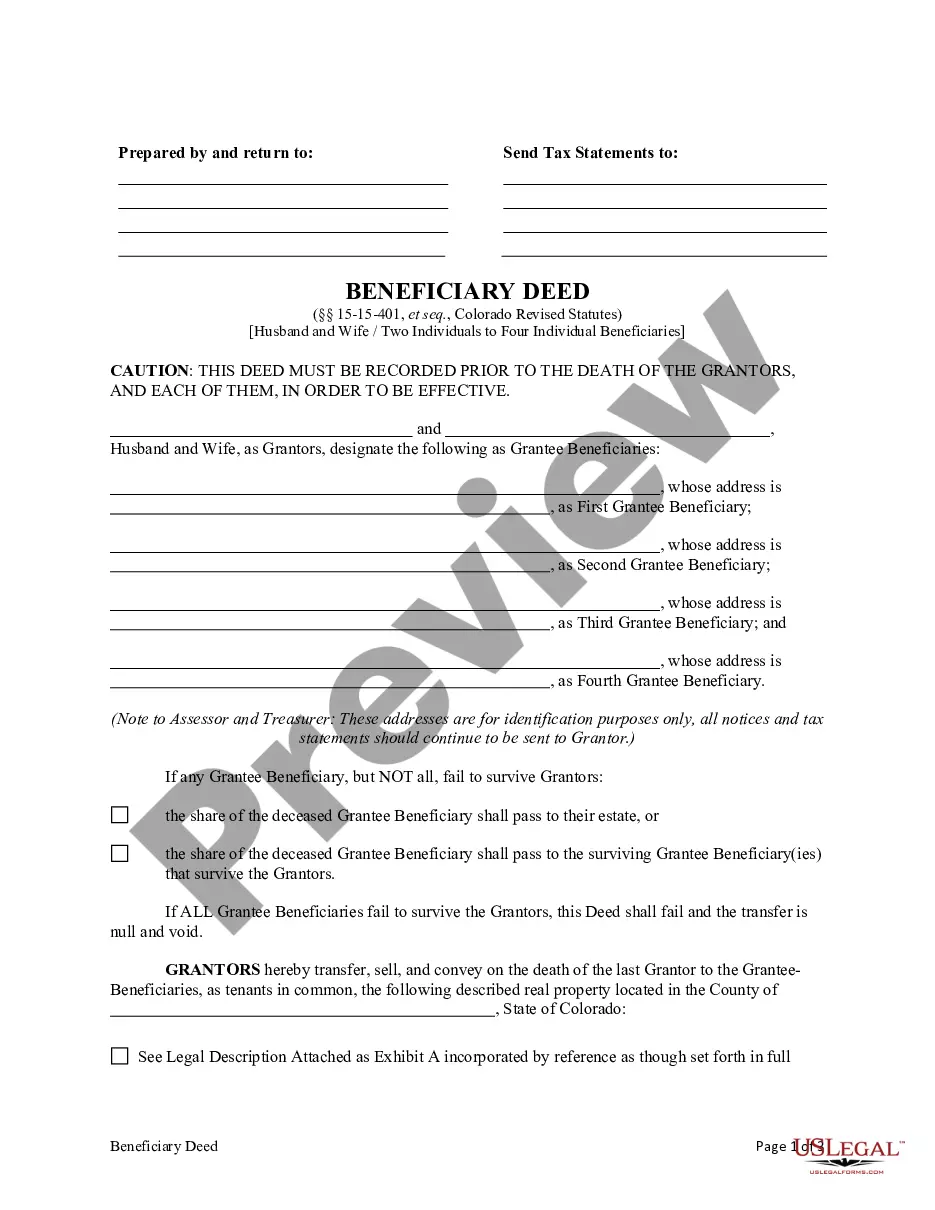

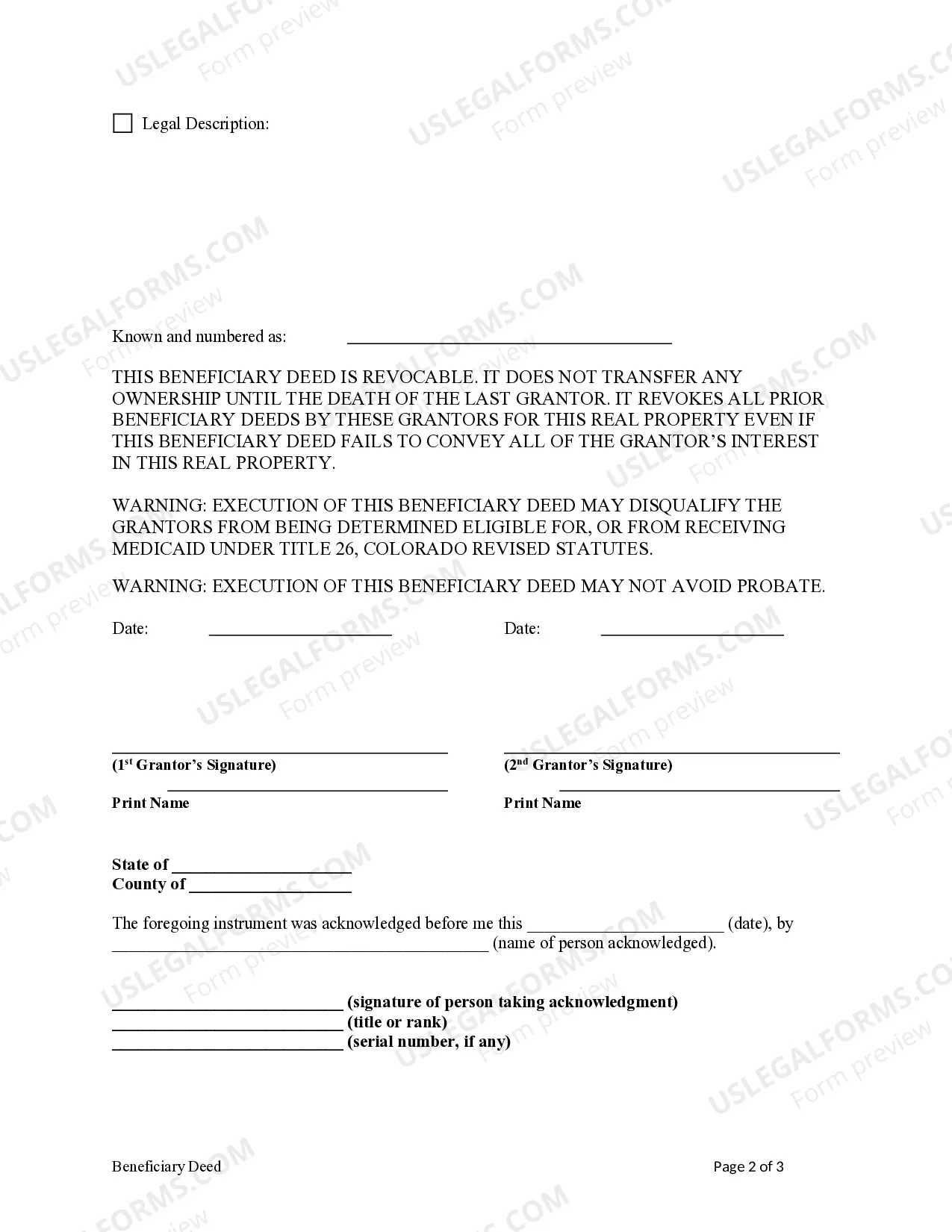

Transfer on Death Deed - Colorado - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Further, it must be recorded prior to death of last Grantor.

