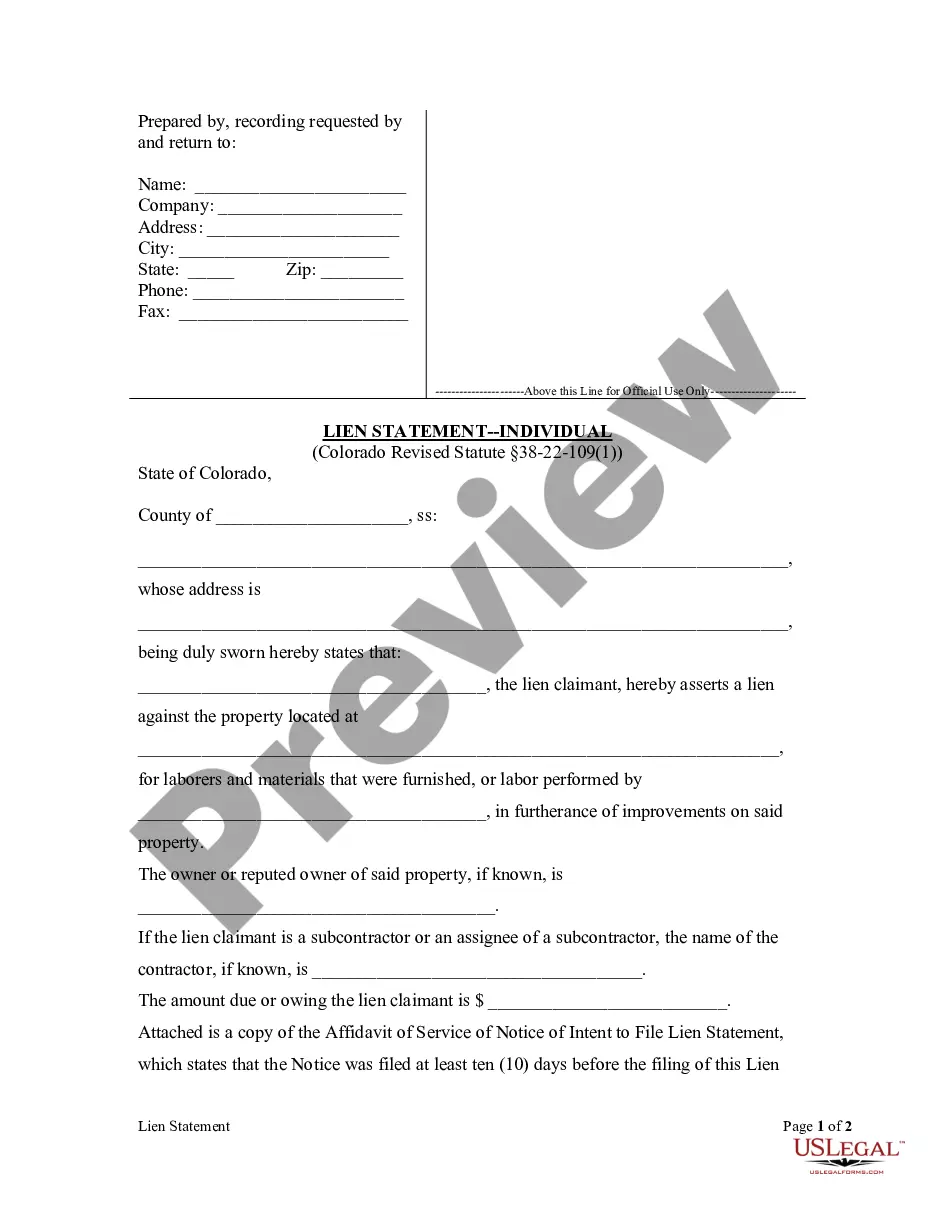

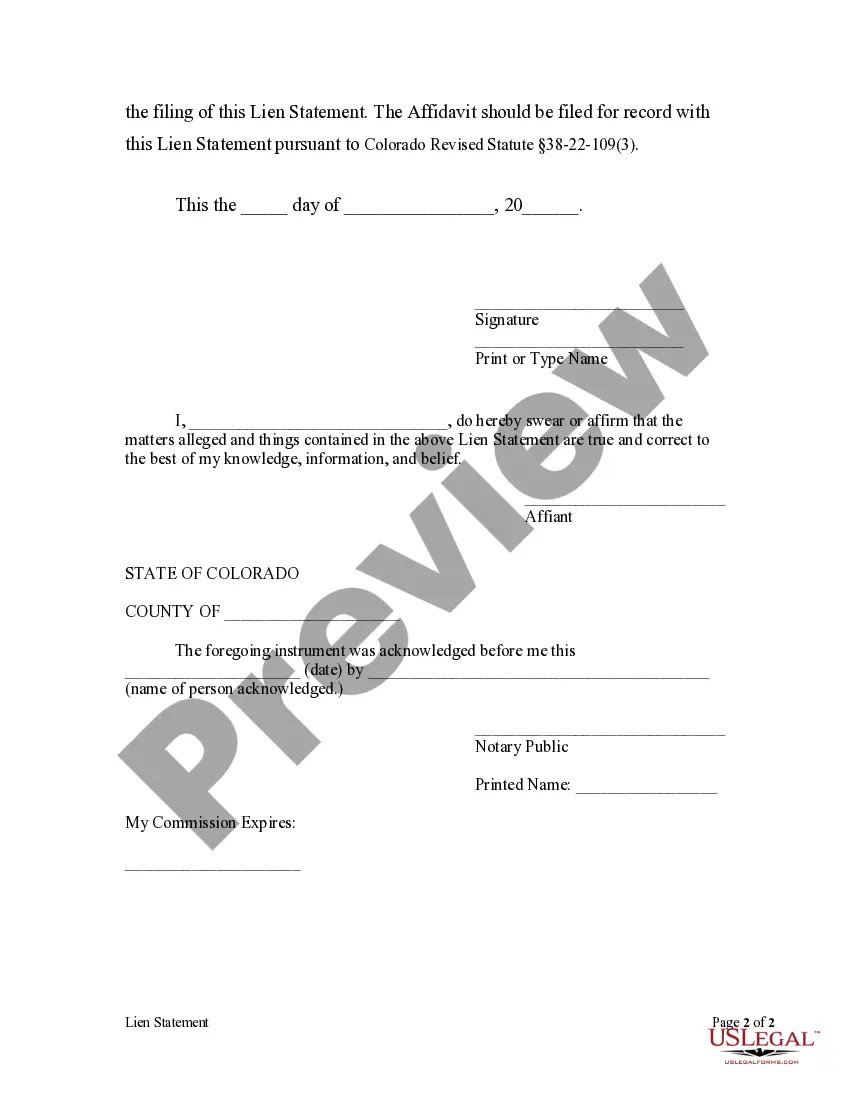

This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Centennial Colorado Lien Statement - Individual

Description

How to fill out Colorado Lien Statement - Individual?

We consistently aim to reduce or evade legal repercussions when navigating intricate law-related or financial matters.

To achieve this, we engage attorney services that are typically very costly.

Nonetheless, not all legal concerns possess the same level of complexity, and many of them can be effectively managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it in the My documents tab. The procedure remains just as simple if you’re new to the website! You can create your account in a matter of minutes. Ensure the Centennial Colorado Lien Statement - Individual complies with the laws and regulations of your state and area. Additionally, it is vital to review the form’s outline (if available), and if you identify any inconsistencies with your initial requirements, look for an alternative form. Once you’ve confirmed that the Centennial Colorado Lien Statement - Individual suits your case, you can select a subscription plan and proceed with payment. You can then download the form in your preferred file format. For over 24 years, we’ve assisted millions by providing ready-to-customize and up-to-date legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Our platform empowers you to handle your matters independently without resorting to an attorney.

- We provide access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, making the search process much easier.

- Benefit from US Legal Forms when you need to locate and securely download the Centennial Colorado Lien Statement - Individual or any other form with ease.

Form popularity

FAQ

Yes, you can waive lien rights in Colorado, but this must be done with care. When you execute a waiver, it should be clear and specific, often outlined in a document like the Centennial Colorado Lien Statement - Individual. This process is crucial for protecting your interests while maintaining compliance with local laws. Our platform can assist you in drafting a proper waiver to ensure it meets legal requirements.

In Colorado, a notice extending the time to file a lien statement allows lien claimants more time to submit their statements. This document must be served to all parties involved and typically grants an extension of up to 90 days. Understanding this process is crucial for effective lien management, and using the Centennial Colorado Lien Statement - Individual can help guide you through the timeline. Uslegalforms provides clarity on these notices, ensuring you stay informed.

To secure a lien release in Colorado, you typically need the original lien document, proof of payment, and any necessary forms, including the Centennial Colorado Lien Statement - Individual. The release must also be signed by the lien holder. It is essential to file the release with the appropriate county clerk to make it official. Using uslegalforms can help you ensure your completion of the required documents.

