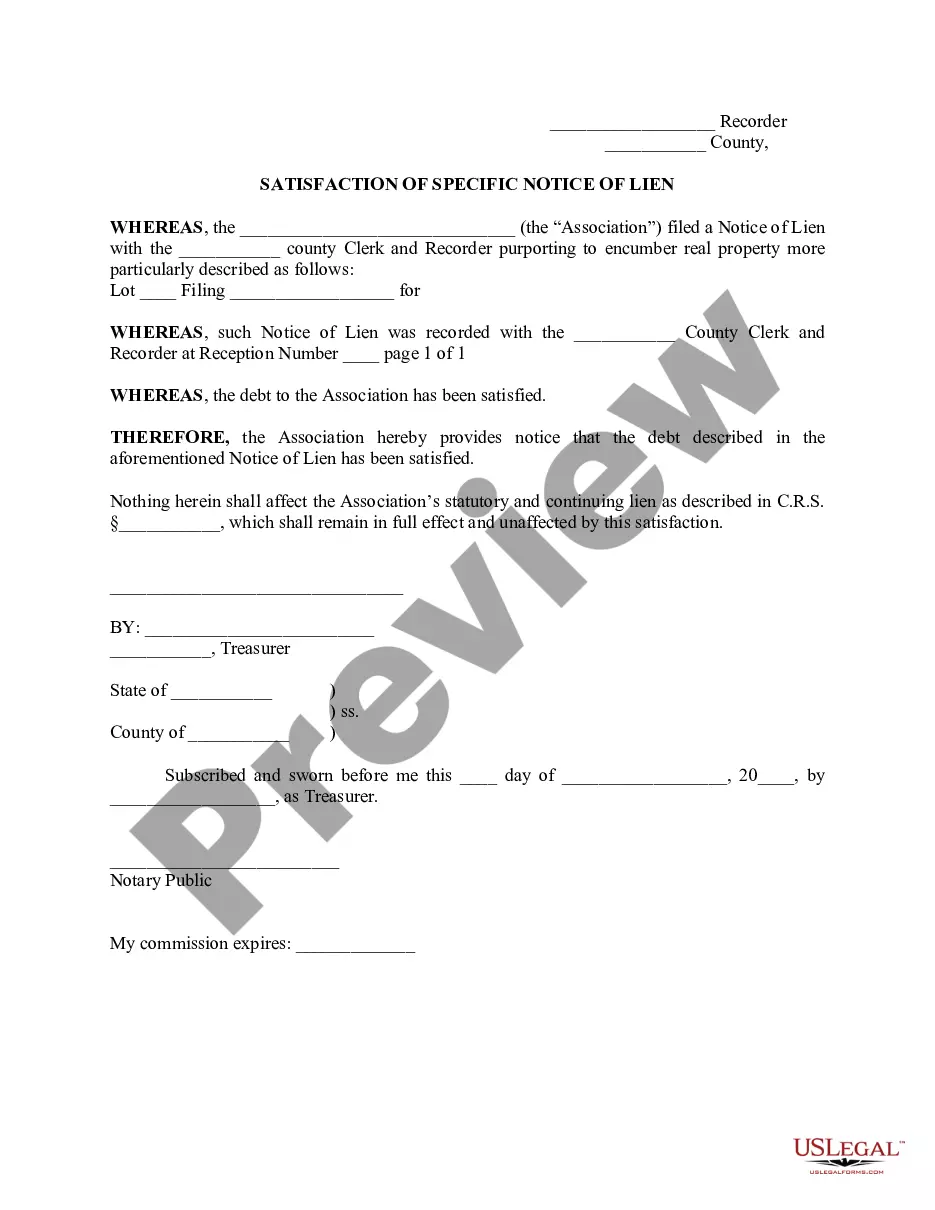

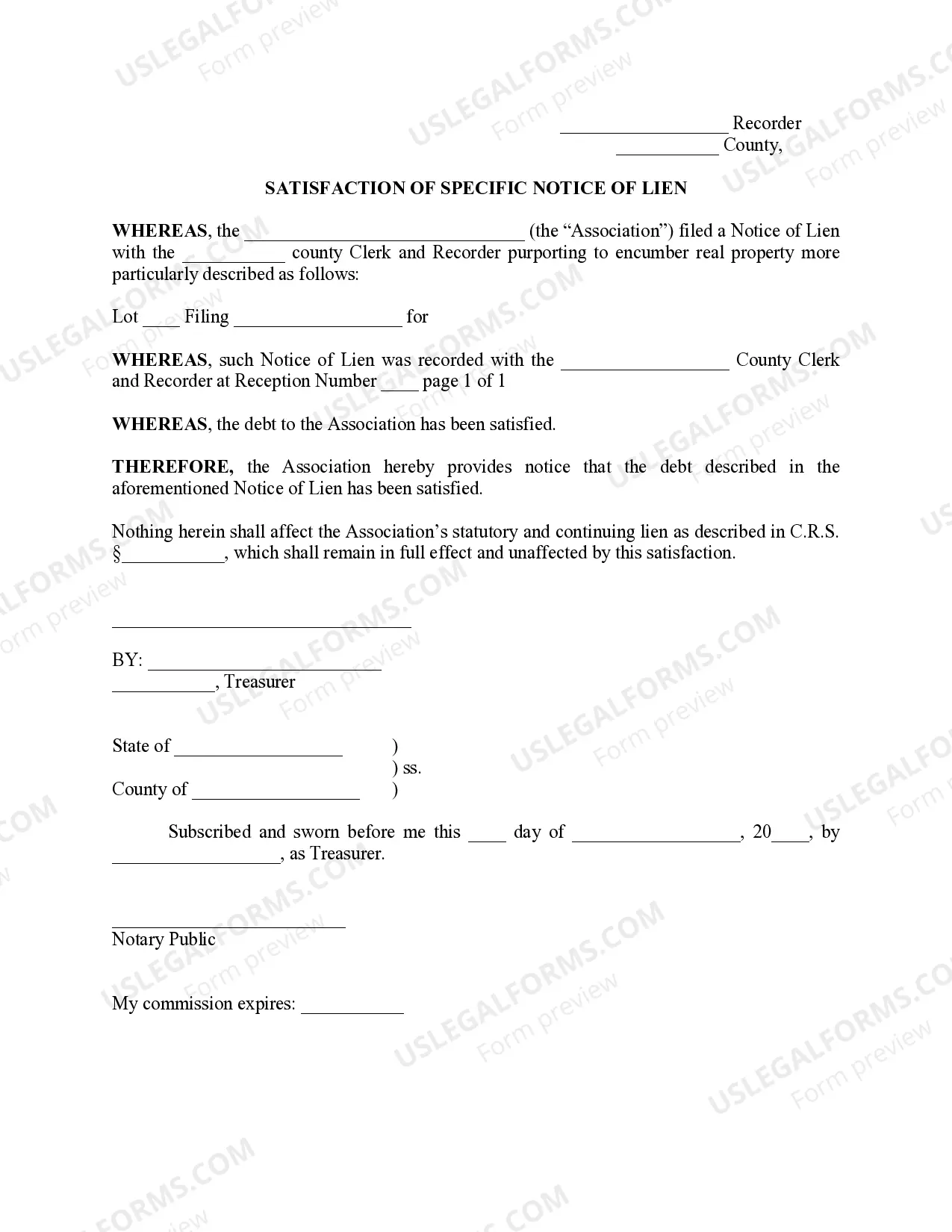

Lakewood, Colorado Satisfaction of Specific Notice of Lien: Everything You Need to Know In Lakewood, Colorado, a Satisfaction of Specific Notice of Lien refers to a legal document that releases a lien placed on a property. When a property has a lien, it means there is an outstanding debt or obligation attached to it. The Satisfaction of Specific Notice of Lien is filed to officially acknowledge that the lien has been paid off, released, or satisfied by the property owner or debtor. Keywords: Lakewood, Colorado, Satisfaction of Specific Notice of Lien, property, outstanding debt, obligation, paid off, released, satisfied, property owner, debtor. Different Types of Lakewood, Colorado Satisfaction of Specific Notice of Lien: 1. Mortgage Satisfaction of Specific Notice of Lien: This type of Satisfaction of Specific Notice of Lien is used when a mortgage lien, typically created when a property is financed through a mortgage loan, has been fully paid off. Once the mortgage lender acknowledges the repayment of the loan, they file the Satisfaction of Specific Notice of Lien to release the lien on the property. 2. Mechanic's Lien Satisfaction of Specific Notice of Lien: Mechanic's liens are filed by contractors, subcontractors, or suppliers who haven't received payment for work or materials provided for a property improvement. If the property owner settles the outstanding debt with the claimant, the Mechanic's Lien Satisfaction of Specific Notice of Lien becomes necessary to release the lien. It ensures that the property is no longer encumbered by the mechanic's lien. 3. Tax Lien Satisfaction of Specific Notice of Lien: When a property owner fails to pay their property taxes, the local government can place a tax lien on the property. To remove the tax lien, the property owner must satisfy the outstanding tax debt by paying the owed amount, including any penalties and interest. Once the payment is made, the Tax Lien Satisfaction of Specific Notice of Lien is filed, notifying that the lien on the property has been removed. 4. Judgment Lien Satisfaction of Specific Notice of Lien: Judgment liens are created when a court issues a money judgment against a debtor. If the debtor pays the amount owed to the judgment creditor, the Judgment Lien Satisfaction is filed to release the lien. This document ensures that the judgment creditor can no longer claim the property to satisfy the judgment. 