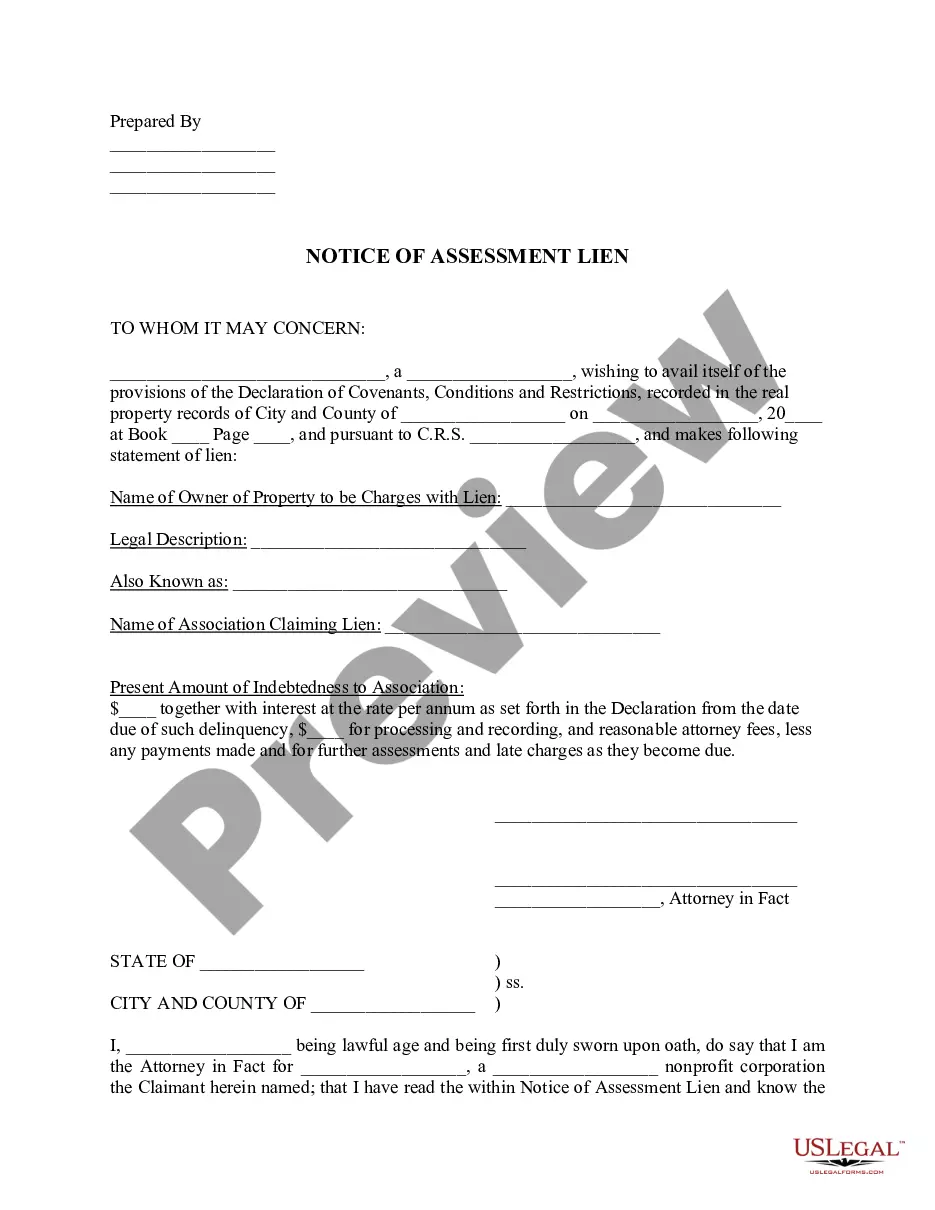

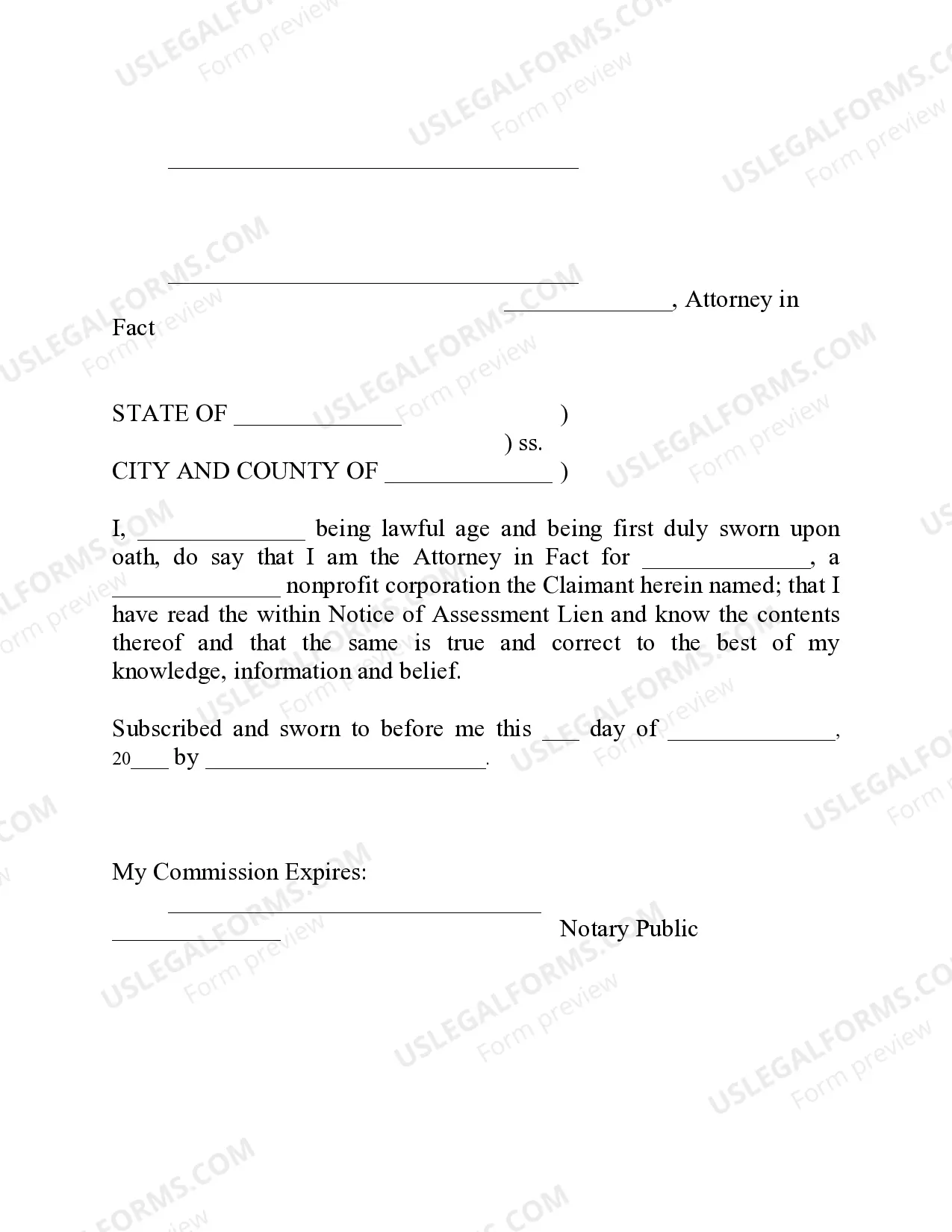

The Thornton Colorado Notice of Assessment of Lien serves as an official document indicating that a lien has been placed on a property or assets in Thornton, Colorado. Lien is generally a legal claim against the property or assets to secure payment of a debt owed. This notice is typically issued by a governmental authority, such as the City of Thornton, to inform property owners of their outstanding debt and the potential consequences if it remains unpaid. Keywords: Thornton Colorado, Notice of Assessment of Lien, property, assets, lien, legal claim, City of Thornton, debt, unpaid, consequences. The City of Thornton issues different types of Notices of Assessment of Lien depending on the specific situation and the nature of the debt. Some of these variations may include: 1. Property Tax Lien: The City of Thornton may impose a lien on a property when the owner fails to pay property taxes. This type of lien ensures that the city collects the owed taxes and can be enforced through various means, including tax foreclosure if the debt remains unresolved. 2. Code Violation Lien: If a property owner in Thornton violates certain city codes, such as building regulations, zoning ordinances, or maintenance standards, the authorities may impose a lien on the property. This lien serves as a mechanism to enforce compliance, and it requires the property owner to rectify the violation or pay the associated penalties. 3. Municipal Utility Lien: In cases where property owners fail to pay their municipal utility bills, such as water or sewer charges, the City of Thornton may place a utility lien on the property. This type of lien enables the city to recover the outstanding balance and may lead to discontinuation of services if the debt remains unresolved. It is important for property owners to receive and review the Thornton Colorado Notice of Assessment of Lien promptly. This notice will typically provide information regarding the amount owed, the nature of the debt, and any actions required to resolve the lien. Ignoring or neglecting this notice can lead to serious consequences, including additional fines, foreclosure, or legal proceedings. Property owners who receive a Notice of Assessment of Lien in Thornton, Colorado should promptly contact the City of Thornton's designated department responsible for lien resolution. By taking immediate action to address the outstanding debt or violation, property owners can mitigate potential consequences and maintain a positive standing with the city. In summary, the Thornton Colorado Notice of Assessment of Lien acts as an official notification from the City of Thornton regarding an imposed lien on a property or assets due to unpaid taxes, code violations, or municipal utility bills. Different types of liens may include property tax liens, code violation liens, and municipal utility liens. Property owners must address these notices promptly to avoid further penalties or legal consequences.

