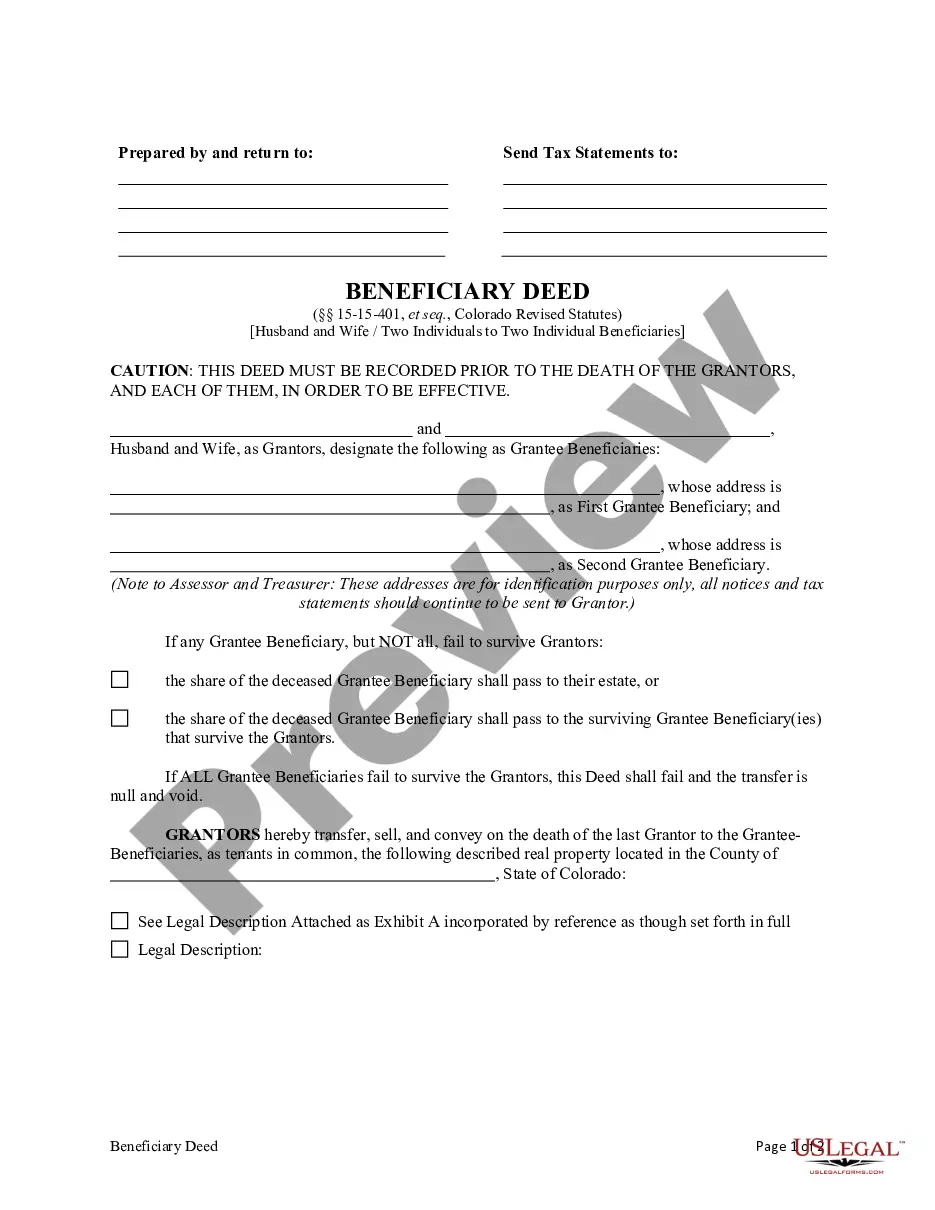

This form is a Beneficiary Deed where the Grantors are two individuals, or husband and wife, and there are two individual Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantors convey and transfer, upon the death of the survivor Grantor, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to either Grantor's death. This deed complies with all state statutory laws.

A Colorado Springs Colorado Beneficiary Deed, also known as a Transfer on Death Deed, is a legal document that allows a property owner to transfer their real estate property to named beneficiaries upon their death, without the need for probate. This type of deed is specifically designed for married couples or two individuals who wish to designate specific beneficiaries to inherit their property, without the inclusion of any successor beneficiaries. The beneficiaries are named individuals who will directly receive the property ownership rights after the death of the property owner(s). The Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is best suited for those who want to ensure a smooth and direct transfer of their property to their chosen beneficiaries. It provides a simple and efficient alternative to a traditional will or trust. Some advantages of using a Colorado Beneficiary Deed include avoiding probate, saving time and money associated with probate court proceedings, maintaining privacy as the transfer is not public record until the owner's death, and allowing the property owner to retain full control and ownership rights during their lifetime. It is important to note that there are different types of beneficiary deeds in Colorado Springs, and they may vary in terms of the number of owners, number of beneficiaries, and inclusion of successor beneficiaries. Some other types of Colorado Springs Colorado Beneficiary Deeds include: 1. Single Person Beneficiary Deed: Designed for individuals who want to transfer their property to a specific beneficiary without probate, in the event of their death. 2. Joint Tenancy Beneficiary Deed: Created for joint property owners who want to designate one or more beneficiaries who will inherit the property upon the death of all the joint tenants. 3. Enhanced Life Estate Deed: Also known as a "Lady Bird Deed," this type of beneficiary deed allows the property owner (granter) to retain full control and ownership rights during their lifetime, while still designating beneficiaries to inherit the property upon their death. In conclusion, a Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries offers a straightforward and efficient method for transferring property ownership to designated beneficiaries without the need for probate. It provides peace of mind and ensures that the property is transferred according to the owner's wishes upon their death.A Colorado Springs Colorado Beneficiary Deed, also known as a Transfer on Death Deed, is a legal document that allows a property owner to transfer their real estate property to named beneficiaries upon their death, without the need for probate. This type of deed is specifically designed for married couples or two individuals who wish to designate specific beneficiaries to inherit their property, without the inclusion of any successor beneficiaries. The beneficiaries are named individuals who will directly receive the property ownership rights after the death of the property owner(s). The Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries is best suited for those who want to ensure a smooth and direct transfer of their property to their chosen beneficiaries. It provides a simple and efficient alternative to a traditional will or trust. Some advantages of using a Colorado Beneficiary Deed include avoiding probate, saving time and money associated with probate court proceedings, maintaining privacy as the transfer is not public record until the owner's death, and allowing the property owner to retain full control and ownership rights during their lifetime. It is important to note that there are different types of beneficiary deeds in Colorado Springs, and they may vary in terms of the number of owners, number of beneficiaries, and inclusion of successor beneficiaries. Some other types of Colorado Springs Colorado Beneficiary Deeds include: 1. Single Person Beneficiary Deed: Designed for individuals who want to transfer their property to a specific beneficiary without probate, in the event of their death. 2. Joint Tenancy Beneficiary Deed: Created for joint property owners who want to designate one or more beneficiaries who will inherit the property upon the death of all the joint tenants. 3. Enhanced Life Estate Deed: Also known as a "Lady Bird Deed," this type of beneficiary deed allows the property owner (granter) to retain full control and ownership rights during their lifetime, while still designating beneficiaries to inherit the property upon their death. In conclusion, a Colorado Springs Colorado Beneficiary Deed — Husband and Wife / Two Individuals to Two Individual Beneficiaries Without Successor Beneficiaries offers a straightforward and efficient method for transferring property ownership to designated beneficiaries without the need for probate. It provides peace of mind and ensures that the property is transferred according to the owner's wishes upon their death.