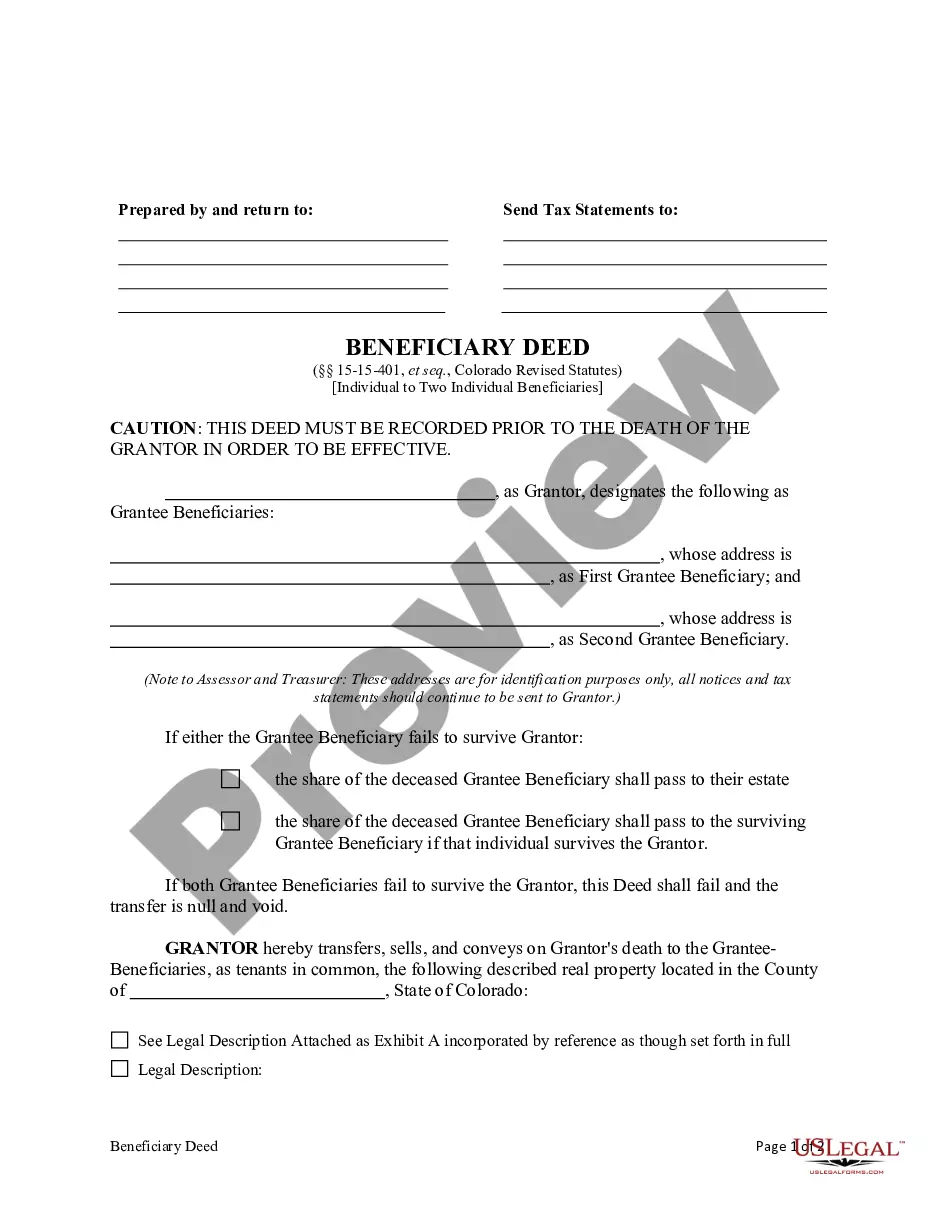

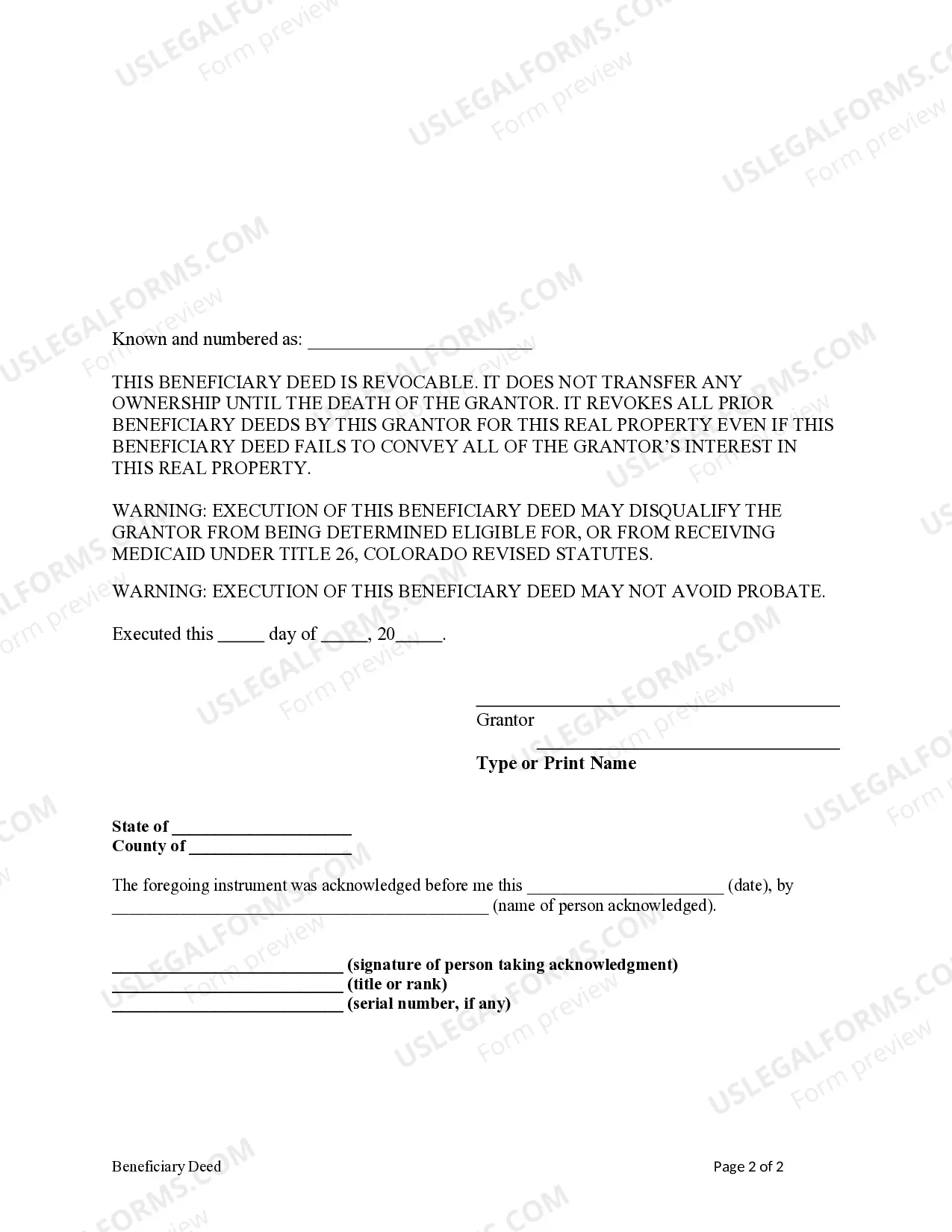

This form is a Beneficiary Deed where the Grantor is an individual and there are two Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantor conveys and transfers, upon Grantor's death, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to Grantor's death. This deed complies with all state statutory laws.

A Fort Collins Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries is a legal document that allows an individual property owner in Fort Collins, Colorado, to transfer their property to two named individuals as beneficiaries without any specified successor beneficiaries. This type of Beneficiary Deed is a popular estate planning tool that helps ensure a smooth transfer of property upon the owner's death, while also providing flexibility and control over the property during the owner's lifetime. The primary purpose of this Beneficiary Deed is to avoid probate, which can be a lengthy and expensive process. By naming specific individuals as beneficiaries in the deed, the property can be transferred directly to them upon the owner's death, bypassing the need for court involvement. One key advantage of this type of Beneficiary Deed is that it allows the owner to retain full ownership and control over the property during their lifetime. They can sell, mortgage, or modify the property without the need for the beneficiaries' consent. Additionally, this Beneficiary Deed allows the owner to designate two individuals as beneficiaries. These individuals can be family members, friends, or anyone the owner wishes to inherit the property. However, it's important to note that this type of