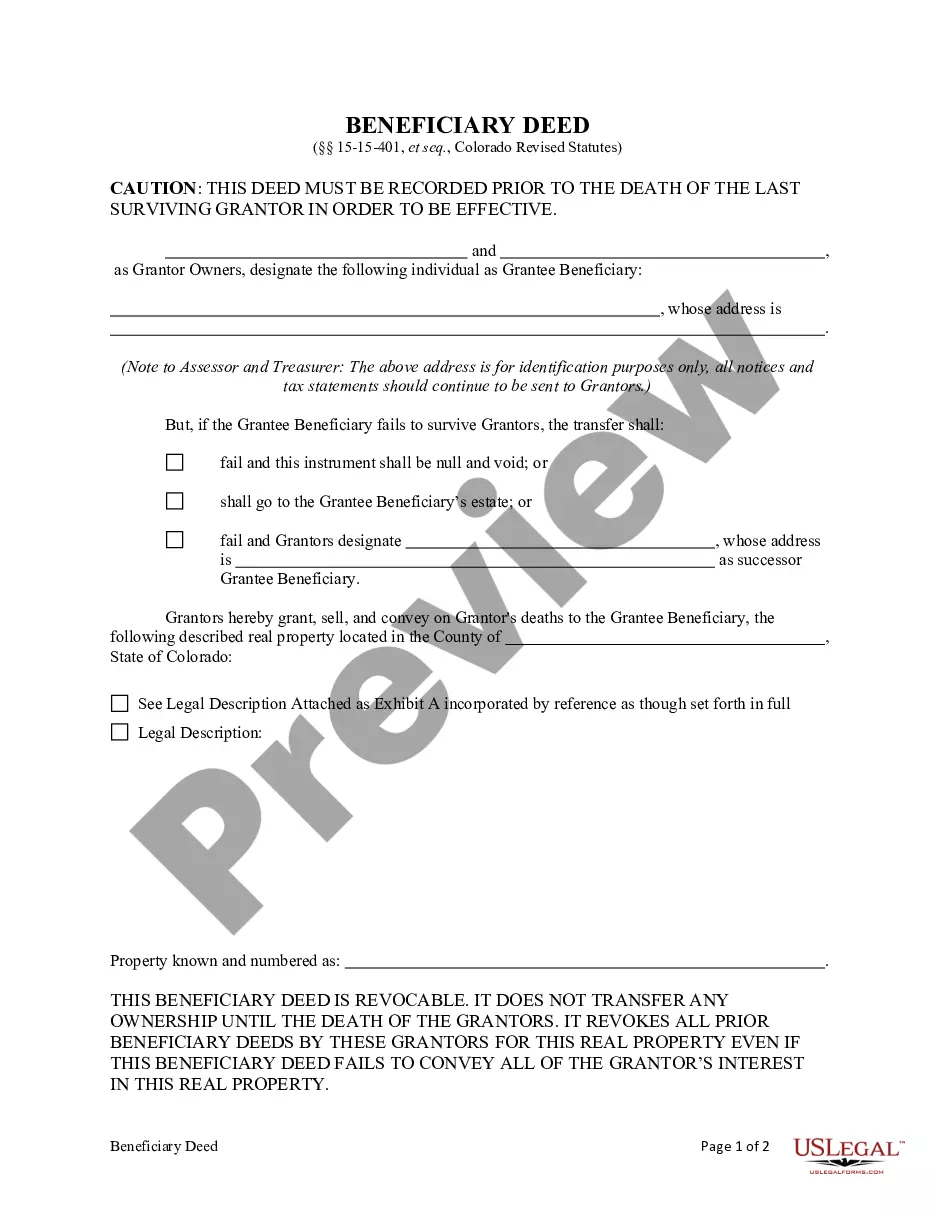

Transfer on Death Deed - Colorado - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time.

Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual

Description

How to fill out Colorado Transfer On Death Deed Or TOD - Beneficiary Deed - Husband And Wife To Individual?

No matter your social or occupational standing, completing law-related paperwork is an unfortunate requirement in today’s professional landscape.

Frequently, it’s nearly unfeasible for an individual without legal training to create this type of documentation from scratch, largely due to the intricate vocabulary and legal subtleties they incorporate.

This is where US Legal Forms proves beneficial.

Confirm the template you have located is tailored to your area since the laws of one state or region may not apply to another state or region.

Review the form and consider a brief summary (if available) of situations the document might be utilized for.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific documents applicable for nearly any legal circumstance.

- US Legal Forms also serves as an excellent resource for associates or legal advisors who wish to save time utilizing our DIY forms.

- Whether you need the Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual or any other document that will be valid in your state or region, US Legal Forms has everything readily available.

- Here’s how to acquire the Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual in just a few minutes using our dependable platform.

- If you are currently a member, feel free to Log In to your account to access the necessary form.

- However, if you are new to our library, ensure you follow these guidelines before obtaining the Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual.

