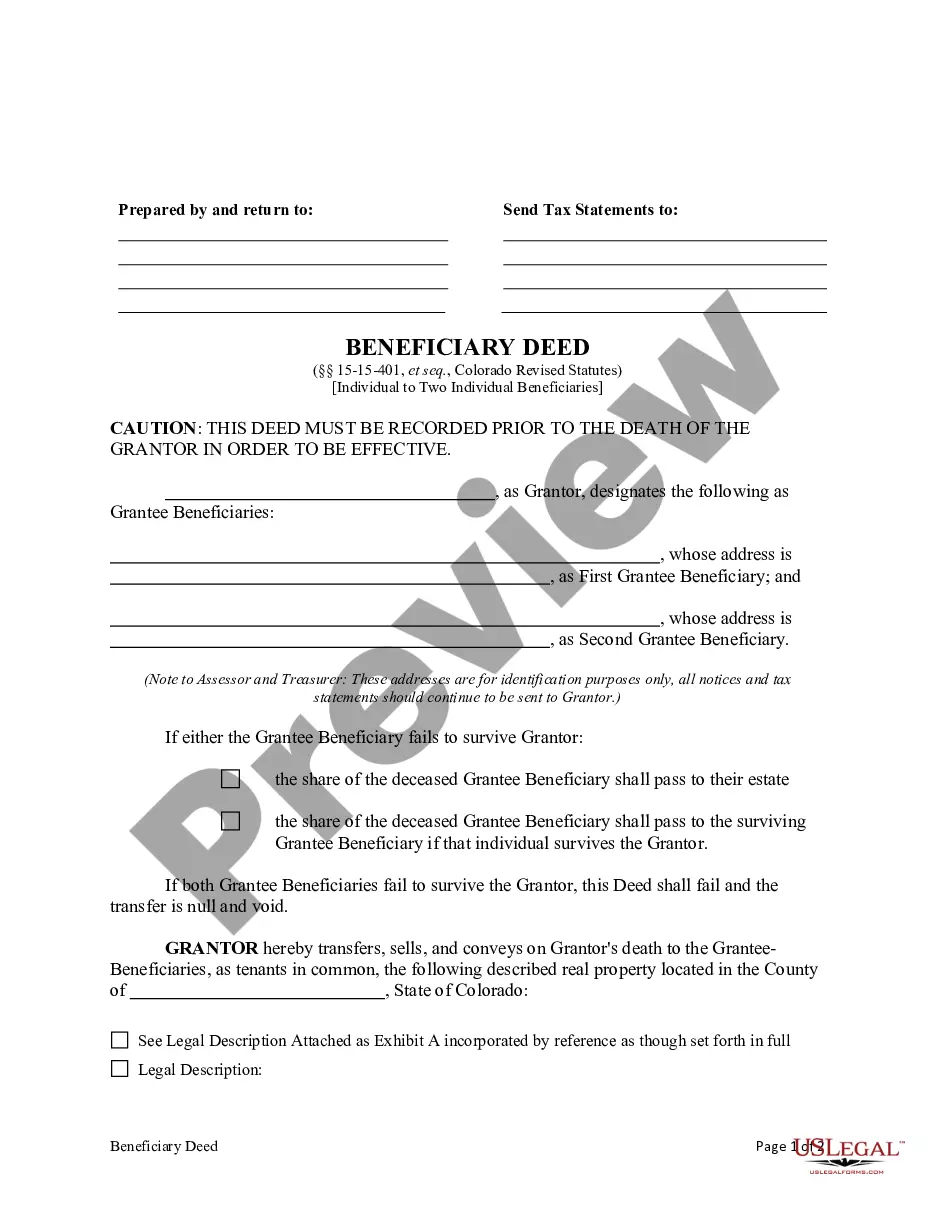

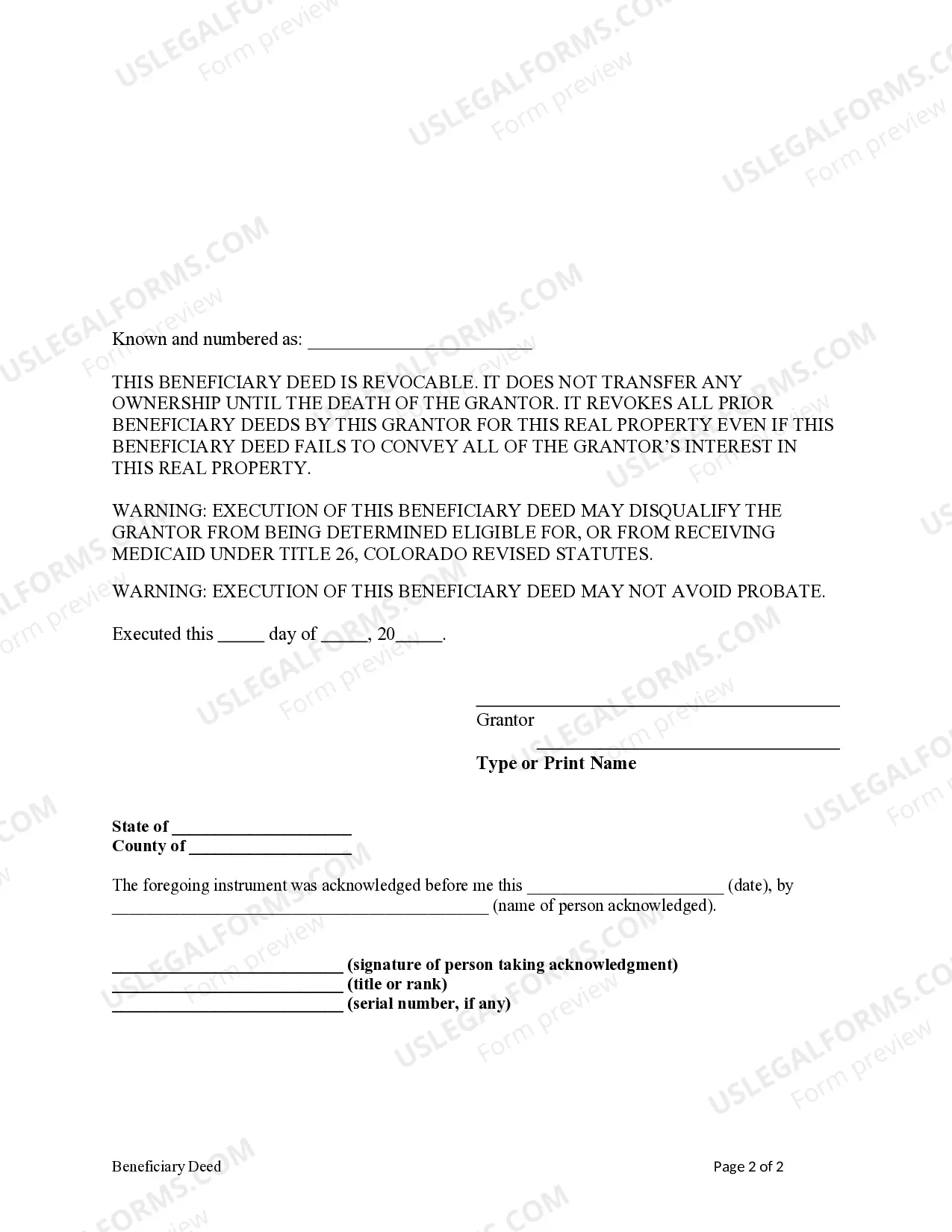

This form is a Beneficiary Deed where the Grantor is an individual and there are two Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantor conveys and transfers, upon Grantor's death, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to Grantor's death. This deed complies with all state statutory laws.

The Arvada Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries is a legal document used to convey real estate property to two individuals as joint tenants with rights of survivorship, but without designating any successor beneficiaries. This type of deed enables the property to pass directly to the surviving joint tenant(s) upon the death of one joint tenant, without the need for probate. In Arvada, Colorado, there are different variations of the Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries, including: 1. Arvada Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries with Reserved Life Estate: This type of deed allows an individual (granter) to retain a life estate in the property, meaning the granter has the right to occupy and use the property during their lifetime. Upon the granter's death, the property transfers to the two designated joint tenants named without successor beneficiaries. 2. Arvada Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries with Unequal Interests: This variation of the beneficiary deed allows the granter to distribute the property unequally between the two joint tenants. For example, one joint tenant may receive a 60% share, while the other receives a 40% share. Upon the death of the granter, the property passes to the joint tenants without any successor beneficiaries. 3. Arvada Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries with Right of Survivorship: This version of the deed ensures that if one joint tenant passes away, their share of the property automatically passes to the surviving joint tenant(s) in equal portions. The property will not go through probate or be subject to the deceased joint tenant's estate. In all these variations, it is crucial to consult an experienced attorney or real estate professional to ensure that the deed is