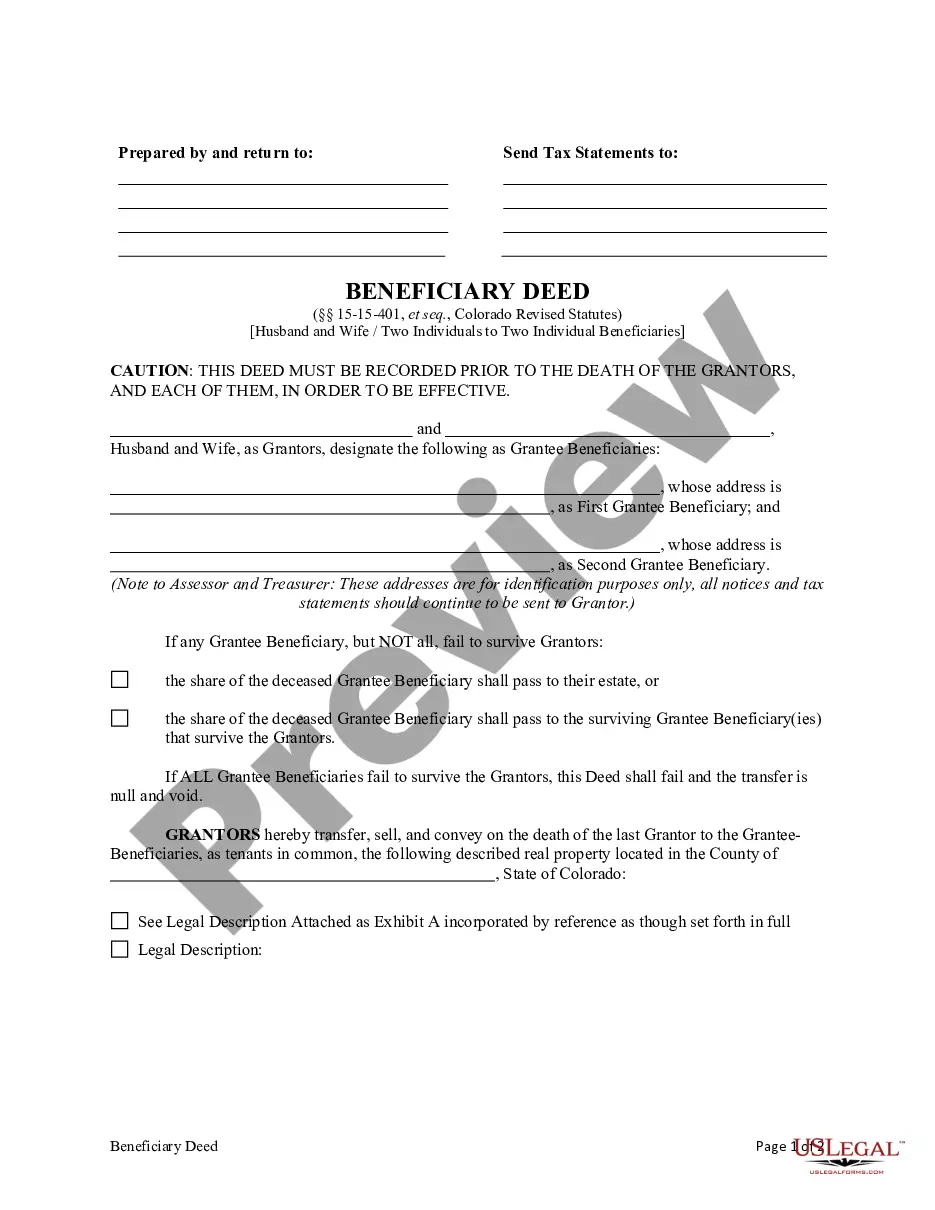

This form is a Beneficiary Deed where the Grantors are two individuals, or husband and wife, and there are two individual Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantors convey and transfer, upon the death of the survivor Grantor, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to either Grantor's death. This deed complies with all state statutory laws.

A Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows a married couple or two individuals to transfer their real estate property to two individual beneficiaries without naming any successor beneficiaries. This type of beneficiary deed ensures that the specified beneficiaries will receive the property upon the death of the granter(s) without the need for probate. The Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries provides a straightforward and efficient way to transfer property ownership upon death. It is commonly used in estate planning, allowing individuals to control the distribution of their assets after they pass away. This type of beneficiary deed is specifically designed for married couples or two individuals who wish to leave their property to two separate beneficiaries without any additional successors. It grants the beneficiaries the right to inherit the property, avoiding the complex probate process associated with traditional wills. By creating a Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries, the granter(s) ensure that their chosen individuals receive the property rights without any additional legal hurdles. This type of deed can provide peace of mind, as it allows the granter(s) to define the specific terms of property transfer, making their intentions clear and legally binding. Using this type of beneficiary deed allows the property to bypass probate courts and be transferred directly to the beneficiaries upon the death of the granter(s). It offers a streamlined and cost-effective alternative to traditional estate planning methods. Different variations or subtypes of Centennial Colorado Beneficiary Deeds may include variations based on the number of individuals involved, such as Centennial Colorado Beneficiary Deed — Single Individual to Two Individual Beneficiaries Without Successor Beneficiaries, or Centennial Colorado Beneficiary Deed — Husband and Wife to Single Individual Beneficiary Without Successor Beneficiaries, among others. These variations allow for different combinations of granters and beneficiaries while maintaining the same principle of transferring property without the need for probate or successor beneficiaries.A Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is a legal document that allows a married couple or two individuals to transfer their real estate property to two individual beneficiaries without naming any successor beneficiaries. This type of beneficiary deed ensures that the specified beneficiaries will receive the property upon the death of the granter(s) without the need for probate. The Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries provides a straightforward and efficient way to transfer property ownership upon death. It is commonly used in estate planning, allowing individuals to control the distribution of their assets after they pass away. This type of beneficiary deed is specifically designed for married couples or two individuals who wish to leave their property to two separate beneficiaries without any additional successors. It grants the beneficiaries the right to inherit the property, avoiding the complex probate process associated with traditional wills. By creating a Centennial Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries, the granter(s) ensure that their chosen individuals receive the property rights without any additional legal hurdles. This type of deed can provide peace of mind, as it allows the granter(s) to define the specific terms of property transfer, making their intentions clear and legally binding. Using this type of beneficiary deed allows the property to bypass probate courts and be transferred directly to the beneficiaries upon the death of the granter(s). It offers a streamlined and cost-effective alternative to traditional estate planning methods. Different variations or subtypes of Centennial Colorado Beneficiary Deeds may include variations based on the number of individuals involved, such as Centennial Colorado Beneficiary Deed — Single Individual to Two Individual Beneficiaries Without Successor Beneficiaries, or Centennial Colorado Beneficiary Deed — Husband and Wife to Single Individual Beneficiary Without Successor Beneficiaries, among others. These variations allow for different combinations of granters and beneficiaries while maintaining the same principle of transferring property without the need for probate or successor beneficiaries.