This form is a Quitclaim Deed where the Grantor is a trust and the Grantees are two individuals, or husband and wife. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

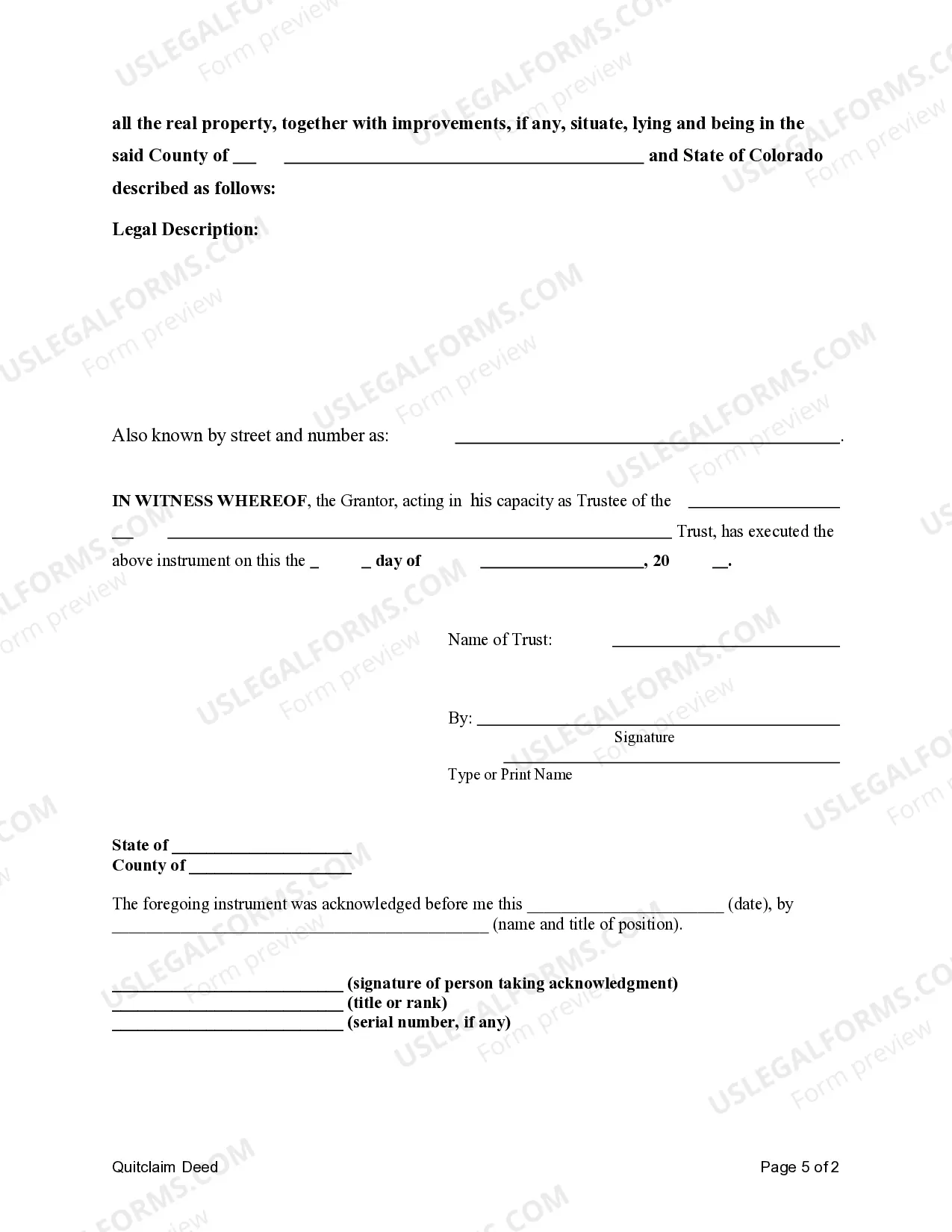

Arvada, Colorado Quitclaim Deed from a Trust to Two Individuals: A Comprehensive Guide A quitclaim deed is a legal document used to transfer ownership of a property from one party to another, typically without any warranties or guarantees regarding the title. In the specific context of Arvada, Colorado, a quitclaim deed from a trust to two individuals refers to the transfer of property ownership held in a trust to two named individuals. The process of executing a quitclaim deed from a trust to two individuals involves several essential steps. It is crucial to ensure the accuracy and legality of the transfer. While there may not be any distinct types of quitclaim deeds specifically for Arvada, Colorado, the following keywords can help provide helpful information on various aspects of this process: 1. Arvada, Colorado Property Ownership: Understanding the regulations and requirements related to property ownership in Arvada, Colorado is vital. This includes familiarizing oneself with local laws, zoning regulations, and property tax implications. This knowledge is vital for a smooth transfer of property ownership through a quitclaim deed. 2. Trusts in Arvada: Trusts are commonly used to hold property ownership in Arvada, Colorado. It is helpful to understand the different types of trusts available, such as living trusts, revocable trusts, or irrevocable trusts. Consulting with a legal professional experienced in estate planning and trust administration is highly recommended ensuring compliance with state laws. 3. Quitclaim Deed Process: To transfer property ownership from a trust to two individuals, the following steps are generally involved: — Obtain a blank quitclaim deed form: A template or official form can be obtained from the Arvada County Clerk and Recorder's office or by consulting with a real estate attorney. — Specify the parties involved: Clearly state the names of the trust, the granter(s), and the two individuals as the grantees. — Property description: Provide a detailed legal description of the property being transferred, including the address, lot number, and any other relevant details. — Execute the deed: Thgranteror(s) must sign the quitclaim deed in the presence of a notary public. — Notarization and recording: The deed must be notarized and recorded with the Arvada County Clerk and Recorder's office for it to be legally valid. 4. Title Examination: While a quitclaim deed offers no guarantees regarding the title, a title examination is still advisable. This examination ensures that there are no encumbrances, liens, or undisclosed claims that may affect the property's ownership. 5. Tax Implications: It is crucial to be aware of any tax implications associated with transferring property ownership through a quitclaim deed. Consultation with a tax professional can help determine any potential tax consequences, including gift tax or capital gains tax obligations. In conclusion, an Arvada, Colorado quitclaim deed from a trust to two individuals involves the transfer of property ownership held within a trust to two named individuals. Understanding local property laws, trust administration, executing the proper documentation, and considering tax implications are vital aspects of this process. Remember to consult with legal and tax professionals to ensure compliance and a smooth property transfer.