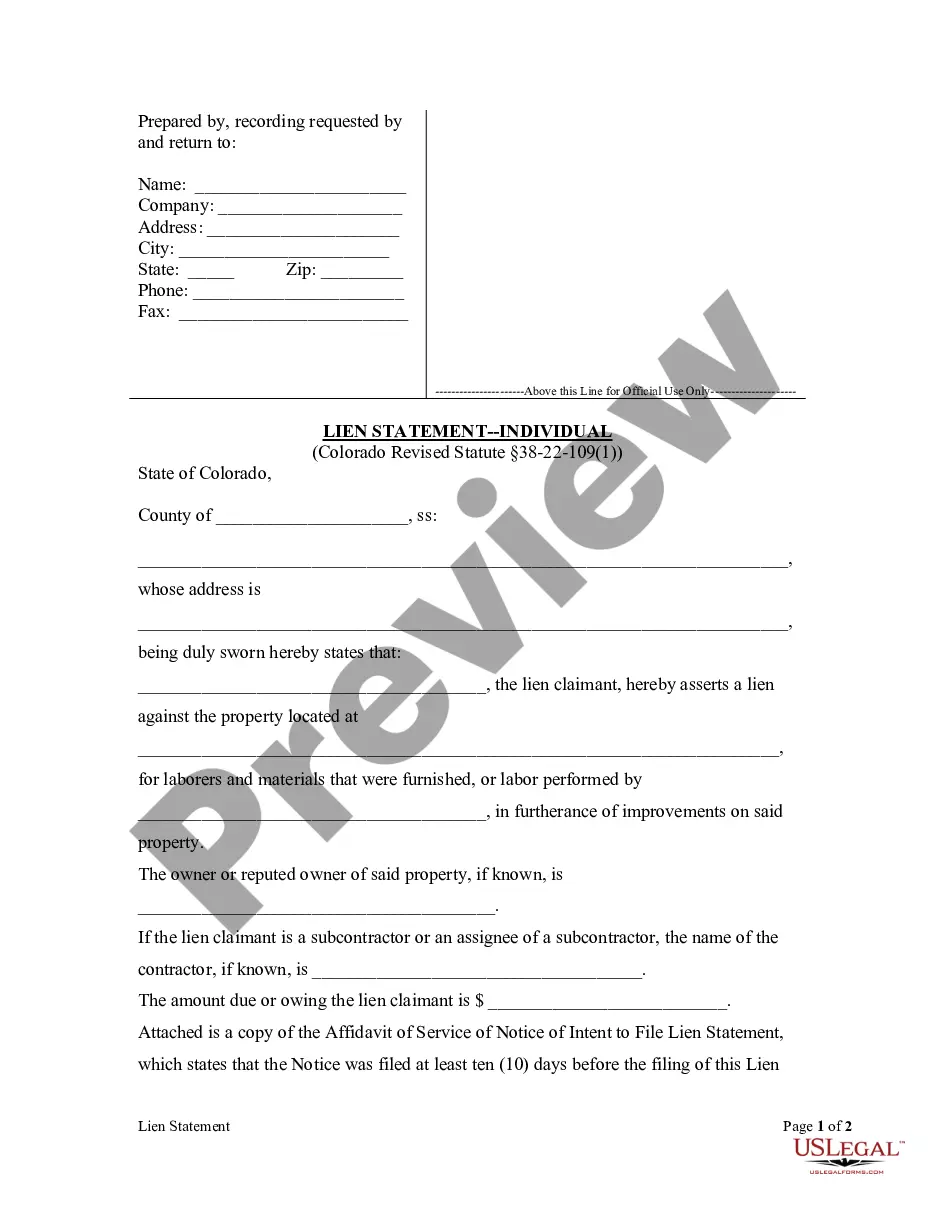

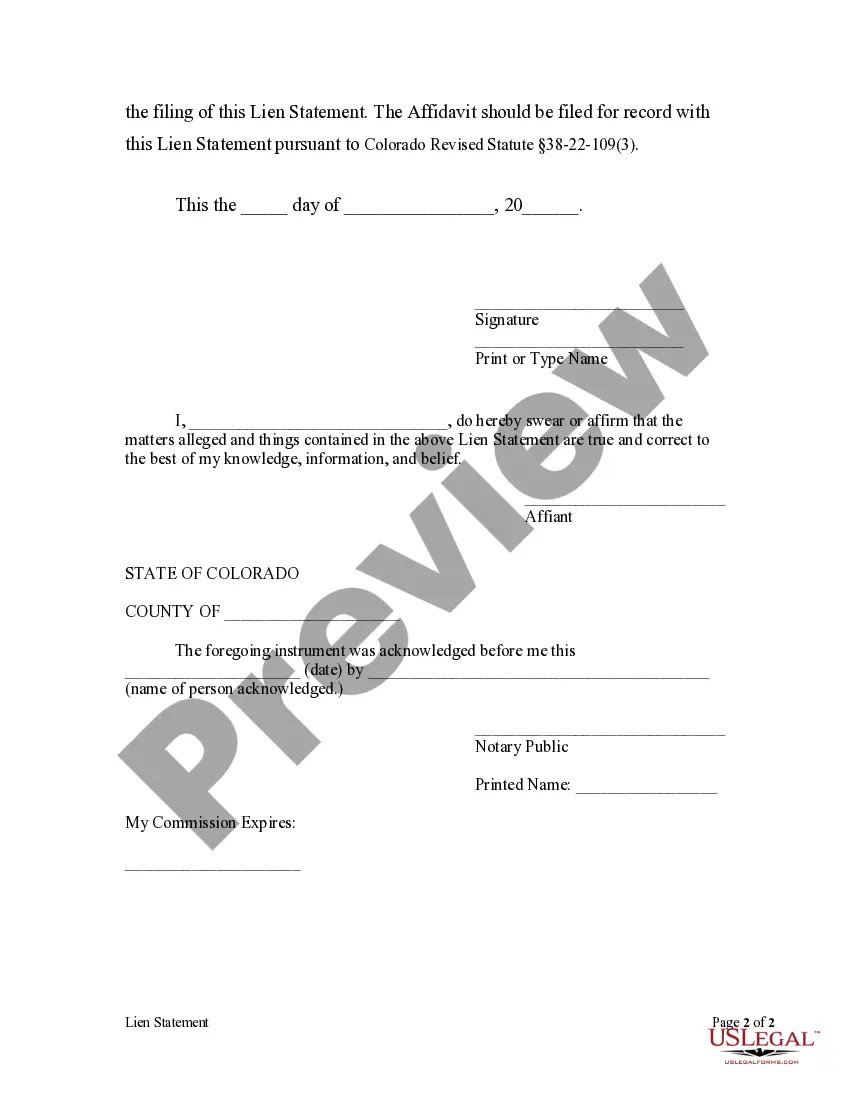

This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Aurora Colorado Lien Statement - Individual

Description

How to fill out Colorado Lien Statement - Individual?

Acquiring validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents catering to individual and professional requirements for various real-life situations.

All the forms are meticulously organized by their area of application and jurisdiction, making it as straightforward as pie to find the Aurora Colorado Lien Statement - Individual.

Maintaining organized paperwork that adheres to legal standards is highly crucial. Take advantage of the US Legal Forms library to have necessary document templates readily accessible for all your requirements!

- Examine the Preview mode and form description.

- Ensure you have chosen the right one that aligns with your needs and fully complies with your local jurisdiction stipulations.

- Search for an alternative template if necessary.

- If you come across any discrepancies, utilize the Search tab above to find the correct template. If it fits your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

In Colorado, the notice extending the time to file a lien statement provides additional time for individuals to submit their Aurora Colorado Lien Statement - Individual. This extension can be crucial in ensuring that all necessary documentation is accurately prepared and filed. Typically, this notice must be issued within a specific timeframe after the initial deadline. Make sure to stay informed about the specific dates to protect your rights and interests in any property.

Yes, in some instances, someone can put a lien on your property without notifying you first. The law often allows creditors to file a lien based on a legal judgment or unpaid debt. It is crucial to regularly check your property records to stay informed. By obtaining an Aurora Colorado Lien Statement - Individual, you can ensure you are aware of any liens affecting your property.

If someone puts a lien on your house, you should first confirm its validity. You can contact a legal expert for assistance and explore options for dispute resolution. It's also wise to gather documentation supporting your claim. Utilizing the Aurora Colorado Lien Statement - Individual can provide essential information about the lien's details and help you take the next steps.

