A limited partnership is a modified partnership and is a creature of State statutes. Limited Partnerships must have at least one general partner and one limited partner. Limited partners in a limited partnership are protected from personal liability for the debts and liabilities of the limited partnership. The only amount they can lose is their investment. There is an exception, however, which would impose liability on a limited partner. If the limited partner is actively involved in the management of the limited partnership (in other words, acting as a general partner), the limited partner will expose his/her personal assets for the debts and liabilities of the limited partnership.

A limited partnership is formed in Colorado by filing a Certificate of Limited Partnership with the Department of State, naming the general partner and providing an address for the general partner. Typically, the partners also enter into a written partnership agreement.

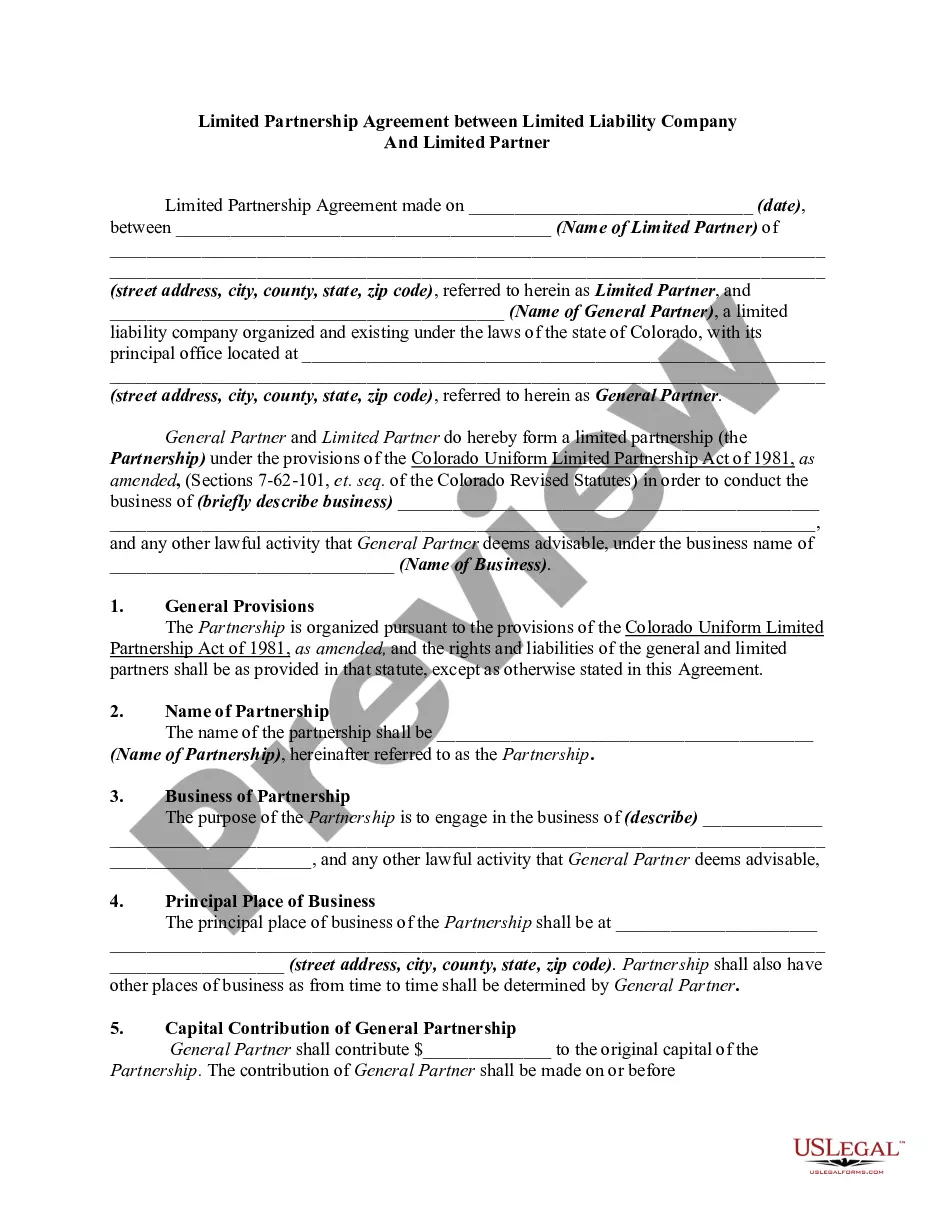

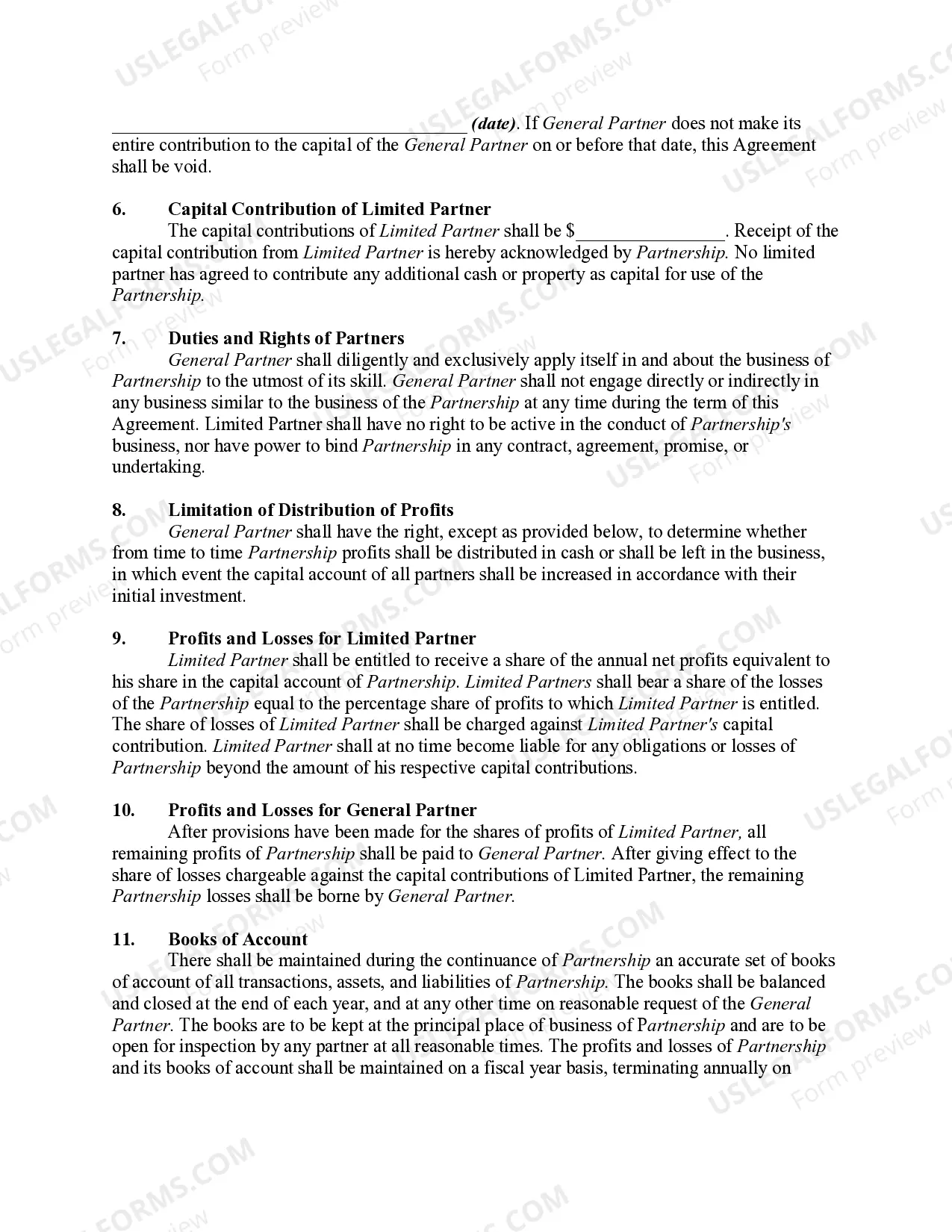

Title: Understanding the Lakewood Colorado Limited Partnership Agreement Between a Limited Liability Company and Limited Partner Introduction: The Lakewood Colorado Limited Partnership Agreement forms the foundation for collaboration between a Limited Liability Company (LLC) and a Limited Partner, outlining their respective rights, responsibilities, and obligations. This comprehensive legal document ensures clarity and protects the interests of all involved parties. This article will provide a detailed description of this agreement, highlighting its essential components and implications. Key Elements of the Lakewood Colorado Limited Partnership Agreement: 1. Identification: The agreement begins by clearly identifying the LLC and the Limited Partner. This includes their legal names, addresses, and other pertinent information. 2. Capital Contributions: The agreement specifies the capital contributions expected from each party. The LLC may be required to contribute both cash and non-cash assets, while the Limited Partner typically provides capital in the form of cash, property, or other valuable assets. 3. Profit and Loss Distribution: Details regarding the distribution of profits and losses among the LLC and the Limited Partner are mentioned. The partnership agreement may dictate the specific proportions or percentages to be used for this distribution. 4. Management Authority: This section delineates the rights and responsibilities of each party concerning the management and day-to-day operations of the partnership. In most cases, the LLC acts as the general partner, holding decision-making authority, while the Limited Partner assumes a more passive role. 5. Limited Liability Protection: The agreement outlines the limited liability protection enjoyed by the Limited Partner, safeguarding them from personal liability beyond their investment. 