Form popularity

FAQ

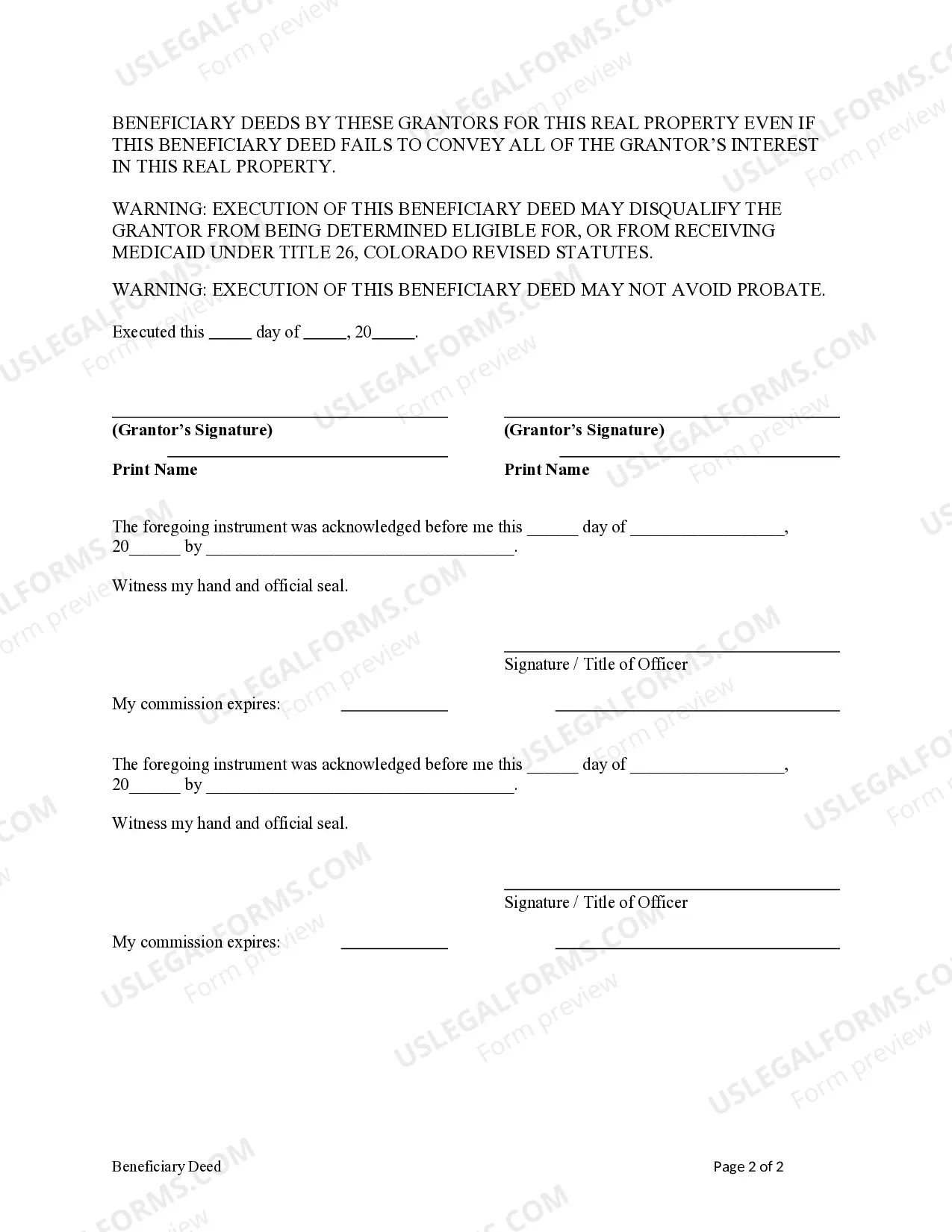

To write a beneficiary deed, start by clearly identifying the property involved and the names of the current owners. You will also need to specify the beneficiary, who can inherit the property through the Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual arrangement. It is important to sign the deed in front of a notary, which ensures its validity. Finally, make sure to record the deed with the county clerk's office to complete the process and protect the beneficiary's rights.

To file a TOD deed in Colorado, start by completing the Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual form accurately. Once completed, both spouses should sign the deed, and you must then file it with the county clerk and recorder's office. This process ensures that the transfer is documented and recognized officially, providing clarity for your beneficiaries.

One possible disadvantage of a Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual is that it does not protect the property from creditors. If the property owner has outstanding debts, creditors could still claim it after their death. Additionally, the transfer automatically occurs upon death, which may limit flexibility in managing the property during the owner's lifetime.

While it's not legally required to have a lawyer for a Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual, consulting one can provide peace of mind. A lawyer can help clarify your specific circumstances and ensure that the deed meets all legal requirements. Using a service like uslegalforms can simplify the process and provide forms that are compliant with Colorado law.

Filing a Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual requires completing the deed form and having it signed by both spouses. After signing, you must record the deed with your local county clerk and recorder's office. This official step ensures that the deed is recognized legally and will facilitate a smooth transfer of property upon death.

There are several negatives associated with a Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual. One significant issue is the lack of control over the property after the owner's passing, which may lead to disputes among heirs if not handled properly. Furthermore, a TOD deed might not always align with the owner's overall estate plan if other assets are included. Engaging with a trusted estate planning service like uslegalforms can help you navigate these challenges effectively.

While a Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual can simplify the estate transfer process, a few disadvantages exist. For one, the deed does not provide flexibility if circumstances change, such as if the beneficiary passes away before the owner. Additionally, it might not offer adequate protection from claims by creditors after the property owner's death. Thus, consider these factors carefully when drafting your estate plan.

Using a Transfer on Death deed can be a beneficial estate planning tool for many individuals. It provides a straightforward way to transfer property and minimizes probate complexities. However, it's essential to consider your overall estate plan and consult resources like uslegalforms for assistance in making the best decision regarding the Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual.

While the Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual offers benefits, there can be certain drawbacks. These deeds do not replace the need for a comprehensive estate plan, and they might not address specific family dynamics or other legal considerations. Additionally, if you change your mind about the beneficiary, you will need to execute a new deed.

A Transfer on Death deed does not inherently avoid capital gains tax. When the property is transferred, the beneficiary may inherit the property at its fair market value, potentially affecting future capital gains taxes. It is wise to consult with a tax professional to understand the nuances of tax implications related to the Westminster Colorado Transfer on Death Deed or TOD - Beneficiary Deed - Husband and Wife to Individual.