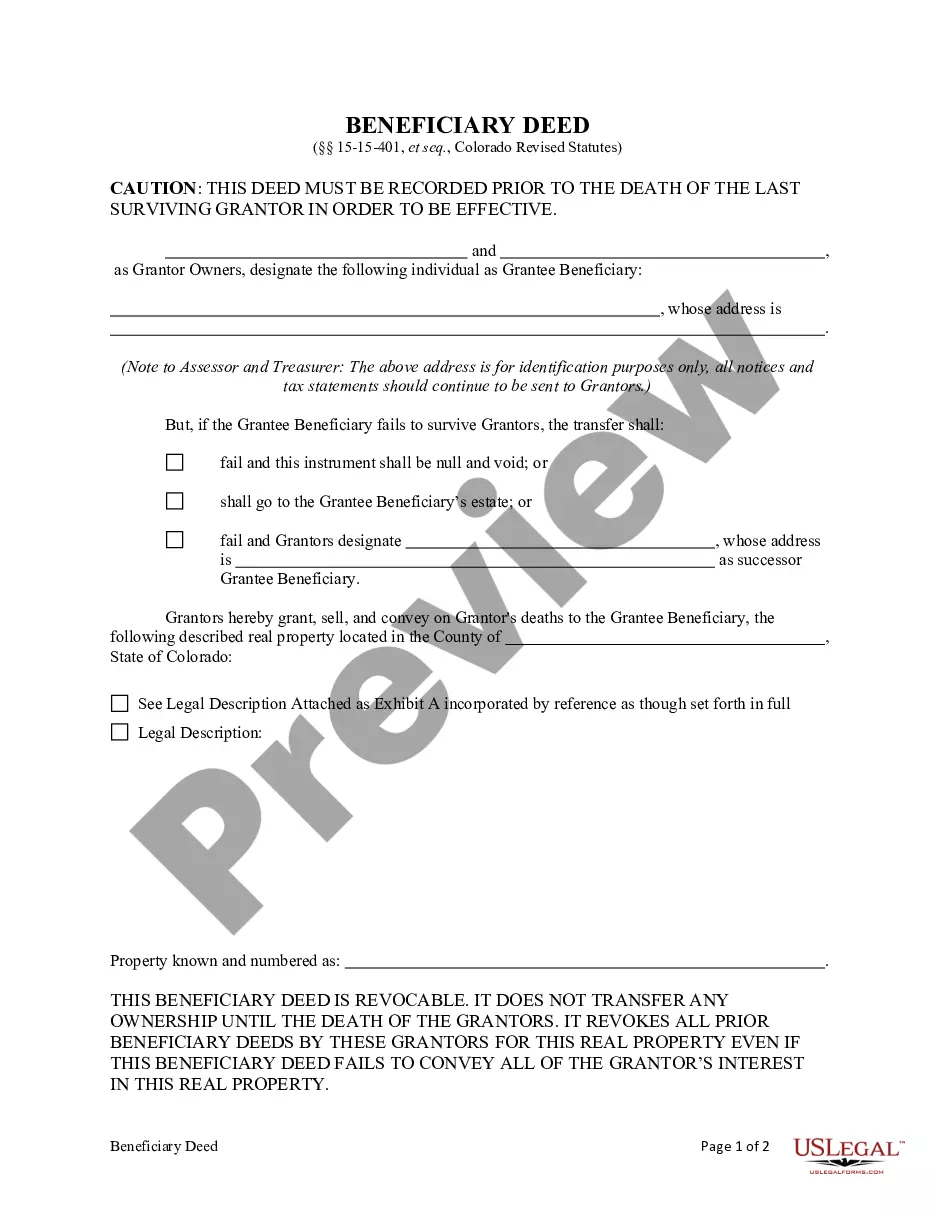

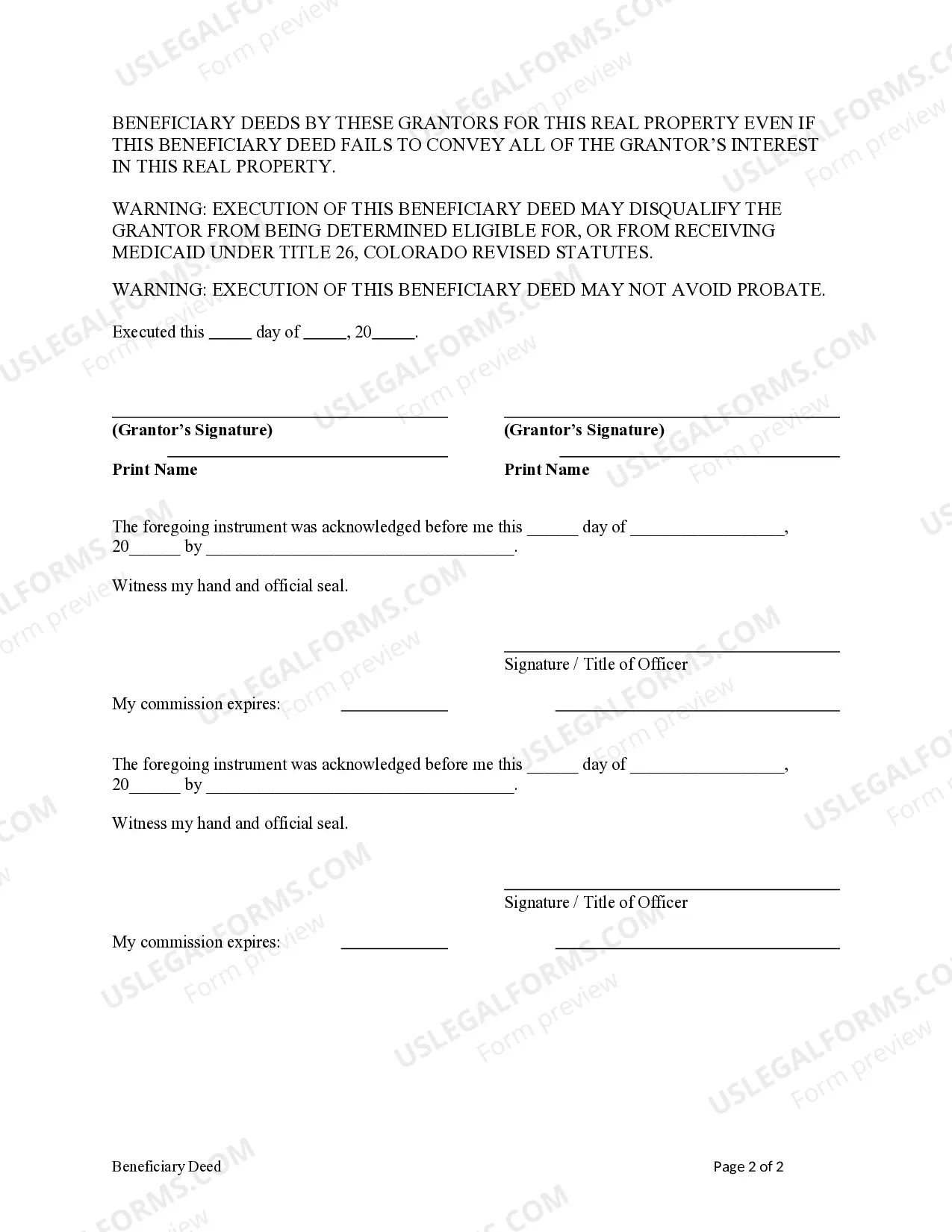

Transfer on Death Deed - Colorado - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time.

Fort Collins Colorado Transfer on Death Deed or TOD — Beneficiary Dee— - Husband and Wife to Individual is a legal document that allows property owners in Fort Collins, Colorado, to designate a specific individual as the beneficiary of their real estate upon their death. This deed is specifically designed for married couples who wish to transfer their property to an individual beneficiary and can offer several advantages in estate planning. 1. What is a Transfer on Death Deed (TOD)? A Transfer on Death Deed (TOD) is a legal instrument that allows property owners to name a specific beneficiary or beneficiaries who will inherit the property upon their death. This type of deed allows individuals to transfer their real estate outside the probate process, potentially saving time and money for their loved ones. 2. Understanding the Beneficiary Deed The Beneficiary Deed, also known as a Transfer on Death Deed, is a legal tool that provides married couples in Fort Collins, Colorado, the ability to transfer their property to an individual beneficiary. This form of estate planning helps avoid the need for probate, allowing a smooth and efficient transfer of property to the designated recipient. 