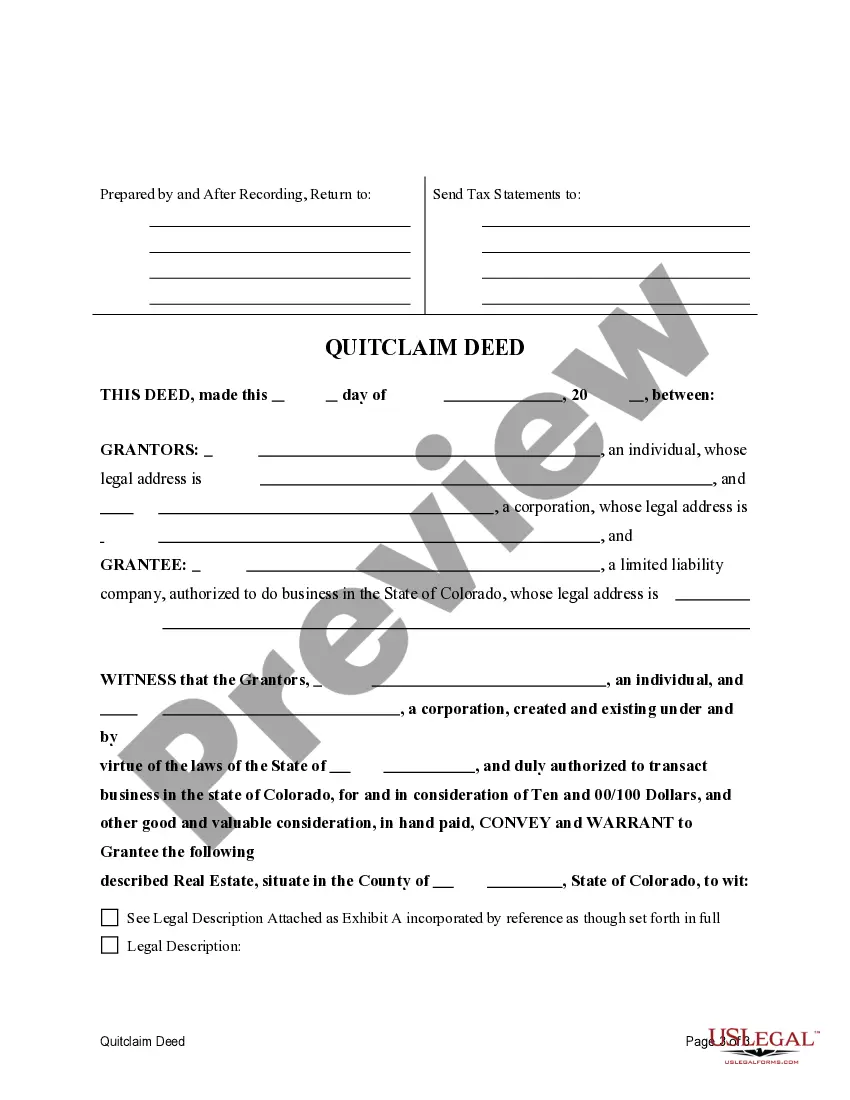

This form is a Quitclaim Deed where the Grantors are an individual and a corporation and the Grantee is an LLC. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

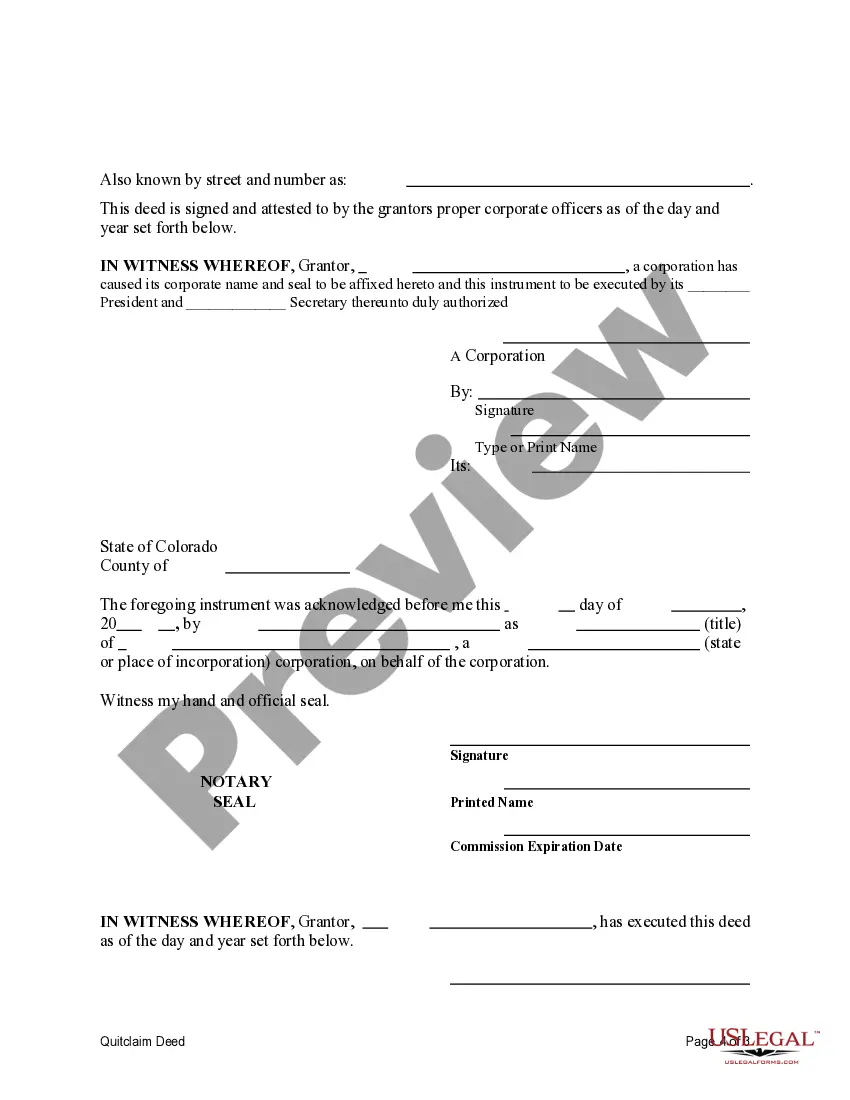

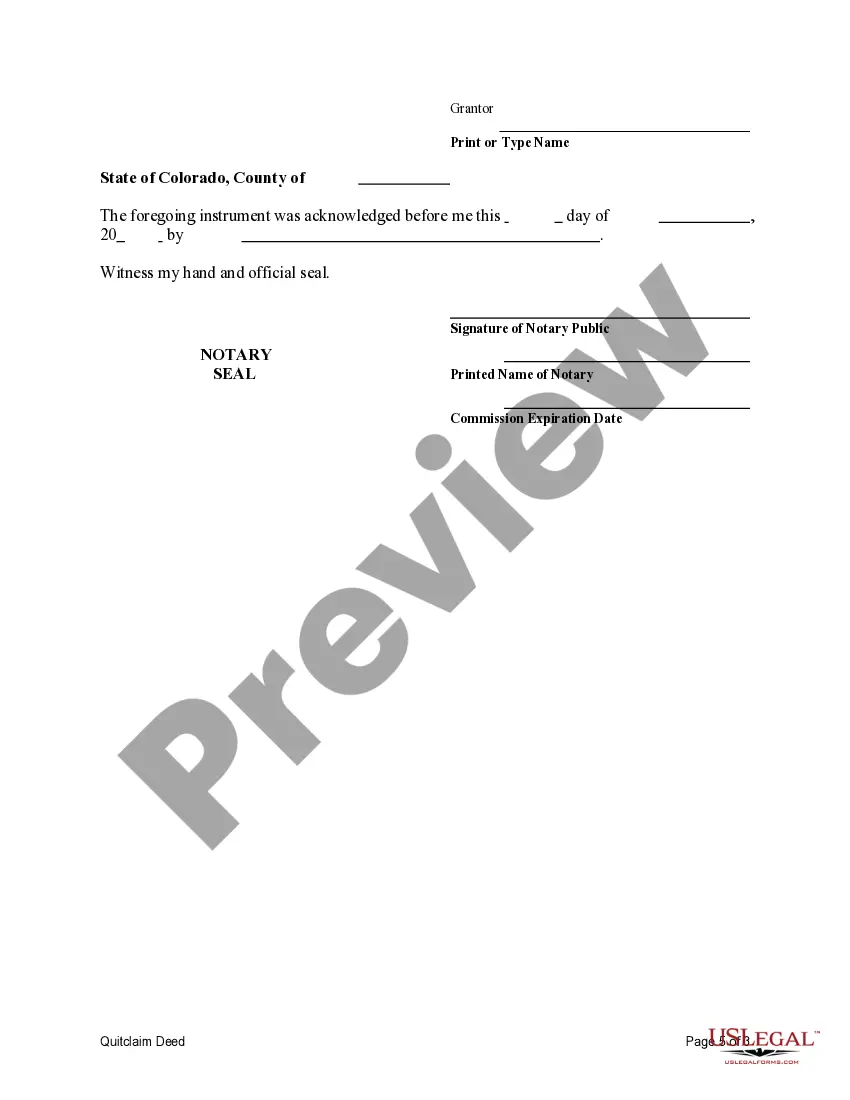

Title: Understanding Lakewood Colorado Quitclaim Deed — Transfers from Individual and Corporation to LLC Introduction: A Lakewood Colorado Quitclaim Deed is a legal document used to transfer property ownership from an individual or a corporation to a limited liability company (LLC). It serves as a means of transferring the property rights without any warranties or guarantees regarding the title. This comprehensive guide will delve into the intricacies of the process, outlining the different types of Lakewood Colorado Quitclaim Deeds involved in transfers from individuals and corporations to LCS. 1. What is a Lakewood Colorado Quitclaim Deed? A Lakewood Colorado Quitclaim Deed is a legal instrument used to convey property rights from a granter (individual or corporation) to a grantee (limited liability company) without warranties. By executing this deed, the granter relinquishes all claims to the property, and the grantee becomes the new owner. 2. Types of Lakewood Colorado Quitclaim Deeds for Transfers to LCS: a) Individual to LLC Quitclaim Deed: — In this scenario, an individual property owner willingly transfers their ownership interest to an LLC they establish or are affiliated with. The individual granter terminates their personal ownership and becomes a member or owner of the LLC itself. b) Corporation to LLC Quitclaim Deed: — This type of quitclaim deed involves the transfer of property ownership from a corporation to an LLC. It often occurs when a corporation opts to restructure itself or spin off a portion of its assets into a separate LLC entity. 