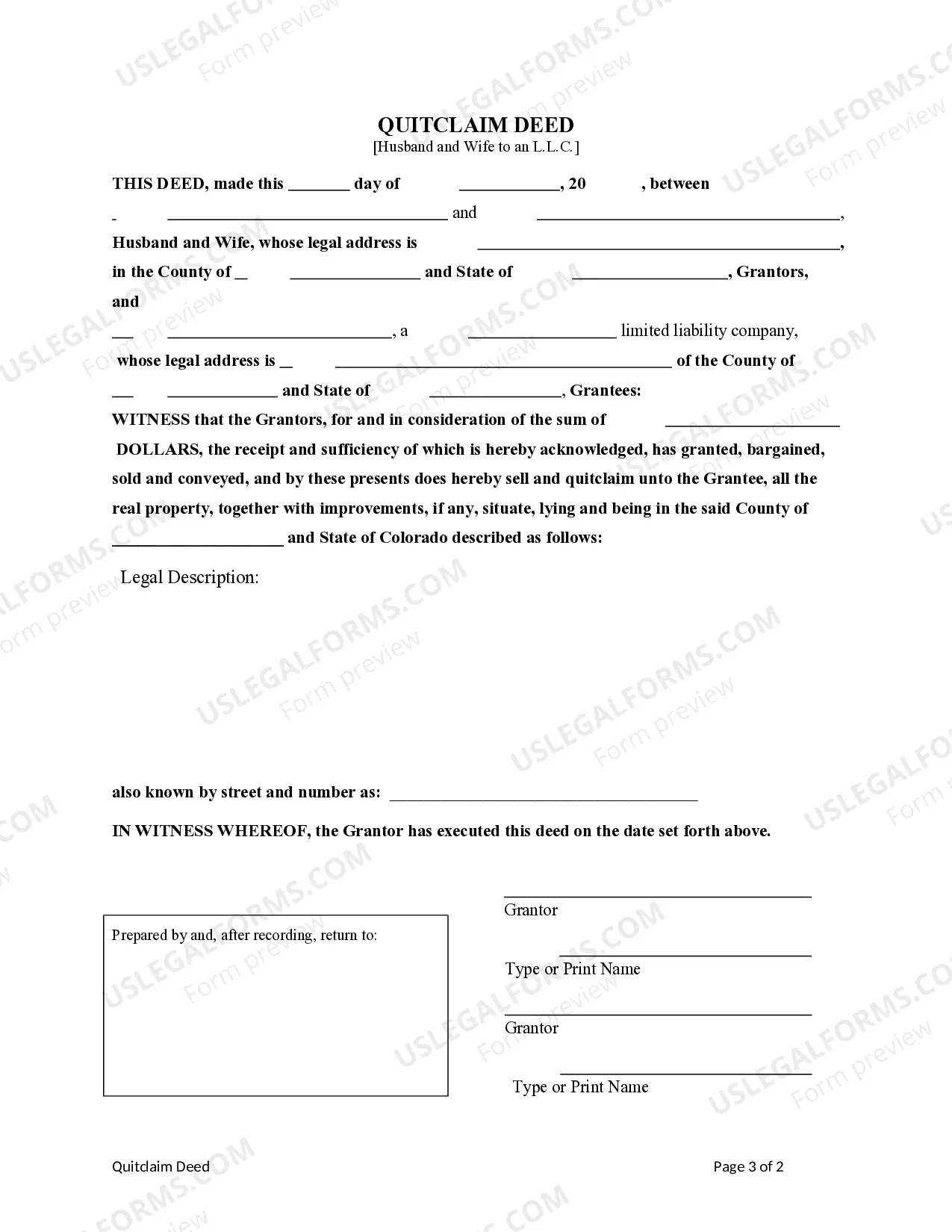

This form is a Quitclaim Deed where the Grantors are Husband and Wife and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

A Lakewood Colorado Quitclaim Deed — Husband and Wife to a Limited Liability Company is a legal document that allows a married couple to transfer the ownership of their property to a Limited Liability Company (LLC) in Lakewood, Colorado. This type of deed is commonly used when individuals want to protect themselves from potential liability and take advantage of certain tax benefits by transferring their property into an LLC. The quitclaim deed process involves the husband and wife, as granters, transferring their interest in the property to the LLC, which becomes the grantee. By doing so, the LLC takes on the rights and responsibilities associated with the property. Using a quitclaim deed in this scenario does not guarantee that the property is free from any existing liens or encumbrances. It simply transfers whatever interest the husband and wife have in the property to the LLC. It is essential for both parties involved to seek legal advice and conduct a thorough examination of the property's title before proceeding with the transfer. Different types of Lakewood Colorado Quitclaim Deed — Husband and Wife to a Limited Liability Company include: 1. Individual to LLC Quitclaim Deed: This is the standard type of deed that involves a husband and wife transferring their property ownership to an LLC that they solely own. In this case, both spouses act as granters, conveying their interests to the LLC. 2. Joint Tenancy with Right of Survivorship to LLC Quitclaim Deed: This type of deed allows a husband and wife, who jointly own a property as "joint tenants with right of survivorship," to transfer their ownership to an LLC. Joint tenancy with right of survivorship means that if one spouse passes away, the other automatically inherits their share of the property. The quitclaim deed helps facilitate the transfer of this joint ownership to an LLC. 3. Tenancy in Common to LLC Quitclaim Deed: In cases where a husband and wife share property as "tenants in common," this type of quitclaim deed is applicable. Tenancy in common means that each spouse owns a distinct share of the property, which they can dispose of as they desire. The quitclaim deed allows them to transfer their individual interests to an LLC jointly. 4. Community Property to LLC Quitclaim Deed: This type of deed is relevant for married couples residing in a community property state, like Colorado. Community property refers to assets acquired during the marriage that are considered jointly owned by both spouses. The quitclaim deed enables the sharing of community property ownership with an LLC. In all cases, it is crucial to consult a knowledgeable real estate attorney or legal professional to ensure compliance with Lakewood, Colorado's specific legal requirements and to