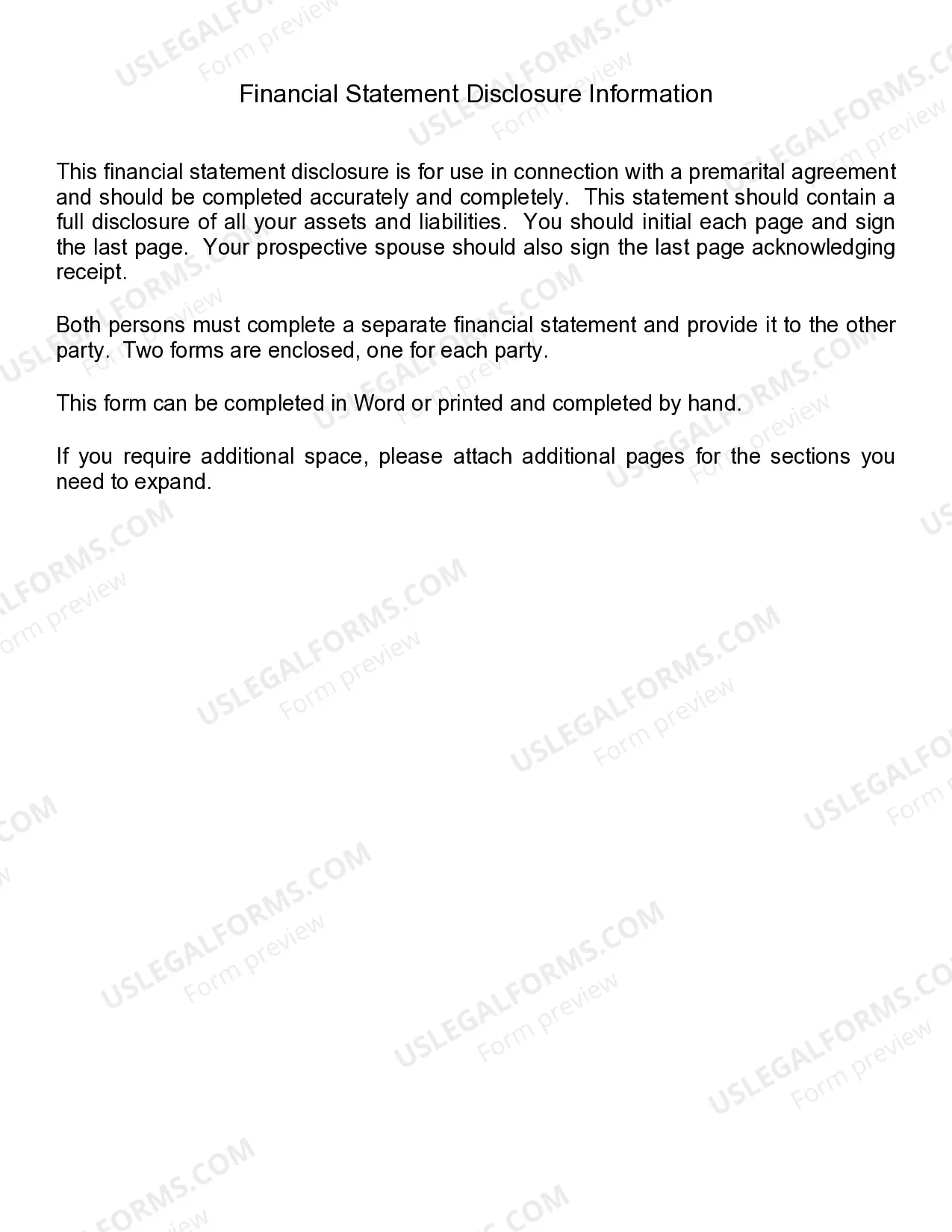

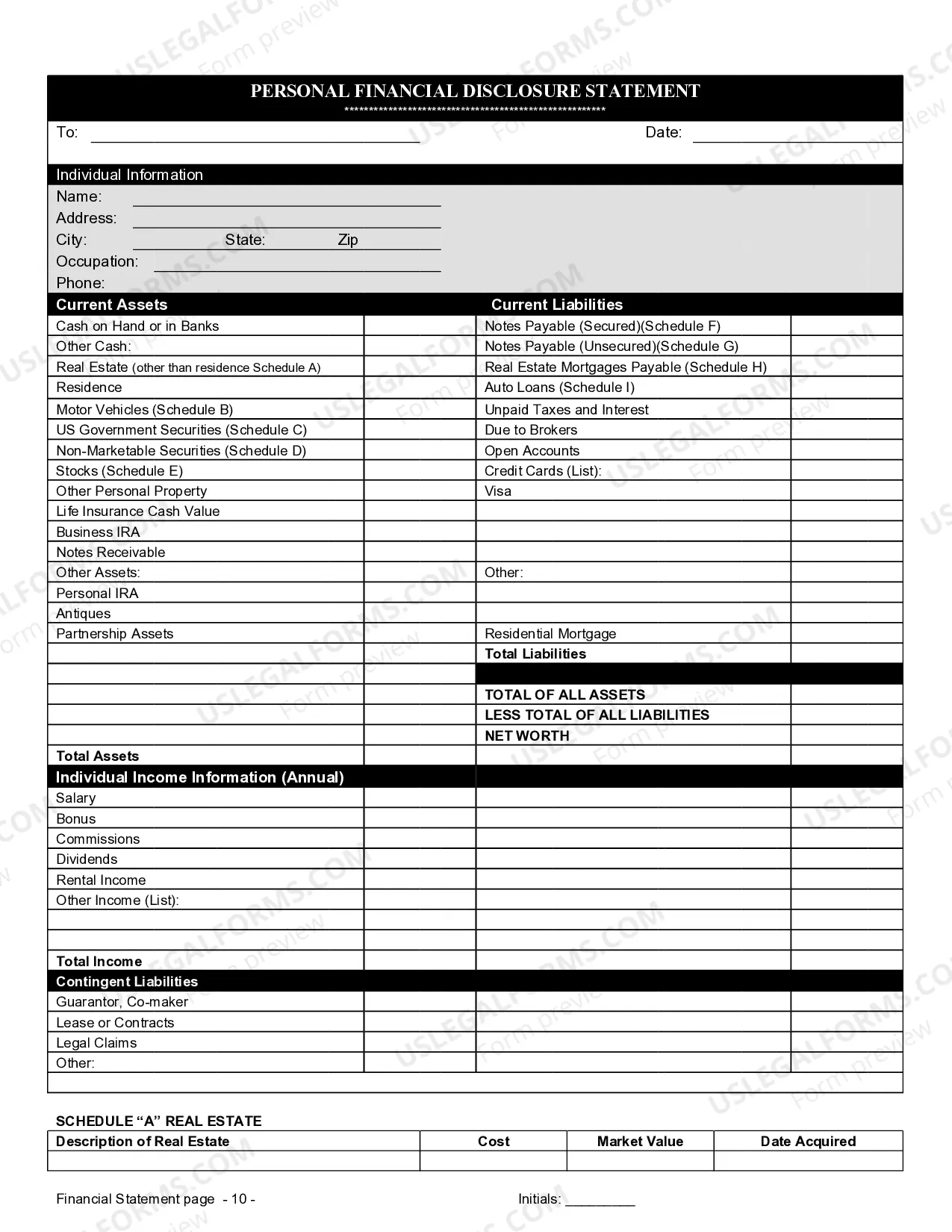

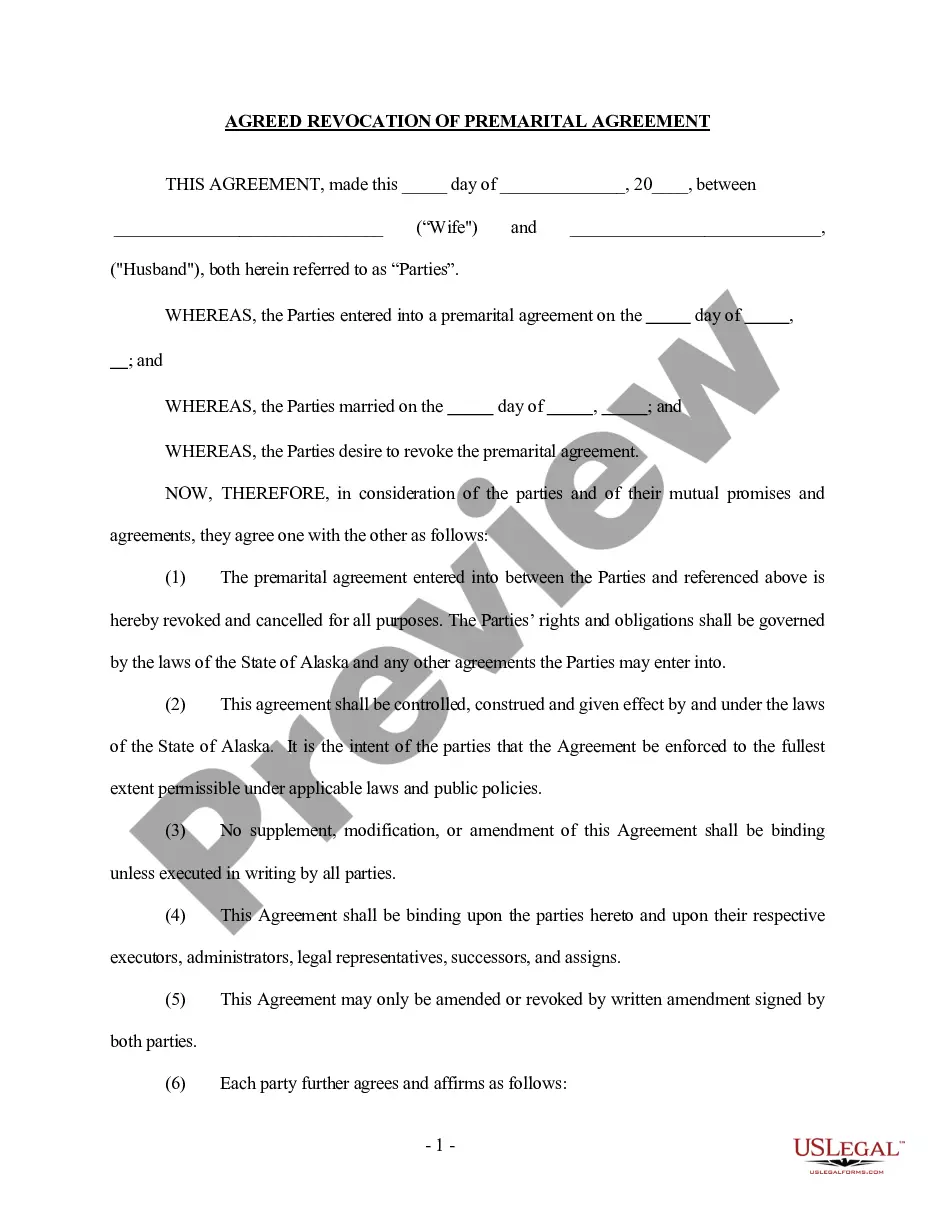

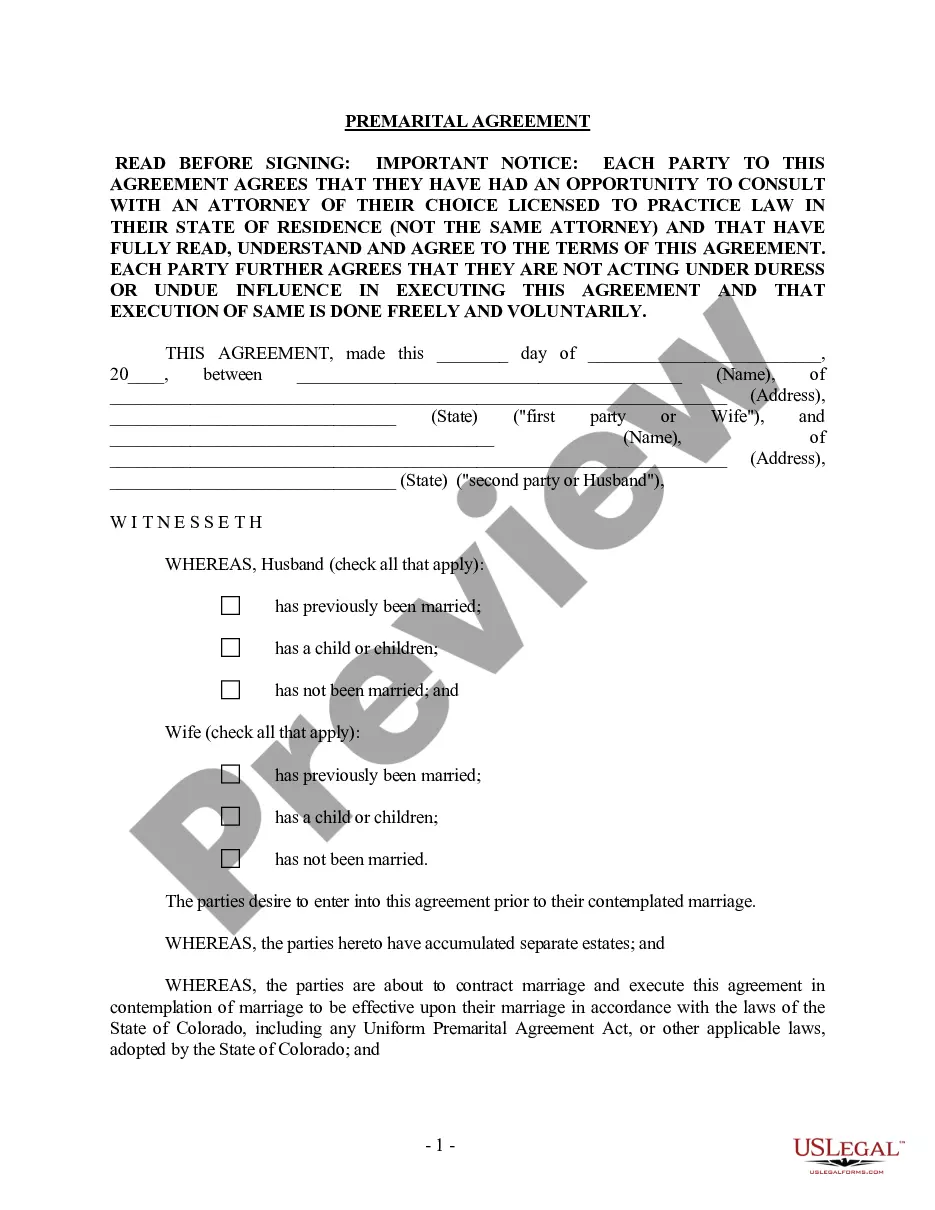

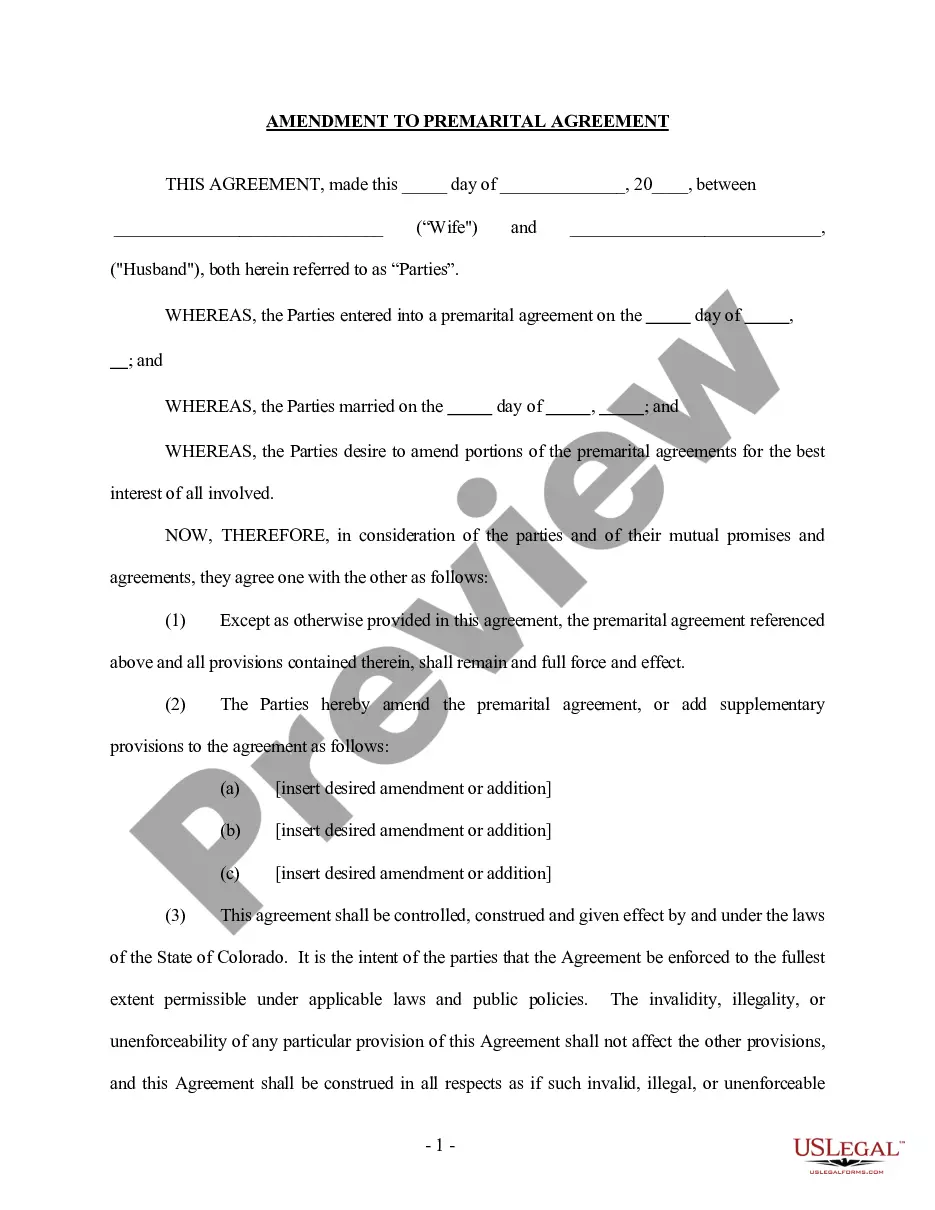

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Colorado Springs Colorado Prenuptial Premarital Agreement with Financial Statements is a legal document designed to protect the financial interests of individuals entering into a marriage or civil partnership in the beautiful city of Colorado Springs, Colorado. This agreement outlines the rights and responsibilities of each partner regarding their assets, debts, and income both during the marriage and in the event of potential divorce or separation. This legally binding contract offers couples the opportunity to establish clear guidelines for asset division, property rights, spousal support, and more, thereby ensuring a mutually agreed-upon financial arrangement that can prevent disputes and conflicts in the future. A Colorado Springs Colorado Prenuptial Premarital Agreement with Financial Statements is particularly valuable for individuals with substantial wealth, business