3. Procedure for Executing a Lakewood Colorado Quitclaim Deed to LLC: a) Obtain Legal Advice: — Before proceeding with the quitclaim deed, it is crucial to seek legal advice to understand the implications, tax considerations, and ensure compliance with local laws. b) Prepare the Quitclaim Deed: — Engage an attorney experienced in real estate law or utilize an online document service to draft a valid quitclaim deed. The deed must include details such as the granter's and grantee's names, property description, and any specific conditions or considerations agreed upon. c) Granter Signatures: — Thgranteror, whether an individual or corporation, must sign the quitclaim deed in the presence of a notary public. The signature signifies their intent to transfer ownership rights to the LLC. d) Record the Quitclaim Deed: — File the executed quitclaim deed with the Lakewood County Clerk and Recorder's Office, usually within the same county where the property is located. This step ensures the transfer is legally documented and publicly recorded. 4. Key Considerations for Lakewood Colorado Quitclaim Deeds to LCS: a) Title Search and Insurance: — While quitclaim deeds do not guarantee a clean title, it is advisable for the LLC to conduct a thorough title search and consider obtaining title insurance to mitigate any potential risks associated with the property's ownership history. b) Tax Implications: — Consult with a tax professional to understand the potential tax consequences that may arise from transferring the property from an individual or corporation to an LLC. c) Operating Agreement: — After the transfer, an LLC should consider drafting or updating its operating agreement to reflect the new ownership structure and outline the rights and responsibilities of its members. In conclusion, a Lakewood Colorado Quitclaim Deed allows for the transfer of property ownership from individuals or corporations to a limited liability company without warranties. By following the proper procedure and seeking