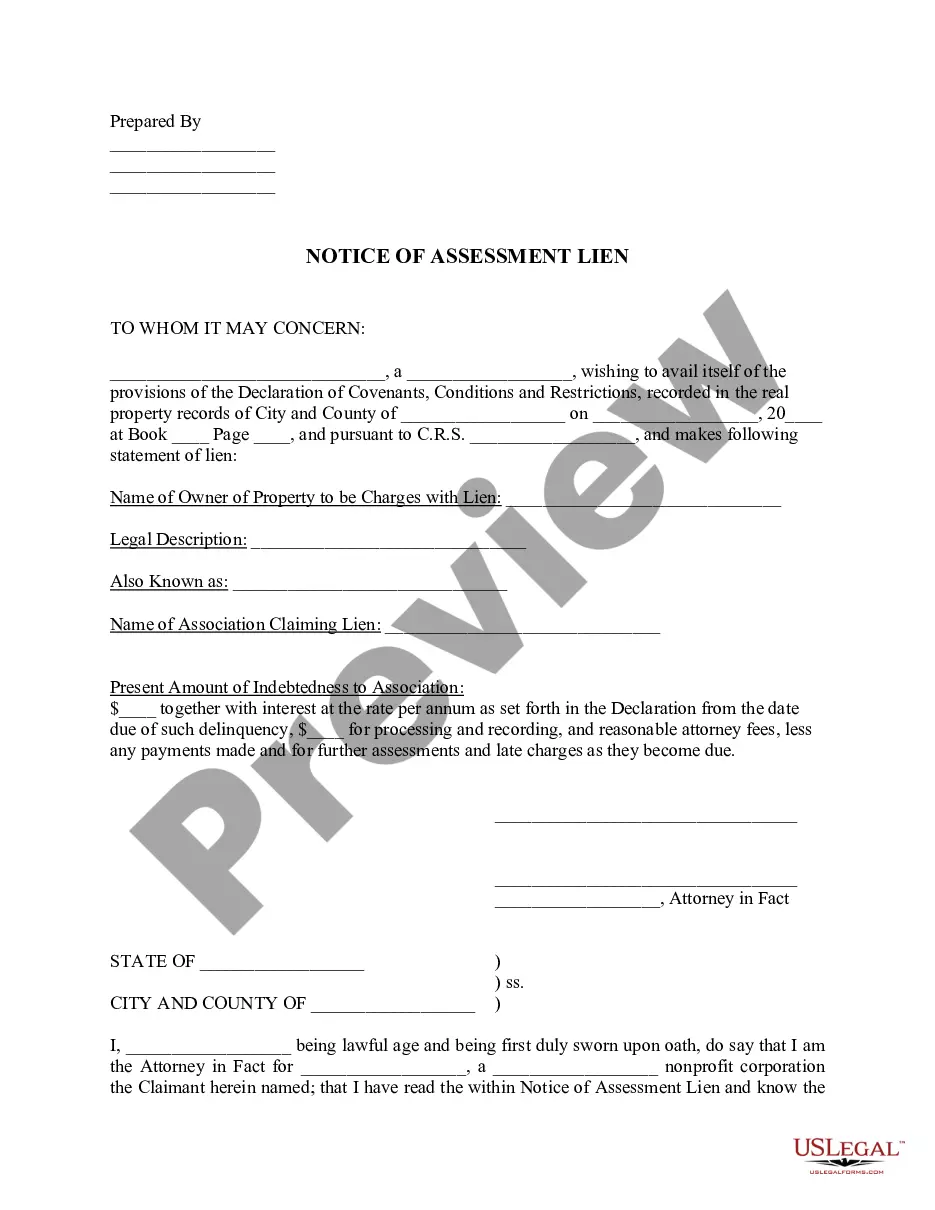

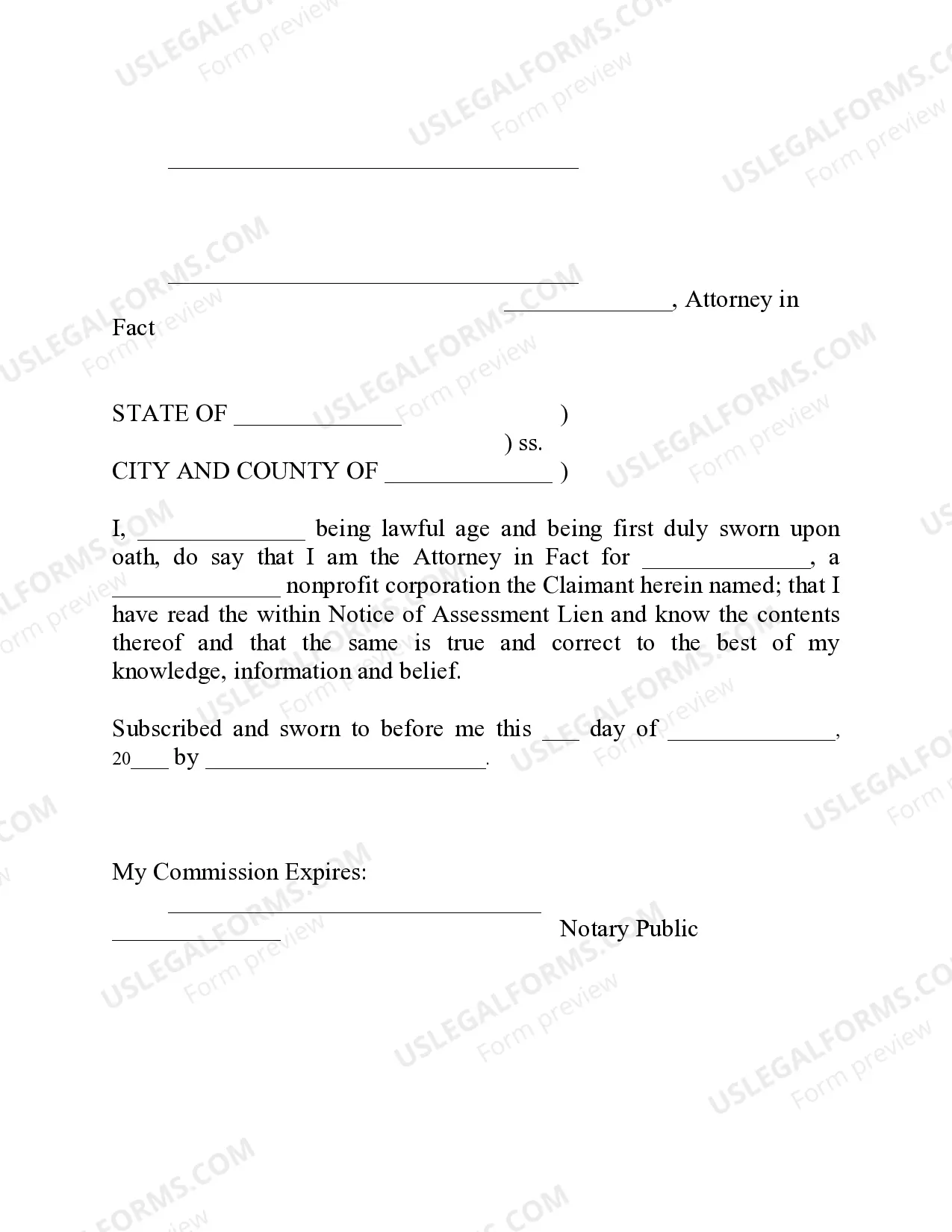

The Westminster Colorado Notice of Assessment of Lien is an important document that property owners in Westminster, Colorado should be familiar with. This notice is issued by the county assessor's office and serves as a formal communication regarding a lien on a property located within Westminster. Lien assessments are typically conducted when there are outstanding taxes or other debts owed by the property owner to the county. The Westminster Colorado Notice of Assessment of Lien contains essential information that property owners need to understand. It includes details about the property in question such as the address, legal description, and ownership details. Additionally, the notice provides a breakdown of the assessed lien amount, the reason for the lien, and the date by which the payment needs to be made to avoid further consequences. It's important to note that there may be different types of Westminster Colorado Notice of Assessment of Lien. These variations could include different reasons for the lien, such as unpaid property taxes, delinquent special assessments, or outstanding fees related to road improvements, sewer infrastructure, or other public services. Each type of lien may have different consequences and may require specific actions to resolve. Receiving a Westminster Colorado Notice of Assessment of Lien can be a concerning situation for property owners. Ignoring or failing to address the notice can result in increased penalties, further legal actions, or even potential foreclosure. Therefore, it is crucial for property owners to carefully review the notice, understand the reason for the lien, and promptly take the necessary steps to address it. To resolve a Westminster Colorado Notice of Assessment of Lien, property owners can contact the county assessor's office or the relevant department mentioned in the notice for more information. They may find it useful to seek legal advice or consult a tax professional who specializes in property liens to navigate the process effectively. It is important to act promptly and communicate with the appropriate authorities to establish a payment plan or address any disputes related to the lien assessment. By doing so, property owners can protect their property rights and prevent further financial and legal complications. In summary, the