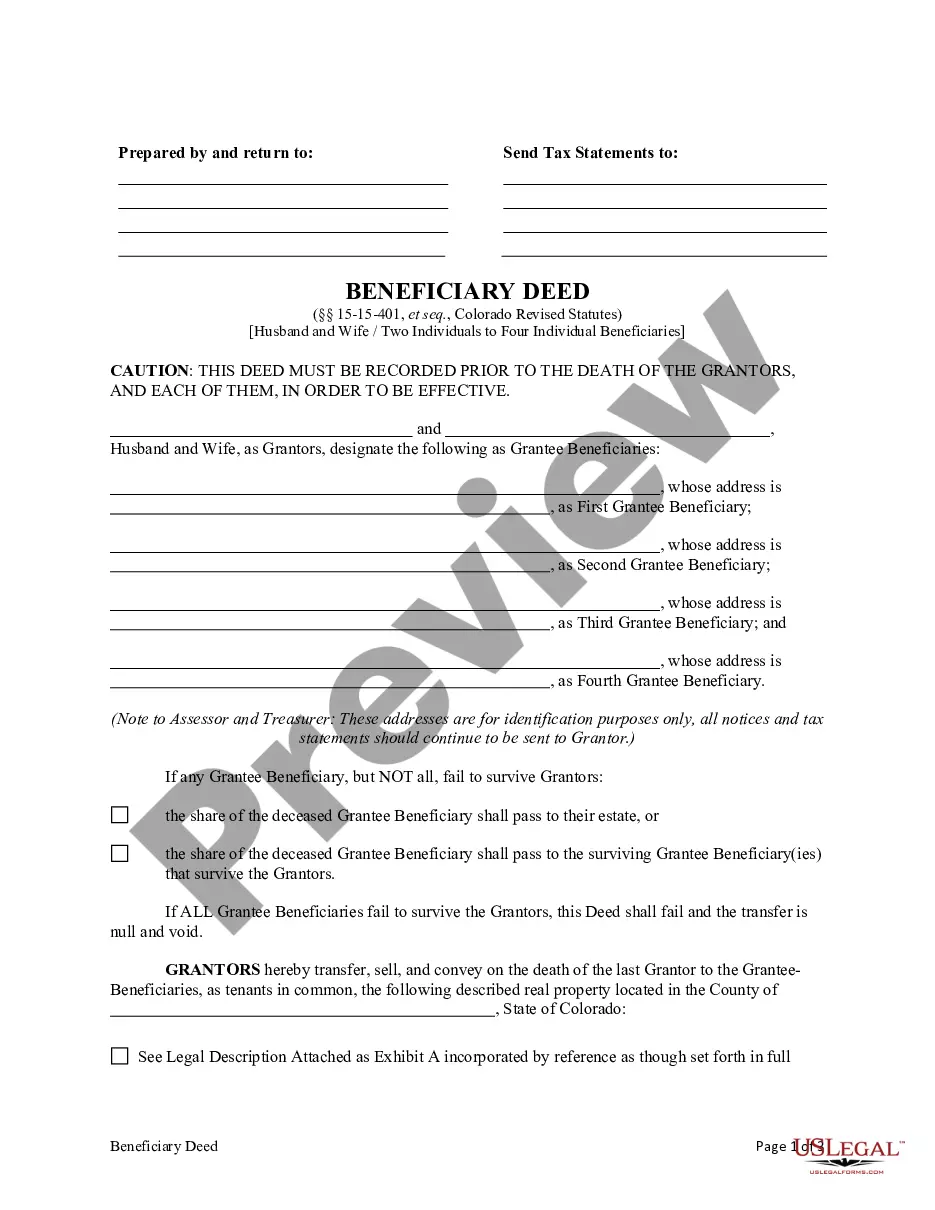

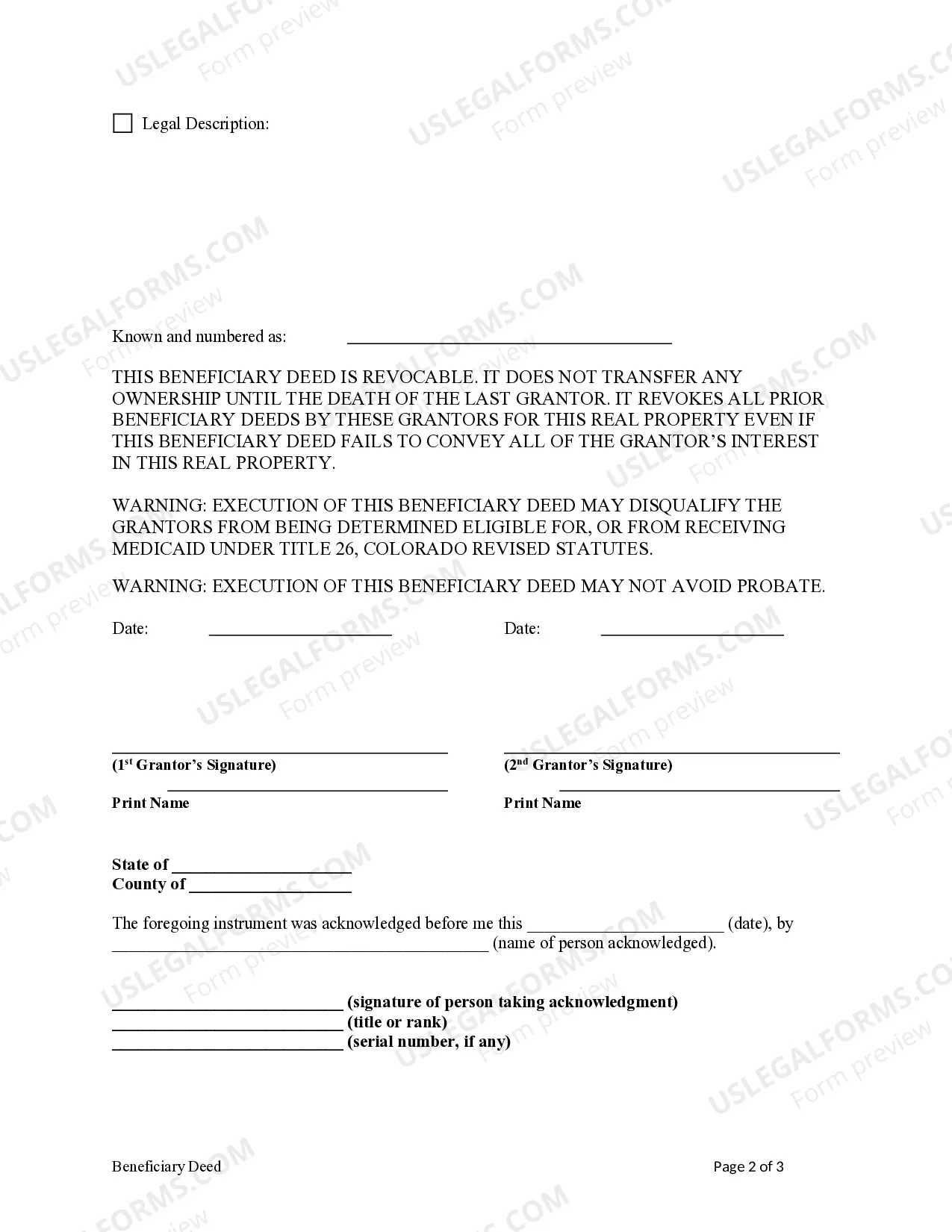

Transfer on Death Deed - Colorado - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Further, it must be recorded prior to death of last Grantor.

A Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document used to transfer property ownership to multiple beneficiaries upon the death of the original owners. This type of deed is unique in that it allows for the seamless transfer of property without the need for probate or a will. Here is a detailed description of this specific type of beneficiary deed, including its key features and benefits. The Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is designed for married couples or two individuals who wish to transfer their property to four specific individuals as beneficiaries. Unlike other beneficiary deeds that may include successor beneficiaries, this particular deed does not allow for any additional beneficiaries beyond the four designated individuals. The primary purpose of this beneficiary deed is to ensure a smooth and efficient transfer of property ownership after the death of the original owners. By stating the four individual beneficiaries without successor beneficiaries, the deed clearly outlines the intended recipients of the property. This helps to avoid any potential disputes or confusion among family members or other parties involved in the transfer. One notable advantage of this type of beneficiary deed is that it ensures that the property does not go through the probate process. Probate can be time-consuming, costly, and can lead to potential disputes among heirs. With a beneficiary deed, the property passes directly to the designated beneficiaries, bypassing probate entirely. This can save both time and money for the beneficiaries and streamline the transfer process. It is important to note that the Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries can only be used for real property located in Centennial, Colorado. The deed must conform to all applicable state laws and regulations regarding beneficiary deeds, including proper execution and recording. In summary, the Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legally binding document that allows married couples or two individuals to transfer their property to four specific beneficiaries without the need for probate or a will. The deed provides a clear and