6. Dissolution Procedures: In case the partnership needs to be dissolved, the agreement should clarify the process, including the steps to be followed and the distribution of remaining assets. 7. Taxation Considerations: The agreement should address any tax implications for both the LLC and the Limited Partner, including the allocation of tax liabilities and reporting requirements. Types of Lakewood Colorado Limited Partnership Agreements: 1. Limited Partnership Agreement for Real Estate Investments: This agreement focuses specifically on partnerships formed for real estate investment endeavors in Lakewood, Colorado. It may include provisions related to property acquisition, management, and profit distribution. 2. Limited Partnership Agreement for Business Ventures: This type of agreement is tailored to partnerships formed for various business ventures in Lakewood, Colorado. It may cover aspects such as company management, investment contributions, and decision-making authority. 3. Limited Partnership Agreement for Capital Ventures: This agreement caters to partnerships established for capital-intensive projects, such as infrastructure development or large-scale construction projects in Lakewood, Colorado. It may contain provisions related to funding, project milestones, and profit sharing. Conclusion: In Lakewood, Colorado, the Limited Partnership Agreement between an LLC and a Limited Partner serves as a crucial legal documentation outlining the terms and conditions of their partnership. Understanding the intricacies of this agreement is essential for all parties involved to ensure a harmonious and mutually beneficial business relationship. Depending on the nature of the partnership, specific variations of the agreement might be needed, such as those focusing on real estate investments, business ventures, or capital-intensive projects.Title: Understanding the Lakewood Colorado Limited Partnership Agreement Between a Limited Liability Company and Limited Partner Introduction: The Lakewood Colorado Limited Partnership Agreement forms the foundation for collaboration between a Limited Liability Company (LLC) and a Limited Partner, outlining their respective rights, responsibilities, and obligations. This comprehensive legal document ensures clarity and protects the interests of all involved parties. This article will provide a detailed description of this agreement, highlighting its essential components and implications. Key Elements of the Lakewood Colorado Limited Partnership Agreement: 1. Identification: The agreement begins by clearly identifying the LLC and the Limited Partner. This includes their legal names, addresses, and other pertinent information. 