properly drafted and complies with Arvada, Colorado, and state laws. Beneficiary deeds can be powerful estate planning tools, simplifying the transfer of property and avoiding the necessity of probate.The Arvada Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries is a legal document used to convey real estate property to two individuals as joint tenants with rights of survivorship, but without designating any successor beneficiaries. This type of deed enables the property to pass directly to the surviving joint tenant(s) upon the death of one joint tenant, without the need for probate. In Arvada, Colorado, there are different variations of the Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries, including: 1. Arvada Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries with Reserved Life Estate: This type of deed allows an individual (granter) to retain a life estate in the property, meaning the granter has the right to occupy and use the property during their lifetime. Upon the granter's death, the property transfers to the two designated joint tenants named without successor beneficiaries. 2. Arvada Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries with Unequal Interests: This variation of the beneficiary deed allows the granter to distribute the property unequally between the two joint tenants. For example, one joint tenant may receive a 60% share, while the other receives a 40% share. Upon the death of the granter, the property passes to the joint tenants without any successor beneficiaries. 3. Arvada Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries with Right of Survivorship: This version of the deed ensures that if one joint tenant passes away, their share of the property automatically passes to the surviving joint tenant(s) in equal portions. The property will not go through probate or be subject to the deceased joint tenant's estate. In all these variations, it is crucial to consult an experienced attorney or real estate professional to ensure that the deed is properly drafted and complies with Arvada, Colorado, and state laws. Beneficiary deeds can be powerful estate planning tools, simplifying the transfer of property and avoiding the necessity of probate.