efficient method for passing on property, ensuring that the intended beneficiaries receive their rightful inheritance.A Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document used to transfer property ownership to multiple beneficiaries upon the death of the original owners. This type of deed is unique in that it allows for the seamless transfer of property without the need for probate or a will. Here is a detailed description of this specific type of beneficiary deed, including its key features and benefits. The Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is designed for married couples or two individuals who wish to transfer their property to four specific individuals as beneficiaries. Unlike other beneficiary deeds that may include successor beneficiaries, this particular deed does not allow for any additional beneficiaries beyond the four designated individuals. The primary purpose of this beneficiary deed is to ensure a smooth and efficient transfer of property ownership after the death of the original owners. By stating the four individual beneficiaries without successor beneficiaries, the deed clearly outlines the intended recipients of the property. This helps to avoid any potential disputes or confusion among family members or other parties involved in the transfer. One notable advantage of this type of beneficiary deed is that it ensures that the property does not go through the probate process. Probate can be time-consuming, costly, and can lead to potential disputes among heirs. With a beneficiary deed, the property passes directly to the designated beneficiaries, bypassing probate entirely. This can save both time and money for the beneficiaries and streamline the transfer process. It is important to note that the Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries can only be used for real property located in Centennial, Colorado. The deed must conform to all applicable state laws and regulations regarding beneficiary deeds, including proper execution and recording. In summary, the Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legally binding document that allows married couples or two individuals to transfer their property to four specific beneficiaries without the need for probate or a will. The deed provides a clear and efficient method for passing on property, ensuring that the intended beneficiaries receive their rightful inheritance.