A limited partnership is a modified partnership and is a creature of State statutes. Limited Partnerships must have at least one general partner and one limited partner. Limited partners in a limited partnership are protected from personal liability for the debts and liabilities of the limited partnership. The only amount they can lose is their investment. There is an exception, however, which would impose liability on a limited partner. If the limited partner is actively involved in the management of the limited partnership (in other words, acting as a general partner), the limited partner will expose his/her personal assets for the debts and liabilities of the limited partnership.

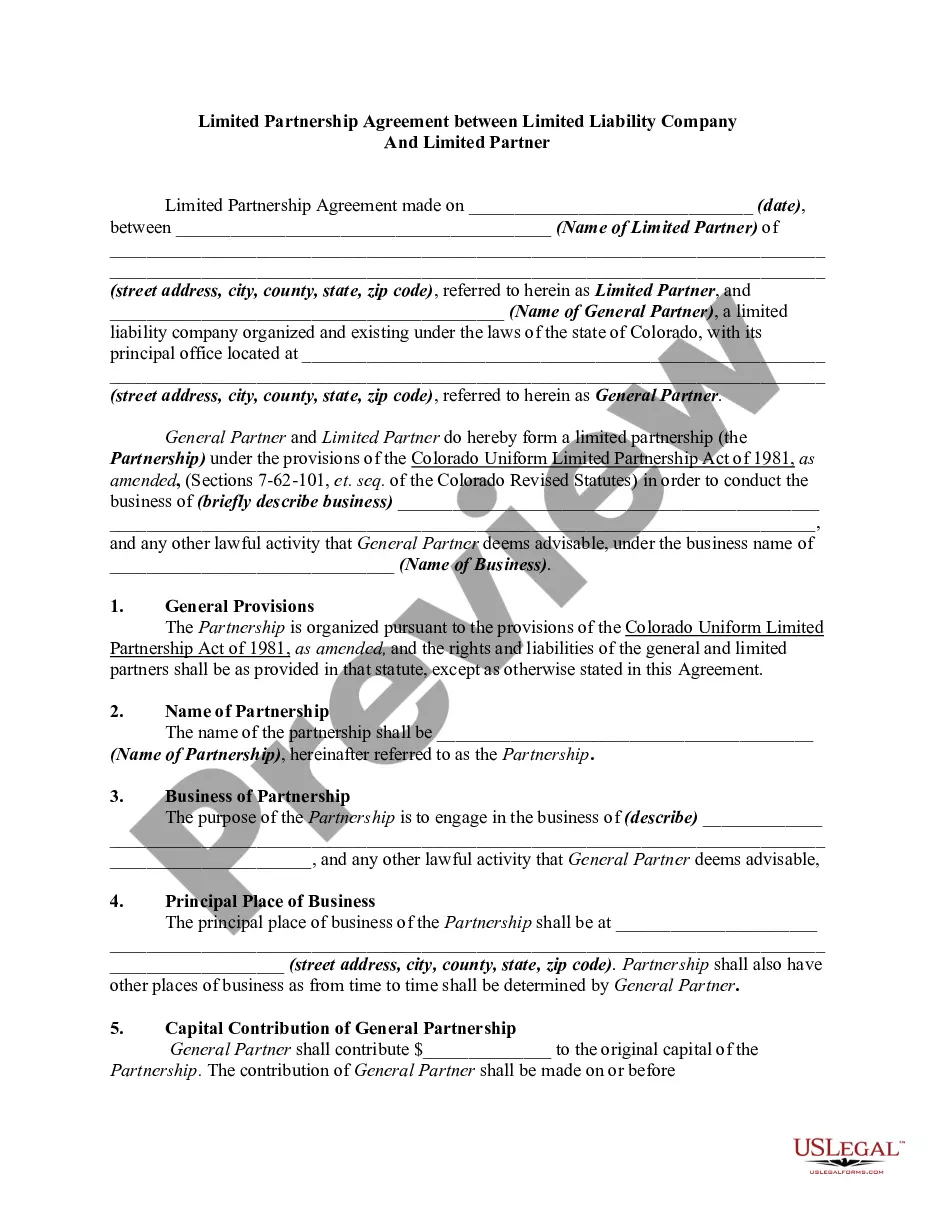

A limited partnership is formed in Colorado by filing a Certificate of Limited Partnership with the Department of State, naming the general partner and providing an address for the general partner. Typically, the partners also enter into a written partnership agreement.