5. Homeowners Association (HOA) Lien Satisfaction of Specific Notice of Lien: HOA liens are filed by homeowners associations when a property owner fails to pay their regular fees or assessments. If the property owner fulfills their financial obligations to the HOA, the HOA Lien Satisfaction of Specific Notice of Lien is filed, releasing the lien on the property. By understanding the different types of Lakewood, Colorado Satisfaction of Specific Notice of Lien, property owners can ensure that their property is free from any encumbrances and that all outstanding debts or obligations have been resolved to maintain a clear title.

Lakewood Colorado Short Form Contract to Buy and Sell Real Estate - Office Condominium Unit

Description

How to fill out Lakewood Colorado Short Form Contract To Buy And Sell Real Estate - Office Condominium Unit?

Benefit from the US Legal Forms and obtain instant access to any form sample you need. Our useful website with a huge number of documents makes it simple to find and get almost any document sample you need. You are able to download, fill, and certify the Lakewood Colorado Satisfaction of Specific Notice of Lien in a matter of minutes instead of surfing the Net for hours attempting to find an appropriate template.

Utilizing our library is a superb way to increase the safety of your document filing. Our professional lawyers regularly review all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Lakewood Colorado Satisfaction of Specific Notice of Lien? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Moreover, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions below:

- Find the form you require. Make sure that it is the template you were looking for: verify its headline and description, and take take advantage of the Preview function if it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Export the file. Choose the format to obtain the Lakewood Colorado Satisfaction of Specific Notice of Lien and revise and fill, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy document libraries on the web. We are always ready to help you in virtually any legal procedure, even if it is just downloading the Lakewood Colorado Satisfaction of Specific Notice of Lien.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!