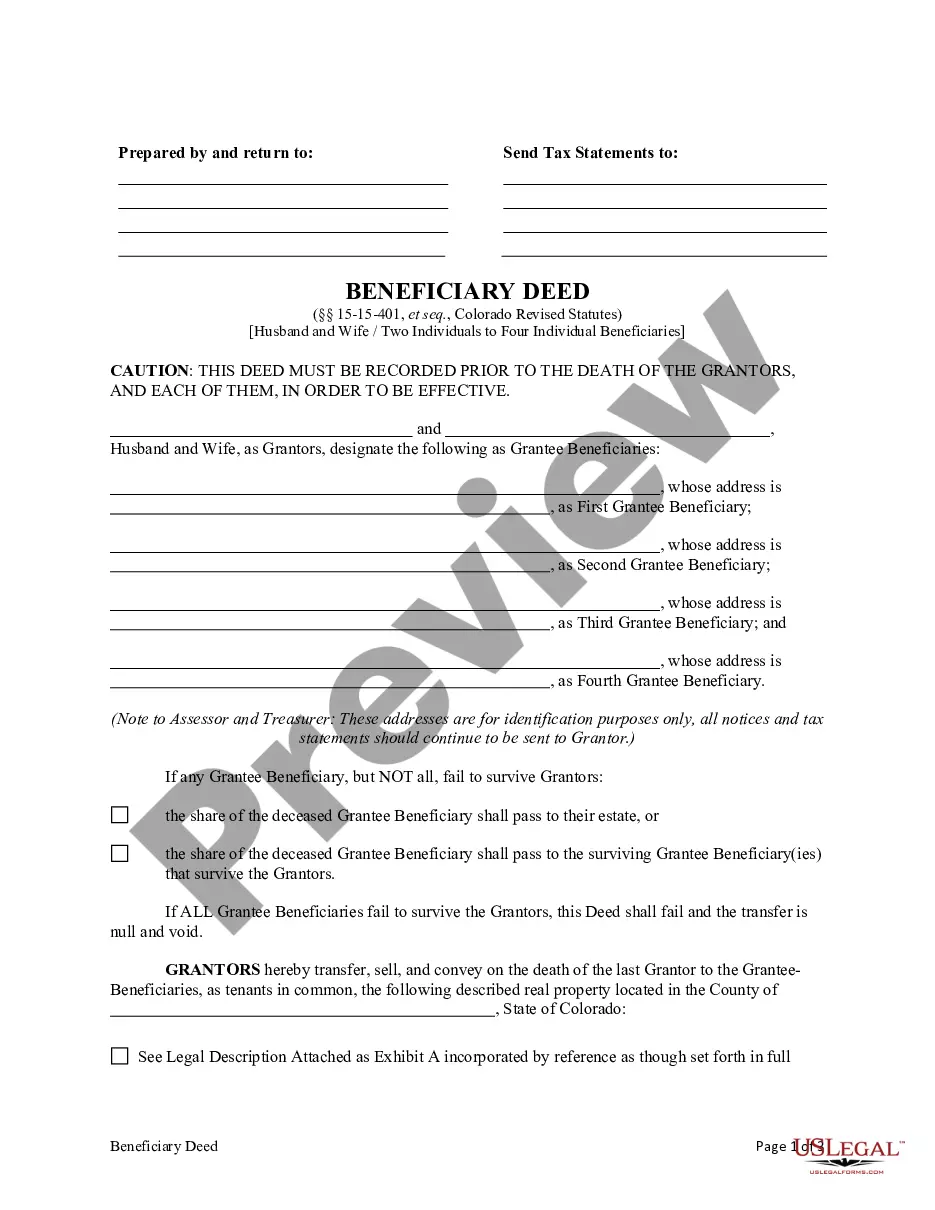

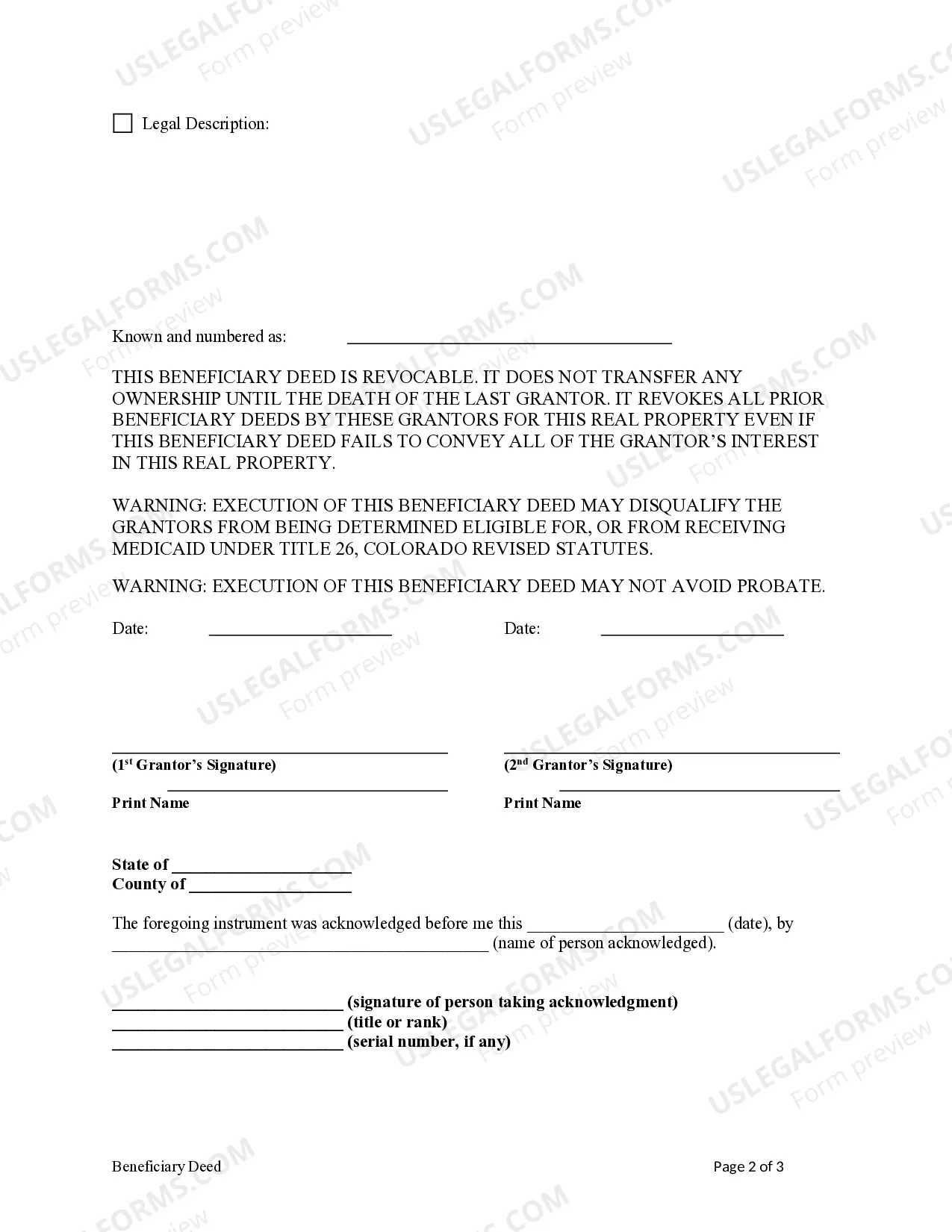

Transfer on Death Deed - Colorado - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Further, it must be recorded prior to death of last Grantor.

Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows property owners in Colorado Springs to transfer their property to up to four individual beneficiaries without any successor beneficiaries. This type of beneficiary deed is specifically designed for married couples or two individuals who want to designate multiple beneficiaries to inherit their property after their death, without the possibility of any further transfer to other beneficiaries. A Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries provides a straightforward and efficient way to transfer property ownership upon the benefactor's death. By utilizing this type of deed, individuals can ensure that their property is transferred directly to their chosen beneficiaries, bypassing probate court proceedings and potentially saving time and money for their loved ones. The main advantage of this type of beneficiary deed is the ability to name up to four individual beneficiaries without any successor beneficiaries. The benefactor can choose multiple individuals to inherit the property, such as children, grandchildren, or close friends, and specify their respective shares or percentages in the deed. This flexibility allows for a customized distribution of assets based on the benefactor's wishes. It is important to note that there are different types of beneficiary deeds available in Colorado Springs, each with its own specific characteristics and requirements. Some common types include: 1. Colorado Springs Colorado Beneficiary Deed — Individual to Individual: This type of beneficiary deed allows an individual property owner to transfer their property to a single beneficiary of their choice without any successor beneficiaries. It is suitable for individuals who want to transfer property ownership quickly and efficiently. 2. Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to One Individual Beneficiary Without Successor Beneficiaries: This variant allows married couples or two individuals to transfer their property to a single beneficiary without any successor beneficiaries. It is suitable for couples or individuals who have a clear intention to leave their property to a specific person or organization. 3. Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Multiple Beneficiaries With Successor Beneficiaries: This type of beneficiary deed enables married couples or two individuals to transfer their property to multiple beneficiaries with the provision of successor beneficiaries. Successor beneficiaries are named individuals who will inherit the property if any of the primary beneficiaries pass away before the benefactor. Regardless of the specific type of Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries, it is crucial to consult with an experienced attorney to ensure the deed is properly executed and meets all legal requirements.Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows property owners in Colorado Springs to transfer their property to up to four individual beneficiaries without any successor beneficiaries. This type of beneficiary deed is specifically designed for married couples or two individuals who want to designate multiple beneficiaries to inherit their property after their death, without the possibility of any further transfer to other beneficiaries. A Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries provides a straightforward and efficient way to transfer property ownership upon the benefactor's death. By utilizing this type of deed, individuals can ensure that their property is transferred directly to their chosen beneficiaries, bypassing probate court proceedings and potentially saving time and money for their loved ones. The main advantage of this type of beneficiary deed is the ability to name up to four individual beneficiaries without any successor beneficiaries. The benefactor can choose multiple individuals to inherit the property, such as children, grandchildren, or close friends, and specify their respective shares or percentages in the deed. This flexibility allows for a customized distribution of assets based on the benefactor's wishes. It is important to note that there are different types of beneficiary deeds available in Colorado Springs, each with its own specific characteristics and requirements. Some common types include: 1. Colorado Springs Colorado Beneficiary Deed — Individual to Individual: This type of beneficiary deed allows an individual property owner to transfer their property to a single beneficiary of their choice without any successor beneficiaries. It is suitable for individuals who want to transfer property ownership quickly and efficiently. 2. Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to One Individual Beneficiary Without Successor Beneficiaries: This variant allows married couples or two individuals to transfer their property to a single beneficiary without any successor beneficiaries. It is suitable for couples or individuals who have a clear intention to leave their property to a specific person or organization. 3. Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Multiple Beneficiaries With Successor Beneficiaries: This type of beneficiary deed enables married couples or two individuals to transfer their property to multiple beneficiaries with the provision of successor beneficiaries. Successor beneficiaries are named individuals who will inherit the property if any of the primary beneficiaries pass away before the benefactor. Regardless of the specific type of Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries, it is crucial to consult with an experienced attorney to ensure the deed is properly executed and meets all legal requirements.