investments, inheritances, or other complex financial situations. There are several types of Colorado Springs Colorado Prenuptial Premarital Agreement with Financial Statements, each designed to cater to various needs and circumstances. These include: 1. Standard Prenuptial Agreement: This type of agreement covers the basics of asset division, debt allocation, and potentially spousal support. It is suitable for couples who want a straightforward financial arrangement without additional provisions. 2. Complex Prenuptial Agreement: This agreement includes more intricate provisions, such as the protection of separate property, defining marital and non-marital assets, establishing specific rules for the management of shared finances, and outlining potential penalties for breaching the agreement. 3. High Net Worth Prenuptial Agreement: Tailored for couples with substantial wealth, this agreement addresses intricate financial matters, tax implications, business interests, complex investments, and potential concerns related to future inheritances or family trusts. 4. Postnuptial Agreement: While not strictly a prenuptial agreement, this legal document serves a similar purpose. It is signed after the marriage has taken place and can be used to establish or modify financial arrangements, address changes in circumstances, or rectify any financial oversights that were not initially addressed. In summary, a Colorado Springs Colorado Prenuptial Premarital Agreement with Financial Statements is an invaluable tool for couples entering into a marriage or civil partnership, allowing them to establish clear financial guidelines and protect their individual interests. With various types of agreements available, individuals can find one that suits their specific needs and circumstances, ensuring a fair and secure financial future.Colorado Springs Colorado Prenuptial Premarital Agreement with Financial Statements is a legal document designed to protect the financial interests of individuals entering into a marriage or civil partnership in the beautiful city of Colorado Springs, Colorado. This agreement outlines the rights and responsibilities of each partner regarding their assets, debts, and income both during the marriage and in the event of potential divorce or