3. Advantages of Using a Fort Collins TOD — Beneficiary Dee— - Avoiding probate: The primary advantage of using a Transfer on Death Deed is the ability to bypass the probate process. This allows for a quicker and more straightforward transfer of property to the designated beneficiary without court involvement. — Flexibility: The transfer can be revoked or modified at any time during the property owners' lifetime, providing them with the flexibility to change beneficiaries or sell the property if necessary. — Cost-effective: The TO— - Beneficiary Deed offers a cost-effective way to transfer property to an individual beneficiary without the need for legal assistance or complex estate planning measures. 4. Types of TOD — Beneficiary Deeds In Fort Collins, Colorado, there are several types of Transfer on Death Deeds that married couples can utilize: — Joint Tenancy: This type of TO— - Beneficiary Deed allows the property to be jointly owned by the husband and wife, with the right of survivorship. Upon the death of the first spouse, the property automatically transfers to the surviving spouse. — Tenancy in Common: With this type of deed, each spouse owns a specific percentage or share of the property. Upon the death of one spouse, their share can pass to the designated individual beneficiary, bypassing probate. In conclusion, the Fort Collins Colorado Transfer on Death Deed or TOD — Beneficiary Dee— - Husband and Wife to Individual offers numerous benefits for married couples in estate planning. By using this legal instrument, property owners can ensure a seamless transfer of their real estate to the designated individual beneficiary while avoiding probate and unnecessary costs.