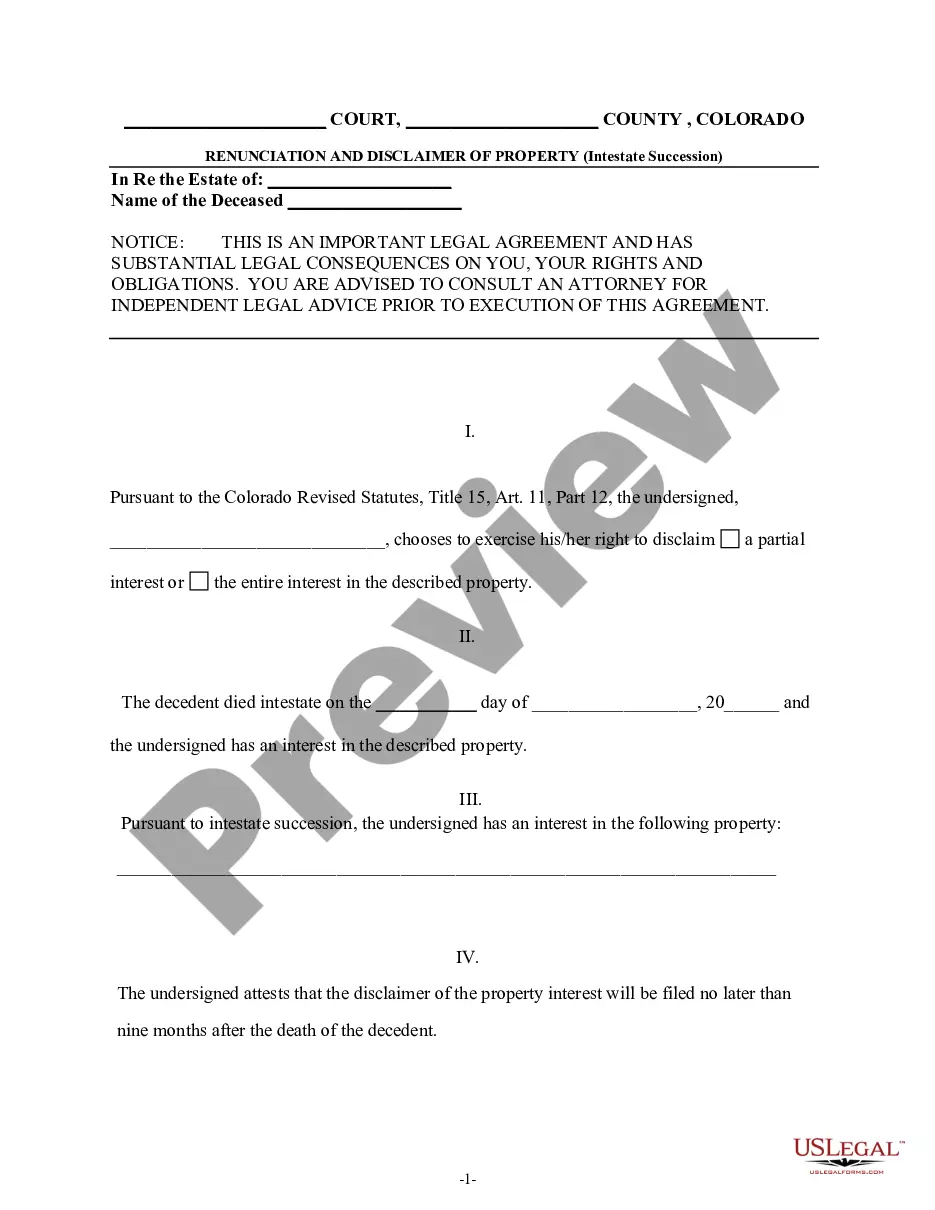

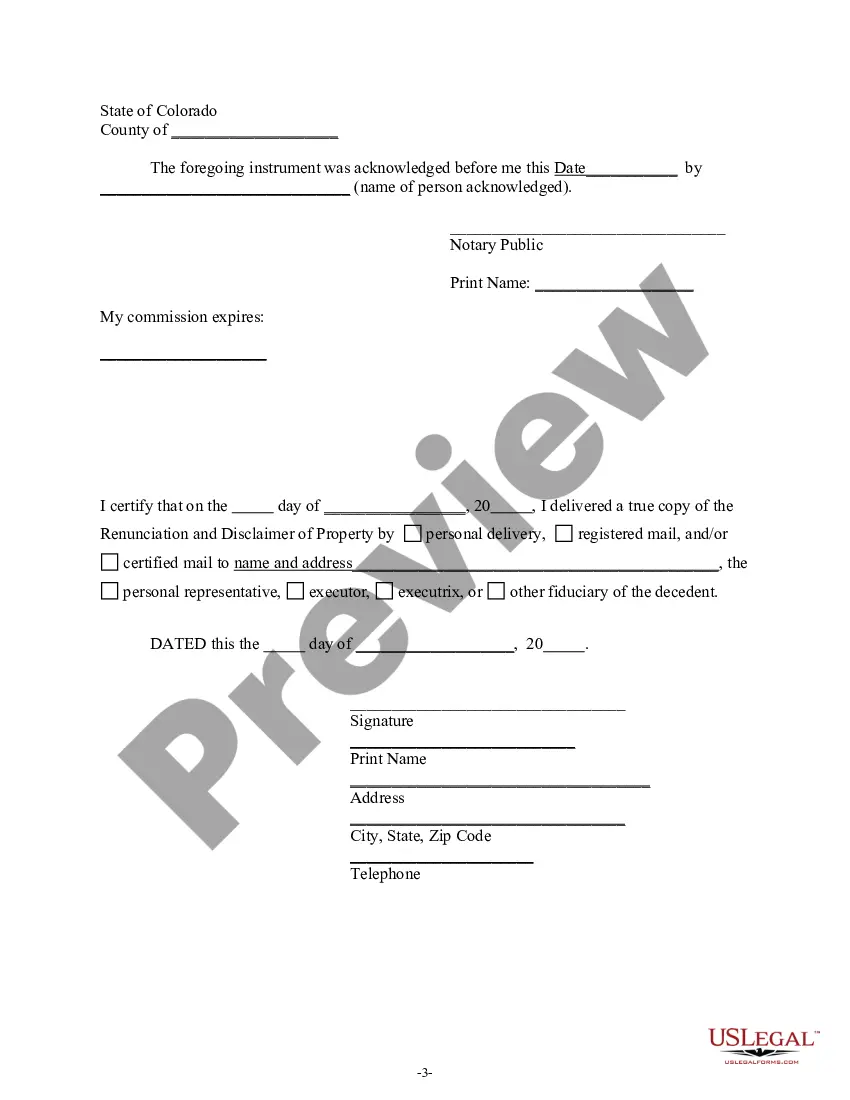

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the Colorado Revised Statutes, Title 15, Art. 11, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest in the property. The disclaimer will relate back to the date of death of the decedent and is an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Colorado Springs Colorado Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Colorado Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you are seeking a pertinent form template, it’s hard to discover a superior location than the US Legal Forms website – one of the largest collections on the internet.

Here you can acquire a vast number of form samples for business and personal use categorized by types and regions, or keywords.

With the specialized search feature, finding the most current Colorado Springs Colorado Renunciation And Disclaimer of Property obtained through Intestate Succession is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Select your desired file format and download it to your device.

- Furthermore, the legitimacy of each document is validated by a team of experienced attorneys who consistently evaluate the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and have an account, all you need to do to obtain the Colorado Springs Colorado Renunciation And Disclaimer of Property received by Intestate Succession is to Log In to your user account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines below.

- Ensure you have located the template you require. Review its description and utilize the Preview functionality (if available) to examine its content. If it does not meet your needs, employ the Search feature near the top of the page to find the correct document.

- Confirm your choice. Click the Buy now button. Subsequently, choose your preferred subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

Procedure for Relinquishment? Any Relinquishment over a Property is made through Relinquishment Deed or Release Deed. Section 17 of Registration Act 1908 makes it mandatory for a Relinquishment Deed to be registered.

According to the statute to be effective the disclaimer must: be in writing; declare who the disclaimer is; describe the interest (property) disclaimed, signed by the disclaimer; and. delivered to the personal representative, or trustee of the estate; or. filed with the court proceeding over the estate.

You disclaim the assets within nine months of the death of the person you inherited them from. (There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.) You receive no benefits from the proceeds of the assets you're disclaiming.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

In the context of a contract, a renunciation occurs when one party, by words or conduct, evinces an intention not to perform, or expressly declares that they will be unable to perform their obligations under the contract in some essential respect. The renunciation may occur before or at the time of performance.