Thornton Colorado Notice of Assessment of Lien

Description

How to fill out Thornton Colorado Notice Of Assessment Of Lien?

Finding authenticated templates pertinent to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents catering to both personal and professional requirements for various real-world scenarios.

All the paperwork is accurately categorized by usage area and jurisdiction, making the retrieval of the Thornton Colorado Notice of Assessment of Lien as straightforward as 1-2-3.

By maintaining your documentation organized and compliant with legal standards, you'll find it advantageous. Leverage the US Legal Forms library to consistently have vital document templates available at your fingertips!

- Ensure to review the Preview mode and form description.

- Verify you've selected the appropriate one that aligns with your requirements and entirely meets your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the accurate one. If it fits your needs, proceed to the subsequent step.

- Purchase the document.

Form popularity

FAQ

To file a notice of intent to lien in Colorado, you must prepare the notice with specific information, including the description of the property and details of the debt. Afterward, submit this notice to the county clerk and recorder's office in the county where the property is located. For assistance, you can use USLegalForms, which offers resources tailored to ensure your Thornton Colorado Notice of Assessment of Lien is properly filed.

Writing a letter of intent to lien involves stating your intent clearly and including key details such as the property address, a description of work performed, and the amount due. Be concise and formal in your approach, detailing the expectation for payment. If you're unsure about the format, USLegalForms provides templates that can help you draft an effective Thornton Colorado Notice of Assessment of Lien.

You can determine if a lien has been filed on your property by searching public records at your local county clerk's office. Many jurisdictions also offer online databases that provide access to these records. If you're particularly concerned about a Thornton Colorado Notice of Assessment of Lien, these resources will help you promptly identify any existing liens.

To file a lien with intent in Colorado, you must complete the appropriate forms and submit them to the county clerk and recorder's office. Ensure that you include all required details such as the property description and the amount owed. USLegalForms can guide you through the process, ensuring your Thornton Colorado Notice of Assessment of Lien is filed correctly and effectively.

To find a lien on a property in Colorado, you can start by searching the county clerk and recorder's office where the property is located. Many counties provide online databases that allow easy access to public records. If you're looking for information related to a Thornton Colorado Notice of Assessment of Lien, using these online tools can streamline your search.

In Colorado, you typically have to file your intent to lien within 120 days after the last date you performed work or supplied materials. This timeframe is crucial to protect your rights as a contractor or supplier. To ensure compliance, consider using resources like USLegalForms to understand the specific requirements related to the Thornton Colorado Notice of Assessment of Lien.

In Colorado, you must file a lien within six months of the last work performed or the dates specified in your contract. This timeframe ensures that you can secure your interest in the property. If you miss this deadline, you may lose your right to the lien. For more accuracy and guidance, a Thornton Colorado Notice of Assessment of Lien can assist you in staying compliant with filing timelines.

To file a lien in Adams County, Colorado, you need to gather the necessary documents, including property details and the reason for the lien. You will file these documents with the Adams County Clerk and Recorder’s office. Utilizing a Thornton Colorado Notice of Assessment of Lien can help you navigate this filing process effectively, ensuring that all requirements are fulfilled.

The assessed value in Adams County, Colorado, represents the value assigned to a property for tax purposes, typically calculated based on a percentage of the property's market value. This value is crucial for property taxes and liens, as outlined in the Thornton Colorado Notice of Assessment of Lien. For more information on how this value impacts you, consider consulting resources available on the uslegalforms platform.

Tax liens in Colorado can remain valid for a period of 10 years from the date they are recorded. However, this timeframe may extend if the tax owed is not settled. Knowing this duration can help you manage your finances effectively, especially when reviewing the Thornton Colorado Notice of Assessment of Lien.