address any potential concerns associated with transferring property ownership to an LLC.A Lakewood Colorado Quitclaim Deed — Husband and Wife to a Limited Liability Company is a legal document that allows a married couple to transfer the ownership of their property to a Limited Liability Company (LLC) in Lakewood, Colorado. This type of deed is commonly used when individuals want to protect themselves from potential liability and take advantage of certain tax benefits by transferring their property into an LLC. The quitclaim deed process involves the husband and wife, as granters, transferring their interest in the property to the LLC, which becomes the grantee. By doing so, the LLC takes on the rights and responsibilities associated with the property. Using a quitclaim deed in this scenario does not guarantee that the property is free from any existing liens or encumbrances. It simply transfers whatever interest the husband and wife have in the property to the LLC. It is essential for both parties involved to seek legal advice and conduct a thorough examination of the property's title before proceeding with the transfer. Different types of Lakewood Colorado Quitclaim Deed — Husband and Wife to a Limited Liability Company include: 1. Individual to LLC Quitclaim Deed: This is the standard type of deed that involves a husband and wife transferring their property ownership to an LLC that they solely own. In this case, both spouses act as granters, conveying their interests to the LLC. 2. Joint Tenancy with Right of Survivorship to LLC Quitclaim Deed: This type of deed allows a husband and wife, who jointly own a property as "joint tenants with right of survivorship," to transfer their ownership to an LLC. Joint tenancy with right of survivorship means that if one spouse passes away, the other automatically inherits their share of the property. The quitclaim deed helps facilitate the transfer of this joint ownership to an LLC. 3. Tenancy in Common to LLC Quitclaim Deed: In cases where a husband and wife share property as "tenants in common," this type of quitclaim deed is applicable. Tenancy in common means that each spouse owns a distinct share of the property, which they can dispose of as they desire. The quitclaim deed allows them to transfer their individual interests to an LLC jointly. 4. Community Property to LLC Quitclaim Deed: This type of deed is relevant for married couples residing in a community property state, like Colorado. Community property refers to assets acquired during the marriage that are considered jointly owned by both spouses. The quitclaim deed enables the sharing of community property ownership with an LLC. In all cases, it is crucial to consult a knowledgeable real estate attorney or legal professional to ensure compliance with Lakewood, Colorado's specific legal requirements and to address any potential concerns associated with transferring property ownership to an LLC.