legal guidance, the deed facilitates a smooth transfer with potential tax benefits and aligns property ownership with the desired LLC structure.Title: Understanding Lakewood Colorado Quitclaim Deed — Transfers from Individual and Corporation to LLC Introduction: A Lakewood Colorado Quitclaim Deed is a legal document used to transfer property ownership from an individual or a corporation to a limited liability company (LLC). It serves as a means of transferring the property rights without any warranties or guarantees regarding the title. This comprehensive guide will delve into the intricacies of the process, outlining the different types of Lakewood Colorado Quitclaim Deeds involved in transfers from individuals and corporations to LCS. 1. What is a Lakewood Colorado Quitclaim Deed? A Lakewood Colorado Quitclaim Deed is a legal instrument used to convey property rights from a granter (individual or corporation) to a grantee (limited liability company) without warranties. By executing this deed, the granter relinquishes all claims to the property, and the grantee becomes the new owner. 2. Types of Lakewood Colorado Quitclaim Deeds for Transfers to LCS: a) Individual to LLC Quitclaim Deed: — In this scenario, an individual property owner willingly transfers their ownership interest to an LLC they establish or are affiliated with. The individual granter terminates their personal ownership and becomes a member or owner of the LLC itself. b) Corporation to LLC Quitclaim Deed: — This type of quitclaim deed involves the transfer of property ownership from a corporation to an LLC. It often occurs when a corporation opts to restructure itself or spin off a portion of its assets into a separate LLC entity. 