Beneficiary Deed does not allow for successor beneficiaries. In other words, if one or both of the named beneficiaries pass away before the owner, the property will not pass to any other parties automatically. The Fort Collins Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries is designed to provide simplicity and efficiency in transferring property while allowing the owner to maintain control and flexibility during their lifetime. Other types of Beneficiary Deeds that can be utilized in Fort Collins, Colorado, include: 1. Fort Collins Colorado Beneficiary Deed — Individual to Spouse Without Successor Beneficiaries: This type of Beneficiary Deed allows an individual property owner to transfer their property to their spouse without any specified successor beneficiaries. 2. Fort Collins Colorado Beneficiary Deed — Individual to Trust Without Successor Beneficiaries: Here, an individual property owner can transfer their property to a trust, naming the trust as the beneficiary, without any specified successor beneficiaries. 3. Fort Collins Colorado Beneficiary Deed — Individual to Two Individuals with Successor Beneficiaries: In this case, the individual property owner can transfer their property to two named individuals as beneficiaries, with the provision of successor beneficiaries who would receive the property in case the primary beneficiaries pass away before the owner. In conclusion, the Fort Collins Colorado Beneficiary Deed — Individual to Two Individuals Without Successor Beneficiaries is an important estate planning tool that allows property owners to transfer their property efficiently, avoid probate, and maintain control over their assets during their lifetime.