Westminster Colorado Notice of Assessment of Lien is a formal communication from the county assessor's office regarding a lien on a property located in Westminster, Colorado. Property owners must carefully review this notice, understand the reason for the lien, and take appropriate actions to resolve it. Different types of liens may exist, including those related to unpaid property taxes, delinquent special assessments, or outstanding fees. Promptly addressing the notice and seeking assistance from professionals can ensure a smoother resolution of the lien assessment process.

Westminster Colorado Notice of Assessment of Lien

Description

How to fill out Westminster Colorado Notice Of Assessment Of Lien?

If you’ve already used our service before, log in to your account and save the Westminster Colorado Notice of Assessment of Lien on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Westminster Colorado Notice of Assessment of Lien. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!

Form popularity

FAQ

Finding tax liens in Colorado can be done by visiting the local tax assessor’s office or their website. Many counties provide user-friendly tools to search for tax lien records. It’s important to stay vigilant about your tax-related obligations, as a Westminster Colorado Notice of Assessment of Lien could indicate unpaid taxes or fees.

To see if your company has a lien, you should access the public records from the county where your business operates. Checking the county clerk and recorder's office either online or in person can reveal any filed liens. Regularly reviewing this information can help you manage potential risks. Remember, if you receive a Westminster Colorado Notice of Assessment of Lien, it indicates a formal claim on your business assets.

To look up liens on a business, you can search through public records at the local county clerk’s office. Many states now offer online databases where you can check the status of a company for any liens filed against it. It's essential to stay informed, especially with potential impacts on credit and business operations. The Westminster Colorado Notice of Assessment of Lien is an example of how liens are documented in Colorado.

