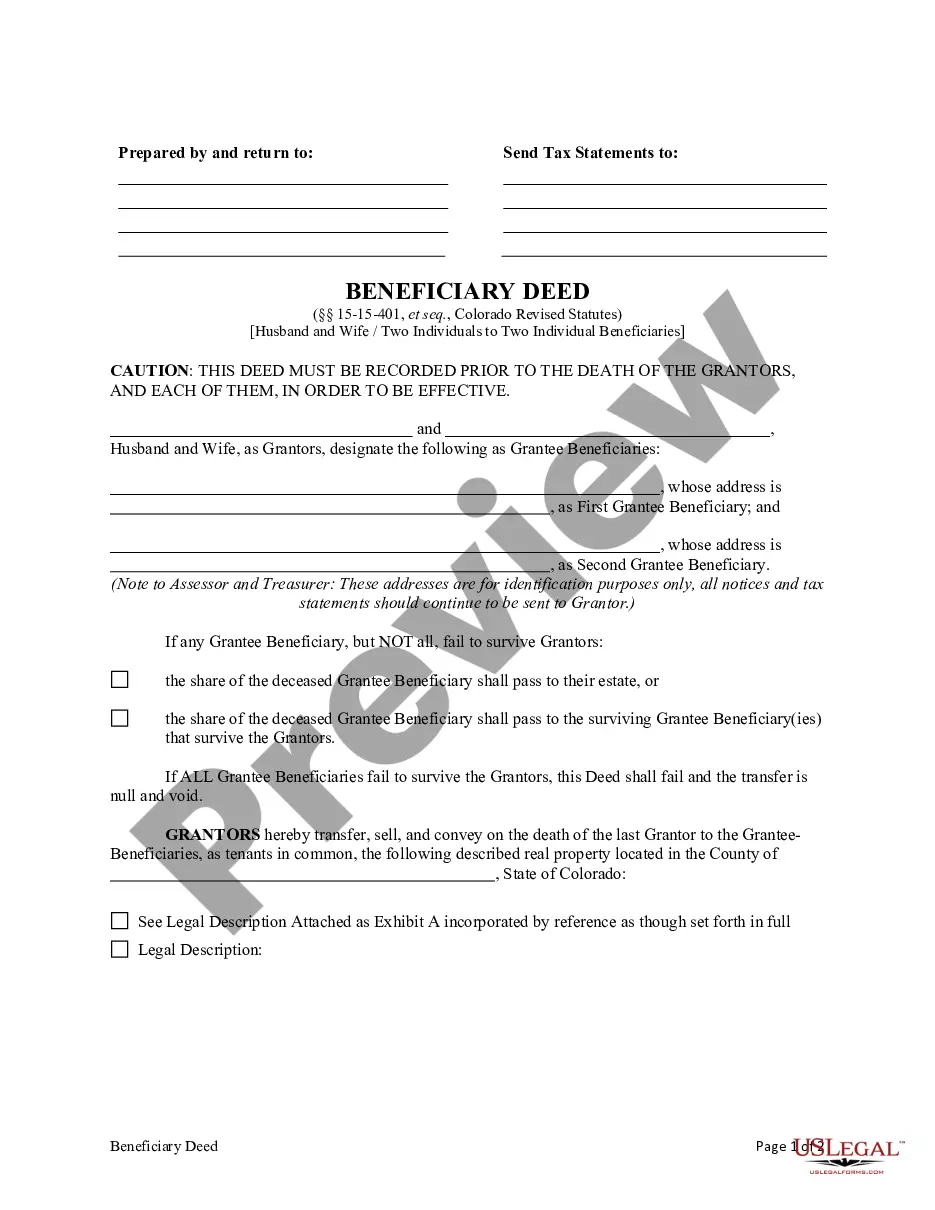

This form is a Beneficiary Deed where the Grantors are two individuals, or husband and wife, and there are two individual Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantors convey and transfer, upon the death of the survivor Grantor, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to either Grantor's death. This deed complies with all state statutory laws.

Arvada Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows property owners in Arvada, Colorado, to transfer their real estate assets to two individual beneficiaries without any designated successor beneficiaries. This type of beneficiary deed is specifically designed for married couples or two individuals who want to allocate their property rights to specific beneficiaries upon their death, without any provision for successor beneficiaries. It provides a straightforward and efficient way to transfer ownership of real estate to chosen individuals while minimizing the need for probate. The Arvada Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries allows property owners to maintain complete control and ownership of their property during their lifetime. They can freely use, sell, mortgage, or modify the property without any restrictions. The transfer of ownership to the beneficiaries only occurs upon the death of the property owners. By using this type of beneficiary deed, property owners ensure that their chosen beneficiaries inherit the property seamlessly and directly, bypassing the costly and time-consuming probate process. It provides peace of mind knowing that their real estate assets will be transferred according to their wishes, without the need for court involvement. It is important to note that there are no specific subtypes or variations of the Arvada Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries. However, it is always recommended consulting with a knowledgeable attorney or legal professional to ensure compliance with local laws and to address any specific requirements or circumstances. Using keywords relevant to this topic, here are some possible variations of Arvada Colorado Beneficiary Deed: 1. Arvada Colorado Joint Beneficiary Deed — Husband and Wife to Two Individual Beneficiaries Without Successor Beneficiaries 2. Arvada Colorado Beneficiary Deed — Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries 3. Arvada Colorado Spousal Beneficiary Deed — Husband and Wife to Two Individual Beneficiaries Without Successor Beneficiaries 4. Arvada Colorado Beneficiary Deed — Transfer of Ownership to Two Individual Beneficiaries Without Successor Beneficiaries Remember, it is crucial to consult with a legal professional or attorney before attempting to create or execute an Arvada Colorado Beneficiary Deed to ensure it aligns with specific state laws and individual circumstances.Arvada Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows property owners in Arvada, Colorado, to transfer their real estate assets to two individual beneficiaries without any designated successor beneficiaries. This type of beneficiary deed is specifically designed for married couples or two individuals who want to allocate their property rights to specific beneficiaries upon their death, without any provision for successor beneficiaries. It provides a straightforward and efficient way to transfer ownership of real estate to chosen individuals while minimizing the need for probate. The Arvada Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries allows property owners to maintain complete control and ownership of their property during their lifetime. They can freely use, sell, mortgage, or modify the property without any restrictions. The transfer of ownership to the beneficiaries only occurs upon the death of the property owners. By using this type of beneficiary deed, property owners ensure that their chosen beneficiaries inherit the property seamlessly and directly, bypassing the costly and time-consuming probate process. It provides peace of mind knowing that their real estate assets will be transferred according to their wishes, without the need for court involvement. It is important to note that there are no specific subtypes or variations of the Arvada Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries. However, it is always recommended consulting with a knowledgeable attorney or legal professional to ensure compliance with local laws and to address any specific requirements or circumstances. Using keywords relevant to this topic, here are some possible variations of Arvada Colorado Beneficiary Deed: 1. Arvada Colorado Joint Beneficiary Deed — Husband and Wife to Two Individual Beneficiaries Without Successor Beneficiaries 2. Arvada Colorado Beneficiary Deed — Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries 3. Arvada Colorado Spousal Beneficiary Deed — Husband and Wife to Two Individual Beneficiaries Without Successor Beneficiaries 4. Arvada Colorado Beneficiary Deed — Transfer of Ownership to Two Individual Beneficiaries Without Successor Beneficiaries Remember, it is crucial to consult with a legal professional or attorney before attempting to create or execute an Arvada Colorado Beneficiary Deed to ensure it aligns with specific state laws and individual circumstances.