separation. This legally binding contract offers couples the opportunity to establish clear guidelines for asset division, property rights, spousal support, and more, thereby ensuring a mutually agreed-upon financial arrangement that can prevent disputes and conflicts in the future. A Colorado Springs Colorado Prenuptial Premarital Agreement with Financial Statements is particularly valuable for individuals with substantial wealth, business investments, inheritances, or other complex financial situations. There are several types of Colorado Springs Colorado Prenuptial Premarital Agreement with Financial Statements, each designed to cater to various needs and circumstances. These include: 1. Standard Prenuptial Agreement: This type of agreement covers the basics of asset division, debt allocation, and potentially spousal support. It is suitable for couples who want a straightforward financial arrangement without additional provisions. 2. Complex Prenuptial Agreement: This agreement includes more intricate provisions, such as the protection of separate property, defining marital and non-marital assets, establishing specific rules for the management of shared finances, and outlining potential penalties for breaching the agreement. 3. High Net Worth Prenuptial Agreement: Tailored for couples with substantial wealth, this agreement addresses intricate financial matters, tax implications, business interests, complex investments, and potential concerns related to future inheritances or family trusts. 4. Postnuptial Agreement: While not strictly a prenuptial agreement, this legal document serves a similar purpose. It is signed after the marriage has taken place and can be used to establish or modify financial arrangements, address changes in circumstances, or rectify any financial oversights that were not initially addressed. In summary, a Colorado Springs Colorado Prenuptial Premarital Agreement with Financial Statements is an invaluable tool for couples entering into a marriage or civil partnership, allowing them to establish clear financial guidelines and protect their individual interests. With various types of agreements available, individuals can find one that suits their specific needs and circumstances, ensuring a fair and secure financial future.