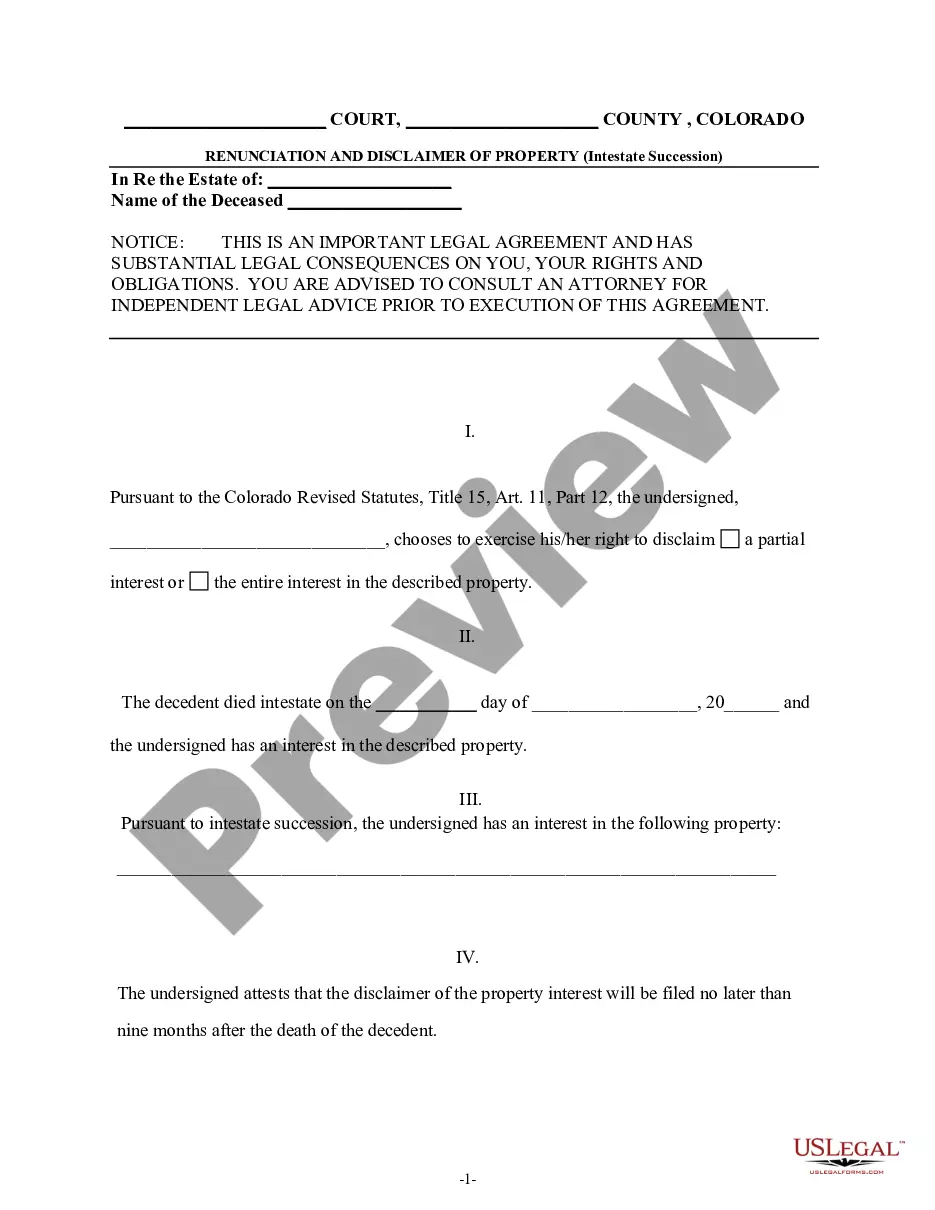

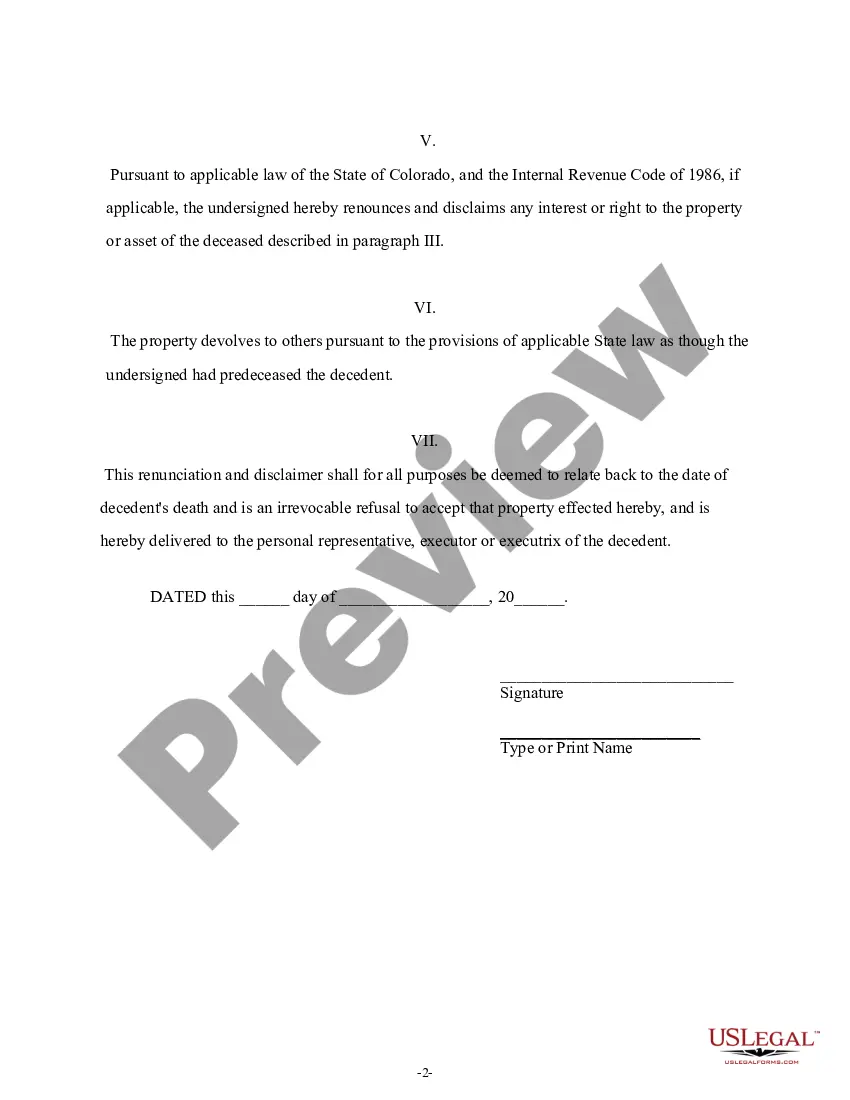

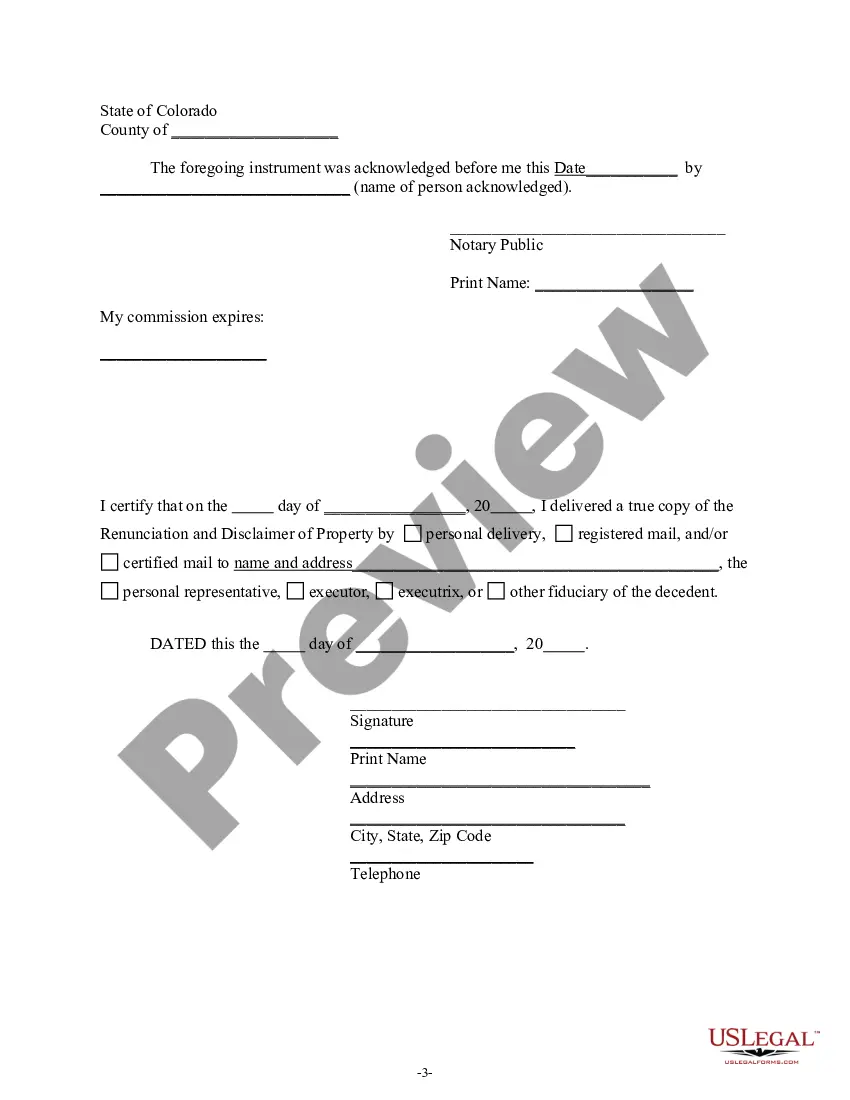

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the Colorado Revised Statutes, Title 15, Art. 11, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest in the property. The disclaimer will relate back to the date of death of the decedent and is an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Lakewood Colorado Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Colorado Renunciation And Disclaimer Of Property Received By Intestate Succession?