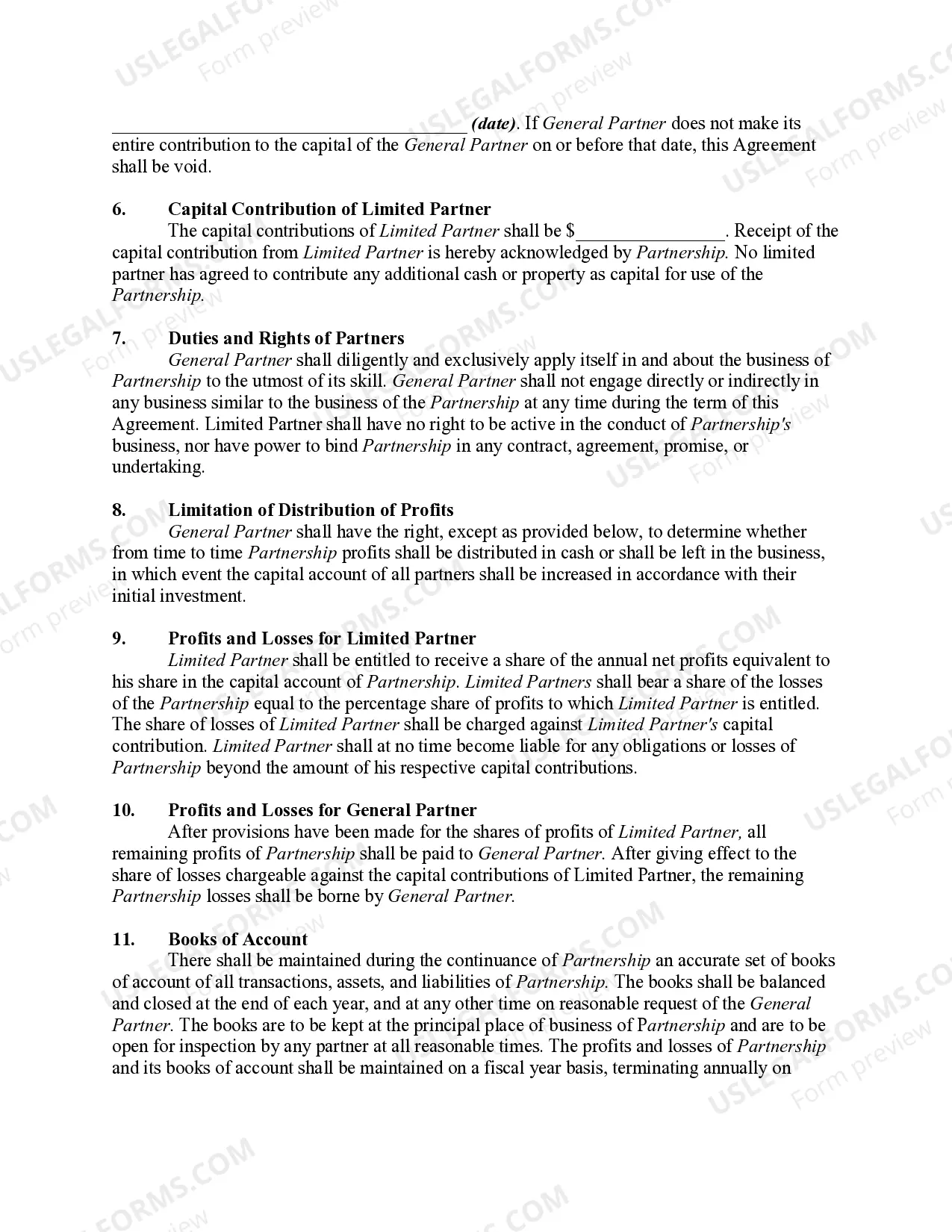

Centennial Colorado Limited Partnership Agreement Between Limited Liability Company and Limited Partner is a legally binding document that outlines the arrangement and agreement between a limited liability company (LLC) and a limited partner in Centennial, Colorado. This agreement governs the rights, responsibilities, and obligations of each party involved. The Centennial Colorado Limited Partnership Agreement establishes the partnership structure, clarifies the roles of the LLC and the limited partner, and ensures the smooth operation of the business. It is crucial for all parties to understand the content of the agreement before entering into a partnership. The agreement specifies the nature of the partnership, whether it is a general partnership or a limited partnership. In a general partnership, all partners have equal rights and responsibilities in managing the business and sharing the profits and losses. Conversely, in a limited partnership, the limited partner's liability and involvement in the business are limited, while the LLC assumes more managerial control and unlimited liability. Key provisions in the Centennial Colorado Limited Partnership Agreement include the capital contribution required from the limited partner, profit distribution percentages, and the terms for admitting new partners or withdrawing from the partnership. It may also cover the allocation of management responsibilities and decision-making authority. The agreement should address potential disputes and procedures for resolving them, such as through mediation or arbitration. It is essential to include a clause that outlines the dissolution process in case the partnership is no longer viable or if one of the parties wishes to terminate it. Furthermore, the Centennial Colorado Limited Partnership Agreement may include specific provisions regarding tax implications, reporting requirements, and compliance with local, state, and federal regulations. In summary, the Centennial Colorado Limited Partnership Agreement Between Limited Liability Company and Limited Partner delineates the relationship between a limited liability company and a limited partner, ensuring clarity and fairness in the partnership. This agreement serves as a foundational document to establish the rights, obligations, profit-sharing, and decision-making mechanisms for both parties involved. Different types of Centennial Colorado Limited Partnership Agreements may exist to accommodate various business needs or situations. These may include agreements for real estate partnerships, investment partnerships, joint venture partnerships, or professional service partnerships. Each agreement may have slight variations depending on the specific industry or purpose