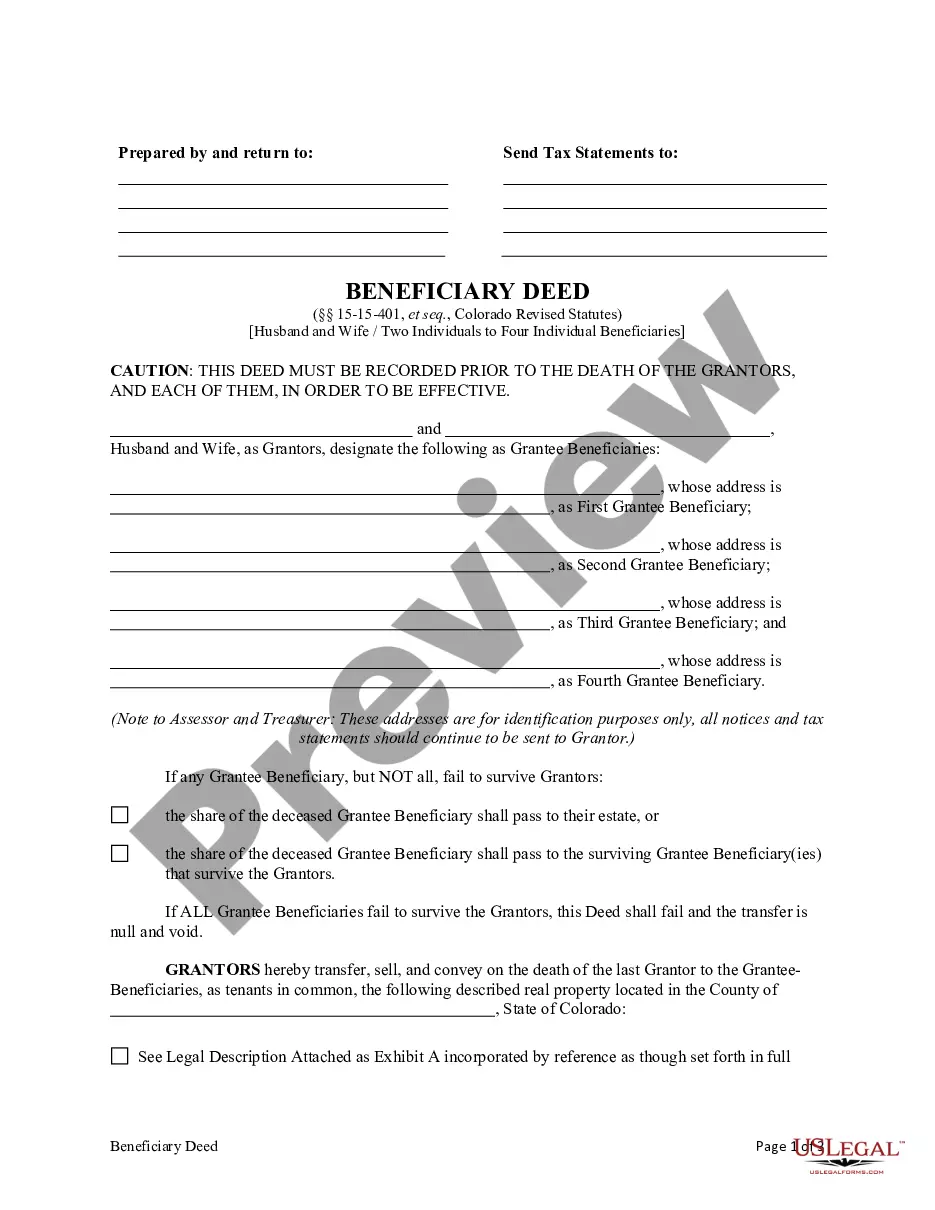

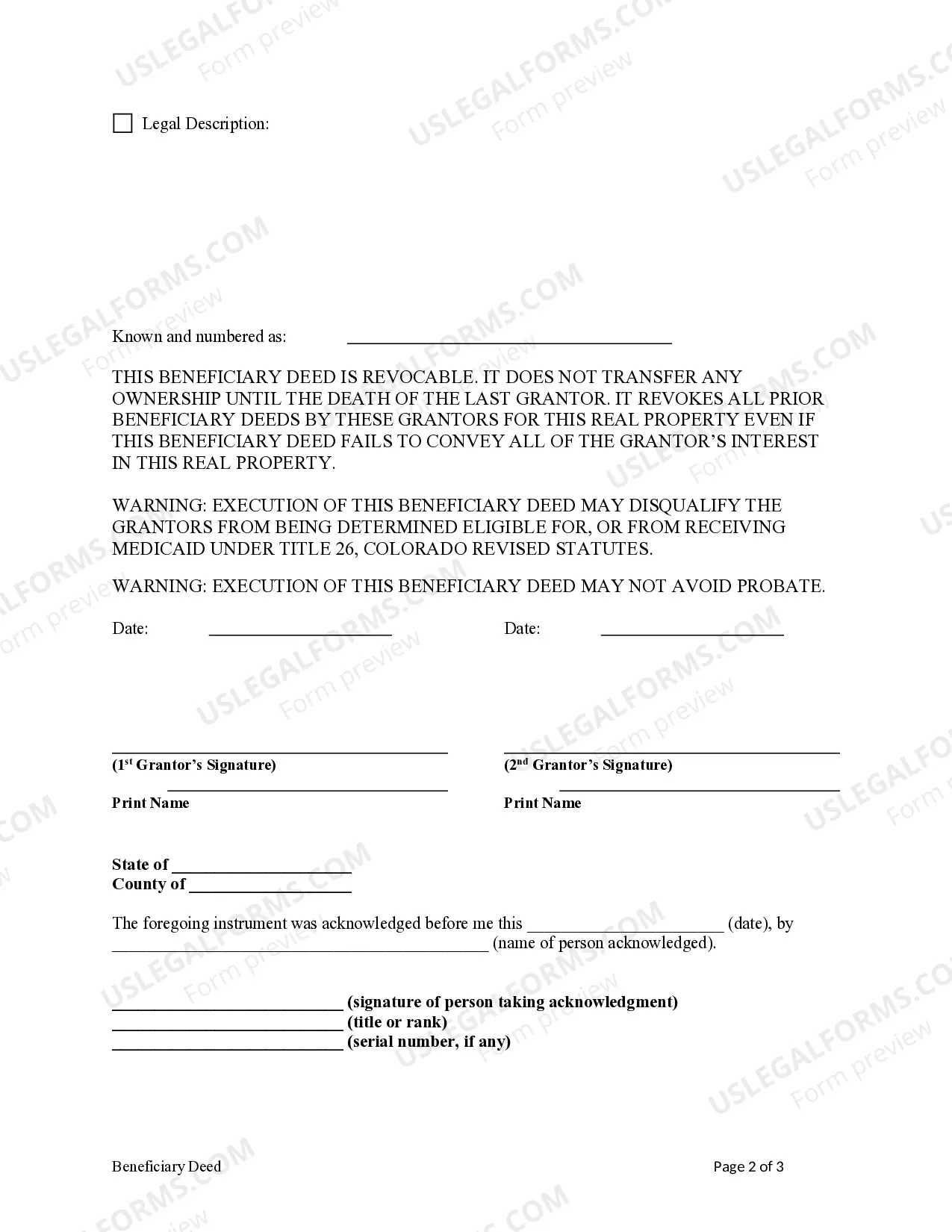

Transfer on Death Deed - Colorado - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Further, it must be recorded prior to death of last Grantor.

A Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows property owners in Fort Collins, Colorado to transfer their real estate assets to four specific individuals without the need for probate or a will. This type of beneficiary deed is commonly used by married couples or two individuals who wish to ensure their property is transferred directly to their chosen beneficiaries upon their death, while also preventing the need for court involvement. In this specific scenario, the deed allows married couples or two individuals to name four individual beneficiaries who will inherit the property. It is important to note that this type of deed does not involve any successor beneficiaries, meaning that if any of the named beneficiaries were to predecease the owners, their share would not pass on to their heirs automatically. The Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries offers flexibility for property owners, as they can choose the specific individuals they want to inherit their property. This could include family members, friends, or anyone else they wish to pass their assets to. By utilizing this type of deed, property owners can avoid the complexities and delays associated with probate, potentially saving their loved one's time and money. However, it is crucial to work with an experienced attorney to ensure the deed is properly executed and meets all legal requirements in Fort Collins, Colorado. Other types of Beneficiary Deeds available in Fort Collins, Colorado may include different combinations of granters (individuals transferring the property) and beneficiaries. Some common variations include: 1. Fort Collins Colorado Beneficiary Deed — Individual to Husband and Wife: This type of deed allows an individual property owner to transfer their property to a married couple as beneficiaries. 2. Fort Collins Colorado Beneficiary Deed — Husband and Wife to Husband and Wife: This variation is used when a married couple owning a property wishes to transfer it to another married couple as beneficiaries. 