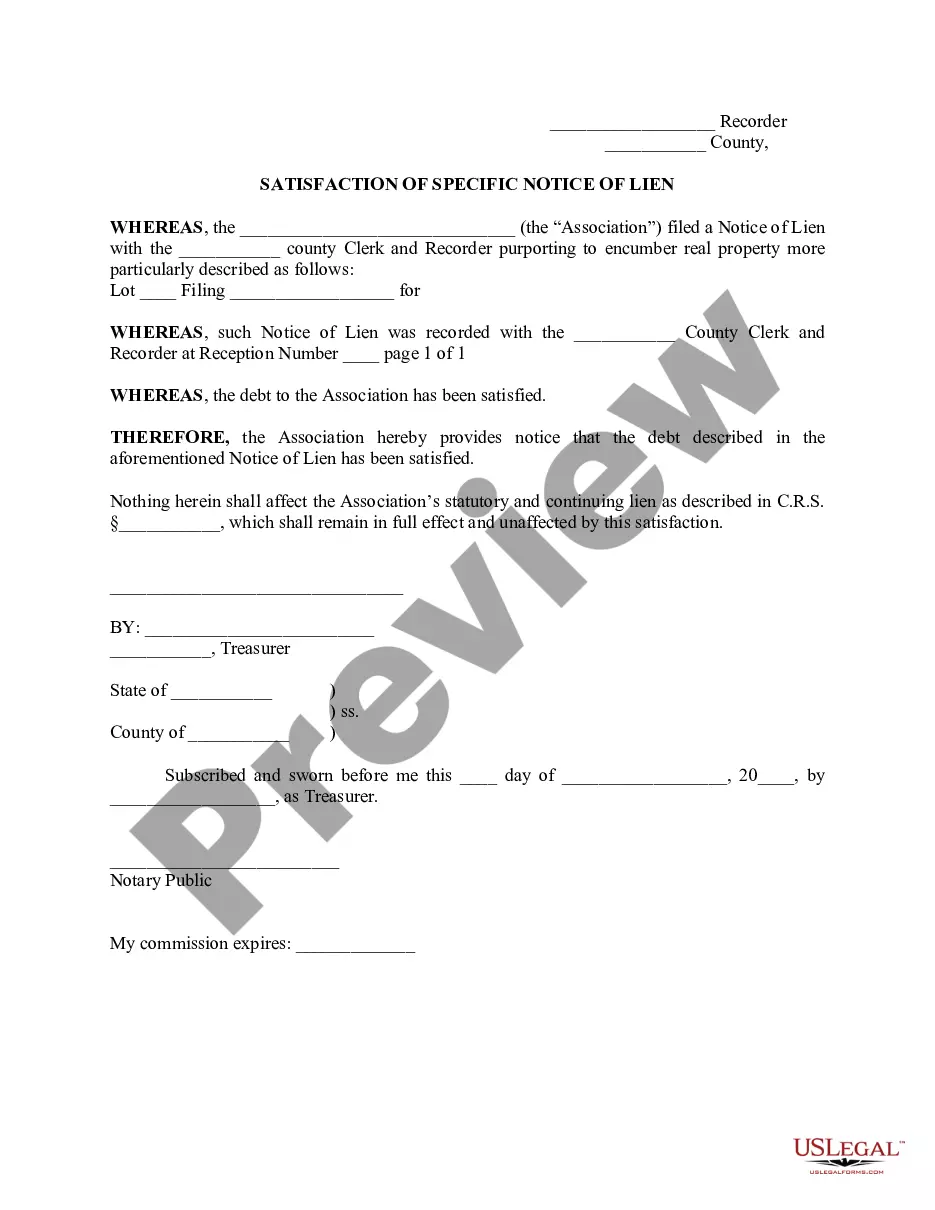

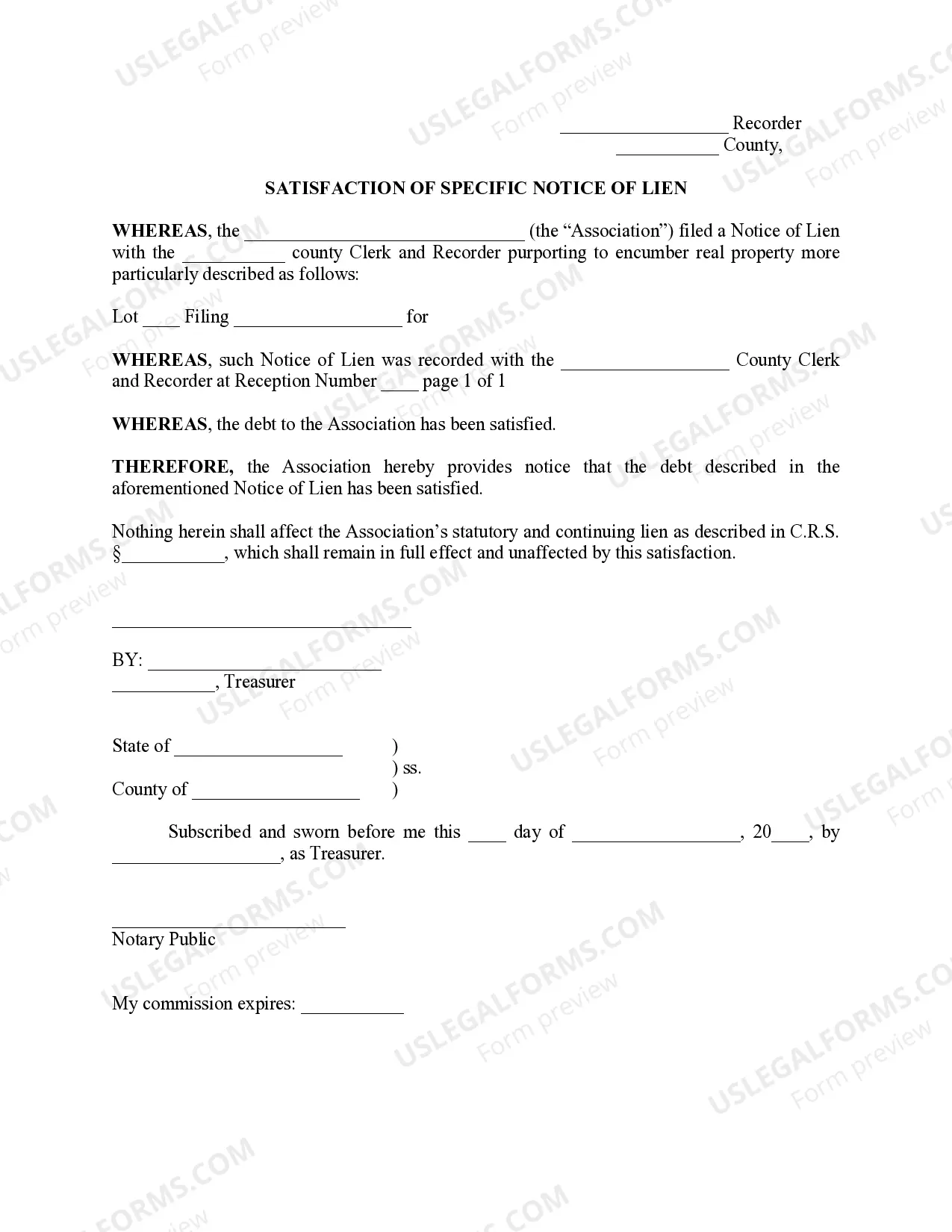

Title: Exploring Fort Collins Colorado Satisfaction of Specific Notice of Lien: Types and Process Introduction: Fort Collins, Colorado, situated at the foot of the Rocky Mountains, is a thriving city known for its vibrant community and flourishing economy. Understanding the intricacies of legal procedures such as the Satisfaction of Specific Notice of Lien can be crucial for residents and businesses. In this article, we will delve into the details of this process, its importance, and potential variations that could arise in Fort Collins. Keywords: Fort Collins Colorado, Satisfaction of Specific Notice of Lien, legal procedure, residents, businesses 1. The Significance of Satisfaction of Specific Notice of Lien: The Satisfaction of Specific Notice of Lien is a legal mechanism aimed at releasing a previously filed lien on a property. It signifies that the underlying debt or obligation, often related to unpaid taxes or contractors' fees, has been satisfied, settled, or resolved. 2. Key Parties Involved: The primary parties involved in the Satisfaction of Specific Notice of Lien process include the lien holder (the party who filed the original lien), the property owner or debtor, and any relevant government or legal authorities overseeing the proceedings. 3. Types of Fort Collins Colorado Satisfaction of Specific Notice of Lien: a. Tax Lien Satisfaction: This refers to the release of a lien placed on a property by the government or tax authorities due to unpaid taxes. Property owners must fulfill their tax obligations, including back taxes, penalties, and interest, to have the tax lien satisfied. b. Construction Lien Satisfaction: Construction-related liens may result from unpaid contractors, subcontractors, or suppliers involved in property development. The debtor must settle the outstanding debts to obtain a satisfaction of construction lien notice. c. Mortgage Lien Satisfaction: This type of lien relates to mortgage loans taken out on a property. When the debt secured by the mortgage is fully paid, the lien can be released, providing satisfaction of the mortgage lien. 4. The Satisfaction of Specific Notice of Lien Process in Fort Collins: a. Property owner's responsibility: The property owner must ensure that all outstanding debts or obligations related to the lien are fully paid, resolved, or satisfied. This can include contacting