To complete a waiver of lien, you must identify the project and the parties involved clearly. You should include the specific amounts that are being waived and ensure that the waiver is signed and dated. Using the Centennial Colorado Lien Statement - Individual can simplify this process. Our platform offers templates and guidance to assist you in creating an effective waiver.

In Colorado, not all liens need notarization, but certain types, such as those involving real estate, often do. For the Centennial Colorado Lien Statement - Individual, it’s advisable to have your lien notarized to ensure its validity. Notarization can help prevent disputes and provide additional legal standing. Always check local requirements and consider using platforms like uslegalforms to streamline the process.

In Colorado, lien waivers typically do not need to be notarized to be effective. However, having a notarized lien waiver may provide extra protection against disputes. It is wise to ensure that all legal documents related to liens are executed correctly. You might consider consulting the Centennial Colorado Lien Statement - Individual to better understand the waiver process.

Yes, it is possible for someone to put a lien on your house without your knowledge in Colorado. The legal framework allows for liens to be recorded publicly without informing the homeowner beforehand. Keeping track of your property records regularly can help you stay informed about any liens. Utilizing the Centennial Colorado Lien Statement - Individual will assist you in recognizing any filings that may affect your property.

If someone has placed a lien on your house, it is important to take immediate steps to address the situation. Start by reviewing the lien to determine its validity and the amount owed. You can negotiate with the creditor to resolve the debt or contest the lien if it is improperly filed. Resources like the Centennial Colorado Lien Statement - Individual can help you navigate these challenges effectively.

In many cases, a lien can be filed without notification to the homeowner. Creditors may not be required to inform you before placing a lien. However, upon filing, the lien typically becomes part of public records. To understand your rights and the implications of a lien, you can refer to the Centennial Colorado Lien Statement - Individual for guidance.

In Colorado, a mechanic's lien allows contractors, subcontractors, or suppliers to secure payment for services rendered on a property. Once filed, the lien creates a legal claim against the property, which can complicate its sale until the debt is resolved. For individuals navigating a Centennial Colorado Lien Statement - Individual, understanding this process is essential, and utilizing platforms like US Legal Forms can simplify filing and compliance.