3. Procedure for Executing a Lakewood Colorado Quitclaim Deed to LLC: a) Obtain Legal Advice: — Before proceeding with the quitclaim deed, it is crucial to seek legal advice to understand the implications, tax considerations, and ensure compliance with local laws. b) Prepare the Quitclaim Deed: — Engage an attorney experienced in real estate law or utilize an online document service to draft a valid quitclaim deed. The deed must include details such as the granter's and grantee's names, property description, and any specific conditions or considerations agreed upon. c) Granter Signatures: — Thgranteror, whether an individual or corporation, must sign the quitclaim deed in the presence of a notary public. The signature signifies their intent to transfer ownership rights to the LLC. d) Record the Quitclaim Deed: — File the executed quitclaim deed with the Lakewood County Clerk and Recorder's Office, usually within the same county where the property is located. This step ensures the transfer is legally documented and publicly recorded. 4. Key Considerations for Lakewood Colorado Quitclaim Deeds to LCS: a) Title Search and Insurance: — While quitclaim deeds do not guarantee a clean title, it is advisable for the LLC to conduct a thorough title search and consider obtaining title insurance to mitigate any potential risks associated with the property's ownership history. b) Tax Implications: — Consult with a tax professional to understand the potential tax consequences that may arise from transferring the property from an individual or corporation to an LLC. c) Operating Agreement: — After the transfer, an LLC should consider drafting or updating its operating agreement to reflect the new ownership structure and outline the rights and responsibilities of its members. In conclusion, a Lakewood Colorado Quitclaim Deed allows for the transfer of property ownership from individuals or corporations to a limited liability company without warranties. By following the proper procedure and seeking legal guidance, the deed facilitates a smooth transfer with potential tax benefits and aligns property ownership with the desired LLC structure.