the lien holder, receiving a payoff statement, and making the necessary payments. b. Documentation: The lien holder must issue a Satisfaction of Specific Notice of Lien document to recognize that the lien has been satisfied. This document should be recorded with the appropriate government agency responsible for maintaining property records in Fort Collins. c. Legal formalities: The process may involve specific legal formalities, such as signing and notarizing the Satisfaction of Specific Notice of Lien document, ensuring compliance with local laws and regulations. d. Recording the document: To complete the process, the property owner or their representative should submit the Satisfaction of Specific Notice of Lien document to the relevant government agency to officially release the lien from the property's title. Conclusion: Understanding the nuances of the Satisfaction of Specific Notice of Lien process in Fort Collins is vital for property owners and lien holders alike. By fulfilling their obligations and following the required legal procedures, individuals can ensure the smooth release and satisfaction of different types of liens, including tax, construction, and mortgage liens. Seeking legal advice or assistance can be beneficial to navigate through this complex legal process effectively.

Fort Collins Colorado Short Form Contract to Buy and Sell Real Estate - Office Condominium Unit

Description

How to fill out Fort Collins Colorado Short Form Contract To Buy And Sell Real Estate - Office Condominium Unit?

Are you looking for a trustworthy and affordable legal forms provider to buy the Fort Collins Colorado Satisfaction of Specific Notice of Lien? US Legal Forms is your go-to solution.

No matter if you require a simple agreement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed based on the requirements of particular state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Fort Collins Colorado Satisfaction of Specific Notice of Lien conforms to the laws of your state and local area.

- Read the form’s details (if available) to learn who and what the form is good for.

- Start the search over in case the template isn’t good for your specific situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the Fort Collins Colorado Satisfaction of Specific Notice of Lien in any available file format. You can get back to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal paperwork online once and for all.