3. Fort Collins Colorado Beneficiary Deed — Individual to Individual: This form of beneficiary deed allows an individual property owner to transfer their property to another individual as the beneficiary. When considering any type of beneficiary deed, it is essential to consult with a qualified attorney who can provide guidance on the specific requirements and legal implications in Fort Collins, Colorado.A Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows property owners in Fort Collins, Colorado to transfer their real estate assets to four specific individuals without the need for probate or a will. This type of beneficiary deed is commonly used by married couples or two individuals who wish to ensure their property is transferred directly to their chosen beneficiaries upon their death, while also preventing the need for court involvement. In this specific scenario, the deed allows married couples or two individuals to name four individual beneficiaries who will inherit the property. It is important to note that this type of deed does not involve any successor beneficiaries, meaning that if any of the named beneficiaries were to predecease the owners, their share would not pass on to their heirs automatically. The Fort Collins Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries offers flexibility for property owners, as they can choose the specific individuals they want to inherit their property. This could include family members, friends, or anyone else they wish to pass their assets to. By utilizing this type of deed, property owners can avoid the complexities and delays associated with probate, potentially saving their loved one's time and money. However, it is crucial to work with an experienced attorney to ensure the deed is properly executed and meets all legal requirements in Fort Collins, Colorado. Other types of Beneficiary Deeds available in Fort Collins, Colorado may include different combinations of granters (individuals transferring the property) and beneficiaries. Some common variations include: 1. Fort Collins Colorado Beneficiary Deed — Individual to Husband and Wife: This type of deed allows an individual property owner to transfer their property to a married couple as beneficiaries. 2. Fort Collins Colorado Beneficiary Deed — Husband and Wife to Husband and Wife: This variation is used when a married couple owning a property wishes to transfer it to another married couple as beneficiaries. 3. Fort Collins Colorado Beneficiary Deed — Individual to Individual: This form of beneficiary deed allows an individual property owner to transfer their property to another individual as the beneficiary. When considering any type of beneficiary deed, it is essential to consult with a qualified attorney who can provide guidance on the specific requirements and legal implications in Fort Collins, Colorado.