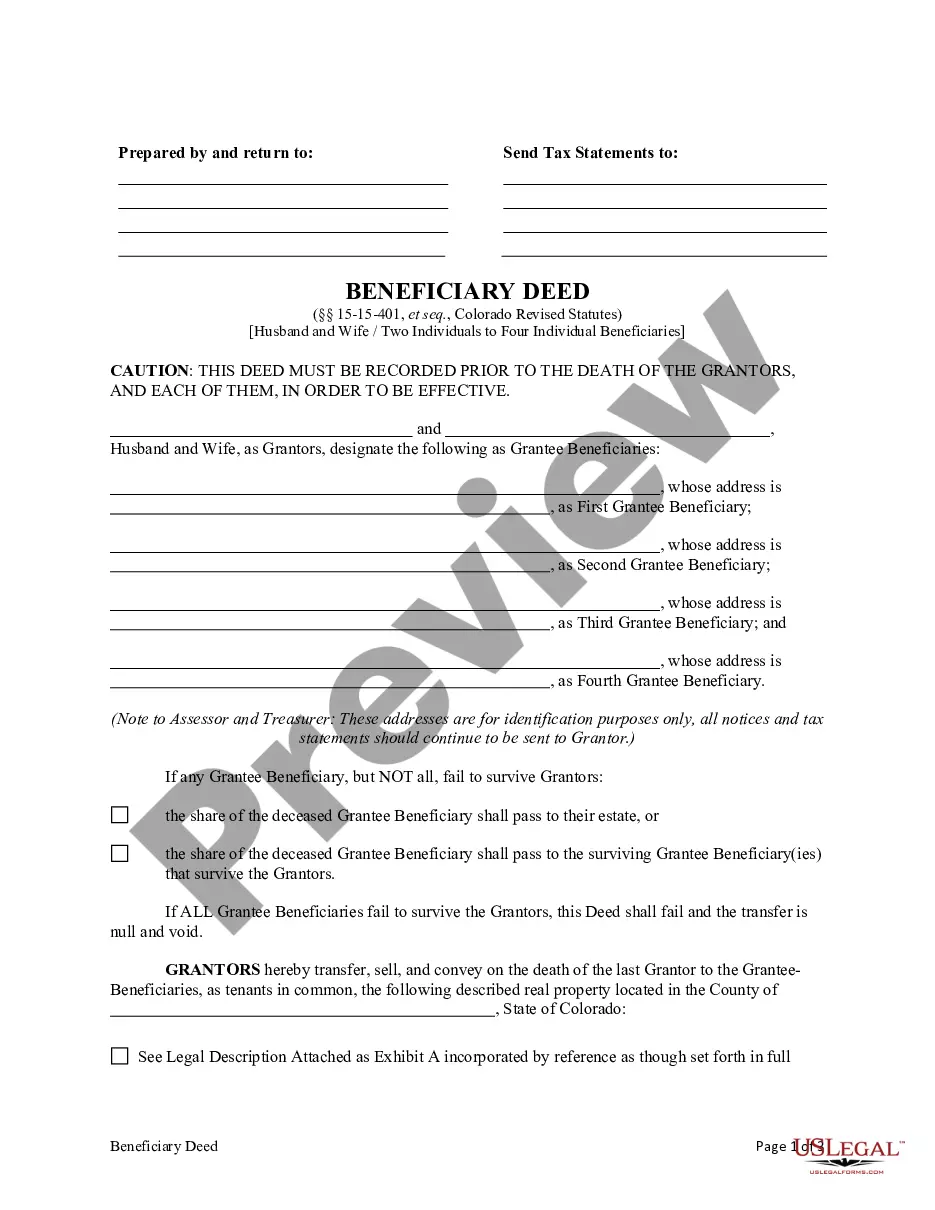

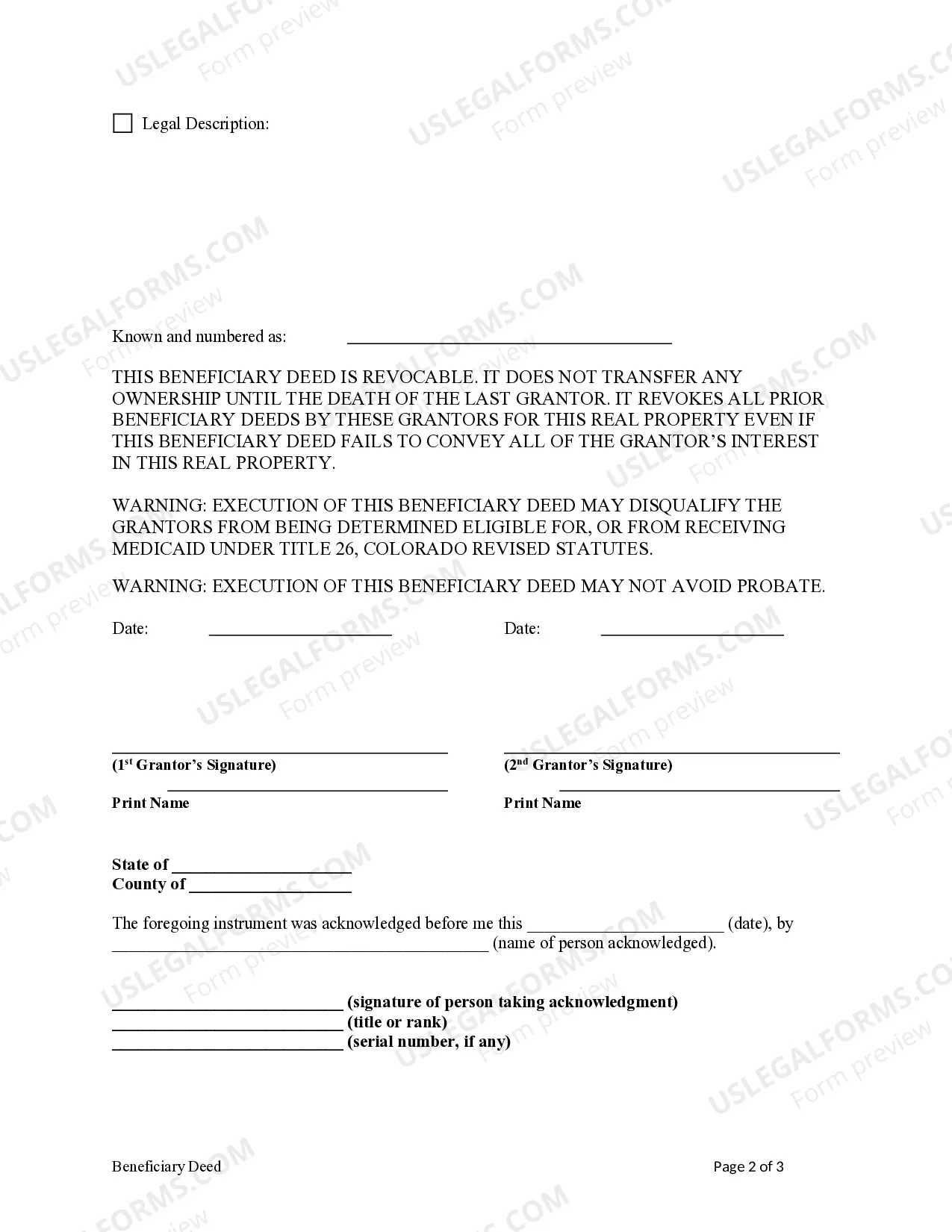

Transfer on Death Deed - Colorado - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Further, it must be recorded prior to death of last Grantor.

Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document that enables the transfer of real estate property ownership upon the death of the owners. This type of deed is specific to the state of Colorado and provides a streamlined process for transmitting property to designated individuals without the need for probate. The Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is ideal for married couples or two individuals who jointly own property and wish to ensure a smooth transfer of ownership to up to four individual beneficiaries upon their passing. It offers flexibility in designating beneficiaries and allows them to avoid the complex and time-consuming probate process. By utilizing this beneficiary deed, individuals can be assured that their chosen beneficiaries will receive ownership of the property promptly, bypassing probate court involvement. This mechanism ensures an efficient transfer of property rights while minimizing additional costs and legal proceedings. Different variations of the Aurora Colorado Beneficiary Deed may include options such as: 1. Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to One Individual Beneficiary Without Successor Beneficiaries: This type of deed allows for the transfer of property ownership from a married couple or two individuals to a single designated beneficiary without any successor beneficiaries named. 2. Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Multiple Individual Beneficiaries With Successor Beneficiaries: This variation enables the property owners to designate multiple beneficiaries who will inherit the property together. In the event that one or more of the primary beneficiaries pass away, successor beneficiaries are named to ensure the smooth transfer of ownership to eligible individuals. 3. Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to a Trust Without Successor Beneficiaries: This deed allows the property owners to transfer ownership to a trust instead of individual beneficiaries. This option can be beneficial for individuals who wish to have greater control over the distribution of their assets or have specific instructions for the management and distribution of the property after their passing. Overall, the Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries offers property owners in Aurora, Colorado, a simplified and efficient way to pass their real estate to chosen beneficiaries. It is important to consult with a qualified attorney or legal professional to ensure that this type of deed is suitable for your specific circumstances and to understand all legal implications involved.Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document that enables the transfer of real estate property ownership upon the death of the owners. This type of deed is specific to the state of Colorado and provides a streamlined process for transmitting property to designated individuals without the need for probate. The Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is ideal for married couples or two individuals who jointly own property and wish to ensure a smooth transfer of ownership to up to four individual beneficiaries upon their passing. It offers flexibility in designating beneficiaries and allows them to avoid the complex and time-consuming probate process. By utilizing this beneficiary deed, individuals can be assured that their chosen beneficiaries will receive ownership of the property promptly, bypassing probate court involvement. This mechanism ensures an efficient transfer of property rights while minimizing additional costs and legal proceedings. Different variations of the Aurora Colorado Beneficiary Deed may include options such as: 1. Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to One Individual Beneficiary Without Successor Beneficiaries: This type of deed allows for the transfer of property ownership from a married couple or two individuals to a single designated beneficiary without any successor beneficiaries named. 2. Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Multiple Individual Beneficiaries With Successor Beneficiaries: This variation enables the property owners to designate multiple beneficiaries who will inherit the property together. In the event that one or more of the primary beneficiaries pass away, successor beneficiaries are named to ensure the smooth transfer of ownership to eligible individuals. 3. Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to a Trust Without Successor Beneficiaries: This deed allows the property owners to transfer ownership to a trust instead of individual beneficiaries. This option can be beneficial for individuals who wish to have greater control over the distribution of their assets or have specific instructions for the management and distribution of the property after their passing. Overall, the Aurora Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries offers property owners in Aurora, Colorado, a simplified and efficient way to pass their real estate to chosen beneficiaries. It is important to consult with a qualified attorney or legal professional to ensure that this type of deed is suitable for your specific circumstances and to understand all legal implications involved.