2. Capital Contributions: The agreement specifies the capital contributions expected from each party. The LLC may be required to contribute both cash and non-cash assets, while the Limited Partner typically provides capital in the form of cash, property, or other valuable assets. 3. Profit and Loss Distribution: Details regarding the distribution of profits and losses among the LLC and the Limited Partner are mentioned. The partnership agreement may dictate the specific proportions or percentages to be used for this distribution. 4. Management Authority: This section delineates the rights and responsibilities of each party concerning the management and day-to-day operations of the partnership. In most cases, the LLC acts as the general partner, holding decision-making authority, while the Limited Partner assumes a more passive role. 5. Limited Liability Protection: The agreement outlines the limited liability protection enjoyed by the Limited Partner, safeguarding them from personal liability beyond their investment. 6. Dissolution Procedures: In case the partnership needs to be dissolved, the agreement should clarify the process, including the steps to be followed and the distribution of remaining assets. 7. Taxation Considerations: The agreement should address any tax implications for both the LLC and the Limited Partner, including the allocation of tax liabilities and reporting requirements. Types of Lakewood Colorado Limited Partnership Agreements: 1. Limited Partnership Agreement for Real Estate Investments: This agreement focuses specifically on partnerships formed for real estate investment endeavors in Lakewood, Colorado. It may include provisions related to property acquisition, management, and profit distribution. 2. Limited Partnership Agreement for Business Ventures: This type of agreement is tailored to partnerships formed for various business ventures in Lakewood, Colorado. It may cover aspects such as company management, investment contributions, and decision-making authority. 3. Limited Partnership Agreement for Capital Ventures: This agreement caters to partnerships established for capital-intensive projects, such as infrastructure development or large-scale construction projects in Lakewood, Colorado. It may contain provisions related to funding, project milestones, and profit sharing. Conclusion: In Lakewood, Colorado, the Limited Partnership Agreement between an LLC and a Limited Partner serves as a crucial legal documentation outlining the terms and conditions of their partnership. Understanding the intricacies of this agreement is essential for all parties involved to ensure a harmonious and mutually beneficial business relationship. Depending on the nature of the partnership, specific variations of the agreement might be needed, such as those focusing on real estate investments, business ventures, or capital-intensive projects.