No, someone cannot randomly put a lien on your house without a valid reason. Typically, a lien requires proof of debt or a legal decision. If you are facing issues related to a lien, it is important to review your situation. Using tools like the Aurora Colorado Lien Statement - Individual can help clarify your standing.

A Colorado Statement of mechanics lien is a legal document that provides notice of a party's claim for payment for labor or materials supplied in the construction or improvement of a property. It must detail the scope of work, the property's location, and other relevant identifiers. Understanding this document is vital for both contractors and property owners to ensure all claims are addressed through the correct channels like the Aurora Colorado Lien Statement - Individual.

In Colorado, the minimum amount for filing a mechanic's lien varies based on the type of work performed, but there is no set dollar limit for the lien itself. However, it's essential to document all work and expenses accurately to justify the amount claimed. Utilizing services like US Legal Forms can assist you in navigating the requirements associated with the Aurora Colorado Lien Statement - Individual.

In Colorado, a mechanic's lien typically lasts for six months after it is filed, assuming no legal action is taken. However, if the lienholder initiates a foreclosure or other legal proceedings, it can continue until resolved. Understanding the timeline associated with a mechanic's lien is crucial, especially when considering the Aurora Colorado Lien Statement - Individual to protect your interests.

To find a lien on a property in Colorado, you can visit the county clerk and recorder's office for the area where the property is located. Most counties offer online databases where you can search using the property address or owner's name. Keeping track of liens is vital, as they can impact property transactions; the Aurora Colorado Lien Statement - Individual can help clarify obligations.

You can obtain a lien release form from various sources, including your local county clerk's office. Alternatively, US Legal Forms provides easily accessible templates online for the Aurora Colorado Lien Statement - Individual. This service saves time and ensures that you use an appropriate and legally compliant form. Additionally, it's a user-friendly resource for both individuals and businesses.

Filling out a contractor's affidavit involves providing your business information, detailing the work performed, and specifying payment status. It should clearly outline the project details and any claims for payment via an Aurora Colorado Lien Statement - Individual. Using a trusted platform like uslegalforms can streamline this process effectively.