of the partnership.Centennial Colorado Limited Partnership Agreement Between Limited Liability Company and Limited Partner is a legally binding document that outlines the arrangement and agreement between a limited liability company (LLC) and a limited partner in Centennial, Colorado. This agreement governs the rights, responsibilities, and obligations of each party involved. The Centennial Colorado Limited Partnership Agreement establishes the partnership structure, clarifies the roles of the LLC and the limited partner, and ensures the smooth operation of the business. It is crucial for all parties to understand the content of the agreement before entering into a partnership. The agreement specifies the nature of the partnership, whether it is a general partnership or a limited partnership. In a general partnership, all partners have equal rights and responsibilities in managing the business and sharing the profits and losses. Conversely, in a limited partnership, the limited partner's liability and involvement in the business are limited, while the LLC assumes more managerial control and unlimited liability. Key provisions in the Centennial Colorado Limited Partnership Agreement include the capital contribution required from the limited partner, profit distribution percentages, and the terms for admitting new partners or withdrawing from the partnership. It may also cover the allocation of management responsibilities and decision-making authority. The agreement should address potential disputes and procedures for resolving them, such as through mediation or arbitration. It is essential to include a clause that outlines the dissolution process in case the partnership is no longer viable or if one of the parties wishes to terminate it. Furthermore, the Centennial Colorado Limited Partnership Agreement may include specific provisions regarding tax implications, reporting requirements, and compliance with local, state, and federal regulations. In summary, the Centennial Colorado Limited Partnership Agreement Between Limited Liability Company and Limited Partner delineates the relationship between a limited liability company and a limited partner, ensuring clarity and fairness in the partnership. This agreement serves as a foundational document to establish the rights, obligations, profit-sharing, and decision-making mechanisms for both parties involved. Different types of Centennial Colorado Limited Partnership Agreements may exist to accommodate various business needs or situations. These may include agreements for real estate partnerships, investment partnerships, joint venture partnerships, or professional service partnerships. Each agreement may have slight variations depending on the specific industry or purpose of the partnership.