In Colorado, checking for liens involves accessing the public records maintained by the county clerk and recorder’s office. Most counties in Colorado provide online databases where you can search property records for any active liens. Utilize these resources to gather information effectively, and consider the Westminster Colorado Notice of Assessment of Lien for context about local lien regulations.

To look up tax liens in North Carolina, you can start by checking the county tax office's website. Many counties offer online access to lien records and property tax information. If you prefer a direct approach, visiting the county clerk’s office can provide you with detailed records. Remember, the Westminster Colorado Notice of Assessment of Lien may differ from North Carolina processes, but knowing where to look is key.

The new property tax law in Colorado aims to increase transparency and provide more affordable property taxes for residents. It includes provisions for assessment procedures and potential reductions for qualifying homeowners. The Westminster Colorado Notice of Assessment of Lien will reflect any changes in tax assessments introduced by this new legislation, helping you stay updated.

Property taxes can remain unpaid for up to three years before a tax lien is issued. If the taxes continue to be unpaid, the county may eventually foreclose on the property. The Westminster Colorado Notice of Assessment of Lien is essential in keeping property owners informed about their tax obligations and the timeline for payments.

Tax lien investing can come with certain risks, such as the potential for unexpected costs associated with tax foreclosures. Additionally, the investment may not yield high returns if properties do not sell quickly. A thorough understanding of the Westminster Colorado Notice of Assessment of Lien can provide insights into the financial health of properties you might consider for investment.

Property owners in Colorado can technically go for several years without paying taxes before facing foreclosure. However, this period can vary based on local regulations and procedures. The Westminster Colorado Notice of Assessment of Lien indicates your tax payment status, highlighting how soon you should act to avoid complications.

In Colorado, tax liens can last for seven years from the date they are recorded. If the taxes remain unpaid, the county may eventually move towards foreclosure. You can check the Westminster Colorado Notice of Assessment of Lien for an official record of your property’s status and the duration of any existing liens.