A Lakewood Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows property owners to transfer their real estate interests to specific beneficiaries upon their death, without the need for probate. Keywords: Lakewood Colorado, beneficiary deed, husband and wife, two individuals, four individual beneficiaries, without successor beneficiaries. This type of beneficiary deed is specifically designed for married couples or two individuals who jointly own a property and wish to name four individual beneficiaries to receive the property upon their death. It is important to note that this deed does not involve any successor beneficiaries, meaning that if any of the named beneficiaries pass away before the property owners, their share of the property will not be automatically transferred to their heirs or any other individuals. One of the key benefits of this type of deed is that it allows for the direct transfer of property to the named beneficiaries, thereby avoiding the probate process. Probate can be time-consuming and costly, and having a beneficiary deed in place can help streamline the transfer of property and save the beneficiaries from potential legal hurdles. It is important to consult with a qualified attorney or real estate professional familiar with Colorado state laws to ensure that this type of deed is suitable for your specific situation. They can provide guidance on drafting the deed, ensuring it complies with all legal requirements, and help you name the appropriate beneficiaries. In addition to the Lakewood Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries, there may be other variations of beneficiary deeds specific to different situations. These variations may include: 1. Beneficiary Deed — Single Individual to Single Individual Beneficiary: This type of deed is designed for single individuals who wish to transfer their property to a single beneficiary upon their death. It can be a useful estate planning tool for individuals without spouses or partners. 2. Beneficiary Deed — Parent to Minor Children: This deed is specifically designed for parents who want to pass on their property to their minor children. It ensures a smooth transfer of property without the need for probate, as minors cannot legally own property in their own names. 3. Beneficiary Deed — Joint Tenancy with Right of Survivorship: This type of deed allows property owners to automatically transfer their interests in a jointly owned property to the surviving owner(s) upon their death. It is commonly used by married couples or business partners who want to ensure seamless property transfer without probate. These are just a few examples of the different types of beneficiary deeds that may exist. It is crucial to consult with a professional to determine the most appropriate option for your specific circumstances and ensure compliance with local laws and regulations.A Lakewood Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows property owners to transfer their real estate interests to specific beneficiaries upon their death, without the need for probate. Keywords: Lakewood Colorado, beneficiary deed, husband and wife, two individuals, four individual beneficiaries, without successor beneficiaries. This type of beneficiary deed is specifically designed for married couples or two individuals who jointly own a property and wish to name four individual beneficiaries to receive the property upon their death. It is important to note that this deed does not involve any successor beneficiaries, meaning that if any of the named beneficiaries pass away before the property owners, their share of the property will not be automatically transferred to their heirs or any other individuals. One of the key benefits of this type of deed is that it allows for the direct transfer of property to the named beneficiaries, thereby avoiding the probate process. Probate can be time-consuming and costly, and having a beneficiary deed in place can help streamline the transfer of property and save the beneficiaries from potential legal hurdles. It is important to consult with a qualified attorney or real estate professional familiar with Colorado state laws to ensure that this type of deed is suitable for your specific situation. They can provide guidance on drafting the deed, ensuring it complies with all legal requirements, and help you name the appropriate beneficiaries. In addition to the Lakewood Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Four Individual Beneficiaries Without Successor Beneficiaries, there may be other variations of beneficiary deeds specific to different situations. These variations may include: 1. Beneficiary Deed — Single Individual to Single Individual Beneficiary: This type of deed is designed for single individuals who wish to transfer their property to a single beneficiary upon their death. It can be a useful estate planning tool for individuals without spouses or partners. 2. Beneficiary Deed — Parent to Minor Children: This deed is specifically designed for parents who want to pass on their property to their minor children. It ensures a smooth transfer of property without the need for probate, as minors cannot legally own property in their own names. 3. Beneficiary Deed — Joint Tenancy with Right of Survivorship: This type of deed allows property owners to automatically transfer their interests in a jointly owned property to the surviving owner(s) upon their death. It is commonly used by married couples or business partners who want to ensure seamless property transfer without probate. These are just a few examples of the different types of beneficiary deeds that may exist. It is crucial to consult with a professional to determine the most appropriate option for your specific circumstances and ensure compliance with local laws and regulations.