Do you require a trustworthy and economical legal documents provider to obtain the Lakewood Colorado Renunciation And Disclaimer of Property issued by Intestate Succession? US Legal Forms is your preferred option.

Whether you seek a straightforward agreement to establish guidelines for living together with your partner or a complete set of forms to facilitate your divorce through the court, we are here to assist you. Our site features over 85,000 current legal document templates for individual and commercial use. All templates we provide aren’t generic but crafted in alignment with the regulations of specific states and regions.

To obtain the document, you must Log In your account, find the necessary template, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time in the My documents section.

Is this your first visit to our site? No problem. You can create an account in just a few minutes, but before that, ensure to do the following.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is finalized, download the Lakewood Colorado Renunciation And Disclaimer of Property received by Intestate Succession in any available format. You can revisit the website anytime and redownload the document at no additional cost.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and put an end to spending countless hours searching for legal paperwork online once and for all.

- Verify if the Lakewood Colorado Renunciation And Disclaimer of Property received by Intestate Succession aligns with the regulations of your state and locality.

- Review the form’s specifics (if provided) to understand who and what the document is designed for.

- Begin the search anew if the template does not suit your legal situation.

Form popularity

FAQ

The order of priority in intestate succession starts with the spouse and children, followed by parents, siblings, and more distant relatives. In Lakewood, Colorado, this structured approach ensures that your estate is divided fairly according to state laws. Familiarizing yourself with this order can help you better understand the Lakewood Colorado Renunciation And Disclaimer of Property received by Intestate Succession process. For personalized guidance, uslegalforms provides resources to assist individuals in navigating their specific situations.

Certain assets, like life insurance policies, retirement accounts, and jointly owned property, can bypass probate in Colorado. Additionally, any assets with a designated beneficiary usually do not enter the probate process. This can simplify the distribution of your estate, making the Lakewood Colorado Renunciation And Disclaimer of Property received by Intestate Succession even more relevant for those looking to manage their affairs effectively. Knowing which assets are exempt can save time and reduce stress for your loved ones.

Intestate succession dictates how property is distributed when someone passes away without a will. In Lakewood, Colorado, the law outlines that assets typically go first to the deceased's spouse and children. If there are no direct descendants, the estate may be divided among other family members such as parents or siblings. Understanding these principles can help individuals navigate the complexities of the Lakewood Colorado Renunciation And Disclaimer of Property received by Intestate Succession.

The disclaimer law in Colorado provides a structured process for individuals to renounce their right to inherited property. This law is beneficial for those who prefer to abstain from managing an estate or want to ensure that property goes to a different heir. If you desire to explore the option of Lakewood Colorado renunciation and disclaimer of property received by intestate succession, utilizing platforms like uslegalforms can provide you with vital resources to navigate this process effectively.

A disclaimer law allows individuals to officially reject or refuse property or benefits they inherit. This legal framework helps heirs avoid unwanted responsibilities associated with the property. If you are in Lakewood, Colorado, and dealing with the renunciation and disclaimer of property received by intestate succession, it's wise to familiarize yourself with these laws to make informed decisions.

The 9 month disclaimer rule in Colorado requires individuals to file a disclaimer of property within nine months of inheriting it. This time-sensitive rule is crucial for maintaining the validity of your disclaimer and protecting your interests. Understanding the nuances of the Lakewood Colorado renunciation and disclaimer of property received by intestate succession can help you comply with this important timeframe.

The informed consent law in Colorado emphasizes the importance of clear communication and understanding before an individual makes legal decisions. In the context of property renunciation and disclaimers, this law ensures that individuals are fully aware of their rights and the implications of their choices. If you are considering the Lakewood Colorado renunciation and disclaimer of property received by intestate succession, being informed about this law can significantly benefit your decision-making process.

In Colorado, the disclaimer statute allows individuals to refuse property they receive through intestate succession. This legal provision enables heirs to avoid unwanted financial responsibilities or taxes tied to inherited property. So, if you are navigating a property situation in Lakewood, Colorado relating to renunciation and disclaimer of property received by intestate succession, knowing this statute can be essential for you.

To write a beneficiary disclaimer letter effectively, begin with a clear statement of your intention to refuse the inheritance. Include necessary details such as your name, the decedent's name, and specifics about the property. For accurate guidance, you can refer to uslegalforms, which provides templates and instructions that comply with the standards for Lakewood Colorado Renunciation And Disclaimer of Property received by Intestate Succession.

A person who inherits property through intestate succession in Colorado may receive the decedent's assets as outlined by state law. This typically includes real estate, personal property, and financial accounts, distributed according to the family hierarchy. Understanding intestate succession can be complex, but resources from uslegalforms can simplify the process for you.